Natural Sweeteners Market Size, Share & Industry Analysis, By Type (Honey, Molasses, Date Palm, Sugar Alcohol {Xylitol, Mannitol, Sorbitol, and Maltitol}, Stevia, and Others), By Application (Food and Beverage {Bakery, Confectionary, Beverages, and Others}, Pharmaceuticals, and Personal care and Cosmetics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

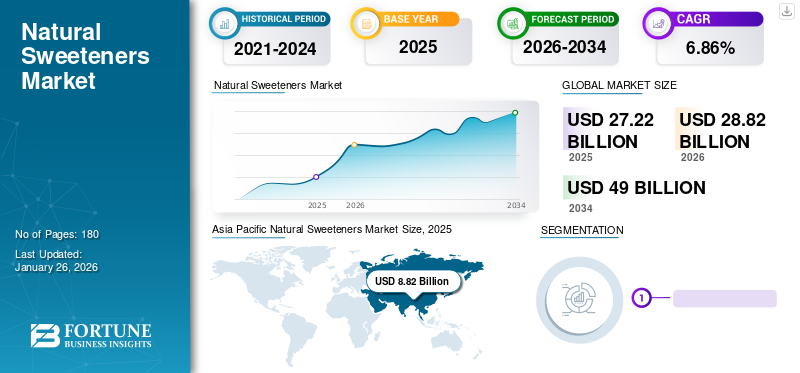

The global natural sweeteners market size was valued at USD 27.22 billion in 2025 and is projected to grow from USD 28.82 billion in 2026 to USD 49.00 billion by 2034, exhibiting a CAGR of 6.86% during the forecast period. Asia Pacific dominated the natural sweeteners market with a market share of 32.39% in 2025. Moreover, the natural sweeteners market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.18 billion by 2032, driven by growing demand of healthy and natural sugar substitutes, coupled with growing awareness among consumers regarding the ill-effects of consuming processed or refined sugar.

The demand for sweeteners that are derived from natural sources and are low in calories is becoming popular among consumers and food and beverage manufacturers. Thus, natural sweeteners refer to products derived from natural sources, such as stevia leaves, honey bees, dates, fruits and vegetables, and others. Some of the major products available in the market are honey, stevia, molasses, dates, coconut sugar, and agave syrup. The demand for these sweeteners has increased in recent years due to growing awareness among consumers about the negative impacts of consuming artificial sweeteners. Sweeteners such as stevia and sugar alcohols are often added to food items and marketed as "sugar-free" or "diet".

The COVID-19 pandemic negatively impacted the production of honey, molasses, date palms, stevia, and others. Several countries globally imposed restrictions on vehicular movement, which hampered the supply chain across all trade routes. Such restrictions delayed the transport of raw materials from farmers to the industries, causing manufacturing delays and shortages of raw materials. For instance, transportation restrictions impacted honey production in countries that import honey bees. Companies, such as Scandia Honey Corporation, a Canada-based honey manufacturing company, import 20,000 bee packages, and the transport of such bees was delayed during the pandemic.

Natural Sweeteners Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 27.22 billion

- 2026 Market Size: USD 28.82 billion

- 2034 Forecast Market Size: USD 49.00 billion

- CAGR: 6.86% from 2026–2034

Market Share:

- Asia Pacific dominated the natural sweeteners market with a 32.39% share in 2025, driven by traditional consumption and favorable government policies like China’s “Healthy China 2030.”

- In terms of application, the food and beverage segment held the highest share due to sugar tax implementations encouraging natural alternatives in bakery, beverages, and confectionery.

Key Country Highlights:

- U.S.: Projected to reach USD 5.18 billion by 2032, fueled by demand for healthy sugar substitutes and increasing consumer awareness.

- China: Policies such as “Healthy China 2030” are driving demand for natural alternatives.

- India: Launch of honey-infused beverages like “Vita Punch” reflects rising demand.

- U.K. & EU: Implementation of sugar taxes has increased use of stevia, honey, and molasses in processed foods.

- UAE: Government partnerships and innovation investments are encouraging adoption of sugar alternatives.

- South America: Rising health awareness is boosting popularity of molasses, stevia, and honey.

Natural Sweeteners Market Trends

Adoption of Advanced Technology in Natural Sweetener Extraction to Support Market Growth

Manufacturers are adopting new technologies to extract and develop new sweeteners to meet their growing demand in the market. Such technologies help companies isolate new sweeteners derived from natural sources and can be easily used to replace traditional sugar and artificial sweeteners that were launched recently in the market. For instance, in 2023, MycoTechnology extracted honey from a white honey truffle found in Hungary. Several commercial food manufacturers are looking forward to collaborating with the company to develop and launch new products in the market. Such collaboration helps food and beverage manufacturers to launch clean-label, better-for-you products.

Download Free sample to learn more about this report.

Natural Sweeteners Market Growth Factors

Immunity Boosting Properties of Natural Sweeteners to Support Market Growth

Honey, molasses, and dates have been popular among consumers since ancient times, and the popularity of newly developed products is also gaining traction in the market. Consumers prefer to enjoy the texture and flavor of these natural sweeteners, which is contributing to their rising popularity globally. Products, such as stevia, are slowly gaining approval in the U.S., the European Union, Australia, New Zealand, and other countries. These products are enriched with vitamins, minerals, and other compounds, providing a wide range of health-boosting properties. Such products are also suitable for consumers who are suffering from diabetes and other health ailments and are a suitable alternative to natural sugar.

As per the World Health Organization (WHO), around 422 million people across the globe have diabetes globally. The consumption of such products is increasing annually. Hence, manufacturers are investing in improving the production of plants and the infrastructure required for cultivating and processing plants to derive such sweeteners.

Better-for-you products with health-benefiting properties are becoming increasingly popular while the demand for organic products is increasing among consumers globally. With the rise in the adoption of new diet regimes, such as vegan diets, the demand for natural and organic products is increasing. They are suitable alternatives to processed sugars and possess several health benefits and lower calories than processed sugar. This makes it a suitable alternative for health-conscious consumers and vegan and keto diet followers.

Imposition of Sugar Tax in Several Countries to Support the Growth of Natural Sweeteners Market Share

Consumption of added sugar is associated with several health diseases, such as obesity, diabetes, cancer, and others. The increasing prevalence of such diseases is a growing concern in several countries globally. Hence, to prevent consumers from eating sugar, governments in several countries are levying taxes on food and beverage manufacturers who use traditional sugar to reduce their sugar content and sugar consumption among consumers. For instance, the U.K. government levied the Soft Drinks Industry Levy (SDIL), or ‘sugar tax,’ to prevent the beverage industry from adding processed sugar to the drinks. Such taxes also propel the food manufacturers to adopt new and natural raw materials for sweetening their products. Furthermore, consumers are increasingly becoming conscious about the negative impact of consuming artificial ingredients. Therefore, the demand for natural clean label alternatives such as honey, molasses, and dates is expected to increase further in the coming years.

RESTRAINING FACTORS

Availability of Adulterated Materials Impedes Market Growth

Adulteration of products, such as honey, molasses, and others, acts as a major factor negatively impacting the market’s growth. Economically motivated adulteration, including substituting cheaper ingredients, also impacts the quality of final food products. Such adulteration impacts food manufacturers who import honey in bulk quantity, which negatively affects the quality of the final food product. Other critical factors negatively impacting the natural sweeteners market growth include reduced fruit production, climate change, pest and predator attacks on crops and bees, and deforestation.

Furthermore, the long-term use of non-nutritive sweeteners is associated with several undesirable health effects such as the increased risk of type 2 diabetes and cardiovascular diseases. Hence, in May 2023, the World Health Organization (WHO) released an advisory which recommended that non-sugar sweeteners (NSS) should not be used to control body weight.

Natural Sweeteners Market Segmentation Analysis

By Type Analysis

Honey is the Leading Type owing to the Taste and Flavor Profile of the Product

Based on type, the market is segmented into honey, molasses, date palm, stevia, sugar alcohol, and others. The honey segment accounts for the highest market share of 34.58% in 2026 in the global market. The chemical properties and flavor of the honey are one of the major factors supporting the use of these products for baking and other processed food and beverage production.

Other products, such as dates, are also becoming popular in the global market. The product helps reduce the body's sugar levels and is a suitable alternative to traditional sugar; hence, manufacturers are using these products to manufacture food products, which are gaining popularity among diabetic and health-conscious consumers. Raw dates are rich in calcium and fiber and products, such as date sugar, are rich in anti-oxidant content, making them a healthy alternative for processed sugar.

Other sweeteners, such as stevia and sugar alcohol, are becoming popular among beverage manufacturers who are substituting traditional sugar with stevia and sugar alcohols. Sorbitol and Xylitol are also used to manufacture personal care products such as toothpaste and cosmetics, leading to their growing polarity. Hence, products such as stevia are expected to register the highest growth among the different types of products available in the global market.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Food and Beverage Segment Leads Owing to the Sugar Drinks-Related Tax Imposed in Several Countries

Based on application, the market is segmented into food and beverage, which includes bakery, confectionery, beverages, and others, pharmaceuticals, and personal care and cosmetics.

The food and beverage segment accounts for the highest natural sweeteners market share of 80.50% in 2026, owing to the higher sweetener adoption for manufacturing beverages. The imposition of the sugar tax on the use of traditional sugar in beverages, including soft drinks, fruit juices, dairy products, and others, is one of the major factors supporting the adoption of these products in the beverage industry. Bakery is another major area where the adoption of such sweeteners is increasing rapidly. Manufacturers are launching sweeteners that can be used for manufacturing cookies, pies, cakes, and similar bakery products. The flavor of products, such as honey, dates, and other products, helps enhance the bakery's flavor. Other food and beverage industry players, including confectionery manufacturers, snacks, and energy bars manufacturers, use natural sweeteners in food production.

REGIONAL INSIGHTS

The global market has been studied across five regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific Natural Sweeteners Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share globally, amounting to USD 8.82 billion in 2025. Sweeteners, such as honey, molasses, and dates, have been popular among consumers since ancient times due to their medicinal properties. The popularity of such products has prompted several food manufacturers to develop products that contain natural sweeteners. Moreover, policies adopted in China, such as “Healthy China 2030,” which aims to reduce sugar consumption by 2030, also create an opportunity for manufacturers to expand their presence in the Asia Pacific region. For instance, in 2022, Minute Maid, a Coca-Cola company, launched the honey-infused beverage “Vita Punch” in the Indian market. The Japan market is projected to reach USD 0.97 billion by 2026, the China market is projected to reach USD 4.36 billion by 2026, and the India market is projected to reach USD 1.2 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Middle East & Africa

The Middle East & Africa are other major markets where products, such as dates, molasses, and honey are produced and consumed locally. Dates are mainly produced in Middle Eastern countries and are infused in several food and beverage products in different forms, such as paste, powder, syrup, and others, to sweeten and enhance their taste. Companies are collaborating with the government and supporting sugar reduction policies by launching natural sweetening products. For instance, Tate and Lyle entered into a partnership with the UAE Ministry of Industry and Advanced Technology. They announced an investment of USD 2 million in a customer innovation and collaboration center in Dubai to promote the innovation of sugar substitutes in the country.

Europe

The adverse health impact of sugar-incorporated ultra-processed food among consumers has prompted the European government and health professionals to adopt policies to limit sugar intake and advise people against sugar consumption. Several European countries, such as France, the U.K., Finland, and seven other countries in the European Union, have implemented sugar taxes on carbonated soft drinks, sweetened milk, juice, and other products that use sugar in their products. Such policies support the growth of the market, with several food manufacturing companies switching to natural sweeteners, such as stevia, honey, molasses, and other similar products for food and beverage production. The UK market is projected to reach USD 0.77 billion by 2026, and the Germany market is projected to reach USD 1.2 billion by 2026.

North American

The demand for these sweeteners is also growing in the North American market. Although other sugar substitutes, such as artificial sweeteners, are becoming popular, the adverse health impact of such products is also prompting consumers to opt for other natural alternatives, such as dates, honey, and molasses, in their food. Furthermore, the growth in adopting the vegan diet is also prompting consumers to opt for natural and healthier options, thus prompting food manufacturers to substitute refined sugar with natural sweeteners, leading to market growth in North America. The U.S. FDA (Food and Drug Administration) assesses the safety of stevia, sugar alcohols, and other sweeteners to ensure that they are safe for consumption. The U.S. market is projected to reach USD 3.42 billion by 2026.

South America

The popularity of molasses, honey, and dates is increasing in South America. Products such as stevia, sugar alcohols, honey, and molasses are becoming popular among health-conscious consumers. Hence, several manufacturers are opting to develop new healthy products to meet the evolving market demand.

List of Key Companies in Natural Sweeteners Market

Product Innovation to Enable Manufacturers to Expand Market Presence

Some prominent players operating in the market include Tate and Lyle PLC, Ingredion Incorporated, and Pure Circle Ltd. There is an increasing demand among food and beverage manufacturers to use these products to manufacture healthy food products for the global market. Market players are collaborating with food and beverage manufacturers to enhance the appearance and flavor of the products. Some manufacturers are launching products in new forms that can be easily included in the final product production and enhance the overall flavor of the final product. Some personal care product manufacturers are launching new toothpaste in the market, which is expected to augment the market’s growth further. For instance, in September 2023, Colgate-owned cruelty-free brand Hello launched a natural sweetener-based toothpaste range named “Seriously Friendly Collection” in the global market.

List of Key Companies Profiled:

- Tate & Lyle PLC (U.K.)

- Ingredion Incorporated (U.S.)

- Pure Circle Ltd. (Malaysia)

- Sweetly Stevia USA (U.S.)

- Fooditive B.V. (Netherlands)

- The Real Stevia Company (Sweden)

- Stevia Biotech Pvt. Ltd. (India)

- DuPont (U.S.)

- Cargill Inc. (U.S.)

- GLG Life Tech Corporation (Canada)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Tate & Lyle PLC, a leading manufacturer of ingredient solutions, launched TASTEVA SOL Stevia Sweetener, which can be used to manufacture healthy food and beverages globally.

- July 2022: Sweegen, a U.S.-based company, launched Bestevia LQ, which was designed to reduce the adoption of sugar in carbonated soft drinks, confectionery items, liquid sweeteners, dessert toppings and concentrated fruit/flavored syrup, and others.

- March 2022: Cargill Inc. launched zero-calorie sweeteners named EverSweet + ClearFlo, gaining wider acceptance as a sugar-reducing product for the food and beverage industry. The product is used in dairy, energy, and immunity-boosting drinks, flavored waters, teas, coffee products, and other industries.

- January 2022: Sweet Harvest Foods, one of the leading honey packers in North America, purchased Nature Nate’s Honey Co to expand their presence in the U.S. market

- April 2021: Manus Bio, Inc., a U.S.-based manufacturer of plant-based sweeteners, launched NutraSweet natural sweetener for the U.S. market.

REPORT COVERAGE

An Infographic Representation of Natural Sweeteners Market

To get information on various segments, share your queries with us

The market research report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market size and growth rate for all possible market segments. The report presents various key insights: an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.86% from 2026 to 2034 |

|

Segmentation |

By Type, Application, and Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 27.22 billion in 2025.

The market is projected to grow at a CAGR of 6.86% during the forecast period (2026-2034).

The honey segment is expected to be the leading type in the global market.

The imposition of sugar tax by the government in several countries is one of the major drivers supporting market growth.

Tate and Lyle, Ingredion Incorporated, and Pure Circle, LLC are a few of the top players in the global market.

Asia Pacific is expected to hold the highest market share throughout the forecast period.

The availability of adulterated raw materials impedes market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic