Plastic Processing Machinery Market Size, Share & Industry Analysis, By Type (Injection Molding Machinery, Blow Molding Machinery, Extrusion Molding Machinery, Thermoforming Machinery, and Others), By Industry Vertical (Packaging, Automotive, Construction, Consumer Goods, Healthcare, and Others), and Regional Forecast, 2026 – 2034

Plastic Processing Machinery Market Size

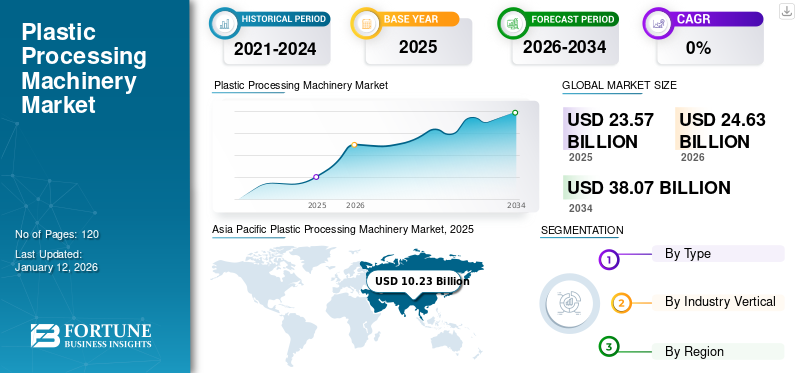

The global plastic processing machinery market size was valued at USD 23.57 billion in 2025. The market is projected to grow from USD 24.63 billion in 2026 to USD 38.07 billion by 2034, exhibiting a CAGR of 5.6% during the forecast period. The Asia Pacific dominated global market with a share of 43.40% in 2025.

Plastic processing machinery encompasses various types of equipment, including injection molding machines (used for producing intricate plastic parts), extrusion machines (for making profiles, pipes, and sheets), blow molding machines (for producing bottles and containers), and thermoforming machines (for creating packaging and disposable products).

Global Plastic Processing Machinery Market Overview

Market Size:

- 2025 Value: USD 23.57 billion

- 2026 Value: USD 24.63 Billion

- 2034 Forecast Value: USD 38.07 billion, with a CAGR of 5.6% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific dominated the global market with a 43.40% market share in 2025, driven by its vast manufacturing base in countries like China and India, rapid industrialization, and export-oriented manufacturing.

- Type Leader: Injection molding machinery holds the highest share due to its cost-effectiveness, high production speed, and versatility in creating a wide range of products for the automotive, packaging, electronics, and medical industries.

- End-User Leader: The packaging industry is the largest segment, relying heavily on plastic processing machines to create containers, bottles, and flexible packaging materials to meet the rising demand for sustainable packaging.

Industry Trends:

- Use of Industry 4.0 Technologies: Machines are increasingly equipped with sensors and internet connectivity to gather real-time data on temperature, pressure, and speed. This fosters predictive maintenance, reduces downtime, enhances product quality, and allows for greater production flexibility.

- Sustainability and Circular Economy Focus: There is a growing emphasis on developing machinery that can process recycled plastics and support circular economy principles. This trend is driven by the need to reduce the environmental impact of plastic waste.

Driving Factors:

- Advancements in Plastic Materials: The continuous development of new plastic formulations with enhanced properties like increased strength, heat resistance, and biodegradability fuels the demand for more specialized and precise processing machinery.

- Demand for Sustainable and Specialized Products: The shift toward biodegradable and recyclable plastic materials, driven by consumer preferences and regulations, creates a need for machinery capable of processing these eco-friendly alternatives.

- Technological Efficiency: Advances in automation and robotics are improving the speed, quality, and precision of plastic processing machinery, while also reducing waste and energy consumption, making them more attractive to manufacturers.

The COVID pandemic disrupted supply chains worldwide, leading to delays in the production and delivery of machinery components. This, in turn, affected the manufacturing capacity of machinery suppliers. Many industries that use plastic products, such as automotive and aerospace experienced low supply of these products during the pandemic. This resulted in reduced investments in new machinery and production facilities. On the other hand, certain sectors, such as healthcare, packaging (especially for food and e-commerce), and personal protective equipment (PPE) saw an increased demand for plastic products.

Advances in technology have increased the efficiency and precision of machines, reducing waste and energy consumption in the plastic manufacturing process. For example, the integration of automation and robotics has improved the production speed and quality. Sustainability is a growing concern in the plastic industry. Manufacturers are exploring ways to reduce the environmental impact of plastic processing machines. This includes developing machinery that can process recycled plastics and exploring alternative materials. The concept of a circular economy, where plastics are reused, recycled, or repurposed rather than discarded as waste, is gaining traction. Plastic processing machines are evolving to support these circular economy principles.

Plastic Processing Machinery Market Trends

Use of Industry 4.0 Technologies to Foster Market Growth

In Industry 4.0, processing machines are equipped with sensors and connected to the Internet. These sensors can collect real-time data on various parameters, such as temperature, pressure, speed, and quality. This data is then transmitted to a central system where it is analyzed. For example, sensors in an injection molding machine monitor the temperature and pressure during the molding process to ensure product quality. Industry 4.0 enables the formulation of predictive maintenance strategies.

By continuously monitoring the condition of processing machinery, manufacturers can predict when maintenance is needed. This prevents unexpected breakdowns and reduces downtime. For instance, if sensors detect abnormal vibrations in an extrusion machine, maintenance can be scheduled before a major failure occurs. Industry 4.0 also enables greater customization and flexibility in production. Machines can be reconfigured quickly to produce different products or adapt to changing customer demands. Furthermore, Industry 4.0 facilitates seamless integration across the entire manufacturing ecosystem, enabling data exchange and collaboration between machines, suppliers, and customers. This interconnectedness fosters a holistic approach to production management, where real-time insights from various sources inform decision-making processes, optimize supply chain operations, and drive continuous improvement initiatives.

Additionally, the implementation of advanced analytics and artificial intelligence algorithms allows for deeper insights into production processes, enabling manufacturers to identify trends, optimize resource utilization, and make data-driven decisions to stay ahead in a rapidly evolving market landscape.

Therefore, the integration of Industry 4.0 in this industry aims to improve efficiency, reduce costs, enhance product quality, and provide greater agility in responding to customer demands. It represents a fundamental shift in the approach toward manufacturing, leveraging the power of data and connectivity to drive innovation and competitiveness.

Download Free sample to learn more about this report.

Plastic Processing Machinery Market Growth Factors

Advancements in Plastic Materials to Fuel Demand For Specialized Processing Machinery

Plastic materials are constantly evolving, with researchers and manufacturers developing new formulations and types of plastics with enhanced properties and capabilities. New plastic materials are engineered to have specific characteristics, such as increased strength, heat resistance, durability, or biodegradability. To process these specialized materials effectively, manufacturers often need updated or specialized plastic processing machinery. Advanced plastic materials require machinery with higher precision and tighter process control to ensure the correct temperature, pressure, and extrusion rates. This precision is essential to achieve the desired properties in the finished plastic products.

3D printing and additive manufacturing technologies have introduced new possibilities in the development of plastic products. Specific types of processing machinery are designed for these additive manufacturing processes. Moreover, the increasing focus on sustainability and environmental concerns is driving the development of biodegradable and recyclable plastic materials, further influencing the demand for specialized plastic processing machinery capable of handling these eco-friendly alternatives. As regulatory frameworks evolve and consumer preferences shift toward more sustainable solutions, the market is set to witness continued growth.

The rising advancements in plastic materials will drive innovation and enhance diversity in the types of plastics available for use in various industries. Plastic processing machine manufacturers must keep abreast of the latest developments in plastic materials to design and produce machinery that efficiently processes these evolving materials. This ensures that manufacturers can meet the demands of industries seeking improved performance, sustainability, and versatility in plastic products, thereby contributing to the plastic processing machinery market growth.

RESTRAINING FACTORS

Government Regulations and Market Saturation To Reduce Growth Opportunities for Manufacturers

Governments worldwide are implementing regulations aimed at reducing single-use plastics, promoting recycling, and limiting plastic waste. These regulations restrict the use of certain plastics and require manufacturers to adopt more sustainable practices. Recycling and circular economy initiatives encourage the reuse and recycling of plastics, thereby reducing the need for virgin plastic production. This decreases the demand for machinery used in primary plastic manufacturing. The development of bioplastics (plastics derived from renewable sources) and alternative materials offers more eco-friendly options. These materials often require different processing methods and machinery, potentially impacting the demand for traditional processing machinery.

In some regions or industries, manufacturers already possess sufficient machinery to meet the demand in the market. This can only limit the need for additional machinery if there is a substantial increase in demand. In industries where plastic processing is well-established and mature, there may be little room for significant growth in the demand for processing machines. For example, the demand for basic plastic products may be saturated in certain regions.

Along with government regulations and market saturation, intense competition within the market can lead to reduced opportunities for market expansion.

Plastic Processing Machinery Market Segmentation Analysis

By Type Analysis

Injection Molding Machines to Gain Traction Owing to Vast Applications in Various Industries

Based on type, the market is segmented into injection molding machinery, blow molding machinery, extrusion molding machinery, thermoforming machinery, and others.

Injection molding machines have the highest share of 40.03% in the 2026 market owing to their cost-effectiveness, high production speed, and versatility in creating a wide range of plastic products. Injection molding injects molten plastic material into a mold cavity to create precise and complex plastic parts. The machine is widely used in automotive, packaging, electronics, and medical industries for components and products.

Blow molding forms hollow plastic shapes by inflating heated plastic parisons inside molds. It is primarily used for bottles, containers, and packaging for beverages, personal care, and household items.

Extrusion molding forces molten plastic through a die to produce continuous profiles with specific cross-sections. They are used in construction, automotive, and packaging sectors for items, such as pipes, window frames, and plastic sheeting.

Thermoforming heats plastic sheets and molds them into shapes with consistent thickness and produces packaging trays, disposable cups, and automotive interior components. The others segment comprises processes, such as rotational molding, compression molding, and transfer molding. These methods serve unique purposes, e.g., rotational molding for large, hollow products, such as tanks and playground equipment.

By Industry Vertical Analysis

Packaging Industry to Extensively Use Plastic Processing Machines Owing to Rising Demand for Sustainable Packaging

Based on industry vertical, the market is segmented into packaging, automotive, construction, consumer goods, healthcare, and others. The packaging segment is expected to capture the largest plastic processing machinery market share of 36.05% in 2026. This industry relies on plastic processing machines to create containers, bottles, and various packaging materials. This machinery is used to produce bottles for beverages, food containers, cosmetic packaging, and flexible packaging materials, such as bags and films.

The automotive industry employs machinery to manufacture various plastic components used in vehicles. The machines are used for producing plastic parts, such as interior panels, bumpers, dashboards, and engine components.

In construction, plastic processing machines are utilized for creating plastic pipes, fittings, profiles, and other building materials. The machinery produces items, such as PVC pipes, window frames, insulation materials, and structural components.

The consumer goods sector employs plastic machinery to manufacture a wide range of everyday products. These machines are used for producing items including toys, kitchen appliances, household items, and electronic device casings.

The healthcare industry relies on plastic processing machines to produce medical devices, packaging for pharmaceuticals, and healthcare equipment. The machinery is used for producing items, such as syringes, medical tubing, pill packaging, and diagnostic equipment components.

Various industries fall under the others segment, including agriculture, where plastic machinery serves specific applications. Agriculture may use plastic processing machinery for producing items, such as irrigation pipes, greenhouse materials, and agricultural equipment components.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Asia Pacific dominated the market with a valuation of USD 10.23 billion in 2025 and USD 10.72 billion in 2026 & leads the market for lastic processing machinery due to its vast manufacturing base, especially in countries, such as China and India. It is a global hub for plastic production and processing. Rapid industrialization, urbanization, and export-oriented manufacturing will drive the regional market. Sustainability efforts and technological advancements are on the rise. Industries, such as automotive, electronics, packaging, and construction heavily rely on plastic machinery. The Japan market is projected to reach USD 1.64 billion by 2026, the China market is projected to reach USD 6.01 billion by 2026, and the India market is projected to reach USD 1.03 billion by 2026.

Asia Pacific Plastic Processing Machinery Market, 2025

To get more information on the regional analysis of this market, Download Free sample

China has one of the world's largest and rapidly growing markets. The adoption rate is extremely high, driven by the country's robust manufacturing sector and export-oriented industries. China's status as a global manufacturing hub, particularly for industries, such as electronics, automotive, and consumer goods, will lead to the substantial demand for these machines in the country.

In North America, the market is characterized by technological advancements and a strong focus on innovation. The market is driven by robust demand from various industries, including automotive, packaging, healthcare, and consumer goods, reflecting the region's significant contribution to the global plastic processing industry. Additionally, stringent regulatory standards and growing emphasis on sustainability are shaping the adoption of advanced plastic processing technologies in North America. The United States market is projected to reach USD 3.82 billion by 2026.

Europe has a well-established and technologically advanced plastic processing machinery industry. The adoption of these machines is high, driven by stringent quality standards, eco-friendly practices, and a strong industrial base. Sustainability and circular economy initiatives have created a significant impact on the regional market. European countries are focusing on recycling and reducing plastic waste. The automotive, packaging, and construction sectors are key consumers of plastic processing machinery. The United Kingdom market is projected to reach USD 0.58 billion by 2026, while the Germany market is projected to reach USD 1.09 billion by 2026.

The adoption of plastic processing machinery varies across countries in the Middle East and Africa. The market in some nations is growing, while others have smaller-scale operations. South America's adoption of plastic processing machines varies by country and industry. Countries, such as Brazil have a more mature market, while others have an emerging market.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Leading Manufacturers Vie for Market Dominance Through Continuous Product Innovations

Many companies involved in this market are investing heavily in research and development to create machinery with improved efficiency, precision, and automation capabilities. They are working on innovations, such as energy-efficient components, enhanced control systems, and IoT integration. Many companies are developing machinery that supports sustainability, such as systems for processing recycled plastics and equipment that uses eco-friendly materials. Manufacturers may diversify their product portfolios to serve multiple industries and applications. This reduces reliance on specific market segments.

List of Top Plastic Processing Machinery Companies:

- ARBURG GmbH (Germany)

- Brown Machine Group (U.S.)

- ENGEL AUSTRIA GmbH (Austria)

- Haitian International Holdings Limited (China)

- Husky Injection Molding Systems Ltd (Canada)

- KraussMaffei (China)

- Milacron LLC (Hillenbrand Inc.) (U.S.)

- NISSEI PLASTIC INDUSTRIAL CO., LTD. (Japan)

- Sumitomo Heavy Industries (Japan)

- WITTMANN Technology GmbH (Austria)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Arburg unreilved the 110-ton Allrounder 470H hybrid injection molding machine with enhanced reliability, ease of use, and energy efficiency.

- August 2022: South Korea’s LS Mtron, a manufacturer of heavy machinery, unveiled a cutting-edge injection molding system powered by artificial intelligence. This system boasts two key technical components: an AI molding assistant and intelligent weight control. The AI molding assistant minimizes stabilization time during the initial molding stage, while the smart weight control feature detects any variations in product weight.

- July 2022: SACMI Group inaugurated its regional headquarters in Mumbai, India, which is specifically devoted to its rigid packaging business.

- June 2022: ENGEL in collaboration with ALPHA Group, IPB, and Brink Printing debuted K 2022, marking a notable milestone in the packaging industry. This breakthrough allows for the production of PET thin-walled containers in a single injection molding process, a first of its kind achievement.

- May 2022: Husky Technologies unveiled the HyPET HPP50 Recycled Melt to PreformTM system, a groundbreaking innovation in preform injection molding, which converts washed flake into preforms.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Industry Vertical, and Region |

|

Segmentation |

By Type

By Industry Vertical

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 38.07 billion by 2034.

In 2025, the market was valued at USD 23.57 billion.

The market is projected to record a CAGR of 5.6% during the forecast period.

The injection molding machinery segment leads the market by type.

Advancements in plastic materials will fuel the demand for specialized plastic processing machinery, thereby contributing to the market growth.

ARBURG GmbH, Brown Machine Group, ENGEL AUSTRIA GmbH, Haitian International Holdings Limited, Husky Injection Molding Systems Ltd, KraussMaffei, Milacron LLC (Hillenbrand Inc.), NISSEI PLASTIC INDUSTRIAL CO., LTD., Sumitomo Heavy Industries, and WITTMANN Technology GmbH are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By industry vertical, the consumer goods segment is expected to record a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us