Ceramic Balls Market Size, Share & Industry Analysis, By Material (Silicon, Alumina, Zirconia, and Others), By Function (Inert and Active), By Application (Bearing, Grinding, Valve, and Others), By End-User (Automotive, Oil & Gas, Chemical, Aerospace, Medical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

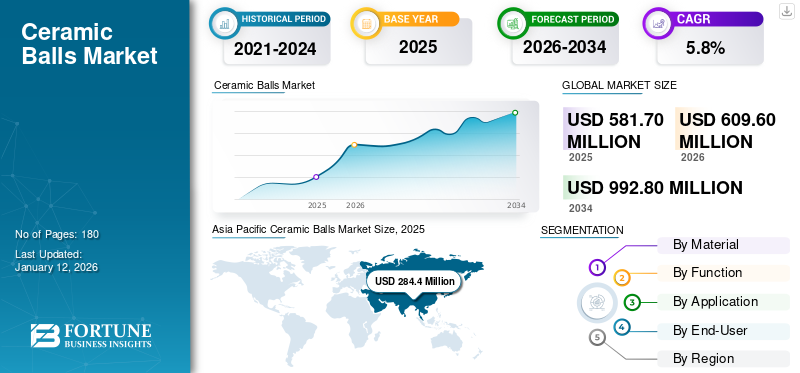

The global ceramic balls market size was valued at USD 581.7 million in 2025 and is projected to grow from USD 609.6 million in 2026 to USD 992.8 million by 2034, exhibiting a CAGR of 5.8% during the forecast period. Asia Pacific dominated the ceramic balls market with a market share of 49% in 2025. Moreover, the ceramic balls market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 100.21 million by 2032, driven by the strong demand from aerospace sector which are used in components such as bearings, actuators, seals, and thrust reversers.

Ceramic balls are rolling, spherical elements providing lighter weight, higher rigidity, reduced thermal expansion, intensified resistance to corrosion, and more excellent electrical resistance than steel balls. They are produced from a mixture of several ceramic materials. A mixture of ceramic powder binder is pressed in a preformed shape for manufacturing; precision finishing and lapping are essential for determining product design and specifications. A combination of diverse ceramic compounds can be opted for producing these balls according to the requirements of the end-users. Some combinations are aluminum silicate, alumina-zirconia, aluminum nitride, silicon nitride, alumina, boron carbide, and boron nitride.

In addition, these balls are used in widespread application areas supporting the growth of the market. Alumina-based balls provide extremely high strength, abrasion resistance, and furnace atmospheres resistance. These balls are useful in conveyors, ball transfer units, roller tables, casters, roller or lazy Susan applications. In petrochemical refineries, it is used as a covering and support material for the catalyst in the reactor. It can buffer the impact of the gas and liquid entering the reactor on the catalyst, protect the catalyst, and improve the distribution of liquid and gas in the reactor. It is widely used as automotive bearings, with seat slides, seatbelt locking mechanisms, and safety restraints. The superior properties offered by ceramic spherical balls and their increasing use in the automotive industry are significant drivers for the growth of the market. However, high production costs may hamper the ceramic balls market growth.

The COVID-19 pandemic in 2020 caused unprecedented social and economic disruptions. According to some experts, this global crisis caused more problems than any other historical event, which will be remembered as one of the most significant events in human history. COVID-19 had a significant economic impact on the automobile and petrochemical industries. Various scenarios, such as disruptions in cash flow, breaks in supply chains, shifts in resource allocation, requirement for social distance, and others brought about a change on every level.

GLOBAL CERAMIC BALLS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 581.7 million

- 2026 Market Size: USD 609.6 million

- 2034 Forecast Market Size: USD 992.8 million

- CAGR: 5.8% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 49% share, rising from USD 284.4 million in 2025 to USD 299.1 million in 2026, driven by strong demand from automotive, oil & gas, and chemical industries.

- By material: Alumina dominated due to high strength, abrasion resistance, and furnace atmosphere tolerance.

- By application: Bearings held the largest share owing to enhanced strength, shock resistance, and aerospace & automotive demand.

- Aerospace segment accounted for 7.45% share in 2024.

Key Country Highlights:

- China: Largest regional market, driven by automotive, petrochemical, and aerospace industries (7.49% aerospace share).

- United States: Projected to reach USD 100.21 million by 2032, supported by aerospace and petrochemical sectors.

- Germany: Strong automotive base and rising EV adoption boost demand.

- Middle East & Africa: Growth fueled by Saudi Arabia’s oil & gas industry consumption.

- Latin America: Increasing industrialization and use in chemical and medical sectors.

Ceramic Balls Market Trends

Increasing Demand from Wind Farms Will Create New Opportunity for Market Growth

Due to growing urbanization, the need for wind turbine farms increases in size and power generation; as a result, the blade length, tower height, and generator size have increased load and size requirements. Silicon nitride ball bearings have the longevity and load-carrying capacity to bring the best solution to meet these demands. The durability of silicon nitride balls further lends itself to reducing the risk of unscheduled maintenance. SKF remains at the forefront of manufacturing ceramic bearing balls, application, industrialization, and standardization. Development work is ongoing, especially in the more extensive ball size range. There are opportunities to cater to the new material composition for specific requirements of the product application. This will help to get effectual output from the generator motors. Moreover, it saves the environment and reduces energy consumption. Asia Pacific witnessed a ceramic balls market growth from USD 259.3 million in 2023 to USD 271.2 million in 2024.

