Energy Management System Market Size, Share & Industry Analysis, By System Type (Home Energy Management System (HEMS), Building Energy Management System (BEMS), and Industrial Energy Management System (IEMS)), By End User (Residential/Smart homes and Commercial Building/Complex), By Application (Property Safety, Automation, Energy Distribution, Design, e-Mobility, and Others), By Industry (Oil and Gas, Manufacturing, Energy and Utilities, Automotive, Healthcare, and Others), and Regional Forecast, 2025 – 2032

ENERGY MANAGEMENT SYSTEM MARKET SIZE AND FUTURE OUTLOOK

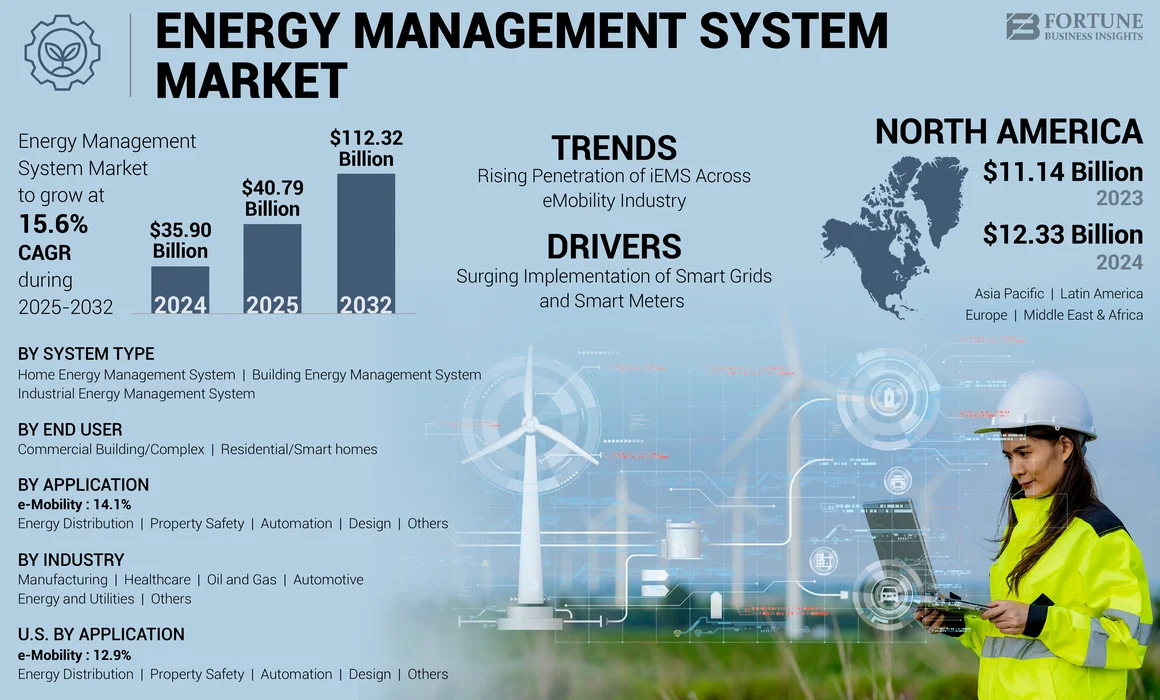

The global energy management system market size was valued at USD 35.90 billion in 2024. The market is projected to grow from USD 40.79 billion in 2025 to USD 112.32 billion by 2032, exhibiting a CAGR of 15.60% during the forecast period. North America dominated the market with a share of 34.35% in 2024.

The Energy Management System (EMS) market encompasses solutions designed to optimize energy consumption, improve efficiency, and reduce operational costs across various industries. These solutions enable organizations to monitor, control, and automate energy usage in real-time, contributing to sustainability and regulatory compliance. The increasing emphasis on energy efficiency, the growing adoption of smart grid technologies, and the rising demand for cost-effective EMS drives the market.

Key players in the market include IBM Corporation, Honeywell International Inc., General Electric Company, Schneider Electric SE, Eaton Corporation, Siemens AG, ABB, Johnson Controls International, Emerson Electric Company, and Landis + GYR (Toshiba Corporation).

The COVID-19 pandemic temporarily disrupted the market due to supply chain interruptions and project delays. However, it also accelerated the adoption of digital solutions and remote monitoring technologies to optimize energy usage in the post-pandemic recovery phase.

ENERGY MANAGEMENT SYSTEM MARKET TRENDS

Rising Penetration of Intelligent Energy Management Systems (iEMS) across eMobility Industry to Emerge as a Growing Trend in the Market

Intelligent iEMS has become a crucial technology for the automotive industry, especially in hybrid and electric vehicles, to manage energy consumption and perform various operations. iEMS offers information regarding energy consumption to the end users in real-time. The iEMS helps to reduce power consumption and provide more energy savings on overall usage. For instance,

- In March 2023, EDP, a Portugal-based renewable energy provider, partnered with GreenFlux to integrate its end-to-end digital platform for energy management and electric vehicle charging into its operations. The partnership also provided GreenFlux geographical expansion opportunities.

Moreover, a growing trend of iEMS noticed in the automotive sector is likely to strengthen during the forecast period. This growth is owing to the rising demand among end users for electric and hybrid vehicles based on EMS. Additionally, switching the power source between the engine and the battery in electric and hybrid vehicles, using the required energy, can be challenging. iEMS helps to overcome this challenge and enhance overall efficiency. Therefore, the rising penetration of iEMS across the automotive industry is a key trend for adopting EMS.

MARKET DYNAMICS

Market Drivers

Surging Implementation of Smart Grids and Smart Meters to Fuel Market Growth

Smart grids use advanced communication and electricity consumption networks that utilize two-way communication and information to optimize energy generation, transmission, and distribution. Smart meters are key components of smart grids, which enable data collection on energy usage and further processing to enhance billing, load management, and demand response programs. EMS incorporating smart grids, and meters are becoming increasingly popular globally. Numerous countries are implementing these technologies to address energy security, reduce carbon emissions, and enhance efficiency. For instance,

- In November 2022, Duke Energy partnered with Amazon Web Services to accelerate the development of grid solutions. The partnership aims to benefit Duke Energy by enhancing its clean energy transition. The company focuses on leveraging AWS to build smart grid software and services and expand its intelligent grid product suite.

Market Restraints

High Costs Associated with Software Integration and Post-Maintenance Services Impede Market Growth

The installation of EMS systems is cost-intensive. Maintenance cost management and visibility are essential to analyze operational spending. The initial installation of EMS requires technical expertise and high capital investments. Manufacturers or businesses often have limited capital expenditures for end-use energy-efficient applications.

Furthermore, the energy management software and hardware must be regularly updated due to the non-standardized guidelines, increasing operational and maintenance costs. Failure in any hardware unit implies replacing the entire hardware system, which raises prices associated with the maintenance services. Moreover, these systems face compatibility issues, further increasing the cost of software integration and post-maintenance. Thus, high costs associated with software integration and post-maintenance service will affect energy management system market growth in the short to medium term of the forecast period.

Market Opportunities

Rising Advancements in Industry 4.0, IoT, and Cloud Analytics Generate Lucrative Opportunities

Industry 4.0, IoT, and cloud analytics are revolutionizing energy management solutions by integrating advanced technologies to create an intelligent, latest, sustainable, and efficient energy infrastructure. Industry 4.0 combines automation, data trading, and IoT to create an efficient and smart factory environment. It is used to optimize energy production, distribution, and consumption through machine learning algorithms such as dragonfly and genetic algorithms. This results in enhanced energy management practices, reduced costs, improved energy efficiency, and decreased environmental impact.

Integrating IoT technology within EMS represents a significant opportunity for the market, as it allows for the interconnectivity of various device sensors and transmits real-time data. Data analytics can enhance decisions and streamline automation processes, including energy consumption, monitoring, predictive maintenance, and demand response. Energy management companies leverage advanced IoT technologies to identify inefficiencies in energy consumption, track energy usage patterns, and adjust the usage to optimize performance and reduce costs. However,

- According to industry experts, the majority of Fortune 500 companies, estimated to be around 85%, could not fully leverage the potential benefits of their big data analytics due to limited accessibility to the data.

Thus, if utilized efficiently, such advancements generate insightful data analytics, which enhances and accelerates energy management initiatives.

SEGMENTATION ANALYSIS

By System Type

High Energy Consumption across Industrial Sector Boosts IEMSSegment Growth

By system type, the market is divided into HEMS, BEMS, and IEMS.

The IEMS segment dominated the market and held 49.70% of the share in 2024, due to high energy consumption in manufacturing, oil & gas, and heavy industries, where optimizing energy efficiency reduces operational costs. The increasing adoption of smart grids, IoT-based monitoring, and automation in industrial facilities further strengthens the demand for IEMS. Additionally, in 2025, the IEMS will hold 49.40% share of the global market.

The HEMS is expected to grow at the highest CAGR of 18.00% over 2025-2032, due to the rising adoption of smart home technologies, increasing consumer awareness of energy efficiency, and government incentives for residential energy conservation. Integrating artificial intelligence (AI), IoT-enabled devices, and smart meters further drives the segment growth, allowing real-time energy monitoring and optimization.

By End User

Rising Focus on Reducing Energy Costs to Drive Commercial Buildings/Complexes Segment Growth

By end user, the market is distributed into residential/smart homes and commercial building/complex.

Commercial buildings/complexes will hold 72.10% market share in 2025 due to the rising focus on reducing energy costs, regulatory mandates for energy efficiency, and increasing adoption of innovative building technologies. The demand for centralized energy monitoring and optimization in office buildings, malls, hotels, and hospitals further accelerates market growth.

The residential/smart homes segment is expected to grow at the highest CAGR of 18.00% of 2025-2032 due to the increasing adoption of smart appliances, home automation systems, and IoT-enabled energy management solutions. Government policies promoting energy conservation and rising electricity costs drive homeowners to invest in advanced EMS.

By Application

Growing Implementation of Smart Grids and Real-time Monitoring to Propel Energy Distribution Segment Growth

By application, the market is classified into property safety, automation, energy distribution, design, e-mobility, and others.

Energy distribution leads the market by holding 24.30% share in 2025 as utilities and industrial sectors are increasingly implementing energy management solutions to enhance grid efficiency, reduce transmission losses, and integrate renewable energy sources. Moreover, the growing deployment of smart grids and real-time energy monitoring technologies further strengthens demand in this segment.

The automation segment is expected to grow at the highest CAGR due to the rising adoption of AI, IoT, and machine learning for predictive energy management and real-time control. The increasing implementation of automated energy optimization in commercial buildings, industries, and residential sectors is driving rapid growth of the segment.

The e-mobility segments accounts for the highest CAGR of 16.40% during 2025-2032.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

High Energy Consumption across Oil & Gas Industry to Fuel Segment Growth

The market is separated by industry into oil and gas, manufacturing, energy and utilities, automotive, healthcare, and others.

The oil and gas industry dominates the market with anticipated market share of 25.00% in 2025, due to its high energy consumption and stringent regulatory requirements for efficiency and sustainability. Additionally, its focus on reducing operational costs and carbon emissions has driven significant investments in the market.

The manufacturing sector is expected to witness the highest CAGR of 16.90% over 2025-2032 in the market due to increasing industrial automation. The rising adoption of energy-efficient initiatives promoting sustainability and cost-saving measures is accelerating the demand for EMS in manufacturing facilities.

ENERGY MANAGEMENT SYSTEM MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America regions.

North America Energy Management System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

Download Free sample to learn more about this report.

North America dominates the market due to stringent energy efficiency regulations, high adoption of smart grid infrastructure, and substantial investments in advanced energy management technologies. The presence of major EMS providers and increasing focus on sustainability further drive market growth in the region. The U.S. leads the North American market due to stringent energy efficiency regulations, high adoption of smart grid technologies, and significant investments in renewable energy integration.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific market will reach USD 8.97 billion in 2025 and is expected to grow at the highest CAGR due to rapid industrialization, urbanization, and increasing investments in smart grid infrastructure across China, India, and Japan. The market in China is estimated to hit USD 2.61 billion, while India will reach USD 1.68 billion, along with Japan market at USD 1.69 billion in 2025. The region's rising demand for energy efficiency, government-led initiatives, and growing adoption of smart building technologies are key growth drivers for the regional market.

Europe

Europe holds the second largest share and will hit USD 10.11 billion at a CAGR of 17.00% over 2025-2032, due to strict regulatory policies, carbon emission reduction targets, and widespread adoption of energy efficiency solutions in industries and commercial buildings. The U.K. market is anticipated to stand at USD 1.68 billion, while France will reach USD 1.80 billion, along with Germany at USD 2.76 billion in 2025. Government incentives for smart energy management and the growing integration of renewable energy sources support market expansion across the region.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America are expected to grow at an average rate due to the gradual adoption of energy management solutions and ongoing investments in smart energy infrastructure. Although increasing energy demand and regulatory frameworks support market growth, economic constraints and limited awareness slow down large-scale adoption. The Middle East & Africa holds the fourth largest market share and will reach USD 5.21 billion in 2025. The market value of GCC is projected to hit USD 2.08 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Alliances and Investments Pave the Way for Growing Business Trajectories

The market players are updating their existing products and developing new products to meet the changing customer requirements. In addition, strategic agreements, partnerships, collaborations, and mergers & acquisitions are prominent fundamental business strategies adopted by every market player to expand their business operations and geographical presence. The strategy aids the overall development and expansion of the energy management system market share.

Major Players in the Energy Management System Market

To know how our report can help streamline your business, Speak to Analyst

The top companies, including high performers, dominate the market share due to their extensive product portfolios, strong global presence, and continuous investments in innovation and advanced technologies such as AI, IoT, and cloud based energy management solutions. Their strategic collaborations, acquisitions, and ability to cater to diverse industry needs further strengthen their market leadership and competitive advantage. For instance,

- In February 2024, GE Appliances introduced the EcoBalance System, a solution designed to address consumer challenges in home energy management. This system enables consumers to control energy usage by integrating air conditioners, appliances, and water heaters across GE brands with intelligent lighting and energy management solutions.

List of Key Energy Management System Companies Profiled:

- IBM Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- General Electric Company (U.S.)

- Schneider Electric SE (France)

- Eaton Corporation(Ireland)

- Siemens AG (Germany)

- ABB (Switzerland)

- Johnson Controls International PLC (U.S.)

- Emerson Electric Company (U.S.)

- Landis + GYR (Toshiba Corporation) (Switzerland)

- NEC Corporation (Japan)

- Hitachi Limited (Japan)

- Cisco Systems, Inc. (U.S.)

- Elster Group GmbH (Germany)

- AES Corporation (U.S.)

- ai Inc. (U.S.)

….and more

KEY INDUSTRY DEVELOPMENTS:

In February 2025, Schneider Electric introduced the SpaceLogic Touchscreen Room Controller, an advanced device for building energy management. This solution integrates modern technology with an intuitive user interface to enhance room control and optimize energy efficiency.

In November 2024, IBM announced the general availability of IBM Maximo Renewables, a new solution designed to enhance the management and efficiency of renewable energy assets. This platform enables companies to track and monitor asset performance, identify causes of efficiency losses, recommend corrective actions, and optimize maintenance planning.

In October 2024, Honeywell introduced new AI-enabled solutions to enhance workforce productivity, improve system efficiency, and accelerate autonomous plant operations. These solutions provide an end-to-end AI experience for field workers, process operators, and enterprise executives.

In September 2024, Eaton launched the AbleEdge HEMS, offering homeowners and installers a comprehensive, easy-to-install, and fully integrated solution to facilitate a safe energy transition. The system enhances flexibility and energy resilience for retrofit and new construction projects.

In February 2024, GE Appliances partnered with Tantalus Systems to enhance energy management by utilizing real-time data for HVAC systems, home appliances, and water heaters. The GE Appliances EcoBalance System will integrate with Tantalus’ TRUSense Gateway to optimize appliance cycling and support grid modernization initiatives through this collaboration.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The investment analysis of the market highlights significant funding in smart grid infrastructure, AI-driven energy optimization, and IoT-enabled monitoring solutions to enhance energy efficiency across industries. Growing opportunities lie in the increasing adoption of cloud-based EMS, rising demand for automated energy control in smart buildings, and government incentives promoting sustainability initiatives. Additionally, emerging markets in the Asia Pacific and the Middle East present lucrative prospects for market expansion, driven by rapid urbanization, industrialization, and regulatory mandates for energy efficiency. For instance,

- In November 2022, a China-based factory announced the implementation of an EMS to sobtain maximum energy consumption efficiency.

REPORT COVERAGE

The global market report covers an overview of the market and centers on central characteristics such as main players, their product/service enterprise types, and their use cases in the market. Besides, the report offers insights into the market trends and highlights current market-related improvements. In addition, the report covers the competitive landscape of the overall market. Further, the report comprises several factors that backed the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 15.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By System Type, End User, Application, Industry, and Region |

|

Segmentation |

By System Type

By End User

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 112.32 billion by 2032.

In 2024, the global market was valued at USD 35.90 billion.

The market is projected to grow at a CAGR of 15.6% during the forecast period.

By industry, the oil & gas segment led the market in 2024.

Increasing adoption of smart appliances is expected to drive the market.

IBM Corporation, Honeywell International Inc., General Electric Company, and Schneider Electric SE are the top players in the market.

North America held the highest market share in 2024.

By system type, the IEMS is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us