Europe Industrial Robots Market Size, Share & COVID-19 Impact Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Cartesian/Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), By Industry (Automotive, Electrical & Electronics, Healthcare & Pharmaceutical, Food & Beverages, Rubber & Plastic, Metals & Machinery, and Others), and Country Forecast, 2025-2032

Europe Industrial Robots market Size

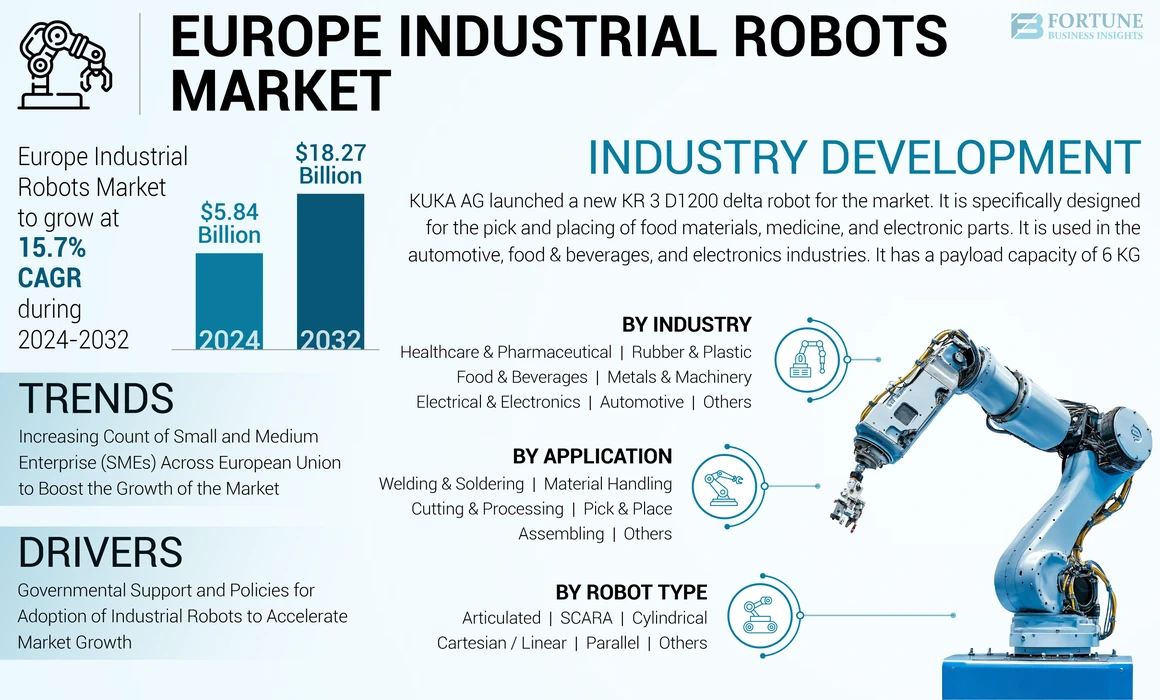

Europe is the second largest region in the global industrial robots market. It is projected to grow at the highest CAGR of 15.7% during the forecast period. The global market for industrial robots is projected to grow from USD 5.84 billion in 2024 to USD 18.27 billion by 2032.

Growth in the industry segments such as the automotive industry, food and beverages, and chemical industries increases the demand for industrial automation, which drives the growth of the market. Germany and Italy are famous for the automotive sector in the European market. For instance, according to the International Federation of Robotics (IFR), Germany is the largest consumer of robots in the European market, owing to around 38% of the automotive companies are having a presence in Germany. In such a way, increasing demand from these factories propel to increasing the Europe industrial robots market share. Also, growth in the e-commerce sectors across Germany, France, and Italy among others, creates the atmosphere for environment to perform operations by end users, fuels the Europe industrial robots market growth. For instance, according to Ecommerce Europe, the e-commerce sector in Europe grew by 13% annual growth rate from 2021 to 2022.

Our report on the European market covers the following countries/regions – Germany, U.K., France, Italy, and the rest of Europe.

Europe Industrial Robots market Trends

Increasing Count of Small and Medium Enterprise (SMEs) Across European Union to Boost the Growth of the Market

The growing the count of small as well as medium enterprises across countries such as Germany, Italy, and France among others is expected to escalate the demand for industrial robots. Also, according to European Union, the number of small, micro, and medium-sized enterprises increased by 2.9% from the year 2020 to 2022. Such an increasing number of small, micro, and medium-sized enterprises across European countries, which uplifts the demand for these robots for various applications such as welding, painting, material handling, and assembling operations. Such factors are the market trends for the robotics industry.

Europe Industrial Robots market Growth Factors

Governmental Support and Policies for Adoption of Industrial Robots to Accelerate Market Growth

Major government bodies and local authorities are planned to spend on robotics sectors across European nations such as Germany, France, the U.K. , and Italy among others, which surge in the demand for this market. Such investment in the industrial sectors, which surge in the adoption of mobile robots, and collaborative robots across various manufacturing sectors, which increase the demand for these robots. Also, this spending in robotic sectors, uplift the demand for more products across various end user verticals such as automotive, food & beverages, and others. For instance, according to International Federation of Robotics (IFR), in 2020, the “Horizon Program” initiated by European nations quoted that, the European government planned to invest around USD 780 million for improving the robots market in Europe. Such investments create the demand for more industrial robots for end user industries.

RESTRAINING FACTORS

High Initial Capital Investment and High Maintenance Costs to Restrain Market Growth

Industrial robots require huge installation and maintenance cost. Also, the growth in the automotive, food & beverage, metal & machinery, and rubber & plastic sectors, which incurs additional investment cost. Thus, huge initial capital investment needed for the automation of production using these robots could restrain the growth of the market.

KEY INDUSTRY PLAYERS

In terms of robot manufacturer, KUKA AG, ABB, and Fanuc Corporation are key players in the Europe market. These players are adopting partnerships, acquisitions, products launch, and product development as strategic developments for strengthening their product portfolio and distribution network through diversified locations to increase their market share in the Europe market.

List of Top Europe Industrial Robots Companies:

- KUKA AG (Germany)

- ABB (Switzerland)

- Universal Robots (Japan)

- Rethink Robotics GmbH (Germany)

- Schunk GmbH & Co. KG (Germany)

- Staubli International AG (Japan)

- Compau SpA (Italy)

- TM Robotics (U.K.)

- Fanuc Corporation (Japan)

- Artiminds Robotics GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: KUKA AG launched a new KR 3 D1200 delta robot for the market. It is specifically designed for the pick and placing of food materials, medicine, and electronic parts. It is used in the automotive, food & beverages, and electronics industries. It has a payload capacity of 6 KG.

- October 2022: ABB introduced a new small industrial robot IRB 1010 having features such as flexibility, energy efficiency, and lightweight. It consumes 20% less energy as compared to other industrial robots. It has a payload capacity of 1.5 KG.

- September 2020: Rethink Robotic GmbH opened a new manufacturing facility in Bochum, Germany. The new manufacturing facility able to manufacture industrial robots and collaborative robots.

REPORT COVERAGE

The market report provides qualitative and quantitative insights on the market and a detailed analysis of the market size & growth rate for all possible segments in the market. Along with the European market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are an overview of the number of procedures, an overview of price analysis of types of products, an overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 15.7% from 2025 to 2032 |

|

Unit |

Value (USD Billion), and Volume (Thousand Units) |

|

Segmentation |

By Robot Type; By Application; By Industry; and By Country/ Sub-Region |

|

Segmentation |

By Robot Type

By Application

By Industry

By Country/ Sub-Region

|

Frequently Asked Questions

Growing at a CAGR of 15.7%, the market will exhibit steady growth over the forecast period (2025-2032).

Key players are spending on their research and development costing to bring new technological advancements in their product portfolio are the major factors driving the industry growth.

Rethink Robotics GmbH, Schunk GmbH & Co. KG, Compau SpA, and TM Robotics are the major players in the Europe market.

Germany to dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us