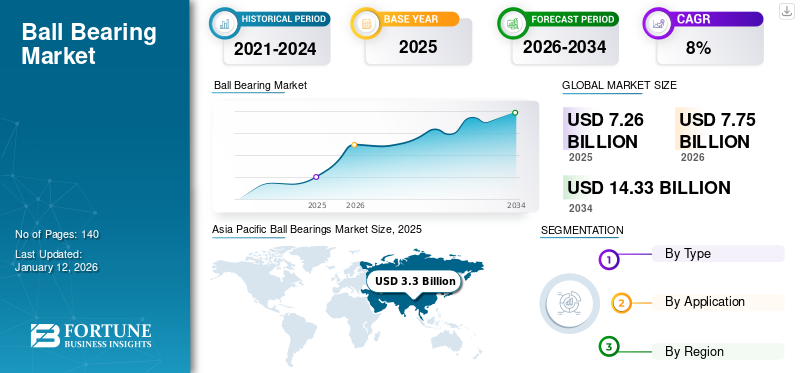

Ball Bearings Market Size, Share & Industry Analysis, By Type (Self-Aligning Ball Bearings, Deep Groove Ball Bearings, Angular Contact Ball Bearings, and Others), By Application (Automotive, Industrial Machinery, Mining & Construction, Medical, and Others), and Regional Forecast, 2026 – 2034

Ball Bearings Market Size

The global ball bearings market size was valued at USD 7.26 billion in 2025 and is projected to grow from USD 7.75 billion in 2026 to USD 14.33 billion by 2034, exhibiting a CAGR of 8% during the forecast period. Asia Pacific dominated the global market with a share of 45.50% in 2025. The ball bearing market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.95 Bn by 2032, driven by the demand in the automotive industry.

A ball bearing is a mechanical component used to reduce friction between rotating parts. It consists of inner and outer rings with a set of steel balls held in a cage between them. The global market is a vital sector within the industry, catering to a wide range of applications across various sectors, such as automotive, aerospace, industrial machinery, construction, and more. These bearings are essential in enabling smooth and efficient rotation in machinery, thereby enhancing performance, reducing downtime, and extending equipment lifespan. The increasing adoption of automation in manufacturing processes is driving the demand for high-performance of the product to ensure smooth and precise motion control in machinery and robotics.

Despite robust growth drivers, the market faces a few challenges, such as fluctuating raw material prices, intense competition among key players, and the impact of economic uncertainties on industrial activities. The COVID-19 pandemic initially led to a downturn in demand due to disruptions in manufacturing and supply chains. However, recovery followed as industries adapted, with rising demand from sectors, such as automation, medical equipment, and e-commerce sustaining the market to some extent.

Ball Bearings Market Trends

Increasing Demand for Specialized Ball Bearing is a Growing Trend in the Global Market

The escalating demand for specialized ball bearing underscores a significant trend shaping the global market, as industries increasingly prioritize tailored solutions to address specific operational challenges and optimize performance.

Different industries have unique operational needs that standard bearings may not adequately address. Specialized ball bearing are designed to meet the specific demands of sectors, such as aerospace, automotive, medical, and renewable energy, among others. These specialized bearings are engineered to optimize performance in challenging environments or applications where standard bearings may not suffice. This includes factors, such as high speeds, extreme temperatures, corrosive environments, or heavy loads.

Industries are increasingly seeking bearings customized to their precise requirements to maximize efficiency, reliability, and longevity. Custom-designed bearings can enhance equipment performance, reduce downtime, and improve overall productivity. In addition, advances in material science and engineering enable the development of specialized bearings with enhanced properties, such as higher strength-to-weight ratios, improved wear resistance, or superior lubrication capabilities. As industries continue to prioritize efficiency and reliability, the pursuit of tailored solutions is expected to remain a key focus, fostering ongoing advancements and strategic partnerships across diverse sectors.

Download Free sample to learn more about this report.

Ball Bearings Market Growth Factors

Increasing Adoption of Automation to Drive the Demand for Ball Bearings

The growing prevalence of automation across industries serves as a significant catalyst driving the global market.

Industrial automation involves the extensive use of machinery and equipment across manufacturing facilities. These machines often require ball bearing to facilitate smooth motion and rotation in various components, such as motors, gearboxes, actuators, and linear guides.

Precision is critical in industrial automation applications to ensure accurate positioning, movement, and coordination of machinery and robotic systems. As a result, ball bearing that provide low-friction and precise motion control, enabling smooth operation and high repeatability in automated processes, are in high demand. Many automated systems operate at high speeds to maximize production throughput. Ball bearing that are capable of handling high rotational speeds are essential components in these applications, ensuring reliable performance and minimizing wear and tear on machinery.

Further, advances in industrial automation, such as collaborative robots (cobots), additive manufacturing (3D printing), and smart factories (Industry 4.0), drive the demand for specialized ball bearing tailored to the specific requirements of these innovative applications. For example, bearings with integrated sensors enable condition monitoring and predictive maintenance in smart manufacturing environments.

Overall, industrial automation is playing a vital role in driving the demand for ball bearing globally by necessitating precise motion control, high-speed operation, heavy load handling, and reliability in various manufacturing and industrial processes. As industries continue to embrace automation to improve productivity and competitiveness, the demand for high-performance ball bearing is expected to remain robust in the coming years.

RESTRAINING FACTORS

Proliferation of Counterfeit Products to Hinder Market Growth

The proliferation of counterfeit and low-quality product presents a significant challenge within the global market. Counterfeit bearings are typically produced without adhering to industry standards and quality controls, often using inferior materials and manufacturing processes. As a result, these counterfeit products may not meet the performance and reliability requirements of genuine ball bearing.

The impact of counterfeit bearings extends beyond monetary losses for genuine manufacturers. These products pose serious risks to end-users and their equipment. These bearings are prone to premature failure, which can result in unexpected downtime, costly repairs, and safety hazards. In critical applications, such as aerospace, automotive, and industrial machinery, the failure of a single component, such as a ball bearing, can have catastrophic consequences.

Low-quality bearings may not withstand the operational stresses and environmental conditions for which they are intended. Their failure can cause damage to machinery components, leading to costly repairs and replacements. Genuine manufacturers may suffer reputational damage due to incidents involving counterfeit bearings. This loss of trust can have long-term consequences, affecting customer loyalty and market competitiveness.

Ball Bearings Market Segmentation Analysis

By Type Analysis

Deep Groove Ball Bearing Segment Dominates the Market due to Their Widespread Usage across Various Industries

Based on type, the market is segmented into self-aligning ball bearing, deep groove ball bearing, angular contact ball bearing, and others.

The deep groove ball bearing segment holds the highest market share of 32.65% in 2026, due to its widespread use across various industries. These bearings are characterized by their ability to accommodate radial and axial loads in both directions, making them versatile and suitable for a wide range of applications. Industries, such as automotive, industrial machinery, appliances, and agriculture rely heavily on deep groove ball bearing for smooth and efficient operation of rotating equipment.

The self-aligning ball bearing segment is set to exhibit the highest CAGR among all types of ball bearing over the forecast period. These bearings are designed to accommodate misalignment between shafts and housing, making them suitable for applications where shaft deflection or misalignment is common. The increasing adoption of automation and robotics in industrial applications is accelerating the demand for self-aligning ball bearing, as they can compensate for misalignment caused by dynamic operating conditions.

While the demand for angular contact ball bearing is driven by factors, such as the need for improved performance, reduced friction, and increased efficiency in rotating equipment. Industries, such as machine tools, aerospace, and automotive use these ball bearing in applications, such as spindles, gearboxes, and wheel hubs.

Other bearings include specialty ball bearing, such as thrust ball bearing, miniature ball bearing, and precision ball bearing that are used in specific applications or industries.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Automotive Industry Holds the Highest Market Share due to Increasing Vehicle Production

Based on application, the market is segmented into automotive, industrial machinery, mining & construction, medical, and others

The automotive segment holds the highest global ball bearings market share of 43.61% as they are extensively used in various automotive components such as engines, transmissions, wheel hubs, steering systems, and chassis assemblies. Increasing vehicle production, technological advancements in automotive systems, and the growing demand for fuel-efficient vehicles are expected to drive the market for ball bearing in the automotive sector.

The medical segment is expected to exhibit the highest CAGR over the forecast period, driven by the increasing adoption of medical devices and equipment in healthcare facilities globally.

The industrial machinery segment is a significant consumer, encompassing a wide range of applications in manufacturing, processing, packaging, and material handling equipment.

In contrast, the mining & construction segment utilizes the product in heavy-duty equipment, such as excavators, loaders, crushers, and conveyor systems used in mining operations, construction sites, and infrastructure projects.

REGIONAL INSIGHTS

In terms of geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Ball Bearings Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 3.3 billion in 2025 and USD 3.56 billion in 2026. Asia Pacific dominates the global market in terms of market share as well as CAGR. The region benefits from rapid industrialization, urbanization, and infrastructure development, particularly in countries, such as China, Japan, and India. Strong demand from automotive, manufacturing, and construction industries drives global ball bearings market growth in the region. The region's competitive manufacturing ecosystem, lower labor costs, and favorable government initiatives support the production and export of ball bearing.

China is a key player in the industry, boasting a significant share due to its large manufacturing base, robust industrial sector, and high demand from various industries. China's rapid industrialization has fueled the demand for the product, particularly in sectors, such as manufacturing, construction, and infrastructure development. The country's status as a global manufacturing hub provides opportunities for the manufacturers to export products to international markets, further boosting growth. The Japan market is projected to reach USD 0.39 billion by 2026, the China market is projected to reach USD 1.87 billion by 2026, and the India market is projected to reach USD 0.57 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America also holds a significant share of the global market, driven by the presence of key industries, such as automotive, aerospace, and manufacturing. The region is characterized by high demand for precision-engineered ball bearing to support advanced machinery and equipment. Technological advancements, particularly in industries, such as robotics, automation, and aerospace, fuel the demand for high-performance ball bearing. The region's focus on innovation, coupled with stringent quality standards, contributes to market growth. The U.S. market is projected to reach USD 1.22 billion by 2026.

Europe

Europe is a prominent market, supported by the presence of leading automotive manufacturers, machinery producers, and aerospace companies. The region emphasizes quality and precision engineering, driving demand for premium products. Technological advancements in industries, such as automotive, aerospace, and renewable energy drives the adoption of specialized ball bearing. Increasing investments in research and development stimulate innovation and product differentiation. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.7 billion by 2026.

South America

South America represents a growing market, supported by the expansion of manufacturing and automotive industries in countries, such as Brazil, Argentina, and Colombia. The region's abundant natural resources drive demand for heavy machinery and equipment fitted with ball bearing. Rising investments in infrastructure projects, including transportation, energy, and construction, are stimulating market growth in South America.

Middle East & Africa

The Middle East & Africa accounts for a relatively smaller share of the global market but demonstrates potential for growth, driven by infrastructure development projects and industrial expansion in countries, such as the UAE, Saudi Arabia, and South Africa. Political instability, economic uncertainties, and logistical challenges pose hurdles to market expansion in certain parts of the region. Additionally, competition from imported bearings and fluctuations in commodity prices is impacting the market dynamics.

KEY INDUSTRY PLAYERS

Focus on Technological Advancements by Key Players

The manufacturing companies are constantly pushing the boundaries of technological innovation to stay ahead in the competitive market. By investing in research and development, these manufacturers strive to introduce advanced bearing designs, materials, and manufacturing processes that offer improved performance, reliability, and efficiency.

List of Top Ball Bearings Companies:

- NSK Ltd. (Japan)

- Nachi Fujikoshi Corp (Japan)

- Myonic GmbH (Germany)

- LYC Bearing Corporation (China)

- Luoyang Huigong Bearing Technology Co. Ltd. (China)

- ISB Industries (Italy)

- NTN Bearing Corporation (U.S.)

- SKF (Sweden)

- The Timken Company (U.S.)

- TBH Bearings (China)

- Alchemy Immersive (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: RBC Bearings Incorporated announced the acquisition of Specline, Inc., a precision bearing manufacturer for commercial and defense aerospace markets, for USD 18.7 million.

- April 2023: NTN Corporation unveiled a cutting-edge technology that utilizes multiple AI methods to predict the remaining useful life of bearings precisely. By accurately forecasting the remaining useful life post-flaking, a common cause of bearing failure, NTN enables the creation of efficient maintenance plans for machinery and equipment, thereby contributing to enhanced productivity and cost reduction.

- March 2023: Schaeffler announced the acquisition of ECO-Adapt SAS, a company specializing in innovative condition monitoring solutions based on electrical signal analysis and energy consumption optimization systems. This collaboration allows Schaeffler to provide high-quality services and solutions for bearings and electric powertrain components throughout their entire lifecycle.

- February 2023: The Timken Company acquired the assets of American Roller Bearing Company (ARB), a North Carolina-based manufacturer of industrial bearings. ARB's offerings, complementing Timken's portfolio, contributed to sales exceeding USD 30 million in 2022.

- April 2021: JTEKT Corporation enhanced muddy water resistance in ball bearing for agricultural machinery used in challenging environments by incorporating seals previously utilized in automotive hub units.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 14.33 Billion by 2034.

In 2025, the market was valued at USD 7.26 Billion.

The market is projected to grow at a CAGR of 8% during the forecast period.

The deep groove ball bearing segment is leading the market in terms of share.

Increasing adoption of automation is the key factor driving the market growth.

NSK Ltd., Nachi Fujikoshi Corp, Myonic GmbH, LYC Bearing Corporation, Luoyang Huigong Bearing Technology Co. Ltd., ISB Industries, NTN Bearing Corporation, SKF, The Timken Company, TBH Bearings, and Alchemy Immersive are the top players in the market.

Asia Pacific region generated the maximum revenue in 2025.

The medical application segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us