Cold Chain Equipment Market Size, Share & COVID-19 Impact Analysis, By Type (Refrigerated Storage and Transportation), By Industry Vertical (Pharmaceuticals, Food and Beverage, Chemicals, Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

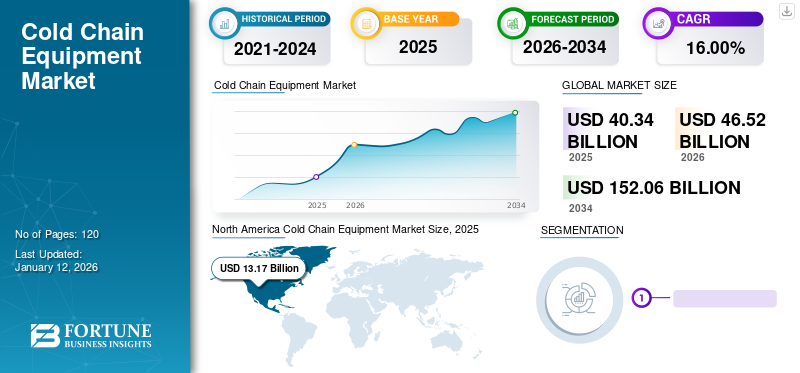

The global cold chain equipment market size was valued at USD 40.34 billion in 2025 and is projected to grow from USD 46.52 billion in 2026 to USD 152.06 billion by 2034, exhibiting a CAGR of 16.00% during the forecast period. North America dominated the cold chain equipment market with a market share of 32.70% in 2025.

The cold chain equipment is crucial in preserving and transporting temperature-sensitive products, such as pharmaceuticals, vaccines, and perishable food items, throughout the supply chain. The market has experienced significant growth in recent years due to the increased demand for effective cold storage and transportation solutions. With the expansion of the pharmaceutical and food industries, the need for reliable refrigeration and freezing technologies has intensified, driving the adoption of advanced cold chain technology globally. Factors such as stringent regulations for quality control, rising awareness about maintaining product integrity, and the growing importance of reducing food waste further contribute to expanding the cold chain equipment market share.

Global Cold Chain Equipment Market Overview

Market Size:

- 2025 Value: USD 40.34 billion

- 2026 Value: USD 46.52 billion

- 2034 Forecast Value: USD 152.06 billion, with a CAGR of 16.00% from 2026–2034

Market Share:

- Regional Leader: North America held a 29.50% market share in 2025, driven by advanced healthcare logistics and demand in food and pharmaceuticals

Industry Trends:

- Eco‑friendly & Energy‑Efficient Refrigeration: Growing emphasis on natural refrigerants, advanced insulation, and renewable-powered systems to reduce carbon footprint

- Smart Tech & Real‑Time Monitoring: Adoption of IoT-enabled sensors and cloud-based systems for temperature tracking and supply chain transparency

- Post‑COVID Acceleration: Vaccine rollouts and pharmaceutical cold storage needs have accelerated investment in advanced cold chain infrastructure

Driving Factors:

- Pharmaceutical Sector Demand: Expansion of vaccine, biologics, and temperature-sensitive drug distribution is fuelling equipment adoption globally

- Perishable Goods Growth: Increasing reliance on refrigeration for food and beverage sectors, across global logistics networks

- Regulatory & Quality Compliance: Stringent standards for temperature control and traceability are driving deployment of certified cold chain equipment

Top cold chain equipment manufacturers continually focus on technological innovations to enhance the efficiency and reliability of their products. The market is characterized by integrating smart technologies, such as IoT-enabled sensors and real-time monitoring systems, to ensure the integrity of temperature-sensitive goods during transit. As the world becomes more interconnected, the market is expected to evolve further, addressing challenges such as energy efficiency, sustainability, and the need for seamless integration within the broader supply chain ecosystem.

COVID-19 IMPACT

COVID-19 Pandemic Spurred a Surge in Demand for Refrigeration Solutions Amid Vaccine Distribution Needs

The COVID-19 pandemic significantly impacted the market, acting as a catalyst for its accelerated growth. The heightened global focus on vaccine distribution and pharmaceutical supply chains intensified the demand for reliable cold storage and transportation solutions. With the urgent need to store and transport temperature-sensitive vaccines, pharmaceutical companies and logistics providers invested substantially in advanced cold chain technologies. This surge in demand bolstered the market and prompted innovation, leading to the integration of cutting-edge features, such as real-time monitoring and IoT-enabled solutions.

Moreover, the pandemic-induced disruptions underscored the critical role of the cold chain in maintaining the integrity of perishable goods, including food and beverages, further boosting the market expansion. As the world grappled with supply chain challenges, stakeholders recognized the importance of resilient and efficient cold chain infrastructure. The enduring impact of COVID-19 has left a lasting imprint on the cold chain equipment industry, shaping its trajectory toward increased technological sophistication and a heightened emphasis on ensuring the seamless flow of temperature-sensitive products.

Cold Chain Equipment Market Trends

Increasing Industry Sustainability Practices Meet Demand for Eco-friendly Solutions, Driving Market Growth

As environmental concerns gain prominence globally, there is a growing emphasis on making cold chain operations eco-friendlier and energy-efficient. Stakeholders in the cold chain equipment industry are actively seeking ways to reduce the carbon footprint of cold chain processes, addressing challenges related to energy consumption and greenhouse gas emissions. Cold chain equipment companies are investing in innovative refrigeration technologies that utilize natural refrigerants with lower global warming potential, moving away from traditional synthetic refrigerants. Additionally, there is a rising adoption of energy-efficient equipment, such as advanced insulation materials and energy recovery systems, to optimize the overall operational efficiency of cold storage facilities and transportation. Furthermore, incorporating renewable energy sources, such as solar and wind power, into cold chain infrastructure is gaining traction. This helps in reducing operational costs and aligns with sustainability goals. As regulations and consumer awareness around environmental impact increase, the trend toward sustainable practices in the market is expected to persist and shape the industry's future landscape, reflecting a broader commitment to balancing economic growth with environmental responsibility.

Download Free sample to learn more about this report.

Cold Chain Equipment Market Growth Factors

High Demand from the Pharmaceutical Industry Propelling Market Growth

The pharmaceutical industry's rapid growth and the rising need for temperature-sensitive drug storage and transportation significantly fuel the demand for advanced cold-chain solutions. With increasing biopharmaceutical products and vaccines requiring stringent temperature control throughout the supply chain, pharmaceutical companies are investing heavily in reliable and efficient cold chain equipment. The global push for vaccination campaigns, especially in response to the COVID-19 pandemic, has further intensified the demand for specialized cold storage and transportation infrastructure.

Governments, pharmaceutical manufacturers, and logistics providers are collaboratively working to establish robust cold chain networks to ensure the safe and effective distribution of vaccines. This driver is characterized by a continual need for technologically advanced cold chain solutions that can maintain precise temperature conditions, comply with regulatory requirements, and ensure the integrity of pharmaceutical products. As the pharmaceutical industry continues to innovate and expand, the demand for this sophisticated equipment is expected to remain a prominent market driver in the foreseeable future.

RESTRAINING FACTORS

High Initial Investment and Operational Costs Hampered Market Growth

The high initial investment and operational costs associated with implementing and maintaining advanced cold chain infrastructure negatively impact the cold chain equipment market growth. The acquisition of cutting-edge refrigeration technologies, monitoring systems, and energy-efficient equipment involves substantial upfront expenses, which can be a significant barrier for Small and Medium-Sized Enterprises (SMEs) or businesses with limited capital. Operational costs, including energy consumption and maintenance, contribute to the ongoing financial burden. The need for continuous monitoring, compliance with stringent regulations, and regular maintenance to ensure the proper functioning of cold chain equipment adds to the overall operational expenses. This cost factor can deter businesses, especially in emerging economies or sectors with thin profit margins.

Moreover, the complexity of integrating new technologies and ensuring seamless interoperability within existing supply chain systems poses challenges. The reluctance to disrupt established workflows and the fear of potential disruptions during technology adoption can restrain some organizations from investing in and embracing the latest advancements in cold storage solutions. Addressing these cost-related challenges and providing financial incentives or flexible financing options could play a crucial role in mitigating this restraining factor and fostering broader adoption of advanced cold chain solutions.

Cold Chain Equipment Market Segmentation Analysis

By Type Analysis

Pharmaceutical and Food Industries Segment Growth Driven by Increased Demand for Reliable Refrigerated Storage Infrastructure

Based on type, the market is segmented into refrigerated storage and transportation.

The refrigerated storage segment is projected to dominate the cold chain equipment market with a 60.49% share in 2026. Firstly, the demand for extended storage durations, especially in the pharmaceutical and food industries, necessitates robust and reliable refrigerated storage infrastructure. Additionally, the emphasis on building strategic distribution hubs and central storage facilities to optimize supply chain efficiency contributes to the prominence of refrigerated storage within the market. The refrigerated storage segment of the market encompasses facilities designed to preserve temperature-sensitive products for extended periods. These include warehouses, cold rooms, and specialized storage units equipped with advanced refrigeration systems.

Refrigerated transportation involves the movement of temperature-sensitive goods from one location to another using specialized vehicles equipped with refrigeration units. This segment addresses the crucial need to ensure that products remain within specified temperature ranges during transit, safeguarding their quality and efficacy.

By Industry Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Need for precise temperature control in preserving boost the Pharmaceuticals industry

Based on industry vertical, the market is segmented into pharmaceuticals, food and beverage, chemicals, and others.

The pharmaceuticals industry is poised to experience the highest growth rate, fueled by the rising demand for temperature-sensitive drug storage and distribution, particularly in regions emphasizing vaccination campaigns. In the market, the pharmaceuticals segment involves storing and transporting temperature-sensitive drugs, vaccines, and biopharmaceutical products. This sector places a premium on maintaining precise temperature control throughout the supply chain to ensure the efficacy and safety of pharmaceutical products.

The food and beverage segment is expected to lead end-use adoption, contributing 48.04% of the market share in 2026. The food and beverage segment encompasses preserving and transporting perishable food items and subsequently dominating the market share. Cold chain equipment is vital in maintaining the freshness and quality of products, reducing food waste, and meeting stringent regulatory standards for food safety.

In the chemical industry, equipment is used for transporting and storing chemicals that require specific temperature conditions to maintain their properties. This includes specialty chemicals and raw materials crucial for various manufacturing processes.

Various industries fall under this category, including electronics, floral products, and other industries where preserving specific temperature conditions is critical for product integrity.

REGIONAL INSIGHTS

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Cold Chain Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 13.17 billion in 2025, driven by the region's well-established pharmaceutical and food industries. The stringent regulatory environment and the increased focus on ensuring the integrity of temperature-sensitive products contributed to the dominance of cold chain infrastructure. With advanced technology adoption and a mature market, North America is poised to continue its significant role in this sector.

The U.S. contributes significantly to the region's dominant market share with a well-established pharmaceutical sector and robust food distribution network. Investments in advanced technologies, such as IoT-enabled monitoring systems and sustainable refrigeration solutions, reflect the country's commitment to maintaining the integrity of temperature-sensitive products throughout the supply chain. The ongoing emphasis on vaccine distribution and stringent regulatory compliance further solidifies this equipment's importance in the U.S.

To know how our report can help streamline your business, Speak to Analyst

South America witnessed moderate growth in the market, influenced by evolving pharmaceutical and food distribution networks. Additionally, the increasing awareness of the importance of cold chain logistics and ongoing developments in supply chain infrastructure contribute to a gradual market expansion.

Europe maintained a robust position in the market, driven by stringent regulations, particularly in pharmaceutical distribution. The well-established cold chain infrastructure and focus on regional sustainability practices have further propelled market growth. Europe is expected to continue investing in advanced technologies to enhance the efficiency and sustainability of its cold chain operations. The UK market reaching USD 1.63 billion by 2026 and the Germany market reaching USD 3.64 billion by 2026.

The Middle East & Africa experienced steady growth in the market, with a focus on improving pharmaceutical and food supply chain resilience. Investments in infrastructure development and increasing awareness of the benefits of cold chain logistics contribute to the market's expansion.

Asia Pacific exhibited the highest growth rate over the forecast period, driven by rapid industrialization, expanding pharmaceutical manufacturing, and the increasing demand for quality food products. The region's dynamic economies, such as China and India, are witnessing significant investments in cold chain infrastructure. The burgeoning e-commerce sector and a growing middle class further contribute to the escalating demand for efficient cold chain solutions. The Japan market reaching USD 1.50 billion by 2026, the China market reaching USD 4.84 billion by 2026, and the India market reaching USD 4.55 billion by 2026.

List of Key Companies in Cold Chain Equipment Market

Leading Manufacturers Vie for Market Dominance Through Continuous Product Innovations

Amid the current market scenario, cold chain equipment manufacturers are adapting swiftly to meet the evolving demands of the pharmaceutical and food distribution industries. Manufacturers are prioritizing technological advancements to enhance the efficiency and sustainability of their products. Additionally, a growing focus is on developing energy-efficient solutions to address sustainability concerns. The emphasis on end-to-end visibility and traceability within the supply chain is prompting manufacturers to offer comprehensive solutions that encompass monitoring, data analytics, and automation, ensuring the integrity of products throughout their journey in the cold chain. Overall, manufacturers are strategically innovating and aligning with industry trends to provide robust, future-ready solutions in response to the dynamic market landscape.

List of Key Companies Profiled:

- Americold Logistics, Inc. (U.S.)

- BITZER SE (Germany)

- CAREL (Italy)

- ebm-papst (Germany)

- Carrier Transicold (U.S.)

- Intertecnica (Italy)

- Schmitz Cargobull (Germany)

- Viessmann (Germany)

- Thermo King (U.S.)

- Zanotti SpA (Italy)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: A.P. Moller Maersk announced the inauguration of a new facility in Norway, meticulously designed to meet the specific requirements of the expansive Norwegian fish industry. This state-of-the-art facility ensures seamless supply chain connectivity, particularly benefiting customers involved in transporting frozen and chilled goods.

- September 2022: BITZER, the refrigeration and air conditioning specialist, unveiled sustainable solutions tailored for bus and rail challenges at the Berlin InnoTrans trade fair. BITZER showcased the SPEEDLITE ELV52 scroll compressor, a specially developed solution for electric buses and rail vehicles.

- November 2021: Schmitz Cargobull, Europe's leading semi-trailer manufacturer, introduced its first product from the U.K. plant – the S. KO PACE SMART. This fully modular dry-freight semi-trailer is designed for U.K. and Irish operators, incorporating market-specific features.

- June 2021: In a strategic move toward network expansion, Stockhabo acquired Frigologix, a cold storage provider. This acquisition welcomed three new sites in Belgium (Herk de-Stad, Lommel, and Val-de-Meuse), expanding Stockhabo's capacity to 235,000 pallet slots and enhancing potential revenue flow.

- July 2020: LINEAGE LOGISTICS HOLDING, LLC completed the acquisition of Ontario Refrigerated Services, Inc., establishing its presence in Canada as a major player in refrigerated storage services.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Industry Vertical

By Region

|

Frequently Asked Questions

The market is projected to reach USD 152.06 billion by 2034.

In 2025, the market was valued at USD 40.34 billion.

The market is projected to grow at a CAGR of 16.00% during the forecast period.

By the industry vertical, the food and beverage segment leads the market.

High demand from the pharmaceutical industry is propelling the market growth.

Americold Logistics, Inc., BITZER SE, CAREL, ebm-papst, Carrier Transicold, Intertecnica, Schmitz Cargobull, Viessmann, Thermo King, and Zanotti SpA are the top players in the market.

North America is expected to hold the highest market share.

By industry vertical, the pharmaceuticals segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us