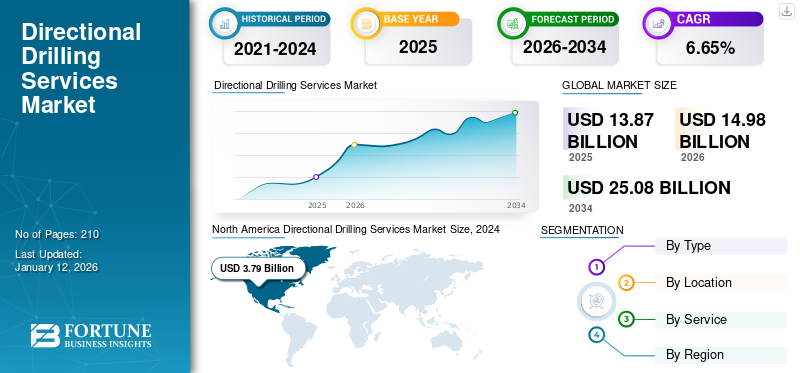

Directional Drilling Services Market Size, Share & Industry Analysis, By Type (Conventional and RSS), By Location (Onshore and Offshore), By Service (Logging While Drilling (LWD), Measurement While Drilling (MWD), Rotary Steerable System (RSS), Mud Motors, and Others) and Regional Forecast, 2026-2034

Directional Drilling Services Market Size and Future Outlook

The global directional drilling services market size was valued at USD 13.87 billion in 2025. The global market is projected to grow from USD 14.97 billion in 2026 to USD 25.07 billion by 2034, exhibiting a CAGR of 6.65% during the forecast period. North America dominated the global market with a share of 29.77% in 2025.

Directional drilling services encompass advanced subsurface trajectory techniques to optimize hydrocarbon extraction and geological reservoir penetration. The methodology facilitates numerous benefits, including flexibility, minimum site restoration, low soil contamination, low risk for geological abnormalities, and others.

Increasing E&P activities at different locations, coupled with advanced techniques and adaptability to drill multiple wells from a single location to deliver maximum output with minimum downtime, is set to propel the industry outlook further and elevate the need for directional drilling services.

Schlumberger (SLB) is a global market leader in directional drilling services. The company has developed advanced capabilities that enable precise wellbore navigation, including rotary steerable systems and intelligent downhole automation, which help improve drilling efficiency and productivity.

MARKET DYNAMICS

MARKET DRIVERS

Discoveries in Oil & Gas Industry are Boosting Market Growth

Discoveries in reserves and oilfields have been explored worldwide, which is propelling the directional drilling services industry. The major discoveries include Alpine high in West Texas, Alaska in U.S., Golan Heights in Israel, gas discoveries in the Kara Sea off the northwestern part of West Siberia's Yamal Peninsula - Dinkov and Nyarmeyskoye, oil discoveries in the Stabroek block Tilapia, Yellowtail (oil) and Haimara (gas-condensate), an offshore gas discovery with the Lang Lebah-1RDR2 exploration well and among other discoveries. It is projected that oil prices will be on the rise in the coming years, which would encourage oil field operators, gas production, and independent exploration companies to invest in oil & gas discoveries and exploration activities.

For instance, in 2024, Equinor revealed the discovery of an oil and gas well named Ringand. The estimated recoverable resources are between 2 to 13 million barrels of oil equivalent. This discovery is important for Europe’s energy mix as it could provide additional resources for Norway, which is one of Europe’s largest oil exporters, thus helping stabilize the region’s energy supply.

Increasing Energy Demand is Estimated to Propel Market Size Positively

The global oil and gas market is experiencing significant growth, driven by increasing demand from emerging economies. According to OPEC's projections, global oil demand is expected to grow, with an annual increase of 1.5 million barrels per day. Diverse regional developments and production strategies further stimulate the drilling market. Non-OPEC+ countries are anticipated to contribute over 70% of oil supply growth in 2025, primarily from increased production in the Americas.

Canada, Brazil, and Guyana are expected to start multiple new offshore production facilities, while the U.S. is projected to maintain steady production growth. BP's outlook suggests a potential peak in global oil demand of around 102 million barrels per day in 2025, indicating a complex transition period where oil remains crucial in the global energy mix. Despite slower growth compared to pre-pandemic trends, the continued demand from developing countries, particularly in transportation and industrial sectors, ensures ongoing investment and expansion in the drilling market.

MARKET RESTRAINTS

Volatility in Oil Prices and Growth in Alternative Energy Generation Technologies Hamper Market Growth

The oil price is subjected to demand and supply of oil, which fluctuates considerably. The higher price of oil halts the upcoming projects and investments, which interrupts drilling projects. Significant growth in alternative energy generation technology such as solar, wind, and hydro would reduce the dependency on oil & gas, which is likely to affect the oilfield services. Hence, volatility in oil prices, along with growth in alternative energy generation technologies, is anticipated to restrain the market growth in the projected timeframe.

MARKET OPPORTUNITIES

Growing Investment for Exploring Untapped Oil & Gas Reserves Accelerates Market Growth

The growth in oil & gas is the backbone of energy demand across the globe. Over the years, oil & gas have been abruptly used in power generation, manufacturing goods, and transportation, among other end-use industries. However, the significant demand for unconventional fuels such as shale gas, tight gas, and coal bed methane is due to increasing urbanization, globalization, and massive economic development, which is estimated to drive market growth. Additionally, many countries are increasing their Capital Expenditure (CAPEX) to secure upcoming energy demand.

Offshore hydrocarbons, oil, and gas are proven to be one of the most efficient and reliable sources of energy that attract many investors and oil & gas companies. Thus, rising interest in recovering untapped oil & gas is anticipated to drive the market during the forecast period. According to the U.S. Energy Information Administration, natural gas is expected to play a major role in this market expansion. As reported, proved reserves of U.S. natural gas increased by 10%, reaching a record of around 691.0 Tcf at the end of 2022. Similarly, global projections suggest that yet-to-find (YTF) resources will contribute around 30% of total natural gas production worldwide by 2050.

MARKET CHALLENGES

High Capital Cost Investment for New Project is a Challenge for the Market

High capital investment requirements pose a significant challenge to the directional drilling services market growth. Directional drilling rigs and specialized machinery demand substantial upfront investments, with complex tools such as motors, mud pumps, downhole motors, locators, and measurement-while-drilling systems potentially costing millions of dollars per rig. The extensive financial commitment creates substantial barriers to entry, particularly for small and medium-sized companies that may hesitate to adopt these advanced drilling techniques due to the significant capital expenditure required. Moreover, the constant wear and tear on downhole tools during drilling operations leads to high maintenance and replacement costs, further amplifying the economic challenges for operators seeking to expand their directional drilling capabilities.

DIRECTIONAL DRILLING SERVICES MARKET TRENDS

Advancements in Horizontal Directional Drilling (HDD) Boosting Infrastructure Projects is the Latest Trend

Manufacturers of Horizontal Directional Drilling (HDD) equipment have been expanding their product lines in response to the growing demand for HDD both domestically and globally. It frequently involves overcoming obstacles to reach higher heights of performance and power. Simultaneously, technological developments have become inevitable as producers aim to assist their clients in increasing serviceability, uptime, and productivity. For instance, in 2022, Ditch Witch introduced its fifth and tenth models, which include four all-terrain and nine dirt-only variants. The largest HDDs in the Ditch Witch portfolio are now the AT120 and JT120. With 120,000 lb of thrust and pullback force each, the AT/JT120 can handle larger installations and longer bores. In this size class, the all-terrain capabilities can double the production.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the directional drilling services market, causing a decline in oil and gas demand that resulted in reduced drilling activity and decreased service demand. The pandemic created challenges, including workforce shortages, supply chain disruptions, travel restrictions, and social distancing measures that hampered drilling operations. However, the crisis also accelerated some positive developments, such as increased adoption of remote drilling and monitoring technologies and a growing focus on sustainable and environmentally responsible drilling practices.

SEGMENTATION ANALYSIS

By Type

Low Operation Cost Along with Efficient Drilling Augments Conventional Segment to Grow

Based on type, this market includes conventional and Rotary Steerable Systems (RSS).

The conventional type segment holds a major directional drilling services market share. Conventional directional drilling services have low operation costs, efficient drilling of low-angle wells in complicated formations, and easy components that cater to the growth of the segment during the projected period. The segment is likely to hold 71.82% of the market share in 2026.

The RSS-type segment of directional drilling services is operational for both onshore and offshore wells. Rotary Steerable System (RSS) can drill long horizontal wells with a high inclination angle, even in complicated formations. This method is expected to grow due to its superior technological capabilities. RSS provides enhanced drilling outcomes by combining rotary drilling with precise directional steering, enabling operators to drill complex well profiles with improved directional control, higher rate of penetration, and reduced non-productive time. This segment is set to grow with a considerable CAGR of 7.80% during the forecast period (2025-2032).

By Location

Onshore Segment Dominates Market Due to Low Drilling Cost and Operational Cost

Based on location, this market is segmented into onshore and offshore.

The onshore segment dominates the industry owing to easy drilling methods, low drilling and operating costs, vast resource availability, and various other factors. In recent years, bulk-sized conventional and unconventional reservoirs have been discovered in the onshore location, which, in turn, will propel the demand for directional drilling services in the coming years. This segment held 69.50% of the market share in 2026.

The offshore segment is estimated to grow considerably over the forecast period due to increasing investments in drilling more wells from a single platform to increase the production output.

By Service

To know how our report can help streamline your business, Speak to Analyst

RSS Service Dominates as it Offers Superior Control, Precision, and Efficiency in Directional Drilling

Based on service, the market is broadly categorized into Measurement While Drilling (MWD), Logging While Drilling (LWD), Rotary Steerable Systems (RSS), mud motors, and others.

RSS is the industry leader in directional drilling services due to its exceptional control and precision in steering the drill bit, which allows more complex well trajectories and precise, well placement. When compared to conventional methods, this results in improved reservoir access, decreased drilling time, and increased efficiency, making it the go-to option for demanding drilling operations even if it is more expensive.

Measurement While Drilling (MWD) and Logging While Drilling (LWD) are critical techniques used to collate the dimensions of the wellbore during drilling operations and transfer the collected data to the surface using logging tools. Growing attempts to drill deep formations and achieve real-time monitoring effectively are projected to propel the segment growth during the forecast period. This segment is foreseen to grow with a significant CAGR of 8.07% during the forecast period (2025-2032).

Rotary Steerable Systems (RSS) delivers a wide range of directional drilling capabilities and provides significant power to the drilling bit. The segment is estimated to hold 29.52% of the market share in 2026.

DIRECTIONAL DRILLING SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Directional Drilling Services Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Exploration Activities and Increased Investments Drive Demand in North America

North America dominated the market with a revenue share of USD 4.13 billion in 2025 and USD 4.52 billion in 2026. The region is estimated to hold a larger market share owing to extensive discoveries in the oil & gas industry and the huge potential for exploring oilfields. In April 2019, Shell discovered a blacktip oilfield in the Gulf of Mexico to produce approximately 900,000 barrels per day (bpd) from its deepwater assets. Additionally, a state-owned company, Petroleos Mexicanos (PEMEX), discovered a deposit in southeastern Mexico that could yield 500 million barrels of crude oil.

U.S.

Extensive Shale Gas Reserves and Tight Oil Resources is Driving Exploration & Drilling Activities in the Country

The U.S. plays a pivotal role in the directional drilling market, demonstrating significant growth and potential. The market in the country is driven by its extensive shale gas reserves and tight oil resources, as it possesses one of the largest technically recoverable shale gas reserves and the second-largest tight oil reserves globally. Technological advancements in hydraulic fracturing and low breakeven prices have substantially supported oil and gas directional drilling activities. For instance, in 2023, the Willow project received final approval, which is expected to produce 180,000 barrels of oil per day at peak and yield 576 million barrels over 30 years. It is one of the largest U.S. drilling projects, generating significant economic benefits despite environmental concerns. The U.S. market is expanding, estimated to be worth USD 3.61 billion in 2026.

Europe

Increasing Investments in Offshore Drilling Projects Fuel High Demand in Europe

Europe is the fourth largest market estimated to reach USD 1.93 billion in 2026. The region is projected to grow due to continual investment in offshore locations. Italy is growing and is anticipated to be worth USD 0.19 billion in 2025. Key countries from Europe are investing considerably in exploring new offshore hydrocarbon reserves to increase domestic production. Norway and the U.K. account for a considerable market share owing to growing exploration in the Norwegian continental shelf. Norway is set to gain USD 0.28 billion in 2025, while Russia is projected to reach a valuation of USD 0.40 billion in the same year.

Asia Pacific

Advancements in Drilling Technologies Assist in Asia Pacific’s Growth

Asia Pacific is expected to hold the second-largest market share valued at USD 3.81 billion in 2026, exhibiting a CAGR of 9.29% during the forecast period (2025-2032), owing to advancements in drilling technology, such as long-reach horizontal wells and completion techniques, which include multi-stage hydraulic fracturing. In addition, National Oil Companies (NOC) are investing in offshore E&P activities to increase domestic production, providing impetus to the market. Furthermore, many countries from the Asia Pacific are increasing their Capital Expenditure (CAPEX) to secure future energy demand. Thailand and Indian market are poised to reach USD 0.32 billion in 2025.

China

China is Increasing its Investment in Energy Infrastructure for Advancement in Drilling

China's national energy infrastructure is increasingly focused on developing secure, sufficient, and clean energy sources, which has prompted substantial investment in advanced drilling technologies. The country is currently undertaking numerous large infrastructure projects that necessitate the use of cutting-edge drilling equipment, particularly in renewable energy and telecommunications sectors. For instance, in 2024, China National Offshore Oil Corporation (CNOOC) commenced the Suizhong 36-1/Luda 5-2 oilfield secondary adjustment and development project. This project aims to enhance oil recovery and optimize production processes in the Suizhong 36-1 and Luda 5-2 oilfields. China is expected to be valued at USD 2.14 billion in 2026.

Latin America

Increase in Deepwater and Ultra-deep Water Exploration in Latin America

Latin America is focusing on increasing deepwater and ultra-deepwater exploration to produce considerable oil and gas. Brazil is expected to dominate the regional market due to growing investment in offshore exploration. Hence, growing exploration projects and significant investment in oilfields accelerate the demand for directional drilling services in the forecast period.

Middle East & Africa

Expansion of Offshore Oil Production Investments in the Middle East & Africa

The Middle East & Africa is the third largest market expected to acquire USD 2.89 billion in 2026. Companies from the Middle East & Africa (MEA) are expanding offshore activities to meet their production goals. Predominantly, Qatar, Saudi Arabia, and the UAE are increasing their fleet count. For instance, ANDOC recently announced a major rig fleet expansion to support the company’s upstream growth plans and enable the delivery of its 2030 Smart Growth Strategy. Saudi Arabia is predicted to be worth USD 0.49 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Adopting Advanced Technology for Drilling Services, which Help to Shape Industry Outlook

Various regional and international players are consistently working on developing advanced technologies and featured services for directional drilling applications in the oil & gas industry. Major oil production companies are focused on undergoing different mergers & acquisitions, product development, and joint ventures to strengthen their position in a competitive environment. Companies are also focused on delivering a complete set of services and solutions for efficiently carrying out numerous tasks across all oil & gas development & transportation phases.

List of Key Directional Drilling Services Companies Profiled:

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- National Oilwell Varco (U.S.)

- Nabors Industries (Bermuda)

- Leam Drilling Systems LLC (U.S.)

- Jindal Drilling & Industries Limited (India)

- Gyrodata (U.S.)

- China Oilfield Services Limited (China)

- Phoenix Technology Services (Canada)

- Scientific Drilling (U.S.)

- AlMansoori Specialized Engineering (UAE)

- NewTech Services (Russia)

- Integra (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2024: Halliburton Company officially opened new facilities across Namibia, strategically positioned in Windhoek, Walvis Bay, Swakopmund, and Lüderitz to support the country's rapidly growing oil and gas industry. Spanning a combined 20,000 m², these facilities are designed to provide comprehensive services across different operational domains.

- January 2024: SLB and Nabors Industries joined forces to accelerate the adoption of automated drilling technologies by enabling seamless integration of their respective drilling automation applications and rig operating systems. This strategic collaboration aims to provide oil and gas operators and drilling contractors with enhanced flexibility, access to a broader suite of drilling automation technologies, and improved well construction performance and efficiency.

- September 2023: Halliburton launched the PulseStar™ telemetry service, an advanced system designed to revolutionize drilling operations by providing high-speed, real-time data streaming. This intelligent mud-pulse telemetry system enables operators to receive high-resolution downhole and subsurface data at extended depths, significantly improving well delivery efficiency.

- January 2021: NewTech Services Holding Limited and Saudi Aramco finalized a two-year contract for directional drilling services. Saudi Aramco is authorized to provide specialized drilling technologies, including downhole drilling motors, Measurement While Drilling (MWD), and Logging While Drilling (LWD) services for onshore oil operations in the Kingdom of Saudi Arabia, which is renowned as a global leader in crude oil production.

- August 2020: Baker Hughes unveiled the Lucida advanced rotary steerable service, a cutting-edge drilling technology that combines hardware, software, automation, and remote connectivity to enhance oil and gas drilling operations. The technology significantly advanced Baker Hughes' remote operations capabilities, with over 70% of their drilling operations.

Investment Analysis and Opportunities

- Investments in sensors, digital technologies, and automation are increasing the precision and efficiency of directional drilling, which will speed up project completion and save expenses. The need for directional drilling is fueled by this and investments in the development of unconventional resources, which propels market expansion.

- For instance, in June 2023, Noble Corporation, a global leader in offshore drilling, acquired Diamond Offshore Drilling in a USD 2 billion deal. This strategic investment expanded Noble’s fleet with advanced drilling rigs, particularly for deepwater and ultra-deep operations.

- In August 2022, a consortium led by Petrofac, a leading provider of oilfield services, secured a USD 300 million Engineering, Procurement, and Construction (EPC) contract with Algerias’s state energy company, Sonatrach. The project focuses on upgrading facilities and enhancing gas extraction in Algeria’s Hassi Messaoud oilfield. This investment is expected to create market opportunities for growth for the drilling sector companies in the region.

REPORT COVERAGE

The global directional drilling services market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies in directional drilling services. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.65% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Location

|

|

|

By Service

|

|

|

By Region

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market size was USD 13.87 billion in 2025.

The market is likely to grow at a CAGR of 6.65% during the forecast period of 2026-2034.

The market size of North America stood at USD 4.52 billion in 2025.

Discoveries in the oil & gas industry and increasing energy demand are the key factors driving the market growth.

Some of the top players in the market are Schlumberger, Baker Hughes, Halliburton, and others.

The global market size is expected to record a valuation of USD 25.07 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us