Private Tutoring Market Size, Share & Industry Analysis, By Mode (Offline and Online), By Application (Up-to K-12 and Post K-12), By Subject (Academic and Non-academic), By Duration (Short-Term Courses and Long-Term Courses), By Tutoring Style (Test Preparation Service and Subject Tutoring Service), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

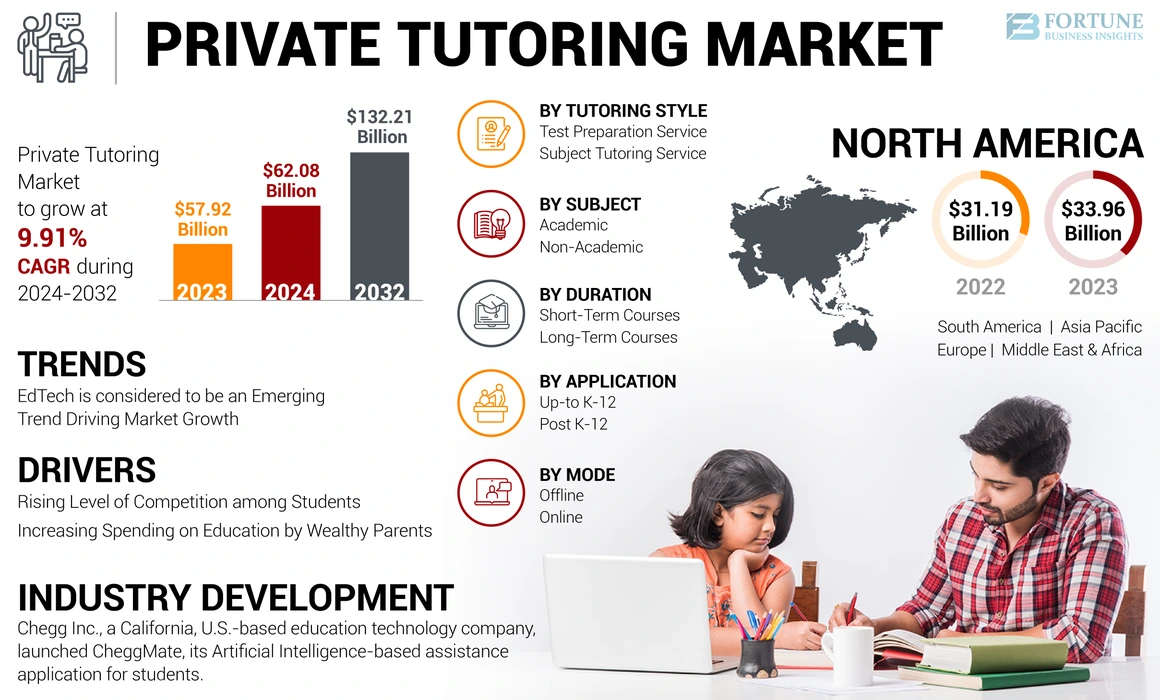

The global private tutoring market size was valued at USD 57.92 billion in 2023 and is projected to be worth USD 62.08 billion in 2024 and reach USD 132.21 billion by 2032, exhibiting a CAGR of 9.91% during the forecast period. Asia Pacific dominated the private tutoring market with a market share of 58.63% in 2023. Moreover, the private tutoring market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 15.74 billion by 2032, driven by rising academic competition to augment market size growth.

The rising awareness regarding literacy and the importance of education in life has significantly accelerated the overall growth of the education and allied industries. Subjects such as mathematics and the sciences have been perceived as increasingly important as they play a crucial role in a child's career development. However, the average student often struggles to learn these subjects in school, which leads to a need for extra coaching to understand the concepts and pass exams. These factors have boosted the demand for private tutoring or shadow education services globally, which can offer customized learning, thereby increasing the global market share.

The emergence of the global pandemic led to the closure of schools, which had a negative impact on the education industry. According to the article 'The Impact of The COVID-19 Pandemic On Education Financing,' published in May 2020 by the World Bank Group, under a downside forecast, the real growth in education spending per capita in all countries was estimated to be at a rate of -5.7% in 2020. This can be attributed to a greater focus on hygiene and health-related goods and services during the pandemic.

GLOBAL PRIVATE TUTORING MARKET SNAPSHOT

Market Size & Forecast:

- 2023 Market Size: USD 57.92 billion

- 2024 Market Size: USD 62.08 billion

- 2032 Forecast Market Size: USD 132.21 billion

- CAGR: 9.91% from 2024–2032

Market Share:

- Asia Pacific led with a 58.63% share in 2023, driven by growing parental expectations, education focus in South Korea, Japan, and India, and strong demand for shadow education.

- Academic subjects, especially mathematics and sciences, dominate tutoring demand, followed by test prep and microlearning modules.

- Online tutoring is the fastest-growing mode, supported by tech-enabled content, flexible schedules, and wider access.

- Up-to K–12 students are the key consumers due to high competition and foundational learning pressure.

Key Country Highlights:

- China & India: Over 55% of students use private tutoring; demand led by tough school exams and rising middle-class spending.

- U.S.: Market projected to reach USD 15.74 billion by 2032; growing digital platforms and academic competition boost adoption.

- South Korea: 75% of students received tutoring in 2019; long hours and structured courses support continued growth.

- U.K.: Private tuition among 11–16-year-olds rose from 20% (2009) to 27% (2019); driven by academic performance goals.

- UAE: High tutoring rates in math (83%) and science (58%) due to STEM emphasis; growing demand for English and Arabic.

Private Tutoring Market Trends

EdTech is considered to be an Emerging Trend Driving Market Growth

Tutoring organizations with online subscriptions are gaining popularity as students are more inclined toward technology-based learning. Technology has helped create subject-related content innovatively, including presentations, 3D colored diagrams, flashcards, and animations that can keep children more focused. This factor has led to an increase in students' interest in the subject during the learning process, thereby accelerating the demand for online tutoring modes. For instance, according to the 2019 Investor Presentation published on February 10, 2020, by Chegg Inc., a U.S.-based education technology company, the annual service subscribers of Chegg increased to 3.9 million in FY19 from 1.0 million in FY15. Therefore, the rising popularity of technology-based shadow education services is likely to support market trends.

- Asia Pacific witnessed private tutoring market growth from USD 31.19 Billion in 2022 to USD 33.96 Billion in 2023.

Download Free sample to learn more about this report.

Private Tutoring Market Growth Factors

Rising Level of Competition among Students to Increase Demand for Private Tutoring Services

Top schools or universities accept students with better grades and have strict criteria, such as passing difficult entrance exams or English language exams. This has increased the competition among students for entry into international schools or colleges. According to the Global Education Census Report 2018, published in November 2018 by Cambridge Assessment International Education, about 4 in 10 surveyed students (43%) had received private tuition outside of school worldwide, with China accounting for more than 5 in 10 surveyed students (57%), followed by India (55%), and 1 in 10 students in the U.S.

Several reasons have contributed to the rising popularity of supplementary tutoring. Parents want their children to achieve the highest academic ranks, or they feel that their children are not performing well in certain subjects. Most students seek tutoring due to the influence of classmates, seniors, or siblings who have attended the same coaching class. Therefore, increasing education-related awareness, higher parental expectations, and the growing prevalence of competition are likely to boost the demand for private tutoring services.

Increasing Spending on Education by Wealthy Parents to Support Private Tutoring Market Growth

The declining quality of the public school-based education system has shifted the focus of wealthy parents toward private schools and private tutors. Parents in developed countries are primarily spending on education to support their children. For instance, according to the Singapore Department of Statistics, Singapore has shown significant expenditure on education, even though the overall population is low. As per the same source, the average monthly household expenditure on educational services increased from USD 175 (SGD 235) in 2007/2008 to USD 250 (SGD 339) in 2017/2018. USD 80 (SGD 112) is accounted for private tuition and other educational services.

High-income families often tend to spend more on their child's growth as they can afford high-quality services. For instance, according to the report ‘PARENT POWER 2018,’ published in September 2018 by The Sutton Trust, the percentage of parents sending their child for coaching is greater among the upper-middle-class group compared to the working-class group. According to the same source, only 6% of working-class parents have availed private tuition services for their children, increasing to about 15% among lower-middle-class parents, followed by 23% among middle-class parents, and further increasing to 31% for upper-middle-class parents. Therefore, increased spending by affluent parents on their children's education is likely to expand the market size.

RESTRAINING FACTORS

Increasing Private Tutoring Fees to Limit Market Growth

The fees of private tutors are often on the higher side, making them unaffordable for lower-income families. Additionally, concerns arise due to the confusion created by different teaching methods used by coaching classes and school teachers for the same subject, leading to conflicting approaches for students. Such practices are likely to lower performance and increase confusion among children during examinations. Therefore, these factors are likely to limit the penetration of after-school tutoring services.

Several factors influence private tutoring fees globally. Given that the private tutoring industry is highly unregulated across countries, individual private tutors or companies determine the costs. Furthermore, private tuition fees vary significantly from city to city within a country, based on the cost of living or commute. Generally, private tutoring costs are considerably higher in larger cities, such as London, than in rural areas, making it challenging for middle-income families to afford private tuition.

Private Tutoring Market Segmentation Analysis

By Mode Analysis

To know how our report can help streamline your business, Speak to Analyst

Online Mode Segment to Witness Fastest Growth Due to its Greater Convenience

By mode, the market is segmented into offline and online. The offline mode segment is likely to hold a major share as home tutoring, group tutoring, or classroom tutoring has gained popularity over the years. A tutor can see a child's growth or weaknesses in person and offer more attention or better solutions accordingly.

However, the advent of technology has led to a shift in preference toward the online mode, where teachers and students can provide and access services from any place globally. For instance, according to the Bramble survey results published in July 2020, about 84% of surveyed students reported that online tutoring was more effective than or as effective as in-person tutoring. Online tutoring's significant benefits were reported by surveyed students, parents, and tutors, including flexible lesson scheduling, searchable lesson recordings, and a more relaxed and focused atmosphere.

As tutors make their recordings available online, they become easier to search for later use whenever needed for learning or revising the content. Therefore, the online tutoring mode is likely to grow rapidly in the near future.

By Application Analysis

Up-to K-12 Segment to Hold Highest Market Share Owing to Increased Parental Pressures on School Children

By application, the market is segmented as up-to K-12 and post K-12. Students up to K-12 grades require a clear understanding of basic subjects to strengthen their foundations, making the up-to K-12 segment dominant. Children in age groups up to 10 to 12 need extra attention in learning to achieve better grades. However, parents' busy schedules and long working hours have resulted in a greater requirement for a private tutor who can dedicate their time to look after a child's academic performance and help them understand the subjects.

Furthermore, a post-K-12 segment is likely to grow with the increasing trend of competitive examinations, where external training is required to achieve a top rank.

By Subject Analysis

Academic Subjects Segment to Dominate owing to Greater Need of Passing the School Examination

Based on subject, the market is segmented into academic and non-academic subjects. The academic subjects segment is likely to gain a significant market share as students seek extra tutoring either for difficult-to-learn subjects or to excel in examinations in scoring subjects. For instance, according to the Global Education Census Report 2018, published in November 2018 by Cambridge Assessment International Education, mathematics was reported to be the most common privately tutored subject, with 66% of surveyed students (about 2/3) receiving private tutoring, followed by physics, accounting for about 43%.

However, non-academic subjects, such as learning an additional language that is not in the syllabus or art-related subjects, are on the rise. This can be attributed to increased demand from parents who want to engage their child in productive activities outside school hours, helping them further in their career.

By Duration Analysis

Long-term Courses Segment to Dominate owing to Increasing Demand from Under-resourced students

By duration analysis, the global market is segmented into short-term courses and long-term courses. The long-term courses segment will likely gain significant market share by providing students with continuous developments in learning methods and higher efficiency for under-resourced students. Industry players typically offer these courses to enable students to gain in-depth knowledge about reskilling. For instance, in January 2022, Udemy, Inc., a U.S.-based education technology company, launched new features such as hands-on labs, software development, skill assessments, and data analytics, expanding its corporate learning platform.

The short-term courses segment is expected to grow significantly throughout the forecast period owing to the increasing popularity of short-term diploma courses based on industry-specific requirements and for a salary boost or career advancement. Several players are introducing short-term courses to cater to increasing consumer demand. For instance, in January 2022, UpGrad, an Indian online higher education company, partnered with Caltech University and Fullstack Academy to launch two new short-term certificate programs in data analytics and cybersecurity.

By Tutoring Style Analysis

Subject Tutoring Segment to Dominate Owing to Increasing Popularity for Microlearning

Based on tutoring style, the global market is segmented into test preparation service and subject tutoring service. The subject tutoring service segment will likely witness significant growth over the forecast period owing to the increasing popularity of adaptive and individualized microlearning among students. Subject tutoring services allow students to learn at their own pace, driving the demand for these services globally.

The growth of the test preparation service segment is attributable to the increasing number of standard admission tests administered by most universities across countries. Additionally, several players are introducing new courses for entrance exams. For instance, in July 2022, Deeksha Classes, a Rajasthan, India-based coaching institute, launched new mentorships and coaching courses for students with enhanced learning and mentorship for various state-level government entrance exams.

REGIONAL INSIGHTS

Asia Pacific Private Tutoring Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

This market is analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific private tutoring market stood at USD 31.19 billion in 2022. Asia Pacific held the largest share globally due to the strong presence of supplementary coaching classes, primarily in Japan, South Korea, and Southeast Asian nations. In May 2020, a press release by Yonhap News Agency reported the results of an annual survey conducted by the National Statistics Korea and the Ministry of Gender Equality and Family. It was reported that in 2019, about ¾th of students received private tutoring in South Korea, with students spending an average of 6.5 hours per week on this tutoring. Moreover, the rising number of middle-class families would further support market growth in Asia Pacific.

North America is expected to hold a significant share. The growth can be attributed to the increasing penetration of online tutoring services. Growing initiatives for advanced tutoring services would promote market growth in the region. For instance, in March 2019, Clark Inc., a U.S.-based software company, introduced its new service that helps tutors create and set up their websites. The company also offers software that can help tutors manage tuition scheduling and payments, which is a convenient method of communication for tutors and parents. Additionally, the presence of high-income groups and a tech-savvy population in the region would further raise the demand for online private tutoring in the region and aid market growth.

The increasing penetration of private tutoring firms in the European market is likely to support market growth. According to the Private Tuition Polling 2019 report by The Sutton Trust, the percentage of children aged between 11 to 16 years who received private/home tuition increased from 20% in 2009 to 27% in 2019 in England and Wales. Among countries in the rest of Europe, Greece, Romania, and Russia, among others, are likely to grow due to an increasing number of private tutors.

Similarly, increased awareness regarding education and rising spending by parents on academics in countries such as Brazil and Chile would increase the need for external tutoring in South America, fueling market growth.

A growing number of infrastructural activities related to education in GCC and South African countries are further likely to boost market expansion in the Middle East and Africa. Moreover, the growth of the region in the science and technology sector would increase the need for coaching in difficult-to-learn science-related subjects and the English language. For instance, according to the study report ‘Parents' Perspectives on Paid Private Tutoring in the United Arab Emirates,’ published in June 2018 by the Regional Center for Educational Planning of the UAE, mathematics was the subject in which most students took out-of-school lessons (83%), followed by science (58%), English (50%), and Arabic (44%).

Therefore, increased awareness regarding education and rising spending by parents are likely to propel the global market growth.

List of Key Companies in Private Tutoring Market

Growing Tutoring Centers Launch by Key Players to Drive Market Growth

Key industry participants adopt various competitive strategies, such as launching new tuition centers to gain a competitive edge. For instance, in February 2022, BYJU'S, an educational technology company, announced the launch of 500 offline tuition centers across 200 Indian cities. Prominent players have also increased their efforts to help users access their services through the online mode, which would allow them to target a greater number of students on an international level. Such initiatives would increase the service's market penetration and enable companies to expand their presence in new markets.

List of Top Private Tutoring Companies:

- Chegg, Inc. (U.S.)

- Mathnasium LLC (U.S.)

- Educomp Solutions Ltd. (India)

- Sylvan Learning, LLC (U.S.)

- Daekyo Co., Ltd. (South Korea)

- Kumon Institute of Education Co., Ltd. (Japan)

- Kaplan Inc. (U.S.)

- Action Tutoring (U.K.)

- Varsity Tutors (U.S.)

- Tutors International (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2023: Chegg Inc., a California, U.S.-based education technology company, launched CheggMate, its Artificial Intelligence-based assistance application for students.

- September 2022: Tutor.com, a New York, U.S.-based online tutoring company, launched LEO (Learner Engagements Online). This institutional tutoring platform provides actionable analytics and scheduling tools for institutions and students that centralize 24/7 academic support services.

- January 2022: Chegg, Inc. announced the launch of Learn with Chegg, a new phase designed to create an individualized learning experience by automatically pushing relevant content and offering more significant personalization services.

- June 2020: Chegg Inc. acquired Mathway, a mathematics-related problem-solving platform. This strategic move will likely expand Chegg’s services portfolio.

- June 2020: Byju’s, an Indian EdTech company, launched its new live online tutoring service that would offer after-school tuition to students.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, services’ analysis, Porter’s Five Forces analysis, categorization, leading applications of the services, and key distribution channels. Besides, the report offers insights into the market trends and highlights key private tutoring industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 9.91% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode

|

|

By Application

|

|

|

By Subject

|

|

|

By Duration

|

|

|

By Tutoring Style

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 57.92 billion in 2023.

The market is likely to grow at a CAGR of 9.91% over the forecast period (2024-2032).

By mode, the offline segment is expected to lead the market due to the rising popularity of home tutoring, group tutoring, and classroom tutoring services.

Increasing spending on education by wealthy parents is expected to drive market growth.

Some of the top players in the market are Chegg, Inc., Mathnasium LLC, Educomp Solutions Ltd., Sylvan Learning, LLC, and Daekyo Co., Ltd.

Asia Pacific region dominated the market in 2023.

Increasing tuition fees will restrain product deployment globally throughout the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us