Cell Culture Media Market Size, Share & Industry Analysis, By Type (Classical Media, Specialty Media, Serum Free Media, and Others), By Application (Drug Screening and Development, Research, and Others), By End User (Biotechnology and Pharmaceutical Industries, Academic & Research Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

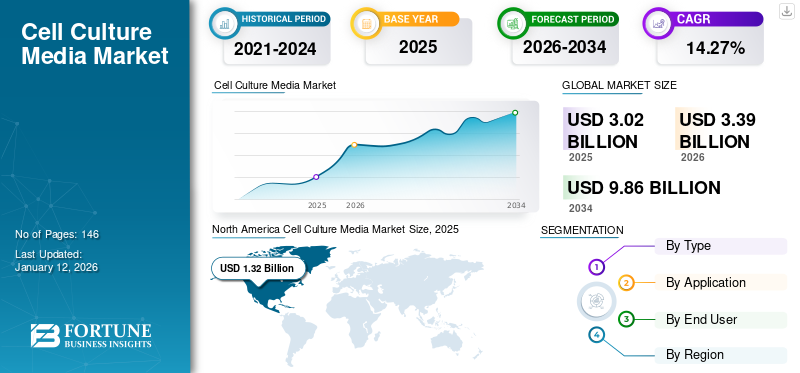

The global cell culture media market size was USD 3.02 billion in 2025 and is projected to grow from USD 3.39 billion in 2026 to USD 9.86 billion by 2034, exhibiting a CAGR of 14.27% during the forecast period. North America dominated the global market with a share of 43.61% in 2025. Moreover, the U.S. cell culture media market size is projected to grow significantly, reaching an estimated value of USD 9.86 billion by 2034, driven by growing demand for vaccines due to increasing prevalence of infectious diseases.

Cell culture media constitutes solid, liquid, or semisolid media, which is made up of several contents and nutrients to simulate the growth, propagation, maintenance, and storage of microorganisms.

These products are one of the critical ingredients in biopharmaceutical manufacturing, therefore driving its demand and augmenting market growth. Furthermore, increasing expenditure by pharmaceutical companies to conduct R&D initiatives and emerging research initiatives to introduce cell-based vaccines is also set to drive the growth of the market.

- For instance, in July 2022, the National Institute of Allergy and Infectious Diseases (NIAID) launched an early-stage clinical trial that can evaluate an investigational vaccine to prevent infection with the Nipah virus.

Furthermore, the rising awareness regarding stem cell research and the growing focus of major companies to launch personalized and regenerative medicine augments the growth of the market. The COVID-19 pandemic positively impacted the demand for cell culture media. The pandemic led to an increase in the demand for these products for the production of vaccines. As the demand for vaccines rose during the period, production facilities started to expand in 2020. The demand for products such as vaccines remained high, augmenting the market size in 2021. The increase in research and development activities for developing different biologics and vaccines continued to lead to a rise in the demand for cell culture media. The market is anticipated to continue growing during the forecast period.

Cell Culture Media Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 3.02 billion

- 2026 Market Size: USD 3.39 billion

- 2034 Forecast Market Size: USD 9.86 billion

- CAGR: 14.27% from 2026–2034

Market Share:

- North America led the global cell culture media market with a 43.61% share in 2025, driven by robust biopharmaceutical research, strong infrastructure for vaccine manufacturing, and a high concentration of key industry players in the U.S.

- By type, Classical Media held the dominant market share in 2024, attributed to increasing usage in biopharmaceutical R&D and extensive application in genetic engineering and basic biological studies.

Key Country Highlights:

- United States: The U.S. is projected to reach USD 2.96 billion by 2032, fueled by increased demand for vaccines due to a rise in infectious disease prevalence and sustained investments in biomanufacturing infrastructure. The expansion of domestic production capabilities (e.g., FUJIFILM Irvine Scientific's USD 188M investment in North Carolina) supports market growth.

- Japan: Japan’s market is supported by the country's advanced regenerative medicine programs and high emphasis on quality standards for biologics and vaccines. Government funding in stem cell and tissue engineering research contributes to steady demand for high-grade media.

- China: Rapid expansion in biologics manufacturing, government support for life sciences, and strong investments in oncology and vaccine development are propelling demand. Companies such as Eminence Biotechnology are enhancing domestic production capacities to meet rising demand.

- Europe: Growth is underpinned by the strong biopharmaceutical industry and strategic expansions such as Sartorius AG’s acquisition of Xell AG in Germany, bolstering capacity for viral vector production used in gene therapies. Regulatory initiatives favoring advanced therapies also support market expansion.

Cell Culture Media Market Trends

Adoption of the Latest Cell Culture Technology to Improve Cell Growth and Productivity

Researchers across the globe are conducting research and development activities to introduce new technologies to increase the efficiency of cell culture media for various clinical applications.

It has been witnessed that albumins are essential during the bio-manufacturing of therapeutic monoclonal antibodies and recombinant proteins. Albumin binds and stabilizes a range of important small molecules and ions.

Therefore, the addition of recombinant mammalian albumin supplement is expected to boost market growth and the product yield of cells in the culture medium by providing a synergistic effect in culturing Hybridoma and Chinese Hamster Ovary (CHO) cell lines.

- For instance, according to an article published by Sigma Aldrich, albumin serum-free media supplements were found useful in bio-manufacturing, tissue engineering, and specialty media. This upcoming trend provides an opportunity in the market.

Similarly, another advancement in the development of cell culture media is adding nano fibers. These fibers are optically transparent, which allows live-cell imaging and real-time quantification of cell mobility. The nano fibers also mimic the 3D topography in vivo and provide the potential to be easily coated with ECM proteins for cancer research.

- For instance, Merck KGaA offers a nanofiber cell culture dish with randomly oriented nanofibers, which provides a potential for the incorporation of epidermal and fibroblast growth factors. This is a new trend in the cell culture industry, which provides an opportunity in this market.

Furthermore, the launches of instruments for easier and convenient analysis of drug products and media propels the market growth.

- For instance, in September 2023, Waters Corporation launched walk-up solutions to simplify sample preparation and analysis. The company combined BioAccord LC-MS with Andrew+ robot for convenient analysis of drug products and cell culture media.

The adoption of these technology boosts the growth of the market in the forecast period.

- North America witnessed a growth from USD 1.12 Billion in 2023 to USD 1.20 Billion in 2024.

Download Free sample to learn more about this report.

Cell Culture Media Market Growth Factors

Increasing Research and Development for the Production of Vaccines Globally to Drive the Market Growth

Major pharmaceutical companies across the globe have started expanding their vaccine production facilities. New players are also seen to have entered the market. This has led to the expansion of vaccine production across all major countries. Due to these factors, the demand for raw materials such as culture media is also anticipated to grow, subsequently driving the global market growth.

- For instance, in January 2023, CanSino Biologics Inc.’s COVID-19 mRNA booster vaccine entered the test production phase.

- Considering another instance, in August 2021, the European Medicines Agency’s human medicines committee approved an additional manufacturing site for the production of Comirnaty, the COVID-19 vaccine developed by BioNTech and Pfizer. Also, EMA has approved a new manufacturing line at BioNTech’s manufacturing site in Marburg, Germany, which increases the active substance manufacturing capacity by approximately 410.0 million doses.

Furthermore, the COVID-19 pandemic highlighted the importance of the production of vaccines across the globe. Thus, in order to meet the increasing demand for COVID-19 vaccines among people, many countries started producing their own vaccines.

- In April 2021, at the African Union vaccination conference, the African nations set the goal of developing their own vaccine production capacity, which can cover 60 percent of their continent’s vaccine needs by 2040.

In order to expand the production capacity of vaccines, cell cultures have also proven to be the most appropriate hosts for the propagation of many types of viruses. Thus, cell culture systems producing a large quantity of attenuated viral particles have always been the basis for the production of both bovine and human vaccines.

Furthermore, major players in the market have also engaged in the development of specialty media for maximum production and growth of the virus.

- For instance, in September 2022, Pfizer Inc. announced the initiation of phase III clinical trial of their m-RNA based influenza vaccine. Such development activities drive the growth of the market.

Cell lines derived from kidneys, such as Vero, MDCK, and HEK293, are currently used for the production of viral vaccines. Thus, the importance of these consumables in the production of vaccines and the increasing production capacity of vaccines are likely to augment the demand for these products during the forecast period.

Increasing Applications of Gene Therapies and Growing Number of Ongoing Cancer Research Projects to Boost the Product Demand

Gene therapy is used for the treatment of multiple acquired and inherited neurological diseases. In addition to this, gene products are also said to reduce cellular dysfunction and have been proven to be a new therapeutic option. Furthermore, several applications of gene therapy have currently emerged and researchers across the globe are involved in R&D activities to discover new applications.

- For instance, gene therapy is currently used as an experimental treatment of genetic disorders such as Severe Combined Immune Deficiency (SCID), Chronic Granulomatous Disorder (CGD), and hemophilia.

Gene therapy is dependent upon viral vectors, which are used to deliver desirable genetic sequences into the cells of the targeted tissue. Propagation of viral vectors in the host cell is necessary for its clinical uses. Cell culture media which fulfills cellular requirements with recombinant proteins also reduces the introduction of viral RNA and DNA, prion proteins, undefined antigenic molecules, and others.

- For instance, OptiPEAK is chemically defined and optimized to promote the superior expansion kinetics of HEK293t, both in tissue culture and in bioreactor formats for clinical and commercial manufacturing. Therefore, the increasing applications of gene therapies require large use of cell culture media and boost the market.

Furthermore, with the increased prevalence of chronic diseases such as cancer, research institutes have been carrying out several research projects to develop and launch new and advanced treatment options.

- For instance, in March 2022, Novartis collaborated with Carisma Therapeutics, with an aim to manufacture the HER 2 targeted CAR-M cell therapy, for the treatment of solid tumors.

To carry out such projects, these products are widely used. Therefore, the growing number of research projects is anticipated to increase the demand for consumables, which supports the market growth.

RESTRAINING FACTORS

Insufficient Infrastructure and Shortage of Highly Skilled Professionals in Emerging Nations Pose Obstacles to Market Growth

The preparation of cell culture media requires laboratories with modern and specifically designed equipment for sterilization and propagation purposes. However, in low and middle-income countries, laboratories are only equipped with basic instruments and have a poorly implemented quality management system with lack of resources, hindering the quality of culture media mainly due to the high contamination rate.

- For instance, according to a 2021 article published by Elsevier, laboratories in LMICs face multiple challenges such as clean water, uninterrupted power supply, high environmental temperatures and humidity, and continuous supply of consumables for preparation of quality culture media.

Moreover, the shortage of skilled personnel in culture laboratories further hampers the productivity. Emerging countries struggle to attract highly trained technicians, which impacts the preparation and maintenance of culture media and disrupts the entire process cycle. Additionally, developing countries, including those in Africa, have recorded significantly low investments in research and development, which also hinders the growth and development of laboratory infrastructure.

The above mentioned factors, along with ethical concerns with the adoption of animal-derived components, are anticipated to hinder market growth.

Cell Culture Media Market Segmentation Analysis

By Type Analysis

Rising Exploration in Genetic Engineering and Research Endeavors Fuel the Demand for Classical Media

On the basis of type, the market is subdivided into classical media, specialty media, serum free media, and others. The classical media segment accounted for the largest share of of 59.69% in 2026. The increasing research spending for biopharmaceutical and biotechnology products which require consumables such as cell culture media boosts the demand for these products.

The specialty media segment is expected to witness significant growth during the forecast period. Due to surge in the number of infectious diseases, the demand for specialty media for effective diagnosis of infectious microorganisms fuels the demand for specialty media.

The advantage of serum-free media over other media, such as increased growth or productivity and decreased contamination risk from serum-borne adventitious agents in cell culture, drives the demand for the segment. Furthermore, increasing launches of the serum free-media by key market players boosts the growth of the segment. For instance, in May 2023, Lonza launched the TheraPEAK T-VIVO Cell Culture Medium to optimize CAR T-cell manufacturing. The medium is free from animal-origin components, simplifies regulatory approval, and accelerates cell therapy development.

- The Specialty media segment is expected to hold a 16.5% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Adoption of Advanced 3D Models in Drug Development to Spur the Segment Growth

By application, the market is segregated into drug screening and development, research, and others.

The drug screening and development segment held a considerable market share of 73.66% in 2026. The increasing demand for culture media in the development of vaccines and several other therapeutic treatments has led major companies to introduce new products in the market, leading to the growth of the segment. Additionally, research initiatives for the launch of new technologically advanced cell culture platforms, such as 3D cell culture models for drug screening, also leads to the growth of the segment.

- According to the journal Springer Link, the 3D cell culture has advantages for drug discovery and screening models as it mimics the physiological environment of the human cells that exist in the 3D structure of the model.

Such advancements propel the growth of the segment.

The research segment is expected to grow with a significant CAGR over the forecast period. Factors such as increasing R&D procedures for the development of new treatments for cancer augment the demand for cell culture media, driving the segmental growth. Other applications of these products include industrial production, diagnostics, and stem cell research. The rising awareness of stem cell culture and its advanced application in life science is expected to fuel the growth of the segment.

By End User Analysis

Based on end user, the market is segmented into biotechnology and pharmaceutical industries, academic & research laboratories, and others. The biotechnology and pharmaceutical industries segment dominates the market with a share of 60.30% in 2026. Factors such as increasing regulatory approvals for vaccines, rise in the use of cell culture consumables in research activities, and a surge in clinical research spending in developed as well as developing economies propel the growth of the segment.

- For instance, in May 2023, GSK announced the U.S. Food and Drug Administration's approval of the Arexvy vaccine, used for the prevention of lower respiratory tract disease caused by respiratory syncytial virus. Such approvals from regulatory bodies boost the segment growth.

The academic & research laboratories segment is expected to account for a significant share of the market over the forecast period. The rise in applications of these products in research studies globally boosts the segment growth.

REGIONAL INSIGHTS

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Cell Culture Media Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 1.32 billion in 2025. A major factor driving the growth of the market in this region is increasing spending on R&D activities by major players in the biopharmaceutical market. Furthermore, increasing efforts of key companies to expand their production capacity in the region also drive the growth of the market. The U.S. market is projected to reach USD 1.38 billion by 2026.

- For instance, in November 2022, FUJIFILM Irvine Scientific, Inc. announced an investment of USD 188.0 million to establish a manufacturing facility in Research Triangle Park (RTP), North Carolina, U.S.

The increasing demand for viral vectors for gene therapy and the strategic developments done by key industry players in Europe augment the growth of the market.

- For instance, in August 2021, Sartorius acquired Xell, the cell culture specialist in Germany, through its subgroup Sartorius Stedim Biotech Xell develops, produces, and markets nutrient media for cell cultures, especially for the production of viral vectors used in gene therapies and vaccines.

The UK market is projected to reach USD 0.19 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

Asia Pacific

Asia Pacific is projected to record the highest CAGR over the forecast period. The increasing demand for life science research and the rapid development of biopharmaceuticals, oncology, and stem cell research are a few of the driving factors for the market in this region. Additionally, there is an increase in initiatives of key companies to fulfil the rapidly growing demand for high quality culture media for various pharmaceutical and biotechnological processes. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.29 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

- For instance, in September 2023, Eminence Biotechnology announced the launch of its state-of-the-art facility for the production of cell culture media to fulfil the growing demand for high-quality media used for vaccines, gene therapies, and recombinant proteins.

List of Key Companies in Cell Culture Media Market

Strong Product Portfolios of Thermo Fisher Scientific and Danaher Led to Their Dominance

The global market is consolidated and the major players account for a dominant share. Thermo Fisher Scientific and Danaher together accounted for major cell culture media market share in 2024. The dominance of these companies is attributed to the strong distribution network and their continuous efforts to launch new products in the market. Furthermore, strategic decisions such as mergers, acquisitions and expansion of manufacturing sites are also important factors leading these players to strengthen their market position.

- For instance, in August 2022, Thermo Fisher Scientific Inc. announced the expansion of manufacturing facilities in Grand Island, New York, for manufacturing dry powder media so as to support the global supply of media. The move would help the company consolidate its brand presence in the market.

Other prominent players such as FUJIFILM Irvine Scientific, Inc., BD (Becton, Dickinson and Company), Sartorius AG, and Corning Incorporated are focused on increasing their R&D activities to secure a significant position in the market.

LIST OF KEY COMPANIES PROFILED:

- Fujifilm Irvine Scientific (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (Becton, Dickinson and Company) (U.S.)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Corning Incorporated (U.S.)

- PromoCell GmbH (Germany)

- Lonza (Switzerland)

- Danaher (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023- Lonza launched a new cell culture platform, TheraPro CHO media system. When used with GS-CHO cell lines, it simplifies media preparation processes and optimizes productivity.

- July 2023- Merck KGaA announced the expansion of a new manufacturing facility in Kansas, U.S., for the expansion of production capacities for manufacturing cell culture media.

- June 2023- Evonik launched next-generation peptide cQrex KC to boost the performance of cell culture media. The move was aimed at enhancing effectiveness and output in cell culture procedures employed for manufacturing monoclonal antibodies, vaccines, and cell therapies.

- August 2022- Thermo Fisher Scientific Inc. announced the expansion of their dry powder media manufacturing facility in Grand Island, New York. The company expanded its production capacity to meet the increasing demand for culture media used for the manufacturing of new vaccines and biologics.

- January 2022- Cytiva and Nucleus Biologics, LLC. signed a collaboration agreement on custom media formulation and fulfillment solutions for the gene and cell therapy industry.

- July 2021- Sartorius AG announced its acquisition of cell culture specialist Xell AG. The company is responsible for developing, producing, and marketing media and feed supplements for cell cultures for the manufacturing of viral vectors, which are used in gene therapeutics and vaccines.

- January 2021- Cytiva launched the HiScreen Fibro PrismA product available for early mAb purification process development. The fiber-based protein A platform accelerated the company’s R&D activities and increased its productivity in large-scale manufacturing settings.

- April 2021- PromoCell GmbH launched an upgrade to a well-established Keratinocyte Cell Culture Portfolio. It is an addition of improved animal extract-free “Keratinocyte GROWTH MEDIUM 3” for the standardized isolation and expansion of juvenile and adult Normal Human Keratinocytes.

REPORT COVERAGE

The global cell culture media market research report provides a detailed analysis of the market. It focuses on key aspects such as new product launches, advantages of chemically defined media over other types, recent research and development activities, key market trends, and the impact of COVID-19 on the market. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.27% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.39 billion in 2026 and is projected to reach USD 9.86 billion by 2034.

In 2025, the North American market stood at USD 1.32 billion.

Registering a CAGR of 14.27%, the market will exhibit steady growth over the forecast period (2026-2034).

The classical media segment is expected to lead this market during the forecast period.

Increasing production of vaccines, rising research & development funding, and technological advancements in cell culture techniques are the major factors driving the growth of the market.

Thermo Fisher Scientific Inc., Merck KGaA, and Danaher are some of the major players in the global market.

North America dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us