Ceramic Balls Market Growth Factors

Rising Demand from EV Automobile Manufacturers to Drive Market Growth

Ceramic hybrid electric motor quality bearings have steel races and ceramic materials. Ceramic balls are suitable for applications where high speeds, loads, and temperatures are maintained. Longer life and the need for sufficient lubrication make this material appropriate for extreme applications. Ceramics is lighter than steel, non-corrosive, non-magnetic, and non-porous material. In ball form, ceramic balls are more rigid than steel, virtually frictionless, non-porous, and capable of spinning at fast rate than steel balls. EV engineers prefer to reduce weight wherever required. These balls cause lower friction in the bearing assembly, hence they experience less wear, require less lubricant, and cause less raceway stress. The Electric Vehicle (EV) industry is still developing and will undoubtedly find ways to innovate and improve its key technologies like chargers, batteries, and electric motors. Thus the critical requirements in the automobile will revolve and help to grow the product expansion.

Growing Product Usage in Petrochemical Refineries Will Drive Market Share

In recent years, the petrochemical industry has increasingly adopted the use of ceramic balls due to their exceptional properties and advantages over other materials. These balls have high resistance to abrasion, corrosion, and high temperatures, making them ideal for use in harsh environments, where other materials may quickly degrade. Additionally, their low coefficient of thermal expansion ensures dimensional stability, thereby preventing cracking or spalling.

The use of the product in the petrochemical industry has grown in recent years due to the increasing demand for more efficient and sustainable processes. The durability of ceramic-based balls enables them to withstand harsh conditions, thereby improving the efficiency and lifespan of the equipment used in the industry. Moreover, using these balls can reduce maintenance and replacement costs as they are less prone to wear and damage compared to other materials. Overall, it is expected that the use of this product in the petrochemical industry will continue to grow in the coming years as more companies strive to improve efficiency and reduce costs, while maintaining high levels of quality and safety.

Download Free sample to learn more about this report.

RESTRAINING FACTORS

Availability of Substitutes and Fluctuation in Raw Material Prices to Hinder Market Growth

The primary alternatives to ceramic balls are steel bearing balls, stainless steel balls, ballpoint balls and other metal balls, which can be used in various end-use industries, majorly in the automobile sector. Price fluctuations in raw materials used for making these balls are a significant concern for the market's consistent growth. Rapid fluctuations in the prices of raw materials such as alumina, silicon, zirconia, and boron and a lack of product availability are expected to impact the global market in the near future. Furthermore, rising environmental concerns and health risks such as asthma, chronic inhalation, and other respiratory problems from manufacturing operations are expected to impose strict regulations, limiting the growth of products over the forecast period.

Ceramic Balls Market Segmentation Analysis

By Material Analysis

Alumina Material to Hold Largest Share Due to its Superior Properties

The market is segmented based on material: alumina, silicon, zirconia, and others. Alumina material held a leading ceramic balls market share of 46.6% in 2026 owing to its characteristics over the other materials in the market. Alumina balls have tremendous benefits in higher density, having a regular shape, efficiently classifying, assorting, and superior grinding efficiency. The selection of high-quality alumina balls allows perfect control at the firing temperature and reaches the proper crystalline structure.

By Function Analysis

Inert Function to Hold Larger Share Due to its Resistant to High Temperature and Pressure

The market is bifurcated based on function: inert and active function. Inert ceramic balls held a larger share of 61.75% in 2026 with the rising demand from the automotive industry and the growing installation for the application of bearings and valves. Inert ceramic balls can sustain high pressure and temperature and are largely used in chemical, petrochemical, fertilizer, and environment-sustainable manufacturing companies. The major application is the increase in the level of gas and liquid distribution points to support the low-strength active catalyst.

Inert function balls will not react with the material and participate proactively with the major market demand. In contrast, active ceramics, like activated alumina, can react with the material and are primarily used as the absorbent. Activated balls are strongly attracted to oxide, and alkali, with defluorination effects that are easy to maintain. These factors show the major uptrend opportunity in the market during the forecasted period.

By Application Analysis

Bearing Application to Account for Largest Share Due to Product’s Enhanced Strength, and Active Shock Resistance

The market is segmented into bearing, grinding, valve, and others, on the basis of application. The bearing segment dominates the market due to expansion in the aerospace and automotive industries with the increased strength and shock resistance capabilities. The Bearing segment is poised to account for 47.39% of the market share in 2026. Ceramic spherical balls are high-purity materials used in grinding with alumina compounds and some proportionate zircon manufactured with the isotactic procedure. The major advantage of using ceramic grinding balls rather than steel balls is the efficient energy saving, which reduces 20-30% in main motor current, decreases cement temperature and reduces the environmental noise.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Industry is Dominating the Segment owing to High Product Usage in Various Auto-Components

Based on the end-user, the market can be segmented into automotive, oil & gas, chemical, aerospace, medical, and others. The Automotive segment is forecast to represent 43.32% of total market share in 2026. Driven by the sustained demand for automobiles and supportive government policy, the market will see a strong rebound in 2022 and robust growth over the coming decade. Ceramic balls are widely used in automobile manufacturing for their benefits, including higher strength, shock resistance, and faster operational speed. Automotive applications are anticipated to drive the demand because of their practical applications in ball bearings, spark plugs, roller bearings, airbags, valves, engine components, seat slides, and locking mechanisms. In aerospace manufacturing, they are used in flow meters, gyroscopes, and airframes. All these factors will help to generate the demand for the balls across various industries. The aerospace segment is expected to hold a 7.45% share in 2024.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Ceramic Balls Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific was valued at USD 284.4 million in 2025 and it is expected to register the fastest growth rate during the forecast period. The market's growth is associated with the expansion of the regional automotive industry, which boosts the different sectors in the area. China is the leading country driving the market growth in the region due to the growing product demand from automotive, oil & gas, and chemical industries. The Japan market is valued at USD 24.8 million by 2026, the China market is valued at USD 136.8 million by 2026, and the India market is valued at USD 49.3 million by 2026.

- In China, the aerospace segment is estimated to hold a 7.49% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

North America's growing petrochemical and aerospace industry will grow this region’s ceramic ball market. Major commercial aircraft player, such as Boeing, dominate aerospace manufacturing and equipment sourcing. Also, the major oil & gas companies, such as ExxonMobil, Chevron, and Marathon Petroleum, also lead to the growth of ceramic materials in the U.S. petrochemical market. The U.S. market is valued at USD 73.9 million by 2026.

Europe

The market growth in Europe is associated with the rapid increase in the region's biggest automobile sector in Germany. The rapid growth in the automotive industry and the increasing adoption of electric vehicles due to the rising CO2 emission will boost European product use. Additionally, the presence of a few giant materials manufacturers in the region is expected to boost the consumption of ceramic spherical balls. The UK market is valued at USD 23.1 million by 2026, and the Germany market is valued at USD 40.7 million by 2026.

The growth of the market in Latin America is due to increased industrialization. The growth is attributed to the rising use of silicon carbide and silicon nitride in industries such as chemicals and the medical industry.

Meanwhile, the Middle East & Africa is expected to have significant market growth driven by Saudi Arabia, due to increased consumption in the oil & gas industry.

KEY INDUSTRY PLAYERS

Key Players to Strengthen their Position by Offering Products to Ceramic Balls Industries

The foremost producers, including Saint-Gobain, SKF, CoorsTek, Inc., Tsubaki Nakashima Co Ltd., and Tipton Corp., are company trademarks for the materials business. Amongst them, Saint-Gobain is a leading manufacturer of ceramic balls with strong presence in Europe. The company has adopted new product development and expansion strategies to gain competence. Similarly, the other key market players have adopted strategies such as capacity expansions, partnerships, and product enhancements to increase their presence.

List of Top Ceramic Balls Companies:

- Saint-Gobain (France)

- SKF (Sweden)

- CoorsTek, Inc. (U.S.)

- Tsubaki Nakashima Co., Ltd. (Japan)

- Tipton Corp. (Japan)

- Toshiba Materials Co. Ltd. (Japan)

- Fineway Inc. (Canada)

- Topack Ceramics Pvt. Ltd. (India)

- Devson Catalyst Private Limited (India)

- Madhya Bharat Ceramics (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2022- Toshiba Materials Co., Ltd. announced a significant investment in a new manufacturing facility for silicon nitride balls on the same site as its headquarters in Yokohama, Japan. The project has a total budget of over 5 billion Japanese yen (approx. USD38 million) and is expected to see production start in November 2024. It will increase capacity by 50% against the fiscal year 2021.

- September 2019- Saint-Gobain Norpro announced a new development of Accu sphere product with small and large submicron pore sizes. This project is under alpha- alumina phase and is anticipated to support the strong growth of Saint-Gobain innovation strategy to identify the optimum solutions for the customers.

REPORT COVERAGE

The market report provides a detailed market analysis and focuses on crucial aspects such as material, function, application, end-users, and leading companies. It provides quantitative data in terms of value, research methodology for market size estimation, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors contributing to the market’s growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.8% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Function

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 609.6 million in 2026 and is projected to reach USD 992.8 million by 2034.

In 2025, the Asia Pacific market size was valued at USD 284.4 million.

Registering a significant CAGR of 5.8%, the market will exhibit rapid growth during the forecast period of 2026-2034.

Alumina material is expected to be the leading segment in this market during the forecast period.

Growth in electric vehicle production is propelling the material demand.

Asia Pacific held the highest share of the market in 2026.

Saint-Gobain, SKF, CoorsTek, Inc., Tsubaki Nakashima Co Ltd, and Tipton Corp. are the major players in the market.

The rising demand from automotive industry drives product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us