Data Privacy Software Market Size, Share & Industry Analysis, By Deployment (On-premises and Cloud), By Application (Compliance Management, Risk Management, Reporting & Analytics, and Others), By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Industry (BFSI, IT and Telecommunication, Government, Manufacturing, Retail, Healthcare, and Others), and Regional Forecast, 2026-2034

Data Privacy Software Market Size

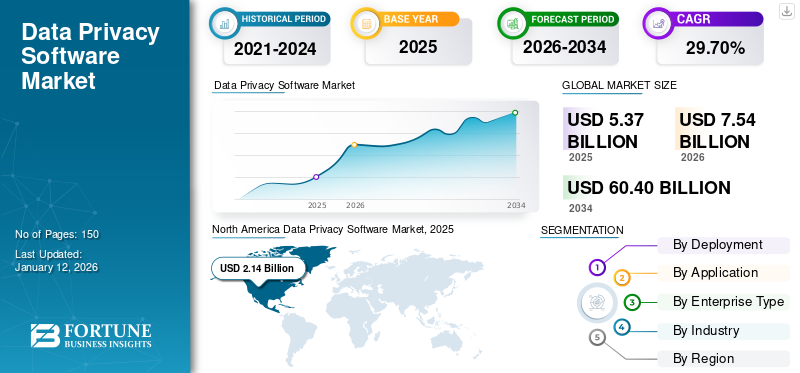

The global data privacy software market size was valued at USD 5.37 billion in 2025. The market is projected to grow from USD 5.37 billion in 2026 to USD 45.13 billion by 2034, exhibiting a CAGR of 35.5% during the forecast period. North America dominated the global market with a share of 40.63% in 2025. Additionally, the U.S. data privacy software market is projected to grow significantly, reaching an estimated value of USD 17,187.9 million by 2032, driven by rising adoption of IoT devices.

In the scope of the study, we have considered companies, such as OneTrust, LLC, AvePoint, Inc., TrustArc, Inc., IBM Corporation, RSA Security LLC, and others. These companies are offering software solutions across various applications, including compliance management, reporting & analytics, risk management, and others.Data privacy software assists organizations in managing and operating customers’ personal data. The software classifies the content of the customer as per the country’s compliance rules and laws.

The increasing concerns regarding personal and confidential data breaches are driving organizations to adopt data privacy software. For instance, in October 2020, AvePoint, Inc., announced its new Policies and Insights (PI) Software-as-a-Service solution to prevent exposure to sensitive data. This data access governance solution helps end-users in oversharing of the data.

During the pandemic period, various businesses and organizations witnessed temporary and permanent shutdowns. Also, major data breaches and cyber incidents occurred globally. As per Moneylife’s article, organizations such as BigBasket faced a data breach in March 2021, where the data of 20 million customers was hacked. Similarly, Twitter data breaches occurred in January 2020. The growing concern of losing personal data to hackers surges the demand for data privacy software across developing nations. Thus, organizations are implementing software, owing to growing cyber breaches as various countries opted for data privacy laws to reduce the misuse of customers’ personal data.

Data Privacy Software Market Trends

Integration of AI and ML to Surge Demand for Data Privacy Solutions

Data privacy concerns are rising due to increasing data breaches, and businesses are taking certain steps to protect their data. According to a Cisco Data Privacy Benchmark Study 2023, around 95% of businesses stated that privacy was an important factor for their business growth. The adoption of AI and ML is increasing for preventing data breaches and helping businesses identify risk and protect their data in less time. According to a study by IBM in 2023, the cost of a data breach, the average time taken to detect and enclose a data breach is 277 days. Therefore, AI and ML can make it easier for business owners to safeguard their data.

In 2024, AI-powered privacy technologies will be used for identifying and preventing cyber threats. Organizations are using AI and ML for identifying potential data privacy risks by getting recommendations, prompts, and trends across data through the AI and ML algorithms. Also, these algorithms can rapidly analyze large datasets, identify patterns, and adjust to emerging regulations, making it an effective tool for mitigating privacy risks.

Download Free sample to learn more about this report.

Data Privacy Software Market Growth Factors

Rising Adoption of IoT Devices to Aid Global Data Privacy Software Market Growth

The data security management software demand is growing owing to rising IoT devices across industries such as manufacturing, BFSI, healthcare, and others. As per McKinsey & Company, by 2023, IoT-connected devices are expected to increase to 43 billion. Similarly, the vast implementation of 5G technology is expected to drive opportunities for key players in the market to expand their offerings.

The Internet of Things (IoT) technology shares and operates real-time data of customers and organizations. Real-time information and the information associated with transactions are shared through the wireless network. The adoption of IoT has seen a vast surge in several areas, such as smart retail, smart home appliances, smart city projects, and health monitoring, which has increased the need for IoT security. Thus, growing IoT devices and applications are likely to drive the demand for software.

RESTRAINING FACTORS

Low Awareness and Insufficient Knowledge About Software Impede Industry Growth

Enterprises are facing challenges with the processing of customers’ personal data and insights. Lack of awareness about software among small and medium enterprises (SMEs), local organizations, and start-ups can hinder the growth of the market. Also, SMEs have a limited budget for IT services and solutions. This restricts the adoption of the software. These factors are expected to hinder the demand for the software and hamper market expansion.

Data Privacy Software Market Segmentation Analysis

By Deployment Analysis

Growing Demand for Cloud-based Software to Fuel the Market Growth

Based on deployment, the market is bifurcated into on-premises and cloud.

The cloud segment is projected to dominate the market with a share of 64.18% in 2026 as it favors the automation of privacy management suits. As businesses grow over the period, organizations are adopting cloud-based software to expand their capability to store a considerable amount of data. The cloud-based software also offers status and insights into the privacy policy and keeps track of the program. This is likely to drive the cloud-based software market.

The on-premises segment is expected to showcase a steady CAGR over 2025-2032 owing to its reliable and secured in-house capability.

By Application Analysis

Increasing Stringent Government Regulations to Fuel Compliance Management Demand

Based on application, the market is categorized into compliance management, risk management, reporting & analytics, and others.

The compliance management segment is expected to account for 44.24% of the total market share in 2026. The software helps organizations perform activities in line with the regulation to protect confidential data. The growing laws in support of data protection are surging the demand for software across compliance management applications.

Risk management is expected to register highest CAGR as the software identifies & evaluates threats and negative impacts of the operation on the individual’s data. Thus, to lower the risk of exposing the client's personal information, data privacy software is gaining traction in risk management.

By Enterprise Type Analysis

Global Presence of Large Enterprises to Drive Demand for Software

Based on enterprise type, the market is divided into small & medium enterprises and large enterprises.

The large enterprises segment is anticipated to hold a dominant market share of 69.76% in 2026. The majority of large enterprises have a robust global presence, which drives the adoption of software for the management of country-wise data protection laws. Further, large enterprises collect, store, and operate on huge sets of client data.

During the forecast period, SMEs are estimated to grow with highest CAGR. The growing data breach incidents across developing nations surge the demand for software among government enterprises, start-ups, and small and medium enterprises. As per the 2020 Carbon Black report, the year 2019 recorded around 65,000 data breach attempts on SMEs in the U.K.

By Industry Analysis

Growing Digital Banking Applications to Drive Demand for Software in BFSI Sector

Based on industry, the market is categorized into BFSI, healthcare, IT and telecommunication, government, retail, manufacturing, and others (education).

The BFSI industry is expected to dominate the market in 2024. The growing adoption of digital banking applications and rising online customer interactions are expected to surge the demand for software. Also, enterprises across BFSI store and process highly confidential data of users.

The healthcare industry is expected to showcase highest CAGR during the forecast period. The increasing threats to the health data of patients with rising cyberattacks on the industry are likely to boost growth. Also, the introduction of the Health Insurance Portability and Accountability Act (HIPPA) in the healthcare industry is increasing the demand for privacy management software.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Geographically, the market is fragmented into five major regions such as North America, South America, Asia Pacific, Europe, and the Middle East & Africa. They are further categorized into countries.

North America Data Privacy Software Market, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America is expected to capture the largest data privacy software market share in 2024. The strong presence of key players and rise in investments by key players are expected to drive market growth opportunity in the region. The United States is expected to lead the segment owing to the growing awareness regarding data protection acts among customers. With the California Consumer Privacy Act as an initial step, the government of the U.S. is expected to drive more stringent laws on data protection. The U.S. market is projected to reach USD 2.29 billion by 2026.

Asia Pacific

Asia Pacific is expected to witness highest CAGR during the forecast period. China and India have introduced national data protection rules to manage the increasing number of data breaches. In October 2020, the Cyber Security Agency of Singapore introduced “Singapore's Safer Cyberspace Masterplan 2020” to enforce strict regulations toward data protection. With growing data breaching incidents, Japan is likely to introduce Europe’s GDPR-like regulation for data safety. This is expected to boost the software market in APAC. The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.57 billion by 2026, and the India market is projected to reach USD 0.3 billion by 2026.

Europe

Europe is anticipated to grow with a substantial CAGR during the forecast period. The initial step toward consumer rights and data protection and the launch of GDPR are likely to provide opportunities for the key players. The U.K. leads the segment during the forecast period. As per the 2020 Carbon Black reports, 88% of the U.K. companies witnessed data breaches in the last 12 months. The UK market is projected to reach USD 0.36 billion by 2026, while the Germany market is projected to reach USD 0.36 billion by 2026.

Likewise, with growing technological advancement in the Middle East & Africa, the key players in GCC, Israel, South Africa, and others are likely to have vast opportunities. South America will witness significant growth during the forecast period. With the growing data protection concern and Brazilian LGPD law, the market is expected to gain traction.

Key Industry Players

Key Companies Are Focused on Offering Solutions In-line with New Regulations

The key players are investing in developing and launching advanced privacy software to fulfill the growing demand for data protection and management. These players are offering software to manage customer data as per the guidelines and regulations of every country. Some of the leading players are providing interactive sessions for organizations to interact with software and security professionals for managing the clients’ information.

List of Top Data Privacy Software Companies:

- Ketch (U.S)

- OneTrust, LLC (U.S.)

- AvePoint, Inc. (U.S.)

- TrustArc, Inc. (U.S.)

- Securiti.AI. (U.S.)

- BigID, Inc. (U.S.)

- IBM Corporation (U.S.)

- Protiviti, Inc. (U.S.)

- RSA Security LLC (U.S.)

- DataGrail, Inc. (U.S.)

- SureCloud (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 – Protiviti India entered a partnership with Riskconnect to help companies in India bring all aspects of risk under one roof through an integrated risk management technology.

- July 2023 – Trust Arc introduced a new Truste EU-U.S. data privacy framework verification to help businesses transfer personal data from the EU to the U.S. in compliance with the EU and GDPR laws.

- April 2023 – Avepoint and Tech Data expanded their partnership for providing Microsoft 365 data management solutions in Japan and Asia Pacific. The extended partnership will cover Indonesia, India, Vietnam, Malaysia, Singapore, and Hong Kong.

- January 2023 - Sourcepoint launched a solution, Vendor Trace, to offer enterprises with a flexible evaluation of vendor behavior on their websites. With the help of Vendor Trace, users can isolate susceptibilities in third-party advertising and marketing technologies and determine the responsible parties.

- September 2022 - BigID launched data deletion abilities to minimize risk and accelerate compliance. The new advancement permits enterprises to effectively and quickly delete sensitive and personal data across various data stores such as Google Drive, AWS, Teradata, and others.

- October 2022 - Securiti launched the first Data Control cloud that facilitates enterprises with key obligations over data privacy, security, compliance, and governance. The new offerings developed a combined layer of data intelligence and controls across various clouds, such as public cloud, private cloud, data clouds, and SaaS.

- March 2022 - AvePoint announced the addition of ransomware detection to its data protection proficiencies. The new addition proactively identifies apprehensive behavior within Microsoft’s OneDrive while reducing disruption to collaboration and productivity. Other features included in ransomware detection are faster investigation, early event detection, and quicker restoration of backup data.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2026-2034 |

|

Growth Rate |

CAGR of 29.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 60.4 billion by 2034.

In 2025, the market size was valued at USD 5.37 billion.

The market is projected to record a CAGR of 29.70% over the forecast period.

Compliance management is expected to lead the market.

The rising adoption of IoT devices is driving market growth.

OneTrust, TrustArc, Inc., BigID, Inc., Securiti.AI., AvePoint, Inc., IBM Corporation, RSA Security LLC, and SureCloud are the top players in the market.

North America is expected to hold the largest market share.

The healthcare industry is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us