Email Security Market Size, Share & Industry Analysis, By Deployment (Cloud, On-Premises, and Hybrid), By Application (BFSI, Government, Healthcare, IT & Telecom, Media & Entertainment, and Others (Retail, Defense)) and by Regional Forecast, 2026-2034

Email Security Market Size

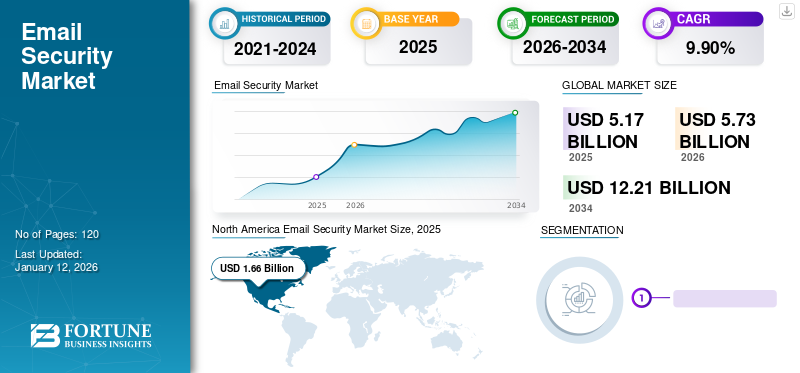

The email security market size was valued at USD 5.17 billion in 2025. The market is projected to grow from USD 5.73 billion in 2026 to USD 12.21 billion by 2034, exhibiting a CAGR of 9.90% during the forecast period. North America dominated the global market with a share of 32.10% in 2025.

Email security is a software platform that protects email from attacks and unauthorized access. It monitors communications for regulatory issues, compliance, and theft, prevents access to inappropriate content, and protects against malware and targeted cyberattacks. Key players, including Cisco Systems Inc., Broadcom Inc., Open Text Corporation, Proofpoint Inc., Fortinet Inc., Barracuda Networks Inc., DataFlowX, Trend Micro Inc., Sophos Ltd., Intermedia.net Inc., and others, are considered in our scope.

Due to an increase in malware and phishing activity, particularly ransomware and targeted attacks such as business email compromise (BEC) and email account compromise (EAC), is driving the growth of electronic mail security platforms. Cofense Intelligence found that malicious phishing emails increased by 569% in 2022, and threat reports related to credential phishing increased by 478%.

The global email security market share is set to grow due to increased investments and the rising need for business data protection by organizations. According to the 2023 electronic mail security report from Barracuda Networks, 26% of organizations have increased their budgets for electronic mail security spending to prevent and respond to threats as email attacks become more sophisticated and harder to detect. Furthermore, increasing BYOD and mobile device use to increase the adoption of electronic mail security solutions. Such factors have helped organizations adopt electronic mail security solutions and drive market growth.

In response to COVID-19, many organizations have shifted to remote-working models that increased the usage of email communication. This shift made it easier for attackers to steal data, perform phishing activities, or email fraud. According to Armorblox, a 70% increase in phishing attacks are attempted, compared to 63% in 2021. Furthermore, remote working from mobile devices expanded due to an ever-increasing number of users shifting to cloud-based workspaces. This factor has increased the cyber fraud risks revolving around cloud-based email security solutions during the pandemic situation.

Email Security Market Trends

Increasing Adoption of Cloud-based Solutions to Aid the Market Growth

With increasing phishing attacks, the shift towards cloud-based email solutions continues. The security and risk management leaders started to evaluate the capabilities offered by cloud-based email systems to ensure they could protect against phishing, malware, and ransomware attacks.

Additionally, organizations are adopting cloud-based mailbox services and migrating from on-premises servers to cloud-based ones. Key players are developing functions and features that enhance cloud-based email services, including providing electronic mail security as a cloud Software-as-a-Service (SaaS) solution. For instance,

- According to Gartner, in 2023, about 40% of businesses will choose to use the abilities and features of cloud-based email services.

The growing usage of cloud-based email security solutions helps protect sensitive data loss along with supportive regulatory compliances. Companies have started transforming and streamlining a robust cloud governance model that can accelerate their security capabilities, thus electronic mail security solutions to impact the market positively.

Download Free sample to learn more about this report.

Email Security Market Growth Factors

Rising Malware, Phishing Activity, and Cyber-Attacks Drive the Demand for Scalable Email Security Solutions

Cyber-attackers have increased the scope of their attacks. They are developing innovative techniques for stealing identities, such as creating external domain names with fake URLs and email header domains. Also, they engage in attacks that combine email and cloud-based accounts or use outbound mail as a bot which threatens an organization’s reputation.

- According to Acronis findings in 2023, the number of email-based phishing attacks increased by 464% in 2023 as compared to 2022.

Additionally, cyber-attackers have leveraged pandemic-driven fears and uncertainties to launch email phishing activities. For instance,

- A study by SlashNext in 2022 examined billions of attachments, messages, and URLs in mobile phones, email, and browsers for over a half year, resulting in around 255 million attacks. They reported a 61% rise in the rate of phishing attacks compared to the last year.

Such an increase in the volume of attacks continues to evolve, becoming more sophisticated and costly for users to aid the adoption of electronic mail security solutions.

RESTRAINING FACTORS

Lack of Awareness to Implement Email Security Solutions and Weak IT Infrastructure May Hinder the Market Growth

Many organizations are not able to set up a fundamental electronic mail security infrastructure for basic operations. They are still not conducting formal training on the dangers of cyber threats, email phishing, and available protections; this network infrastructure is exposed at high risk. For instance,

- According to Stanford University researchers, an employee error accounts for approximately 88% of all data breaches.

Moreover, a lack of organizational foresight and weak IT infrastructure impacts the business, processes, and users. The IT and security teams are forced to review their electronic mail security controls due to significant growth in the volume and effectiveness of these attacks, as well as cloud migration. This is hindering the growth of electronic mail security solutions in the market.

Email Security Market Segmentation Analysis

By Deployment Analysis

Growing Usage of Cloud-Based Email Security to Boost the Market Growth

Based on the deployment,The Cloud segment is projected to dominate the market with a share of 55.84% in 2026, the market is segmented into cloud, on-premises, and hybrid. The cloud-based email security accounted for a larger market share and is projected to grow with a high CAGR during the forecast period as organizations digitally transform and adapt to remote working environments. The usage of cloud-based email security solutions allows remote fingerprint scanning, facial recognition, and document verification to integrate with the servers. Moreover, companies have started adopting these solutions and are realizing that it helps in cost reduction, increasing operational efficiency, and improving security. For instance,

- According to Cisco Systems, by 2021, 70% of public and private companies are expected to use cloud-based email solutions.

Thus, increasing demand for cloud-based email security solutions creates a growth opportunity for the market.

By Application Analysis

IT & Telecom to Dominate the Market Due to Increasing Pressure for Digital Transformation

Based on the application,The IT & Telecom segment is expected to account for 30.01% of the market in 2026, the market is segmented into BFSI, Government, Healthcare, IT & Telecom, Media & Entertainment, and Others (Retail, Defense, etc.). Many businesses are rapidly moving toward adopting electronic mail security solutions due to evolving needs, and the transformation of these solutions has become a growing priority. IT & Telecom to lead as it is teams are constantly under increasing pressure to simplify the deployment and management of security technology, reduce the complexity of their security environments, and strengthen their overall security structure. Organizations are implementing electronic mail security solutions to help protect their digital environments and critical infrastructure from emerging cyber threats. Moreover, the increase in cyber-attacks within the industry has realized organizations adopt electronic mail security solutions. For instance,

- In December 2022, the leading telecom provider TPG Telecom Ltd. reported a cyberattack that gained illegal access to an exchange service that resides the email accounts of up to 15,000 business customers. The attack was an attempt to access customers’ cryptocurrency and financial information.

Thus, electronic mail security solutions in IT & Telecom have helped deliver strong data governance and a secure framework. Thus, the IT & Telecom sector is expected to hold a larger market share and grow with the highest CAGR during the forecast period.

Furthermore, the BFSI sector is anticipated to grow with the second-largest CAGR during the forecast period. This is due to the financial sector suffering from the largest number of cybersecurity threats, which has resulted in a rise in the number of data breach cases across the BFSI industry. This factor boosts the demand for electronic mail security solutions to provide efficient email protection.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

This market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America Email Security Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.66 billion in 2025 and USD 1.82 billion in 2026, owing to the increasing adoption of mobile devices among organizations, stringent regulations, and the introduction of cloud-based email security solutions. Moreover, due to the pandemic's spike in phishing and email scam rates, businesses in the region have increased their attention to safeguarding confidential data stored on email servers. Due to the increasing demand among enterprises, electronic mail security solutions are gaining momentum to protect business information and infrastructure.The U.S. market is projected to reach USD 1.46 billion by 2026. For instance,

- Avanan, a cloud-based email security provider, announced that its API-based inline security threat prevention ability had been approved as a U.S. Patent. This cloud-based solution protects email, file sharing, and instant messaging from phishing, malware, data theft, and other advanced threats. Utilizing its patented technology, the company leverages work with built-in security and scans internal and outbound email.

Such factors helped organizations in the region adopt electronic mail security solutions.

