Flywheel Energy Storage Market Size, Share & Industry Analysis, By Application (Uninterrupted Power Supply, Distributed Energy Generation, Data Centers, Transport, and Others) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

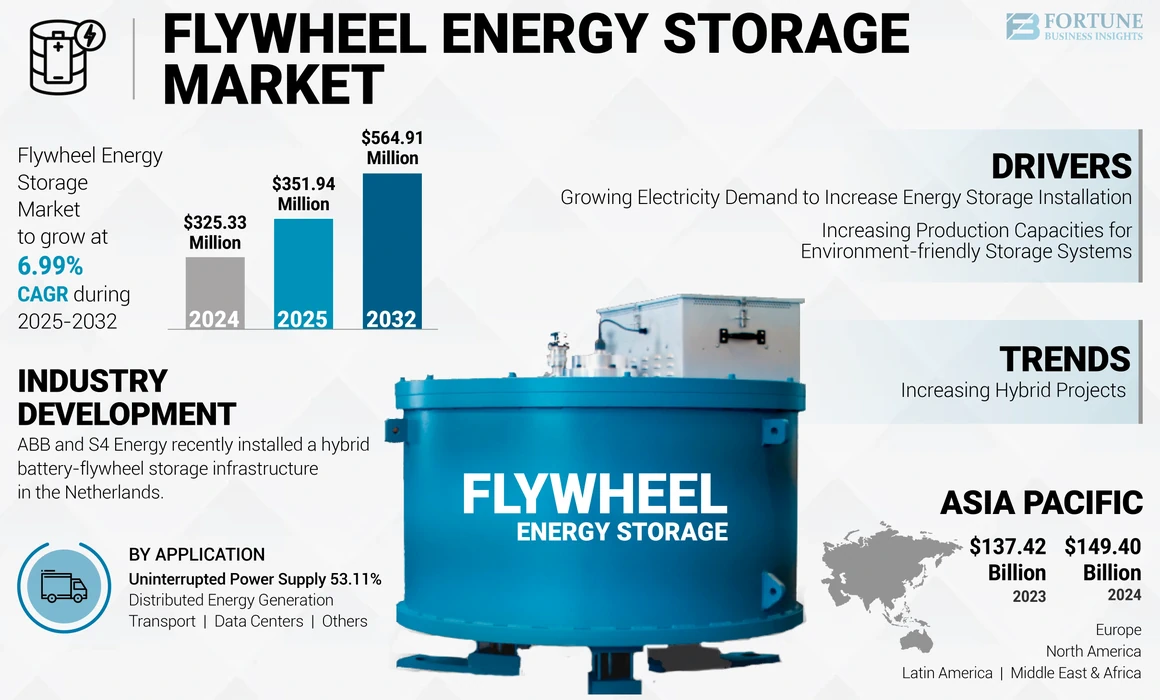

The global flywheel energy storage market size was valued at USD 325.33 million in 2024. The market is projected to grow from USD 351.94 million in 2025 to USD 564.91 million by 2032, exhibiting a CAGR of 6.99% during the forecast period. Asia Pacific dominated the global market with a share of 49.18% in 2024. The Flywheel Energy Storage market in the U.S. is projected to grow significantly, reaching an estimated value of USD 120.76 million by 2032, driven by the need for reliable backup power solutions integration with renewable energy sources.

Flywheel energy storage is a mechanical energy storage system that utilizes the kinetic energy of a rotating mass, or flywheel, to store and release energy. Flywheels store energy by spinning a heavy rotor at high speeds. When excess electricity is available, the motor accelerates the flywheel, converting electrical energy into kinetic energy. When power is needed, the kinetic energy is converted back into electricity as the flywheel decelerates. is trend of storing energy and conserving it while using it has boosted the market growth in the renewable energy sector. Due to the COVID-19 pandemic, major economies across the globe faced unmatched challenges, with people suffering from health, family, and financial conditions. Businesses also faced significant challenges. According to the Energy Storage Association (ESA) survey, industry stakeholders revealed devastating impacts on the energy storage industry.

