Europe Sharps Containers Market Size, Share & COVID-19 Impact Analysis, By Product Type (Multipurpose Containers, Patient Room Containers, and Phlebotomy Containers), By Waste Generator (Hospitals, Other Healthcare Providers, Pharmacies, Academic & Research Institutes, Pharmaceutical Companies, and Others), By Usage (Reusable Containers and Single-Use Containers), By Waste Type (Sharps Waste, Infectious Waste, Non-Infectious Waste, and Pharmaceutical Waste), By Size (1-2 Gallons, 2-4 Gallons, 4-8 Gallons, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

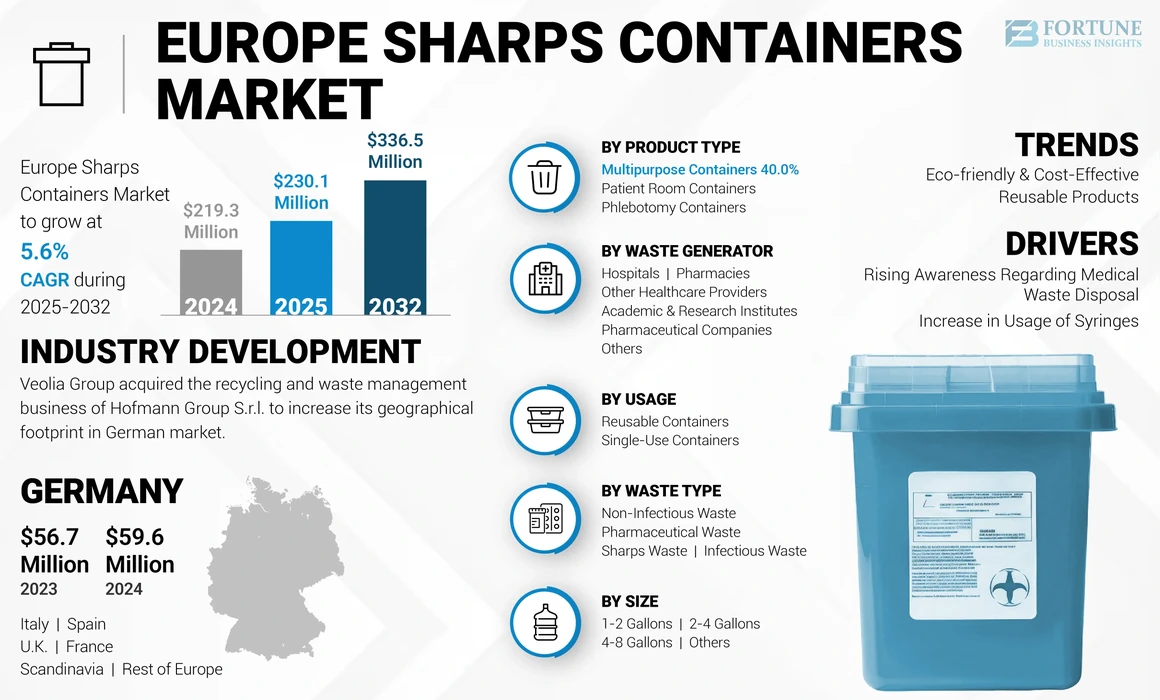

The Europe sharps containers market size was valued at USD 219.3 million in 2024. The market is projected to grow from USD 230.1 million in 2025 to USD 336.5 million by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Clinical waste has emerged as a significant challenge, generated in tons by companies engaged in pharmaceutical manufacturing, pharmacies, healthcare professionals, and healthcare and research institutions. This waste necessitates special handling and treatment due to its toxicity and the presence of infectious contents, such as syringes, infected glass, contagious materials, body parts, serology samples, and blood components. Detection, segregation, and the safe disposal of waste have become essential health priorities. In managing medical waste, several government agencies, public/non-public entities, and manufacturing establishments have made efforts to raise awareness regarding the safe disposal of clinical waste. Therefore, rigorous guidelines have been enforced to manage medical waste and avert severe risks to human health and the environment. For instance, in 2022, Sharpsafe announced the launch of the world’s first full range of sustainable single-use sharps containers.

Bins used for biomedical waste have become sought-after products for secure and safe disposal of sharp instruments, including needles, syringes, lancets, and others. Many containers consist of firm and long-lasting plastic materials that can be reused after proper disinfection. Sharps containers are available in various shapes and sizes based on the type of application they are used for. The overall market landscape is highly competitive, as several small-scale, large-scale, and startup companies have entered the market to develop valuable and infection-free products. Hence, this is likely to boost market growth in Europe during the forecast period

COVID-19 IMPACT

Decline in Volume of Hospital Visits Slowed Market Growth

The COVID-19 pandemic significantly impeded the Europe sharps containers market growth, primarily due to lockdowns that prompted a dip in hospital visits. The pandemic negatively impacted the market growth due to various factors, including production and supply chain issues, diversion of funds and production resources to other essential commodities, and a decline in the number of visits to healthcare facilities. This decrease in the volume of hospital visits in Europe led to a reduction in the usage of sharps, consequently slowing down the sales of these type of containers in 2020.

However, one factor that offset the negative impact of the COVID-19 pandemic in 2020 was the increase in the number of hospitalizations in Europe due to the spread of the coronavirus. According to data published by Our World in Data, from March 2020 onwards, several countries in Europe witnessed a surge in hospitalizations due to COVID-19. For instance, the U.K. witnessed an increase of 181%, and France witnessed an increase of 683% in terms of COVID-19-related hospitalizations from March 2020 to April 2022.

In 2021, the market in Europe witnessed strong growth due to the resumption of normal healthcare activities in the region owing to the easing of COVID-19 restrictions. Furthermore, the significant surge in the usage of injections across diverse healthcare institutions in Europe to administer COVID-19 vaccines also contributed to the market growth. The market witnessed slightly lower growth in 2022 and is anticipated to follow steady growth trends during the forecast period.

LATEST TRENDS

Eco-friendly & Cost-Effective Attributes of Reusable Products to Provide Avenues for Future Product Launches

A prevailing trend in the Europe sharps containers market is the emergence of newer reusable product offerings that are eco-friendlier and incorporate innovations for enhanced safety, such as hand-blocking mechanisms. The increase in the number of patient visits to hospitals for scheduled surgeries and treatment of infections has led to a rise in the amount of medical waste generated, including sharps waste. This, in turn, has boosted the adoption rate of these containers.

Hospital management is shifting toward the adoption of reusable products due to the cost-effectiveness they offer. Moreover, the demand for injections in Europe has surged rapidly due to the rising prevalence of diseases such as diabetes and the ongoing vaccination drive against COVID-19. These factors have resulted in a significant increase in sharps waste generation, consequently amplifying the need for proper disposal. Therefore, regulatory bodies in Europe are taking initiatives to implement favorable and stringent guidelines for reusable products that are environmentally friendly and offer cost-effective attributes. Hence, these market trends present opportunities for key players to launch future products.

Download Free sample to learn more about this report.

DRIVING FACTORS

Rising Awareness Regarding Medical Waste Disposal to Boost Product Adoption

One of the most critical drivers positively impacting the Europe sharp containers market growth is the substantial increase in awareness regarding proper and safe disposal of medical waste. For instance, Health Care Without Harm Europe conducted a survey in 2020 to understand waste management practices and challenges within European hospitals. The survey received 25 responses from 9 countries, revealing that almost 92% of the respondents had a dedicated training program on waste segregation and collection. Additionally, 68% of the respondents' training programs included a strategic plan, promotion of a recycling culture, a reuse scheme, and packaging reduction in procurement criteria.

Such initiatives aimed at increasing awareness of medical waste disposal in healthcare institutions, have led to effective waste management and will ultimately boost the adoption of products related to proper waste disposal.

Increase in Usage of Syringes to Propel Market Growth

In Europe, the demand for syringes has witnessed a consistent increase and significantly spiked during the vaccination drives conducted amid the pandemic. Consequently, the need for safe discarding of these products has also surged. For example, in June 2021, BD (Becton, Dickinson and Company), a leading medical technology company, received 2 billion injection device orders for needles and syringes to support vaccination efforts in more than 40 countries, including the U.K., France, Spain, Germany, Australia, Brazil, Canada, India, the Philippines, Saudi Arabia, South Africa, and the U.S. They successfully delivered more than 900 million injection devices until 2021.

This surge in demand has propelled several established and emerging companies to engage in various R&D initiatives to develop products with varying features, purposes, and designs. For instance, in September 2020, Daniels Healthcare introduced the evolved SHARPSGUARD eco pharmi range made from 100% recycled materials, emphasizing the highest quality and safety standards. Such developments reflect great promise in terms of future product launches, leading to strong and sustained market growth.

RESTRAINING FACTORS

High Costs Attributed to These Products to Hinder Market Growth

Despite various benefits associated with these products, several limiting factors are anticipated to hamper market growth over the forecast period. For example, in the case of disposable containers, which are widely used for biohazard waste disposal, the higher cost associated with clinical waste disposal is a concern. This is coupled with an increased cost of transporting the waste to the incinerator.

While reusable products offer many benefits, such as the ability to use them multiple times, proper cleanliness is essential, which is ensured through an extensive sterilization process. However, this demands extra expenditure. Moreover, according to a Daniels Healthcare study in 2021, 33% of the volume of every sharps container is made of plastic. Every year, several tons of unnecessary waste from these disposable plastic products emit almost 12.5 tons of greenhouse gases.

The increasing usage of reusable products in this market is expected to drive the product’s adoption rate in the healthcare industry. However, the substantial costs associated with these products and their management may deter their widespread adoption across Europe.

SEGMENTATION

By Product Type Analysis

Multipurpose Containers to Dominate Market Due to Their Wide Applications

Based on product type, the market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. The multipurpose containers segment accounted for the largest Europe sharps containers market share in 2024, attributed to the extensive range of product offerings in this segment and their broad applications in clinical waste. These containers have gained popularity as they offer ample volume and space for the disposal of various sharps, ensuring maximum safety for healthcare professionals, thus driving their widespread adoption.

The patient room containers segment is expected to record a considerable CAGR during the forecast period due to the growing need for correct disposal of medical waste. These containers are designed to discard needles, syringes, and soiled cotton swabs to mitigate the risk of infection in patients and healthcare professionals. They find extensive use in hospitals, clinics, and other healthcare facilities to ensure proper disposal of containers’ contaminated content, adhering to stringent medical waste disposal guidelines.

On the other hand, the phlebotomy containers segment is anticipated to witness a comparatively lower CAGR during the forecast period. These containers are used for the disposal of blood, IV needles, and hypodermics. They find applications in clinical laboratories, pharmaceutical companies, and hospitals to safely discard blood samples and related accessories.

To know how our report can help streamline your business, Speak to Analyst

By Waste Generator Analysis

Hospitals to Increase Product Use Due to Generation of Significant Medical Wastes

In terms of waste generator, the market is segregated into pharmacies, hospitals, academic & research institutes, other healthcare providers, pharmaceutical companies, and others. The hospitals segment was expected to dominate with the largest market share in 2024, as a large amount of medical waste is generated by hospitals that require an extensive amount of disposable bins. Furthermore, the rising number of surgeries and infections, coupled with increasing patient visits and compliance with regulatory guidelines for medical waste disposal, are anticipated to drive the growth of the segment during the forecast period.

The other healthcare providers segment accounted for the second-largest market share, attributed to the widespread adoption of these products for safe sharps disposal by various healthcare professionals to prevent needle-stick injuries and infections. Academic and research institutions, pharmacies, and pharmaceutical companies are under continuous scrutiny to comply with government guidelines for proper management of clinical waste, including hazardous and infectious waste.

By Usage Analysis

Reusable Containers to Gain Traction Due to Their Attractive Benefits

Based on usage, the market is bifurcated into reusable containers and single-use containers. The segment of reusable containers generated the highest revenue, and it is expected to register a higher CAGR during the forecast period. The demand for reusable products is increasing, especially in hospital settings, due to their significant benefits, such as cost-effectiveness, the ability to use them multiple times when their cleanliness is maintained, and being environmentally friendly.

On the other hand, the single-use containers segment is projected to record a comparatively lower CAGR during the forecast period due to their high cost. The cost of waste management for single-use containers is also high, which includes packaging, taping, and finalizing the shipment. Single-use containers find extensive use in research institutes and pharmaceutical companies as their research is infection-driven and requires cautious disposal.

By Waste Type Analysis

Rising Usage of Sharps to Treat Diabetes to Increase Sharps Waste Generation

On the basis of waste type, the market is segmented into infectious waste, sharps waste, non-infectious waste, and pharmaceutical waste. The sharps waste segment held a dominant market share in 2024 and is estimated to record a strong CAGR during the forecast period. This is attributed to the increased use of sharps in homecare settings for patients with chronic conditions, such as diabetes, where injectable therapy is a daily need, leading to a significant amount of sharps waste generation.

The infectious waste segment registered significant revenue in 2024 due to the increased usage of test kits, collection of diagnostic samples, swabs, bandages, and plastic vials during the pandemic in both public and private hospitals. This surge in usage led to the generation of a substantial amount of infectious waste.

On the other hand, the non-infectious waste and pharmaceutical waste segments are expected to witness steady growth as they are extensively used by pharmaceutical companies, research institutes, and R&D facilities. The increasing R&D activities by these healthcare institutions are likely to produce a substantial amount of medical waste, necessitating proper waste management.

By Size Analysis

2-4 Gallon Containers to be Widely Used for Safe Disposal of Infectious Waste

Based on size, the market is segmented into 1-2 gallons, 2-4 gallons, 4-8 gallons, and others. The 2-4 gallon segment accounted for the highest revenue generation. These containers are widely utilized by nurses in hospitals and clinics for the disposal of injections and cotton swabs. Moreover, these sharps containers have vertical drop lids and are extensively preferred in hospitals, research institutes, and diagnostic laboratories for the disposal of syringes, tips, and other waste, given that they can be deposited directly in the bin.

The large 4-8 gallon containers are used in hospitals where waste generation is higher to effectively manage medical waste disposal. Additionally, these products are available in sizes of 1-2 gallons, which find usage for a variety of purposes, including biohazard disposal. Thus, they are likely to witness steady demand during the forecast period owing to their higher applicability and variability.

REGIONAL INSIGHTS

Germany, France, and the U.K. to Dominate Market Due to Their Effective Medical Waste Management Strategies

On the basis of country/sub-region, the European market is segmented into Germany, the U.K., France, Italy, Spain, Scandinavia, and the rest of Europe.

The market size in Europe stood at USD 219.3 million in 2024, and the region is expected to witness steady growth trends during the forecast period. The rising awareness regarding medical waste disposal, presence of developed countries, and the increased usage of sharps across Europe will contribute to the regional market growth. Moreover, there has been a strong reinforcement of guidelines regarding sharps disposal, which is also expected to drive market growth during the forecast period.

In terms of countries, Germany accounted for the largest market size, valued at USD 59.6 million in 2024. The country strongly focuses on adhering to infection control and safety regulations by incorporating segregation and proper waste disposal practices. For instance, according to estimates by Umweltbundesamt (UBA), Germany generates an estimated 325 to 350 million tons of medical waste each year, and hazardous waste accounts for 5%. These wastes are managed through various waste treatment techniques, depending on the type of waste involved.

France is projected to account for the second-largest market share in Europe during the forecast period. For example, according to the Association of Cities and Regions (ACR) of France, there are 1.4 million self-managing patients on the French territory, producing 360 tons of home-generated medical waste annually. These statistics are expected to further intensify the demand and growth rate of these products in the country.

The U.K. is estimated to witness a comparatively significant CAGR during the forecast period. The high generation of medical waste, which has boosted the need for effective medical waste management, is driving the market growth in the country. Other European countries, including Italy, Spain, and Scandinavia, will record a comparatively lower CAGR due to the lack of uniformity and strong regulations related to clinical waste management, especially sharps waste. This scenario also affects the awareness regarding the safe disposal of sharps containers in healthcare institutions.

KEY INDUSTRY PLAYERS

Daniels’ & Stericycle’s Diverse Product Portfolio & Strong Distribution Network to Strengthen Their Market Prominence

In terms of the competitive landscape, this market in Europe, reveals a fragmented structure as no single organization influences the market’s growth trajectory. The key players dominate the market by emphasizing on research and development activities to diversify their product portfolios and increase engagement in various strategic initiatives. Furthermore, companies’ strong distribution networks, coupled with their increasing product availability in various European countries, are expected to contribute to their dominance in the Europe market.

Key companies in the Europe market include Daniels - A Mauser Company, Stericycle, Thermo Fisher Scientific Inc., and BD (Becton, Dickinson and Company) due to their strong distribution networks and diverse product portfolios. Stericycle has a strong presence in the Europe market. In contrast, Daniels – A Mauser Company holds a large share in key countries, such as the U.K. It is one of the leading distributors of sharps containers with its own diverse range of offerings. Other players include Daniels Sharpsmart Inc., Henry Schein, Inc., and Cardinal Health, who are actively focused on increasing their unit sales to boost their product availability.

LIST OF KEY COMPANIES PROFILED:

- Bondtech Corporations (U.S.)

- Daniels Sharpsmart Inc. (U.S.)

- Daniels - A Mauser Company (U.K.)

- Henry Schein, Inc. (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Stericycle, Inc. (U.S.)

- GPC Medical Ltd. (India)

- BD (Becton, Dickinson and Company) (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Veolia Group acquired the recycling and waste management activities of Hofmann Group S.r.l. to strengthen its geographical footprint on the German waste management market.

- August 2022 - Aurora Capital Partners announced that it had completed its acquisition of Sharps Compliance Corp., a provider of waste management solutions including pharmaceutical, medical, and hazardous waste.

- July 2021 - Stericycle, Inc. entered a partnership with UPS Healthcare to manage the reverse logistics of medical waste. The partnership resulted in the transportation, treatment, and disposal of several medical waste types including biohazardous, sharps, and pharmaceutical wastes.

- September 2020 - Daniels Healthcare introduced an evolved SHARPSGUARD eco pharmi range made from 100% recycled materials combining the highest quality and safety standards.

- August 2020 - Sharp Services, LLC, part of UDG Healthcare plc, a global leader in contract packaging and clinical supply services, acquired a 25% minority stake in Berkshire Sterile Manufacturing (BSM). The agreement would allow Sharp Services, LLC to deliver isolator-based sterile filling of vials, syringes, cartridges, and containers to its customers.

REPORT COVERAGE

An Infographic Representation of Europe Sharps Containers Market

To get information on various segments, share your queries with us

The market research report provides detailed analysis and focuses on key aspects, such as the pricing analysis and overview of adoption/usage of sharps containers for key countries in Europe. It also offers an overview of guidelines for medical and hazardous waste disposal, key industry developments, and the impact of COVID-19 on the Europe market. Besides these, the research report offers insights into market opportunities and highlights key strategies adopted by leading players. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.6% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

Product Type; Distribution Channel; and Country/Sub-Region |

|

By Product Type |

|

|

By Waste Generator |

|

|

By Usage |

|

|

By Waste Type |

|

|

By Size |

|

|

By Country/ Sub-Region |

|

Frequently Asked Questions

Fortune Business Insights says that the Europe market size was valued at USD 219.3 million in 2024 and is projected to reach USD 336.5 million by 2032.

Recording a CAGR of 5.6%, the market will exhibit steady growth during the forecast period of 2025-2032.

By product type, multipurpose containers are expected to be the leading segment in the market during the forecast period.

The rising awareness regarding medical waste disposal, increased usage of syringes across Europe, and the robust reinforcement of guidelines are the major factors driving market growth.

Daniels - A Mauser Company, Stericycle, Thermo Fisher Scientific Inc., and BD (Becton, Dickinson and Company) are the major players in the Europe market.

Germany dominated the market in 2024.

Increased adoption of sharps containers by institutions, such as manufacturing companies, hospitals, healthcare providers, academic & research institutes, and pharmacies are expected to drive the growth of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic