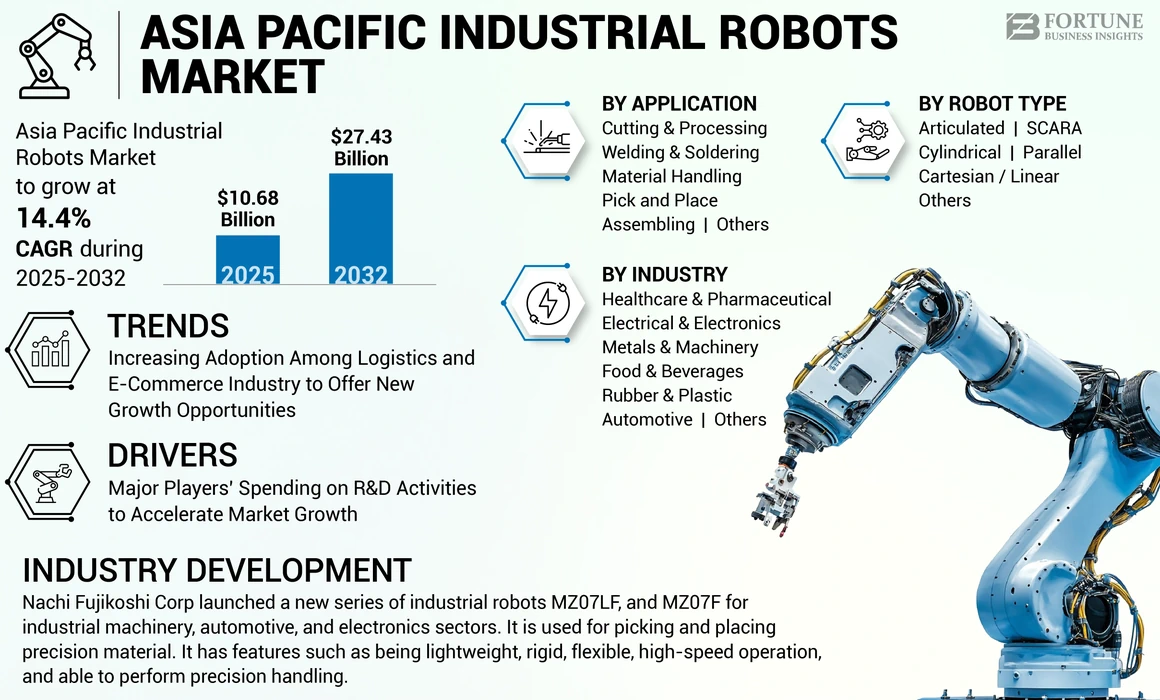

Asia Pacific Industrial Robots Market Size, Share & COVID-19 Impact Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Cartesian/Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), By Industry (Automotive, Electrical & Electronics, Healthcare & Pharmaceutical, Food & Beverages, Rubber & Plastic, Metals & Machinery, and Others), and Country Forecast, 2025-2032

Asia Pacific Industrial Robots Market Size

Asia Pacific is the largest region in the global industrial robots market. It is projected to grow at a CAGR of 14.4% during the forecast period. The global market for industrial robots is projected to grow from USD 10.68 billion in 2025 to USD 27.43 billion by 2032.

The adoption of industrial robots in various industries across Asia Pacific countries such as India, China, Japan, and Korea among others is expected to propel market expansion over the projected period. Also, growth in the automotive industry and manufacturing industry across China, Japan, India, and other countries, is expected to drive the demand for these products. Such factors drive the demand for the growth of the Asia Pacific’s market This robot market is expected to growing with highest Asia Pacific industrial robots market share. Also, in COVID-19 pandemic, the market suffered from loss owing to disruption in supply chain of robots among end users.

According to our analysis, China market with revenue of USD 7.41 billion in 2024 and is projected to reach by 20.33 billion by 2032. Furthermore, Japan comes second in the ranking followed by China. The Japan industrial robots market 2024-2032in million from USD 0.97 billion in 2024 and is expected to reach USD 2.74 billion by 2032. Also, according to our analysis, the Pacific market by automotive 2024-2032 in million with valued at USD 0.34 billion in 2024, and 0.91 billion by 2032.