Subsequently, major renewable and fossil-based energy-producing countries, such as China and the U.S., took stern actions to impede the growth of the novel coronavirus. Various governments across all the regions presented stringent action plans to reduce the spread of COVID-19 infection. The imposition of lockdowns and travel bans caused delays in several planned projects across the energy storage industry

Flywheel Energy Storage Market Trends

Increasing Focus on Grid Stability and Resilience is Propelling Market Growth

One of the latest trends in the global flywheel energy storage market is the increasing focus on grid stability and resilience. With the growing adoption of renewable energy sources, such as wind and solar, which are growing rapidly, there is a heightened need for energy storage solutions to moderate the variability in power generation and ensure grid stability. Flywheel energy storage systems offer fast response times and rapid charge/discharge capability, making them well-suited for providing frequency regulations, voltage support, and grid balancing services. Additionally, advancements in flywheel technology, such as improvements in energy density, efficiency, and reliability, are driving their adoption in various applications, including grid-scale energy storage and UPS systems. Moreover, the increasing focus on decarbonization and sustainability is further propelling the demand for flywheel energy storage as an environment-friendly alternative to traditional fossil fuel-based peaker plants for meeting short-term grid stabilization needs. Overall, the trend toward enhancing grid stability and resilience coupled with technological advancements is shaping the growth trajectory of the global flywheel energy storage market.

Download Free sample to learn more about this report.

Flywheel Energy Storage Market Growth Factors

Growing Electricity Demand for Increasing Energy Storage Installation to Drive Market Growth

Energy Storage Systems (ESS) can balance electrical energy supply and demand by consuming stored energy at times of high need, high generation cost, or when no alternative generation is available. The demand for energy continues to increase across various developing countries, such as Brazil, Russia, India, China, and South Africa; hence, this has increased energy prices. ESS is a vital necessity to aggregate traditional generating plants to meet increasing demand and supplement intermittent Renewable Energy Storage (RES) for their integration into the electrical network.

While some datasets exist that quantify the storage capabilities found in today's power systems, the current global installed capacity for energy storage struggles from a lack of widespread and accessible data and conflicting definitions regarding what should be included in the baseline; however, various governmental regulations have passed regulatory orders to overcome this issue.

For instance, in June 2023, Key Energy installed a three-phase FESS at a residence east of Perth, Western Australia. The 8 kW/32 kWh system was installed over two days in an above-ground enclosure, decreasing the time required to install the flywheel system.

Increasing Production Capacities for Environment-friendly Storage Systems to Boost Market Growth

As a counterpart to today’s electrical network, there is a high demand for reliable, cost-effective, long-lasting, and environmentally sound energy storage systems to support various energy storage applications. With advances in materials technology, bearings, and power electronics, the technology of flywheels for energy storage has significantly developed.

With the growing advancement and adoption of this technology in energy storage, various manufacturers operating in the market are enhancing their production capacities, resulting in the demand for FESS.

In June 2022, Amber Kinetics, Inc., a leading energy storage firm, focused on doubling its energy storage systems by increasing the production capacity of its manufacturing facility in Sto. Tomas, Batangas. With the second plant, the company expects to export its flywheels to other countries that need energy storage systems. Up to 70-80% of the existing plant’s output is for the local market, adding that a flywheel weighs about 2.5 tons.

RESTRAINING FACTORS

Availability of Alternative Energy Storage Systems is Hindering Market Growth

The growth of alternative energy storage systems presents some challenges to the flywheel energy storage market growth. Alternative energy storage technologies include batteries, thermal systems, pumped hydropower, compressed air, superconducting magnets, and others.

For instance, according to the International Hydropower Association (IHA), the predicted pumped hydropower storage capacity is anticipated to grow by almost 50% – to about 240 GW by 2030.

In addition, batteries are the most scalable type of grid-scale storage, and the market has witnessed strong growth in recent years. As per the International Energy Association (IEA), worldwide investment in battery energy storage exceeded USD 20 billion in 2022, mainly in grid-scale deployment, which accounted for more than 65% of total spending in 2022.

Flywheel Energy Storage Market Segmentation Analysis

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Uninterrupted Power Supply Segment to Dominate Due to Rising Demand for Continuous Power Supply

Based on application, the market is segmented into an uninterrupted power supply, distributed energy generation, transport, data centers, and others.

The uninterrupted power supply segment held a larger share in 2024. The demand for continuous and uninterrupted energy is rapidly increasing across the globe. According to the IEA, the global energy demand rose by 6% in 2021. With the rising demand, interruptions and fluctuations are also increasing in the energy supply. This increases the demand for uninterrupted power supply.

For instance, in September 2022, Indian researchers assessed the full range of flywheel storage technologies. They presented a survey of different applications for uninterrupted power supply (UPS), transport, solar, wind, storage, Flexible AC Transmission System (FACTS) devices, and other applications.

The distributed energy generation segment is another lucrative application of flywheel energy storage, as it is known for providing faster power backup. The areas prone to natural disasters majorly install distributed energy generation so that such areas can access electricity during natural disasters.

REGIONAL INSIGHTS

Geographically, this market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Flywheel Energy Storage Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounts for a majority of the global flywheel energy storage market share. The rising demand for uninterrupted electricity is one of the major growth drivers for the market. China, South Korea, Japan, India, and the Philippines are largely adopting flywheel energy storage technology owing to its high efficiency and long service life advantage. The high demand for continuous electricity and rising investments in storage technology drive the market growth.

For instance, in March 2022, The high-power flywheel + battery storage AGC frequency regulation project, led by a thermal plant of China Huainan Corporation in Shuozhou, formally began construction. When finished, it will be China's first flywheel + battery storage project used in frequency regulation. The project has a budget of USD 4.6 million (33.72 million yuan) using a 5MW/5MWh BESS and a 2MW/0.4MWh flywheel storage system. The R&D process of the flywheel and battery control system will probably be completed, which will be ready to operate in August and will be online by the end of 2022. It will be the first application of the hybrid storage system in the power grid frequency regulation scenario in China.

North America is the most lucrative market as far as energy storage is concerned. The U.S. accounts for the majority of installed capacity in North America. For instance, in April 2021, the trial, staged with obtaining partner Sunbelt Rentals, assessed a FESS delivered by technology firm Punch Flybrid.

However, Canada is working extensively to enhance its flywheel energy storage capacity. Both countries have planned upcoming projects, and a few projects are underway for flywheel energy storage technology. The above factors drive the growth of the market.

For instance, in November 2022, NRStor worked on battery microgrid systems and is building Canada's first large-scale commercial FESS project, which will match carbon-free hydropower. NRStor is also building a 1,000-megawatt-hour battery plan with the Six Nations of the Grand River Development Corporation.

Europe is estimated to grow significantly during the forecast period. The transition toward renewable energy to achieve carbon-neutral status has driven growth for energy storage installation in Europe. Flywheel is a preferred technology owing to its environment-friendly nature and strong power capacity. Thus, the above factors drive market growth.

Latin America is likely to anticipate moderate growth during the forecast period. The region is going through a drastic energy transition. Several countries are rapidly transitioning from traditional sources of energy, such as hydroelectricity and crude oils, to a diverse energy mix, including various cleaner fuels. This challenges the region to meet the electricity demand across Latin America. Brazil, Jamaica, Argentina, Chile, and others are increasingly investing in and enhancing the capacity of energy storage systems.

The Middle East & Africa is expected to witness significant growth during the forecast period. The demand and installation of energy storage systems are widely increasing across the region owing to the rapidly growing demand for continuous electricity among the population. The installation of data centers is also increasing in the GCC. There are 22 data centers in Saudi Arabia and 9 in the UAE. These data centers also tend to adopt flywheel energy storage systems due to their benefits, such as high efficiency and reliability, easy maintenance, and more storage power.

List of Key Companies in Flywheel Energy Storage Market

Leading Players such as Langley Holdings Plc are Introducing Long-Duration Flywheel Energy Storage Systems

Amber Kinetics Inc. is a leading player in the flywheel energy storage market, collaborating with many public and private entities. In September 2023, Orlando Utilities Commission (OUC), a Florida-based water and electric utility company, partnered with Amber Kinetics to install a 64 kWh FESS. Commissioned in April 2022, Amber Kinetics flywheels supports OUC's Grid Integration Laboratory (GIL) research program, among other renewable technologies.

Langley Holdings plc has subsidiaries, such as Piller Group GmbH. Piller’s kinetic energy storage product gives the designer a chance to save space and enhance power density per unit.

- For instance, in March 2022, Pillar Group’s UB-V solutions were being evaluated or have been commissioned to provide more than 1.3 GW of power protection at data centers and other critical facilities in energy, healthcare, manufacturing, and transport across Asia, the U.S., and Europe. The UB-V solution can provide many MWs of reliable power protection on a daily basis and, in turn, give customers the confidence that their critical systems will run continuously.

LIST OF KEY COMPANIES PROFILED:

- Langley Holdings plc (U.K.)

- Amber Kinetics, Inc. (U.S.)

- Beacon Power (U.S.)

- Adaptive Balancing Power GmbH (Germany)

- VYCON, Inc. (U.S)

- Teraloop (Finland)

- Stornetic GmbH (Germany)

- Revterra (U.S.)

- PUNCH Flybrid (U.K.)

- Levistor Ltd (U.K.)

- Energiestro (India)

- Candela (Shenzhen) New Energy Technology Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: In Shanxi Province’s city of Changzhi, a project to construct China’s first grid-level flywheel energy storage facility began in June this year. Backed by Shenzhen Energy Group, the project’s main investor, the facility’s storage system employs solutions developed by BC New Energy, a startup specializing in advanced energy storage technology.

- February 2023: Candela New Energy's first megawatt-class magnetic levitation flywheel production line was successfully put into operation in Julongwan Intelligent Equipment Industrial Park, Foshan City. The first set of 1MW/35kWh magnetic levitation flywheel has been positively rolled off the production line.

- October 2022: ABB and S4 Energy recently installed a hybrid battery-flywheel storage infrastructure in the Netherlands. The project features a 10 MW battery system and a 3 MW flywheel system and can supposedly offer a leveled cost of storage ranging between USD 0.020/kWh and USD 0.12/kWh.

- April 2022: The flywheels were installed for OUC's Nanogrid research project at the Gardenia Innovation & Operations Center. The flywheels will be coupled to the research site’s 64-kilowatt (kW) solar array floating on a pond that’s only 70 feet away. Its emerging technologies team began testing the 16-kW flywheels in May 2022. It bought the flywheels from Amber Kinetics.

- April 2022: - China's first 1MW flywheel energy storage device was installed and commissioned at Wannianquan Road Station of Qingdao Metro Line 3 and successfully connected to the grid. According to public data, if one subway trip every three to five minutes is calculated, each subway can save 3-4 kWh of electricity and 500-600 kWh of electricity can be saved in a day.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Flywheel Energy Storage Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.99% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 325.33 million in 2024.

The global market is projected to grow at a CAGR of 6.99% over the forecast period.

The market size in Asia Pacific stood at USD 149.40 million in 2024

Based on application, the uninterrupted power supply segment holds a dominating share of the global market.

The global market size is expected to reach USD 564.91 million by 2032.

Rising demand for electricity is propelling the market growth.

Langley Holdings plc, Amber Kinetics, Beacon Power, and Adaptive Balancing Power GmbH Inc. are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic