Blood Pressure Monitors Market Size, Share & Industry Analysis, By Product (Devices {Sphygmomanometer, Digital BP Monitors, and Ambulatory BP Monitors}, and Accessories {Blood Pressure Cuffs, Transducers, and Others}), By End-user (Hospitals & Clinics, Home Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

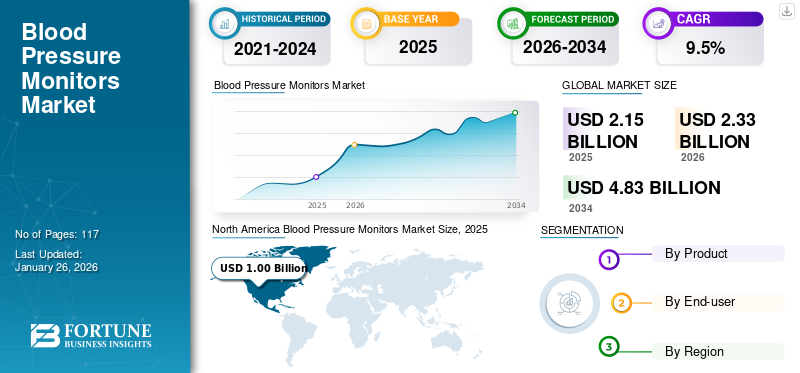

The global blood pressure monitors market size was valued at USD 2.15 billion in 2025 and is projected to grow from USD 2.33 billion in 2026 to USD 4.83 billion by 2034, exhibiting a CAGR of 9.5% during the forecast period. North America dominated the blood pressure monitors market with a market share of 42.70% in 2025.

Blood pressure monitors are devices used to measure the blood pressure of individuals. There are several types of pressure monitors commercially available that help measure the individuals' blood pressure and determine any fluctuations in the pressure rate to help maintain normal rates. The increasing burden of diseases such as cardiac arrhythmia, hypertension, etc., has been fueling the demand for blood pressure monitors.

- For instance, as per the data published by the World Health Organization (WHO) in 2021, around 17.9 million individuals died from cardiovascular diseases globally in 2019. Out of this number, around 85% of the deaths were due to heart attack and stroke.

The growing prevalence of cardiovascular disorders among the general population, along with rising healthcare expenditure in emerging countries, are some of the other factors contributing to the growing blood pressure monitors market size during the forecast period.

The COVID-19 pandemic impacted the global market significantly owing to increased demand and use of these devices to measure blood pressure and other vitals among the patients, including the COVID-19 patients in the emergency departments. The major players operating in the market also witnessed a growth in their revenues owing to increased demand for these devices. However, with the normalization of COVID-19 cases, the demand for these devices returned to normal, and therefore, the market witnessed slower growth in 2021.

Blood Pressure Monitors Market Overview & Key Metrics

Blood Pressure Monitors Market Size & Forecast

- 2025 Market Size: USD 2.15 billion

- 2026 Market Size: USD 2.33 billion

- 2034 Forecast Market Size: USD 4.83 billion

- CAGR: 9.5% from 2026–2034

Market Share

- North America dominated the global blood pressure monitors market with a 42.70% share in 2025, primarily driven by the growing prevalence of hypertension, widespread availability of advanced diagnostic devices, and strong presence of major market players such as Hill-Rom Holdings, Omron Healthcare, and GE Healthcare.

- By product type, devices—especially digital BP monitors—held the largest share in 2024. Their dominance is attributed to increasing adoption among the aging population, ease of use, and ongoing advancements like Bluetooth connectivity and wearable options. Additionally, governments and healthcare systems are promoting at-home monitoring through free device distributions and awareness campaigns.

Key Country Highlights

- The U.S. accounted for a significant portion of North America's dominance, with 119.9 million individuals affected by hypertension as of 2023. Rising awareness, government programs, and technological innovation are pushing the demand for self-monitoring devices.

- Japan shows strong adoption of digital and wearable BP monitors, driven by its rapidly aging population and integration of smart healthcare devices for home use. Key domestic players like Omron and Nihon Kohden are leading innovation and distribution in the market.

- China’s growing geriatric population and rising incidence of hypertension are propelling demand for both clinical and home-based monitoring devices. Increasing healthcare investments and partnerships, such as with Glenmark in India and regional distributors, further accelerate market growth.

- In Europe, demand is fueled by high awareness levels, the prevalence of hypertension, and supportive government initiatives. For instance, Philips’ partnership with Rennes University Hospital (France) reflects a growing focus on digital health integration for monitoring and diagnostics.

Blood Pressure Monitors Market Trends

Preferential Shift Towards Homecare Settings Among the Patient Population

There are several conditions among the population, such as hypertension and other cardiovascular diseases, that require frequent and regular monitoring of blood pressure among the patients to diagnose and manage the conditions timely and efficiently. This is a major factor resulting in the growing adoption of blood pressure monitors in homecare settings among the patient population.

The growing awareness regarding the benefits of home-based monitors among the patient population is expected to fuel this trend further in the future. The increasing technological advancements, such as the use of telehealth services, are another factor that is enabling the use of home-based monitors among patients.

According to a 2022 article published by the National Health Service (NHS), regular home blood pressure monitoring across a population of 50,000 patients could prevent up to 500 heart attacks and 745 strokes over five years.

In response to this preferential shift, the majority of key players, such as SunTech Medical Inc., Omron Healthcare, Inc., etc., increased their focus to develop and introduce advanced blood pressure monitoring devices.

Some of these devices include wearable digital BP monitor devices. They are capable of measuring blood pressure, along with body temperature and cardiac rhythm abnormalities accurately.

- For example, in January 2021, Aktiia SA launched a 24/7 automated blood pressure monitoring system that continuously monitors the blood pressure of the patient even when the patient is asleep.

Download Free sample to learn more about this report.

Blood Pressure Monitors Market Growth Factors

Growing Prevalence of Cardiovascular Disorders Leading to Increasing Demand for the Product

The rising prevalence of cardiovascular diseases, including hypertension and others, among the population globally is a major factor contributing to the growing patient pool requiring monitoring of blood pressure and other vital signs. According to a 2023 article published by the World Health Organization (WHO), an estimated 1.28 billion adults aged 30–79 years worldwide have hypertension, most (two-thirds) living in low- and middle-income countries.

The risk of hypertension is seen to increase with age. Therefore, the growing geriatric population, especially in emerging countries including China, India, and others, is another factor leading to an increasing patient pool requiring these devices. Several epidemiological surveys conducted in the U.S. and Europe conclude that hypertension prevalence in the elderly ranges between 53% and 72%.

Also, increasing awareness and strategic initiatives by government bodies and national and international organizations to promote the use of these devices for the effective management of hypertension is a crucial factor that is projected to augment the adoption of these devices in the market. This has led to the increased demand for self-diagnosis processes and routine checkups among common people, resulting in the rising demand for BP monitors. To cater to this unmet demand, key players in this market are introducing different devices with advanced features, such as data transfer via Bluetooth.

- For instance, in October 2020, Omron Healthcare, Inc. launched two new products, i.e., OMRON HEM-7361T and OMRON HEM-7156, in Indonesia with advanced screening technology and Bluetooth wireless connectivity.

Thus, the rising awareness, coupled with the growing efforts of the companies to develop and introduce technologically advanced products to cater to the rising demand, are expected to fuel the global blood pressure monitors market growth.

RESTRAINING FACTORS

High Cost of Advanced Devices has been Hampering the Market Growth

The rising technological advancements among companies is leading to new and advanced features in pressure monitors are major factors that can be considered to be responsible for the high cost associated with these devices. The limited awareness in emerging countries such as Brazil, Mexico, and others, along with high costs, are some of the factors resulting in slower adoption of these devices in these countries.

- According to a 2023 study article published by Springer Link, the annual cost of home blood pressure monitoring devices in Australia was around USD 6,400, and the annual cost of clinic blood pressure monitoring was around USD 6,700 per person.

Apart from this, the lack of validation and the inaccuracy of some automatic and manual monitors led to incorrect measurements. This is leading to the decreased adoption of these devices among healthcare professionals and the general population. For example, according to a study published by the American Heart Association, Inc., in 2020, the evaluation of roughly 972 BP monitors sold on online platforms in Australia revealed that 93.4% of these devices were non-validated.

Blood Pressure Monitors Market Segmentation Analysis

By Product Analysis

Devices Segment Dominated Due to Increasing Adoption of the Devices Among the Patient Population

Based on product, the market is bifurcated into devices and accessories. The devices segment is further classified into sphygmomanometer, digital BP monitors, and ambulatory BP monitors. The accessories segment is further segmented into blood pressure cuffs, transducers, and others.

The devices segment dominated the global market with share of 80.69% in 2026. A few of the major factors that are responsible for the dominance of the segment include rising awareness among the population regarding the benefits of these devices to monitor and manage conditions such as hypertension and hypotension, as well as the growing adoption of these devices in various healthcare settings.

Also, the rising support of the national organizations to help increase the adoption of the devices is also a significant factor contributing to the segmental growth.

- For instance, in 2021, the NHS distributed free blood pressure monitors to 220,000 people diagnosed with uncontrolled high blood pressure.

On the other hand, the accessories segment is expected to grow at a considerable growth rate. The growth of the segment can be attributed to the growing procurement of accessories in developed countries owing to the increased adoption of devices for pressure monitoring. Also, the rising focus of companies on introducing disposable accessories is supporting the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Home Healthcare Segment Dominated Due to Increase Adoption of the Devices for Remote Monitoring

Based on the end-user, the market is segmented into hospitals & clinics, home healthcare, and others.

The home healthcare segment dominated the market with share of 69.96% in 2026. The growing awareness regarding the benefits of regular monitoring of condition such as hypertension among the population is a significant factor contributing to the dominance of the segment. The increasing patient preference for digital blood pressure monitors, along with the rising adoption of these monitors, is responsible for the segment’s dominance.

The hospital & clinics segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the increasing number of healthcare facilities and a growing number of hospital admissions globally.

The others segment is expected to witness a moderate CAGR during the forecast period. The rising research activities to develop and introduction of advanced products with novel features are major factors contributing to the growth of the segment.

REGIONAL INSIGHTS

Based on geography, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Blood Pressure Monitors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the blood pressure monitors market share and was valued at USD 1.00 billion in 2025. The rising number of people with high blood pressure is leading to a growing demand for devices in countries such as the U.S. and Canada. The U.S. market is projected to reach USD 0.89 billion by 2026.

- For instance, as per the data published by the Centers for Disease Control and Prevention in 2023, around 119.9 million U.S. population suffered from hypertension.

Apart from this, the strong direct presence of prominent market leaders, such as Hill-Rom Holdings Inc., Cardinal Health, and others in the region, is also enabling it to hold the dominant market position.

Europe

Europe is projected to register a steady CAGR during the forecast period. This is due to the rising number of patient population suffering from hypertension in European countries, resulting in an increased demand for these products. In order to fulfill this emerging demand, the global players are focusing on R&D and inorganic strategies, such as mergers and acquisitions. The UK market is projected to reach USD 0.11 billion by 2026, and the Germany market is projected to reach USD 0.12 billion by 2026.

For example, in January 2021, Koninklijke Philips N.V. partnered up with Rennes University Hospital, France, to strengthen the product offerings for diagnostics, interventional imaging, and monitoring of patients.

Asia Pacific

Asia Pacific is expected to grow significantly during the forecast period. The rising geriatric population in countries such as China, India, and others, along with increasing healthcare expenditure and improving healthcare infrastructure in these countries, are resulting in the growing adoption of these devices. The Japan market is projected to reach USD 0.16 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to register moderate CAGR during the forecast period. The growing support and initiatives to promote the use of these devices among the patient population and improve reimbursement scenarios in countries such as Saudi Arabia, UAE and others is expected to fuel the market growth in these regions.

List of Key Companies in Blood Pressure Monitors Market

Diversified Product Launches by Players to Lead to Their Dominance

The global market is a semi-consolidated market with few prominent players accounting for a larger market share. Omron Healthcare, Inc., Hill-Rom Holdings, Inc., and Nihon Kohden Corporation are among the leading players in the global market. The introduction of advanced technology for blood pressure measurement and strategic collaborations among other players to expand their product offerings are some of the key factors primarily responsible for the dominance of these players.

- For instance, in February 2021, Hill-Rom Holdings, Inc. acquired the contact-free continuous technology from EarlySense with a view to monitoring patients remotely.

Apart from this, other key players operating in the market are Koninklijke Philips N.V., Masimo, GE Healthcare, American Diagnostic Corporation, Beurer GmbH, and SunTech Medical Inc. These players have increased their focus on expanding their production capacity in order to strengthen their market position. The growing focus on mergers and acquisitions by these companies is another major factor that is anticipated to fuel their market shares.

- In September 2021, SunTech Medical, Inc. acquired Meditech Kft, one of the leading manufacturers of ambulatory BP monitors (ABPM), with an aim to expand its product portfolio and geographical presence.

LIST OF KEY COMPANIES PROFILED:

- Omron Healthcare, Inc. (Japan)

- Hill-Rom Holdings, Inc. (U.S.)

- Nihon Kohden Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Masimo (U.S.)

- Beurer GmbH (Germany)

- GE Healthcare (U.S.)

- American Diagnostic Corporation (Europe)

- SunTech Medical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 – SunTech Medical, Inc. announced the recent installation of its Oscar 2 Ambulatory Blood Pressure Monitor (ABPM) at Monte Zion Diagnostic and Medical Centre Corporation in the Philippines.

- August 2023 – Omron Healthcare, Inc. and GLENMARK PHARMACEUTICALS LTD partnered to create awareness in India about hypertension and the correct age to monitor blood pressure at home.

- July 2023 – WHALETEQ Co., LTD expanded its portfolio for blood pressure testing monitors with the addition of BPA700.

- September 2022 – Garmin Ltd. announced the launch of a smart blood pressure monitor that can measure systolic and diastolic blood pressure at home easily.

- February 2022 – InBody Pvt. Ltd. announced the launch of BP 170, an automatic blood pressure monitor. These monitors provide individuals with an option to self-record and track major health metrics without visiting their doctor.

REPORT COVERAGE

An Infographic Representation of Blood Pressure Monitors Market

To get information on various segments, share your queries with us

The global blood pressure monitors market report provides a detailed analysis of the industry and focuses on key aspects, such as leading companies, products, and end-users. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.5% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.33 billion in 2026 and is projected to reach USD 4.83 billion by 2034.

In 2025, the North American market value stood at USD 1.00 billion.

The market is forecasted to grow at a CAGR of 9.5% during the forecast period..

By product, the digital BP monitors was the leading segment in the market.

The rising prevalence of chronic diseases, the introduction of technologically advanced monitors, and the growing awareness of this device among common people are the key drivers of the market.

Omron Healthcare, Inc., Hill-Rom Holdings, Inc., and Nihon Kohden Corporation are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic