Metal Cutting Tools Market Size, Share & Industry Analysis, By Product (Machining Centers, Lathe Machines, Boring Machines, Grinding Machines, Milling Machines, and Others), By Application (Automotive, General Machinery, Precision Machinery, Transport Machinery, and Others), and Regional Forecast, 2026-2034

Metal Cutting Tools Market Size

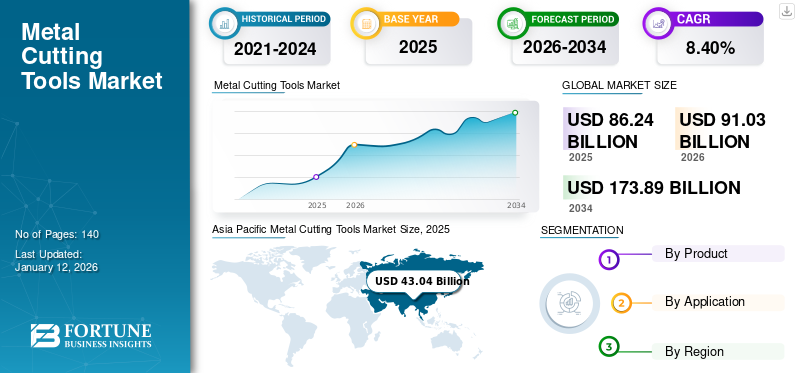

The global metal cutting tools market size was valued at USD 86.24 billion in 2025. The market is projected to grow from USD 91.03 billion in 2026 to USD 173.89 billion by 2034, exhibiting a CAGR of 8.40% during the forecast period. Asia Pacific dominated the global market with a share of 49.90% in 2025. The metal cutting tools market in the U.S. is projected to grow significantly, reaching an estimated value of USD 35.42 Bn by 2032, driven by the increasing investments by the key players in additive manufacturing technologies to produce customize machine tools.

The metal cutting tools industry includes companies involved in the design, manufacturing, and sales of tools and equipment used to cut, shape, and form metal components. These tools range from handheld devices, such as saws, grinders, and shears, to highly specialized machines such as lathes, milling machines, and CNC machines. The industry serves a wide range of sectors including automotive, aerospace, construction, and industrial manufacturing. It plays a critical role in the metalworking process, as the quality and precision of the cutting tools directly impact the quality and precision of the final product.

The industry has been experiencing steady growth in recent years, driven by the increasing demand for metal products across a range of sectors. Advancements in technology have also led to the development of more innovative cutting tools, which have helped increase efficiency, reduce waste, and improve the overall quality of metal products. The growing demand for metal cutting equipment from various industries is boosting the market's growth.

Metal cutting tools are essential for precision machining across industries such as automotive, aerospace, construction, and general manufacturing. These tools—ranging from CNC machines and grinders to lathe and milling equipment—are crucial in shaping components with high accuracy and repeatability. The market is expanding rapidly due to technological upgrades, Industry 4.0 adoption, and demand for high-efficiency tools.

Market Size & Growth:

- 2025 Estimated Value: USD 86.24 billion

- 2026 Estimated Value: USD 91.03 billion

- 2034 Forecast Value: USD 173.89 billion

- CAGR (2026–2034): 8.40%

- Top Region: Asia Pacific – 49.90% market share in 2025

- Top Country: U.S. – projected to reach USD 35.42 billion by 2032

- Top Product: CNC Lathe Machines – driven by automotive and industrial demand

- Top Application: Automotive – due to precision component production

Key Trends and Drivers:

- Additive Manufacturing Integration: Key players are investing in hybrid solutions combining 3D printing with traditional metal cutting for complex parts

- Rise of Smart Tools via Industry 4.0: IoT-enabled tools with self-optimization, real-time monitoring, and predictive analytics improve production precision and reduce downtime

- Demand Surge from Automotive & Aerospace: Growth in EVs, modern gearboxes, and lightweight aerospace components fuels adoption of CNC lathes and grinders

- Automated Quality Control: Implementation of Automated Virtual Metrology (AVM) systems enhances defect detection and boosts production efficiency

- EV Manufacturing Policies: Regional government incentives for EV production are driving investments in metal cutting equipment for precision parts

Market Challenges:

- High Capital Investment: Upfront costs of precision machines and smart CNC systems limit adoption among SMEs

- Volatility in Raw Material Prices: Rising costs of steel and alloy components affect tool pricing and manufacturer margins

- COVID-19 Disruption Lag: Short-term production halts and labor shortages affected supply chains, especially in western markets

Market Opportunities:

- CNC Tool Expansion in Asia: Rapid industrialization and manufacturing capacity expansion in China and India to support tool demand

- Shift to Electric Vehicles (EVs): Need for lighter, more complex components is spurring tool innovation and demand

- Government-led Industrial Zones: Emerging economies are promoting manufacturing clusters and precision engineering hubs, opening new revenue streams

- Cross-border Trade Boost: Upgrades in logistics and port infrastructure in Asia and Europe support tool exports and parts demand

Furthermore, the increasing popularity of CNC machines is also a factor driving the metal cutting tools market growth. This is attributed to the advantages offered by CNC metal cutting equipment, including high efficiency, transparency, affordability, and time efficiency. The research report describes market estimations and growth opportunities across diverse geographies.

The influence of the coronavirus outbreak on the market has been relatively less in the eastern countries, such as Japan, China, and South Korea, whereas the western part of the world has suffered drastically. In the short term, the major impact primarily lies due to the disruption of manufacturing activities globally. The enormity of these disruptions increases as the number of cases surges at a global level. Moreover, the impact on the manufacturing industry of metal cutting equipment will be far more extensive if the virus impacts other main industrial countries beyond India, China, and Germany. In the long term, the industries related to the application of metal cutting tools are likely to be back on track, resulting in substantial demand for machines in future.

Metal Cutting Tools Market Trends

Substantial Growth in Popularity of Additive Manufacturing to Boost Market Growth

The metal cutting industry was significantly affected by the halt of manufacturing during the COVID-19 pandemic. With many countries implementing lockdowns and social distancing measures, manufacturing activity was disrupted, leading to a decrease in demand for metal cutting products.

The demand for efficient metal cutting tools is increasing, which results in growing demand for automotive components such as contemporary disc brakes, gearboxes, and clutch plates. This factor is considered a key factor that boosted the demand for industrial machinery during the forecast period.

Download Free sample to learn more about this report.

Metal Cutting Tools Market Growth Factors

Increasing Adoption of Industry 4.0 is Driving Market

The adoption of Industry 4.0 has had a significant impact on the metal cutting industry. In the metal cutting industry, the adoption of Industry 4.0 has led to the development of smart cutting tools that can communicate with machines, collect data, and make adjustments to optimize performance. These tools can monitor the cutting process in real-time and adjust their speed, feed, and other parameters to optimize the cutting process. This results in improved accuracy, reduced waste, and increased productivity. Utilization of advanced digital technologies such as cloud computing, big data analytics, industrial internet of things (IIoT), and cyber-physical systems by metal cutting tool makers helps enhance the industry 4.0 operations. This factor allows toolmakers to invest to bring digital transformation to their products.

Additionally, Industry 4.0 has enabled manufacturers to use data analytics to identify trends, patterns, and anomalies in their production processes. This helps manufacturers to optimize their processes and identify areas where they can make improvements. The use of predictive analytics can also help manufacturers to anticipate maintenance needs, reducing downtime and increasing productivity.

Furthermore, Quality assurance plays a significant role in the manufacturing field and is directly related to the equipment used. The adoption of Industry 4.0 solutions has introduced a real-time quality assurance process through an Automated Virtual Metrology (AVM) system. The real-time quality assurance is expected to increase the penetration of metal cutting tools.

RESTRAINING FACTORS

High Initial Investment & Fluctuating Raw Material Prices to Hinder Market Growth

The high initial cost and fluctuating raw material prices can have a significant impact on the metal cutting equipment market. Metal cutting tools require advanced manufacturing processes and materials, which can result in high initial costs. As a result, customers hesitate to invest in new tools, which can slow down the market's growth. This can affect small & medium-sized businesses that may not have the financial resources to make significant capital investments. Raw material prices can fluctuate rapidly, which can have a significant impact on the metal cutting industry. When raw material prices increase, the cost of manufacturing metal cutting tools also increases, which can result in higher prices for customers. This can lead to a decrease in demand for metal cutting tools and a slowdown in the market. Fluctuating raw material prices can make it difficult for manufacturers to plan their production schedules and manage their inventory effectively. This can lead to delays in delivery times and increased costs for manufacturers, which can further impact the market's growth.

Metal Cutting Tools Market Segmentation Analysis

By Product Analysis

High Demand for CNC Lathe Machines to Aid Market Growth

Based on product, the market is segmented into machining centers, lathe machines, boring machines, grinding machines, milling machines, and others.

The lathe machines segment is expected to be the fastest-growing segment in the market due to increasing demand from the automotive sector. The benefits offered by CNC lathes including high efficiency, production of complex devices, efficient mass production, and low maintenance are expanding the global market share.

Furthermore, the machining centers segment holds a major metal cutting tools market share of 40.58% in 2026 and is expected to hold a dominant position during the forecast period. This is attributable to the increasing need for mass production from various industries such as the automotive sector. Advancements in precision cutting technologies have resulted in increased demand for milling and boring machines. Grinding machines are gaining popularity in the machine tools industry owing to increasing applications of surface grinders, tools, cylindrical machine grinders, and cutter grinders.

By Application Analysis

Automotive Segment to Remain Dominant Owing to Increasing Demand for Automotive Vehicles

Based on application, the market is divided into automotive, general machinery, precision engineering, transport machinery, and others.

The automotive sector has been at the forefront of the applications segment in terms of market revenue generation in the recent past, driven by the development and manufacturing of advanced automotive components for modern and high-end vehicles, accounting for a 35.60% market share in 2026. Automotive components, such as gearboxes, modern disk brakes, and clutch plates, are increasing the demand for effective metal cutting tools. Furthermore, rising demand for industrial machinery is a result of robust demand from various industries, such as aerospace, construction, and food & beverage.

The precision engineering segment is anticipated to outpace its counterparts due to consistent demand for precision in components. Highly accurate parts are also being manufactured for application in aerospace & defense machines and military equipment. The transport machinery segment is also estimated to gain noteworthy traction due to growth in cross-border trade amongst numerous economies across the globe.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Based on region, the market of metal cutting tools covers North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific holds a major market share and is anticipated to remain dominant during the forecast period, with the market valued at USD 43.04 billion in 2025. This is due to the increasing demand from industries such as construction, automotive, food & beverage and aerospace, etc. For instance, in January 2023, Accusharp Cutting Tools, an India-based high-quality metal cutting tools provider, unveiled new, efficient cutting tools for the aerospace industry vertical during the 20th edition of IMTEX. The Japan market is projected to reach USD 5.88 billion by 2026, and the India market is projected to reach USD 5.41 billion by 2026.

Rising government initiatives to promote electric vehicles are also expected to push the market progress. For instance, China has imposed a restriction on investment in new manufacturing plants for traditional vehicles, with the local governments imposing a quota for EV production for all manufacturers.

Asia Pacific Metal Cutting Tools Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Spurring Manufacturing Clusters Projected to Boost Market Development in China

Considerable efforts to expand the network of manufacturing clusters are expected to emerge as a driving factor for the fast-paced development of the market across China. Favorable policies to encourage the establishment of production facilities for automotive manufacturing and precision engineering products are boosting the market’s development. China is also keen on developing its transportation hubs to facilitate easy and hassle-free cross-border trade from its manufacturing hubs to gain an extensive export reach in the global market. The China market is projected to reach USD 22.58 billion by 2026

To know how our report can help streamline your business, Speak to Analyst

Europe

In Europe, Germany showed the highest revenue in 2022 and it will continue this trend during the forecast period. This growth is attributed to the increasing penetration of manufacturing and industrial sectors in Germany. Furthermore, the U.K., France, and Italy are following Germany’s growth trend and are predicted to generate higher revenue during the forecast period. However, the growth of Nordic countries, the Netherlands, and central European nations, which come under the Rest of Europe, is moderate owing to the lesser market opportunities in this region. The UK market is projected to reach USD 3.4 billion by 2026, while the Germany market is projected to reach USD 5.33 billion by 2026.

North America

In North America, the U.S. held a prominent position in 2022 and may record the highest CAGR during the forecast period. This is due to the increasing number of fabrication and construction projects in the country, which is boosting the market growth. However, the Canada market is also growing due to increasing investment of key market players in the country’s metal cutting tools industry. The U.S. market is projected to reach USD 19.79 billion by 2026.

Middle East & Africa and Latin America

In the Middle East & Africa and Latin America regions, countries, such as Saudi Arabia, the UAE, and Kuwait, are rapidly growing. This is owing to the increasing establishment of oil and gas refinery projects in these countries. However, due to slower industrial development in Africa and Latin America regions, South Africa, Brazil, and Mexico are also growing at a slow rate in the market.

KEY INDUSTRY PLAYERS

Leading Players are Focusing on New Product Developments to Maintain their Market Position

The key market players, such as Doosan and Okuma Corporation, are trying to bring innovative products to the market. The increasing number of manufacturers in the industry is intensifying the competition in the global market. Thus, key players are focusing on high functional efficiency and improved capacity. Furthermore, the companies are opting for organic growth strategies, such as mergers and acquisitions that are expected to drive the market growth. For instance, Sandvik Machining Solutions acquired QUIMMCO CENTRO TECNOLÓGICO (QCT) to enhance its market share in Mexico.

List of Top Metal Cutting Tools Companies:

- Yamazaki Mazak Corporation (Japan)

- Doosan Machine Tools Co., Ltd. (U.S.)

- Trumpf (Germany)

- Amada Machine Tools Co., Ltd (Japan)

- JTEKT Corporation (Japan)

- Okuma Corporation (Japan)

- Hyundai WIA (South Korea)

- FANUC America Corporation (Japan)

- Komatsu Ltd. (Japan)

- Makino (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2022: Sandvik AB acquired Preziss, a developer of solutions for composite and aluminum machining.

- August 2022, Sandvik acquired Switzerland-based Sphinx Tools Ltd, a provider of precision solid round tools and its subsidiary P. Rieger Werkzeugfabrik AG. Through this acquisition Sandvik aimed to strengthen its position in the round cutting tools space.

- June 2022: Milwaukee Tools launched its innovative wrecker integrated with NITRUS CARBIDE SAWZALL Blad, designed to operate more effectively on a wide range of metals that is ideal to operate in remodeling and demolition jobs at construction sites.

- March 2022: Sandvik Coromant announced launch of CoroDrill 860-PM, which provides a premium performance in drilling operations and also provides superior durability to tools, improving operational life of the tools.

- April 2022: Mitsubishi Materials Corporation Metalworking Solutions Company increased its product portfolio and introduced two double sided inserts, which are precision grade M class type and wiper type.

REPORT COVERAGE:

Request for Customization to gain extensive market insights.

The research report provides an in-depth analysis of the market dynamics and competitive landscape. It also offers various key insights including recent developments in the market, such as mergers & acquisitions, SWOT analysis, macro & microeconomic factors, and company profiles.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026– 2034 |

|

Historical Period |

2021– 2024 |

|

Growth Rate |

CAGR of 8.40% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product, Application, and Region |

|

By Product |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

As per the Fortune Business Insights study, the global market value stood at USD 86.24 billion in 2025.

By 2034, the global market value is expected to reach USD 173.89 billion.

The market is projected to record a CAGR of 8.40%, exhibiting moderate growth during the forecast period of 2026-2034.

Asia Pacific dominated the global market with a share of 49.90% in 2025.

Within the product segment, the lathe machines segment is expected to lead the market during the forecast period.

Increasing adoption of industry 4.0 is driving the market.

Yamazaki Mazak Corporation, Doosan Machine Tools Co., Ltd., Okuma Corporation, and FANUC America Corporation are the major players in the market.

The automotive segment is expected to drive the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us