Asia Pacific has the highest adoption rate due to cyber-attackers leveraging Artificial Intelligence (AI) and advanced social engineering to perform data theft in their email phishing attempts. Additionally, companies in Asia Pacific continue to be exposed to a growing rate of cyber threats as the attackers exploit economic and geopolitical disruptions. Such factors are resulting in the rise of electronic mail security solutions across the region.The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.48 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026. For instance,

In Europe, The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.48 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026.

- According to IBM Security's annual XForce Threat Intelligence Index in 2022, the Asia Pacific region was the most attacked region which accounted for 31% of all phishing attacks globally.

Key Industry Players

Strategic Acquisition, Product Enhancements, and Increasing Investments to Boost Market Expansion of Key Players

In direct response to cybercriminals' activities, vendors of electronic mail security solutions are adding new features and functions to their offerings. This includes using various security solutions, such as threat intelligence, browser isolation, profiling and behavioral analysis, forensics, etc. Deeper integration with other security solutions and wider functionality are growing the adoption of electronic mail security solutions.

In addition, players are adopting partnerships and acquisition strategies to expand their businesses into new regions, enhance offerings, and reduce email fraud.

- April 2023 – Cisco, the leader in enterprise networking and security, unveiled its most recent advancement toward its vision of the Cisco Security Cloud. Organizations were able to better safeguard the integrity of their entire IT ecosystems due to the introduction of advanced Duo MFA features and the brand-new XDR solution from Cisco. Cisco XDR analyzes and correlates the six telemetry sources that Security Operations Center (SOC) operators consider essential for an XDR solution: email, identity, DNS, the endpoint, the network, and a firewall.

- May 2022 – Broadcom Inc. and VMware, Inc., a prominent innovator in enterprise software security, announced that Broadcom acquired all of VMware's remaining shares in cash and stock at a valuation of USD 61.0 billion. The Broadcom Software Group also announced rebranding as VMware post the transaction's completion, including Broadcom's existing infrastructure and security software solutions into an expanded VMware portfolio.

List of Top Email Security Companies:

- Cisco Systems Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Open Text Corporation (Canada)

- Proofpoint Inc. (U.S.)

- Fortinet Inc. (U.S.)

- Barracuda Networks Inc. (U.S.)

- DataFlowX (Turkey)

- Trend Micro Inc. (Japan)

- Sophos Ltd. (U.S.)

- Intermedia.net, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – Stellar Cyber formed a partnership with Proofpoint, a cybersecurity and compliance company, to provide email security solutions for SecOps Teams using Stellar Cyber’s Open XDR platform.

- April 2023 – Fortinet, the worldwide online protection pioneer driving the combination of systems administration and security, announced that it had extended the Fortinet Security Fabric with new and upgraded solutions and capacities to empower threat prevention for a self-shielding environment across organizations, endpoints, and clouds.

- February 2023 – Sublime Security raised USD 9.8 million and deployed the first open email security platform to block and identify phishing attacks.

- December 2022 – Proofpoint Inc., a compliance and Cybersecurity Company leader, announced the agreement to acquire Illusive, a key player in Identity Threat Detection and Response (ITDR). This acquisition enhanced Proofpoint's foremost threat and information protection platforms by adding remediation, active identity risk discovery, and a robust post-breach defense capability.

- November 2022 – Barracuda Networks, Inc. announced that Barracuda Email Protection integrated with Amazon Security Lake by Amazon Web Administrations (AWS). Barracuda Email Protection provides electronic mail security findings coordinated with Amazon Security Lake. Combining the two options can address a wide range of security use cases, including threat detection, investigation, and incident response, while lowering the difficulty and cost for clients using their security data from an electronic mail security solution.

- October 2022 – Sophos, a key player in innovating and delivering cybersecurity as a service, released the latest third-party security technology compatibilities with its Sophos Managed Detection and Response (MDR) platform. These compatibilities enable Sophos to rapidly recognize and address attacks in various customer and operational environments.

- November 2021 – Open Text Corporation acquired Zix for USD 860 million in cash. Zix's acquisition aided by Open Text Corporation, which has anticipated to increase production capabilities and resources. Open Text Corporation is a leader in enterprise information management solutions provider.

REPORT COVERAGE

An Infographic Representation of Email Security Market

To get information on various segments, share your queries with us

This market research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 12.21 billion by 2034.

In 2025, the market stood at USD 5.17 billion.

The market is projected to grow at a CAGR of 9.90% over the forecast period (2026-2034).

IT & Telecom is likely to lead the market.

Rising malware, phishing activity, and cyber-attacks are leading to a demand for scalable electronic mail security solutions.

Cisco Systems Inc., Broadcom Inc., Open Text Corporation, Proofpoint Inc., Fortinet Inc., Barracuda Networks Inc., DataFlowX, Trend Micro Inc., Sophos Ltd., and Intermedia.net Inc. are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with the largest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic