Spain Olive Oil Market Size, Share & COVID-19 Impact Analysis, By Type (Refined/Pure, Virgin, and Others), By End-user (Household/Retail, Foodservice/HoReCa, Food Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

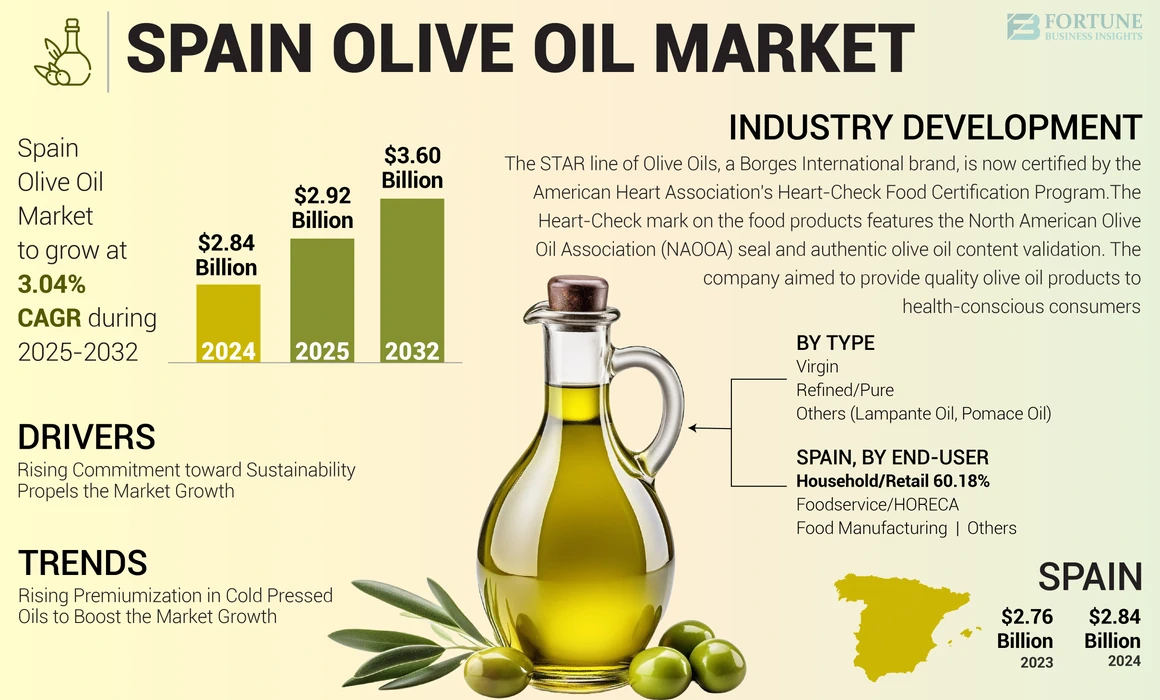

The Spain olive oil market size was valued at USD 2.84 billion in 2024. The market is projected to grow from USD 2.92 billion in 2025 to USD 3.60 billion by 2032, exhibiting a CAGR of 3.04% during the forecast period.

Olive oil is experiencing a surge in demand due to the rising trend of maintaining overall health and wellness among consumers. The foodservice sector in Spain uses the product due to its unique and delicate flavor in various foods such as salad dressing and preparing cold foods. The growing demand for nutrient-rich ingredients in daily diets is also propelling the demand for the product in the market. According to the United States Department of Agriculture (USDA), one tablespoon of olive fruit oil contains 10g of monounsaturated, 2g of polyunsaturated, and 2g of saturated fats. Furthermore, the popularity of natural and minimally processed olive fruit oil is also growing among health-conscious consumers, propelling the Spain olive oil market growth.

Global Spain Olive Oil Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 2.84 billion

- 2025 Market Size: USD 2.92 billion

- 2032 Forecast Market Size: USD 3.60 billion

- CAGR: 3.04% from 2025–2032

Market Share:

- Virgin olive oil dominated the Spain olive oil market in 2024, driven by its nutritional value, distinct taste, and rising consumer preference for monounsaturated fats.

- By end-user, the household/retail segment held the largest market share in 2024, supported by increasing awareness of health benefits, high smoke point, and strong inclusion in daily Mediterranean cooking practices.

Key Country Highlights:

- Spain: Rising domestic consumption during COVID-19 and strong tradition of olive oil in culinary culture drive market expansion.

- Spain: Launch of premium and cold-pressed products supports the trend toward premiumization.

- Spain: Technological advancements and sustainability initiatives by major producers like Deoleo S.A. enhance product quality and transparency.

- Spain: Market growth is restrained by fraud concerns and fluctuating olive harvests due to extreme climate conditions.

COVID-19 IMPACT

Increased Domestic Consumption to Fuel the Market Growth amid COVID-19

The COVID-19 pandemic had a negligible impact on the market of the country. Household consumption increased due to lockdowns and restrictions, leading to increased demand for the product. According to Spain’s Ministry of Agriculture, Fisheries and Food report, individual household olive consumption increased by 12.7% in the 12-month period, which ended in July 2020, compared to the previous year. The substantial increase in household olive oil consumption leveraged the market growth during the period.

LATEST TRENDS

Download Free sample to learn more about this report.

Rising Premiumization in Cold Pressed Oils to Boost the Market Growth

While the trend for organic olive oil has seen consumers' willingness to pay for higher-quality oils, consumers are also interested in the authenticity of the products. Therefore, companies operating in the market are taking initiatives towards innovating premium products owing to the surging demand for such products. For instance, in July 2020, Aceites Sandúa, a family-owned company in Spain, launched new premium extra virgin olive oils. The new products have a distinct taste and are used in salads, dressings, sauces, sausages, cheeses, stews and other food menus.

DRIVING FACTORS

Rising Commitment toward Sustainability Propels the Market Growth

The shift in consumer attitude toward sustainability and the environment has significantly increased in recent years. Consumers' growing interest toward raw, natural, and organic cooking oils further contributes toward sustainable practices. The leading players in the market increasingly emphasize sustainable and environmentally respectful methods for the production of olive fruit oil. For instance, Deoleo S.A., a Spanish multinational processing company, signed an agreement with some of the country’s leading cooperatives in an effort to achieve 100% sustainability for 80% of its olive oil by 2023. The company also implemented education and training programs for farmers and mill workers.

Technological Advancements to Propel the Market Growth

The Spanish olive oil manufacturers have been focusing on improving the quality of the product in the country owing to rising oil fraud. The increasing consumer awareness about the organoleptic and healthy qualities of olive fruit oil and its products led manufacturers to adopt new technologies to provide superior-quality oils. For instance, in December 2020, Spain launched an innovative olive oil testing and quality rating project with a collaborative effort between several essential industry bodies. The project was signed under the agreement between the Interprofessional Organization of Spanish Olive Oil, the Ministry of Agriculture, Fisheries and Food (MAPA), and the Ministry of Agriculture, Livestock, Fisheries and Sustainable Development of the Junta of Andalusia.

RESTRAINING FACTORS

Mislabeling and Fraudulent Activities May Impede the Market Growth

Extra virgin olive oil is known to have the highest quality of olive oil and is characterized by highly beneficial nutritional properties. However, owing to rising consumption and demand, there is a high risk of fraud in the extra virgin olive fruit oil market related to economic value, the liquid nature of the product, and the fragmented supply chain. Consumers may be reluctant to buy such products owing to rising awareness about mislabeling and fraudulent activities, which may hamper the market growth.

Moreover, low olive harvest in 2022 due to extreme draught conditions in major producing regions of the country led to surge in product prices, which may act as a restraint for the market.

SEGMENTATION

By Type Analysis

Virgin Segment to Hold a Prominent Share Owing to Its Nutritional Value and Distinct Taste

Based on type, the market is classified into virgin, refined/pure, and others.

The virgin segment is expected to hold a significant share of the market. Virgin olive oil contains modest amounts of vitamins E and K and antioxidants and help reduce the risk of chronic diseases. The consumers rising inclination toward including monounsaturated fats in their diets propels the product demand. Virgin olive oils have a distinct flavor and are thus used majorly for frying and sautéing. Therefore, several players in the market focus on developing products owing to the rising demand for such products in the market.

The refined/pure segment is expected to grow at a CAGR of 2.93% over the forecast period. Refined oils are neutral in taste and thus used for drizzles, sautéing, and salad dressing. These oils are also used to produce mayonnaises and sauces, which consumers consume majorly in Spain.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Application of the Product in the Household/Retail owing to its High Smoke Point

Based on end-user, the market is classified into household/retail, foodservice/HoReCa, food manufacturing, and others.

The household/retail segment is expected to hold a significant share of the market. Olive fruit oil has been a staple of the Mediterranean diet and increasing the product consumption for household cooking further propels the demand. The growing awareness of the product’s nutritional value and premium quality leads consumers to include virgin olive fruit oil in their daily diet. According to North American Olive Oil Association, it has a smoke point of 470⁰ F making it ideal for stir-frying and sautéing at high temperatures, thus it is used majorly in household cooking.

The foodservice/HoReCa segment is expected to grow at a CAGR of 2.81% over the forecast period. The product is used in many restaurants & by well-known chefs for their top recipes as it adds flavor & nutritional value to the food. Furthermore, traditional and famous dishes of Spanish cuisines, such as salads and Tortilla de Patatas, contain olive oil, surging the demand for the product in the market.

KEY INDUSTRY PLAYERS

Increased Focus on Certifications to Further Accelerate the Business

The product is a rapidly growing category in the edible oil segment. Spain is known to be the leading producer of olive fruit oil, with the presence of strong producers the country. Several players are consistently developing advanced strategies to take a competitive advantage. Many companies are adopting mergers & acquisitions and partnership & collaboration strategies to enable market growth. For instance, in July 2020, Acesur Group, a referent company within the olive oil sector in Spain, acquired a 5.07% stake in Deoleo, a Spanish multinational oil processing company. The acquisition helped both companies expand their olive oil business in the country.

LIST OF KEY COMPANIES PROFILED:

- Deoleo S.A. (Spain)

- Garo, Aceite De Oliva Virgen Extra (Spain)

- Olis Bellaguarda (Spain)

- GEA Group (Germany)

- Goya Foods, Inc. (U.S)

- Borges International Group (Spain)

- Acesur Group (Spain)

- Mercaoleo Sl (Spain)

- Mueloliva Y Minerva.S.L (Spain)

- Henri Mor SL (Spain)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: The STAR line of Olive Oils, a Borges International brand, is now certified by the American Heart Association's Heart-Check Food Certification Program. The Heart-Check mark on the food products features the North American Olive Oil Association (NAOOA) seal and authentic olive oil content validation. The company aimed to provide quality olive oil products to health-conscious consumers.

- June 2021: The Spanish cooperative Oleoestepa, a cooperative of regional growers in Southern Spain, launched the first bottle of PDO extra-virgin olive oil, which is made from 100% recycled plastic (rPET). The new format was introduced to respond to the increasing environmental concerns of consumers.

- February 2020: Suffolk, a Spain-based olive oil manufacturer, established its first U.S. production facility in Suffolk. The company invested USD 11 million for the expansion of its new facility.

REPORT COVERAGES

Request for Customization to gain extensive market insights.

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the market share, market size, market segmentation, and growth rate for all possible segments in the market. The report also provides an elaborative industry analysis of different country markets. The report provides various key insights such as the overview of related markets, market dynamics, SWOT analysis, recent industry developments such as mergers & acquisitions, regulatory scenario in key countries, key market trends, and the competitive landscape.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.04% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

By Type |

|

|

By End-user |

|

Frequently Asked Questions

Fortune Business Insights says that the Spain market was USD 2.84 billion in 2024 and is projected to reach USD 3.60 billion by 2032.

Growing at a CAGR of 3.04%, the market will exhibit robust growth during the forecast period (2025-2032).

The virgin segment is expected to hold a significant share in the forecast period.

Rising commitment toward sustainability and base expansion are the key driving factors of the market.

Deoleo S.A., GEA Group, Borges International Group, and Acesur Group are some of the top players in the market.

The household/retail segment is expected to hold the dominant share in the Spain market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us