Our report on the Asia Pacific industrial robots market covers the following countries/regions – China, Japan, India, Southeast Asia, and the rest of Asia Pacific’s market.

Asia Pacific Industrial Robots Market Trends

Increasing Adoption Among Logistics and E-Commerce Industry to Offer New Growth Opportunities

The growth in e-commerce and logistics sectors across Asia Pacific region is expected to fuel the demand for more industrial robots in industry verticals. For instance, according to India Brand Equity Foundation (IBEF), the e-commerce sector in India grew by 21.5% from 2021 to 2022. Also, growth in the logistics sectors which uplifts the demand for industrial robots for pick & place, and material handling applications, which are expected to witness strong Asia Pacific industrial robots market growth during the forecast period.

Asia Pacific Industrial Robots Market Growth Factors

Major Players’ Spending on R&D Activities to Accelerate Market Growth

Major players such as Fanuc Corporation, Yaskawa Electric Corporation, Nachi Fujikoshi Corporation, and Mitsubishi Electric Corporation and among others are having strong presence over Asia Pacific for this market. These key players are planning to invest in research & development (R&D) activities for bringing new technological advancements in these robots and also improve the features associated with it. All such instances further contribute to market expansion for the robotics industry.

- For instance, 2022, Fanuc Corporation invested around USD 409.8 million in 2022, and USD 426 million for research and development activities. This investment was done for improving the technologically advanced industrial robots for various end-user industries.

RESTRAINING FACTORS

Huge Capital Investment and Installation Cost to Restrain Market Growth

High capital investment and installation costs associated with industrial robot systems across various end user industries across the Asia Pacific is anticipated to restrain for the growth of the market during the forecast period. An increasing demand of industrial robots from the automotive and food & beverage sectors which incurs more capital investment in the market. This cost is not affordable for small as well as medium business sizes. Hence, these factors are projected to restrain the growth of the market.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, Fanuc Corporation, Yaskawa Electric Corporation, and Kawasaki Heavy Industries Ltd are the key players of the Asia Pacific market. These key players are adopting partnerships, acquisitions, products launch, and product development as strategic developments for strengthening their product portfolio and distribution network through diversified locations to increase their share in the Asia Pacific market.

List of Top Asia Pacific Industrial Robots Companies:

- Fanuc Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Kawasaki Heavy Industry Ltd (Japan)

- Omron Corporation (Japan)

- Seiko Epson (Japan)

- Nachi-Fujikoshi Corp (Japan)

- Denso Corporation (Japan)

- Jaka Robotics (China)

- Estun Automation (China)

- Neuromeka (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- July 2022: Nachi Fujikoshi Corp launched a new series of industrial robots MZ07LF, and MZ07F for industrial machinery, automotive, and electronics sectors. It is used for picking and placing precision material. It has features such as being lightweight, rigid, flexible, high-speed operation, and able to perform precision handling.

- January 2022: Yaskawa Electric Corporation acquired additional share of Doolim Yaskawa Co Ltd based in South Korea deals in manufacturing painting robots. The acquisition was done for increasing the product portfolio of painting robots of the company.

- October 2021: Omron Corporation signed an agreement with Techman Robot Inc., based in Taiwan and deals in manufacturing collaborative robots and industrial robots. The agreement was done for acquiring the stake of 10% by the company.

REPORT COVERAGE

The market report provides qualitative and quantitative insights on the market and a detailed analysis of the Asia Pacific market size & growth rate for all possible segments in the market. Along with the Asia Pacific industrial robots market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.4% from 2025 to 2032 |

|

Unit |

Value (USD Billion), and Volume (Thousand Units) |

|

Segmentation |

By Robot Type; By Application; By Industry; and By Country/ Sub-Region |

|

Segmentation |

By Robot Type

By Application

By Industry

By Country/ Sub-Region

|

Frequently Asked Questions

Growing at a CAGR of 14.4%, the market will exhibit steady growth in the forecast period (2025-2032).

Key players are spending on their research and development costing to bring new technological advancements in their product portfolio are the major factors driving the growth of the market.

Fanuc Corporation, Omron Corporation, and Yaskawa Electric Corporation are the major market players in the Asia Pacific market.

China dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us