Nuclear Medicine Market Size, Share & Industry Analysis, By Type (Diagnostics {PET Radiopharmaceuticals [FDG-PET/18F, 68Ga, 68Cu, 11C, and Others] and SPECT Radiopharmaceuticals [Technetium-99m, Iodine-123, Xenon-133, Thallium-201, and Others]} and Therapeutics {Ra-223, Sm-153, Lu-177, I-131, Y-90, and Others}), By Application (Neurology, Cardiology, Oncology, and Others), By End User (Hospitals & Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

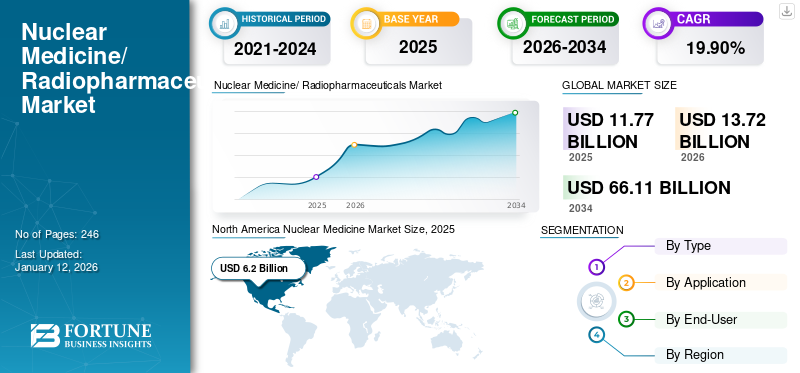

The global nuclear medicine market size was valued at USD 11.77 billion in 2025. The market is projected to grow from USD 13.72 billion in 2026 to USD 66.11 billion by 2034, exhibiting a CAGR of 19.90% during the forecast period. North America dominated the nuclear medicine market with a market share of 52.70% in 2025. Moreover, the U.S. nuclear medicine market size is projected to grow significantly, reaching an estimated value of USD 21.85 billion by 2032, driven by strong innovation and adoption of various therapeutic and diagnostic radiopharmaceuticals.

Nuclear medicine refers to a pharmaceutical drugs group that contain, in terms of ingredients, the radioactive formulations of chemical elements called nuclear medicine radioisotopes. These drugs are utilized for various therapeutic and diagnostic procedures based on the type of radiation these radioisotopes produce. There are various critical applications of these products, which range from the imaging of several organs such as the brain, heart, bone, and the kidney to the treatment of several forms of cancers. This is expected to boost the growth of the market for nuclear medicine radioisotopes.

As the prevalence of cancers and cardiovascular and neurological diseases increases across the globe, there is a greater need for effective therapeutic and diagnostic products, which lead to improved and more efficient patient treatment outcomes. This is anticipated to lead to the greater adoption of these products during the forecast period. Furthermore, the positive efforts from the several stakeholders engaged in the market, such as the various governments and the agencies, including the International Atomic Energy Agency (IAEA), to improve the supply chains of radiopharmaceuticals is also anticipated to contribute to the stellar market growth. In addition, several market players are focusing on different strategies, including strategic collaborations and new product launches, which are further expected to augment the market growth in the coming years.

- For instance, in March 2023, Life Healthcare announced the acquisition of TheraMed Nuclear’s non-clinical imaging operations in Gauteng with an objective for the expansion of its geographical presence in the South Africa market.

- Citing another instance, in June 2021, Bayer AG acquired PSMA Therapeutics Inc. and Noria Therapeutics Inc. Both these radiotherapy firms are creating targeted imaging and therapeutic radiopharmaceuticals. This move is poised to lead to the expansion of Bayer’s existing portfolio of these products for oncology.

- In August 2021, NorthStar Medical Radioisotopes, LLC and GE Healthcare unveiled an exclusive deal for the manufacturing and distribution of iodine-123 (I-123) capsules in the U.S. The product will help expand product portfolio and boost the presence of GE Healthcare in the market. As of April 2023, the collaboration between the two players continues and NorthStar Medical Radioisotopes, LLC is utilizing GE Healthcare’s production capabilities to procure the iodine-123 (I-123) to expand its pipeline.

In 2020, the COVID-19 pandemic exerted a negative impact on the market. The implementation of restrictions such as the lockdown measures significantly reduced the number of diagnostic and therapeutic procedures, which led to a decline in the adoption of these products. Furthermore, the supply chain issues leading to the unavailability of these products also exacerbated the negative impact of the pandemic.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in June 2021, for nuclear medicine specifically, restrictions such as lockdowns led to supply chain disruptions, which impacted the availability of necessary tracers such as 99mTc/99Mo and 131I, which are requisite radiopharmaceuticals for the majority of conventional nuclear medicine studies.

In 2021 and 2022, the market growth reached back to the pre-pandemic levels due to ease of lockdown restrictions. The market is projected to witness steady and consistent growth henceforth during the forecast period.

Global Nuclear Medicine Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 11.77 billion

- 2026 Market Size: USD 13.72 billion

- 2034 Forecast Market Size: USD 66.11 billion

- CAGR: 19.90% from 2026–2034

Market Share:

- Region: North America dominated the market with a 52.70% share in 2025. This is due to strong innovation and adoption of various therapeutic and diagnostic radiopharmaceuticals, increasing prevalence of chronic diseases such as cancer, and strong reimbursement trends.

- By Type: The diagnostics segment held the largest market share in 2024. The segment's dominance is driven by the considerable use of radiopharmaceuticals in various imaging procedures, particularly PET/PET-CT scans, for critical applications in oncology and cardiology.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market growth is driven by a consistent improvement in healthcare infrastructure and greater adoption of cutting-edge diagnostic and therapeutic products for its large patient population.

- United States: The market is propelled by strong regulatory support, with the U.S. FDA frequently approving new products and manufacturing facilities, such as Novartis's state-of-the-art radioligand therapy (RLT) manufacturing plant. Strategic collaborations for the development of new therapies are also a major driver.

- China: Growth is driven by the increasing presence of prominent market players and a focus on bringing innovative diagnostic agents to the market to address the rising need for advanced cancer treatments, such as for prostate cancer.

- Europe: The market is advanced by a strong focus on research and development, with companies opening new laboratory facilities, such as Ariceum Therapeutics' new R&D lab in Berlin. Regulatory approvals for new diagnostic tools, like Curium's Pylclari in the U.K., also support market growth.

Nuclear Medicine Market Trends

Increasing Usage of Artificial Intelligence for the Diagnostic and Therapeutic Products Development is the Major Trend

The surge in the utilization of digital tools such as artificial intelligence (AI) for the innovation and development of these products is considered one of the most critical trends emerging in the global radiopharmaceutical market. In terms of the digital tools present in the global market, artificial intelligence has undergone remarkable advancements since its inception and has an extensive range of problem-solving capabilities that can be applied in radiopharmaceutical development.

The collaboration between these products and AI has led to the creation of a potent partnership that combines molecular targeting with the analytical strength of machine learning algorithms. This collaboration improves the accuracy of radiopharmaceutical imaging, with AI algorithms efficiently navigating through extensive datasets to uncover subtle patterns and anomalies that could be overlooked by humans.

- For instance, as per the data provided by BioMed Central Ltd in January 2024, the integration of AI-driven image analysis and radiopharmaceuticals represents a new era marked by enhanced lesion detection, accurate disease staging, and early assessment of treatment efficacy.

Download Free sample to learn more about this report.

Nuclear Medicine Market Growth Factors

Robust and Strong Therapeutic Radiopharmaceutical Pipelines Anticipated to Drive Market Growth

The global market is projected to witness stellar growth prospects during the forecast period, specifically due to the launches and greater adoption of these therapeutic products. These therapeutic products, as of now, are particularly used for the treatment of several forms of critical cancers in various patient groups. These therapeutic products are increasingly being preferred by healthcare professionals as they provide a more effective form of cancer treatment by acting exclusively against the malignant cells and leaving the healthy tissues and organs untouched during the treatment process.

As an increasing number of players get involved in the R&D initiatives for therapeutic products, a greater number of innovative products are expected to be launched during the forecast period.

- Similarly, as per the data provided by the National Institute for Health Research (NIHR) in November 2023, all the identified radiopharmaceuticals have been classified based on their stage of development (phase 1/2 and 2 and phase 2/3 and 3). The majority (401, 62%) of these products were in the phase 2 development stage, while phase 3 consisted of nearly a quarter of the clinical trials (146, ~23%).

Such factors are expected to contribute to the global market growth during the forecast period.

New Launches of Diagnostic Products to Boost the Market Growth

Despite the greater and increasing interest toward the therapeutic applications of these products, the new product introductions in the diagnostic segment, are a critical growth driver. The diagnostic products are being extensively used in several imaging application areas, such as the positron emission tomography (PET) and the single-photon emission computed tomography (SPECT) procedures.

Furthermore, several established and emerging market players are launching their products in the diagnostic segment. In addition, many prominent market leaders have signed agreements and collaborative partnerships for the commercial releases and development of diagnostic radiopharmaceuticals, which, in turn, is expected to drive the global nuclear medicine market value in the coming years.

- In January 2024, Lantheus Holdings, Inc. announced strategic agreements with Perspective Therapeutics, Inc. Under these agreements, Lantheus obtained an option to exclusively license Perspective’s Pb212-VMT-⍺-NET, a clinical-stage alpha therapy developed for the treatment of neuroendocrine tumors.

RESTRAINING FACTORS

Competition from Other Medical Imaging Modalities May Restrict Market Growth

There is a restricted uptake of nuclear imaging systems owing to the availability of alternative options from other medical imaging modalities, such as MRI and CT scanners globally. Despite the strong efficiency of these modalities, the competition from the other imaging modalities, such as the MRI and CT, which may possess high-end systems, is anticipated to restrict the market growth. Several MRI and CT scanners may comprise more features and greater application areas, which may lead to their greater adoption. Furthermore, in terms of patient concerns, procedures such as the PET scan expose the patient to some degree of radiation, while MRI does not.

- For instance, in 2022-2023, the installed base of CT and MRI was higher than the PET-CT, SPECT, SPECT-CT, and PET-MRI scanners in Canada.

In addition, PET scans have traditionally been costlier than MRI scans, though the cost difference between them has been shrinking with the ongoing improvement of scanners.

- However, in the U.S., PET radiopharmaceuticals observe growth restraints, as all the PET drugs are not covered with respect to reimbursement by Medicare and also, these products are not paid separately from the procedure in the Medicare hospital outpatient setting.

Thus, the issues in the reimbursement and procedure volumes of diagnostic radiopharmaceuticals are slated to hamper the global nuclear medicine market growth during the forecast period.

Nuclear Medicine Market Segmentation Analysis

By Type Analysis

Diagnostics Segment Led Due to Considerable Usage in Several Imaging Procedures

In terms of type, the nuclear medicine/radiopharmaceuticals market is segmented into therapeutics and diagnostics.

The diagnostics segment is further sub-segmented into the SPECT radiopharmaceuticals and PET radiopharmaceuticals. Furthermore, the SPECT radiopharmaceuticals segment is sub-segmented into Xenon-133, thallium-201, technetium-99m, iodine-123, and others. In addition, the PET radiopharmaceuticals segment is further classified into FDG-PET/18F, 68Ga, 68Cu, 11C, and others.

The diagnostics segment held the maximum proportion of the market share 50.14% in 2026. Some of the reasons for the segment’s dominance include the considerable utilization of these products in several imaging procedures, especially the PET/PET-CT imaging procedures. The PET/PET-CT imaging procedures are being widely used in critical applications areas such as oncology and cardiology.

- For instance, in March 2024, the regulatory agency of Medicines and Healthcare products Regulatory Agency (MHRA) in the U.K. announced the regulatory approval for piflufolastat (18F) (Pylclari) of the company Curium. Pylclari is indicated as a diagnostic tool for individuals with suspected or known prostate cancer.

The therapeutics segment can be further sub-segmented into Ra-223, Sm-153, Lu-177, I-131, Y-90, and others. The segment is projected to register the highest CAGR during the forecast period. Therapeutic products are proving to be an effective combat tool for the treatment of several forms of cancers, such as prostate and neuroendocrine cancers. Some of the reasons for the segment’s strong growth prospects include the enhanced specificity of these drugs in terms of treatment, leading to improved patient outcomes.

- For instance, in June 2023, Artbio launched α-particle-emitting isotope-212Pb for the treatment of cancer. Most radiopharmaceuticals that have been approved by the U.S. FDA are β-emitters. The only U.S. FDA-approved α-emitter, called Xofigo (radium Ra 223 dichloride), was invented by the founders of Artbio.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Strong Utilization of These Products for Oncology Applications to Lead to Segment Growth

In terms of application, the market is classified into cardiology, neurology, oncology, and others.

The oncology segment dominated the global nuclear medicine market share 61.58% in 2026 and is also projected to grow at the highest CAGR during the forecast period. Some of the key reasons for the oncology segment’s strong market position include the utilization of these products for both therapeutic and diagnostic applications. Furthermore, several key players in the market have focused their innovation efforts and new product launches in this application segment. These factors and trends, coupled with the burgeoning cases of cancers across the globe, are anticipated to drive the segmental growth.

- For instance, in March 2024, Ratio Therapeutics Inc. announced the extension of its manufacturing agreement with PharmaLogic for the development of FAP-targeted radiopharmaceuticals for the treatment of cancer.

The cardiology segment is anticipated to account for a significant share of the global nuclear medicine/radiopharmaceuticals market during the forecast period. The segment’s strong market share is attributable to the considerable prevalence of cardiovascular diseases across the globe and the robust adoption of these products for the diagnosis of critical cardiovascular diseases such as coronary heart disease.

- In March 2024, the Medicines and Healthcare Products Regulatory Agency approved the Rubidium (Rb82) Generator (RUBY-FILL) as a diagnostic tool for diagnosis or assessment of suspected coronary heart disease.

The neurology segment is expected to grow at a robust CAGR during the forecast period. These products are increasingly being used in the monitoring of disease progression and also for the assessment of the efficacy of the treatment plans for critical neurological disorders.

- For example, in May 2020, the U.S. FDA approved flortaucipir F18 for the diagnosis of Alzheimer’s disease. This radioactive diagnostic agent is developed by Avid Radiopharmaceuticals, and is indicated for use in the PET imaging of the brain.

The others segment consists of application areas such as the blood, gastrointestinal, breast, and renal. For instance, some of the gastrointestinal applications include the Meckel scan, which is undertaken for the identification of the ectopic gastric mucosa through the injection of the 99mTc pertechnetate. As more R&D initiatives across the globe are undertaken, the emergence of novel application areas is anticipated to drive the segmental growth.

By End User Analysis

Greater Utilization of These Products in the Hospitals & Clinics Settings to Drive Segmental Growth

On the basis of end user, the market for nuclear medicine is segmented into diagnostic centers, hospitals & clinics, and others.

The hospitals & clinics segment dominated the global market share 58.01% in 2026 on account of the strong utilization of these products for various therapeutic and diagnostic procedures in these settings. Furthermore, as the demand for therapeutic products continues to grow increasingly, the strong presence of skilled healthcare professionals in these institutions is further expected to support the segmental growth during the forecast period.

- For instance, according to the data published by the World Nuclear Association, in April 2024, more than 10,000 hospitals across the globe used medical radioisotopes. Furthermore, an estimated 90% of these procedures are for diagnostic purposes, with technetium-99 (Tc-99m) accounting for a considerable proportion.

The diagnostic centers segment accounted for the second dominant share in the global market in 2024. The segment’s considerable market share is due to the large number of PET & SPECT imaging equipment installed in these settings that utilize these products. In addition, a large number of nuclear imaging procedures are conducted in these institutions, which further supports the segment’s market share. Furthermore, another factor driving the segmental growth is the opening of new diagnostic centers for the diagnosis of chronic diseases such as cancer, Alzheimer's, and other cardiovascular diseases.

The others segment accounted for a limited share of the market in 2024 and consists of settings such as academic research institutions.

REGIONAL INSIGHTS

In terms of the region, the market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

North America Nuclear Medicine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 6.2 billion in 2025 and USD 7.31 billion in 2026. market in 2024. The region is anticipated to maintain its dominance of the global market throughout the forecast period on account of its strong innovation and adoption of various therapeutic and diagnostic radiopharmaceuticals. Furthermore, the consistently increasing prevalence of chronic diseases such as cancers and the strong reimbursement trends for these products are anticipated to further contribute to the region’s growth during the forecast period. The U.S. market is projected to reach USD 6.81 billion by 2026.

- For instance, in September 2022, Radiopharm Theranostics and the University of Texas MD Anderson Cancer Center formed a joint venture to develop novel radiopharmaceutical therapeutic products for the treatment of cancer.

Europe

Europe has been identified as the second most dominant region in the market and is anticipated to witness significant growth trends due to the presence of several prominent market players in the region. In addition, some of the reasons that can be attributed to the regional growth include the greater prevalence and strong awareness of chronic disorders such as cancers in the various countries of Europe and the adoption of these products. The UK market is projected to reach USD 0.42 billion by 2026, and the Germany market is projected to reach USD 0.57 billion by 2026.

- For instance, in March 2024, Ariceum Therapeutics announced the opening of its new laboratory facilities in Berlin to house the research and development of its next-generation radiopharmaceutical pipeline candidates and support the transfer of advancing products into the clinic.

Asia Pacific

The Asia Pacific market is anticipated to witness the highest CAGR during the forecast period. The region is witnessing a consistent improvement in the healthcare infrastructures, greater awareness in terms of the adoption of cutting-edge diagnostic and therapeutic products, and an ever-increasing patient population suffering from critical diseases such as cancers, which necessitates the need for superior therapeutics for improved patient outcomes. In addition, the increasing presence of several prominent market players has led to a surge in the accessibility of innovative products in the region. The Japan market is projected to reach USD 0.75 billion by 2026, the China market is projected to reach USD 0.94 billion by 2026, and the India market is projected to reach USD 0.28 billion by 2026.

- For instance, in October 2023, Blue Earth Diagnostics Ltd announced a collaboration with Sinotau Pharmaceutical Group to provide prostate cancer PET diagnostic imaging agent, Flotufolastat (18F) injection, in the Chinese market. The launch of this product could offer novel solutions for the diagnosis and treatment of prostate cancer in China, where there is a rising need for such latest advancements.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa regions account for a comparatively limited share of the market. However, the increasing prevalence of chronic diseases, the greater presence of market players leading to newer product launches, and the surging awareness among the population are expected to lead to the growth of these regions during the forecast period.

- For instance, in April 2023, GE HealthCare and Axim Life Isotopes South Africa (ALISA) announced their partnership to expand access to molecular imaging in South Africa with the delivery of two cyclotrons, which produces nuclear medicine radioisotopes enabling the production of tracing agents used in molecular imaging scans.

KEY INDUSTRY PLAYERS

Strong and Cutting Edge Product Portfolio and R&D Expenditures to Contribute to the Dominance of Companies Such as Novartis AG and Lantheus Holdings, Inc.

The competitive landscape of the global radiopharmaceuticals market reflects a semi-consolidated structure, with the presence of several key players across various geographies and of various sizes. Some of the most prominent players in the global market include Cardinal Health, Lantheus Holdings, Inc., Novartis AG, GE HealthCare, Bayer AG, Jubilant Pharmova Limited, and Curium. These players occupy a prominent position in the market owing to extensive product portfolios, wider geographical reach, a strong culture of innovation and R&D expenditures, and engagement in various strategic initiatives.

Novartis AG held a considerable share of the global market in 2024. Novartis’ dominance in the market is owing to several factors such as the company’s strong product portfolio on account of its acquisition of Advanced Accelerator Applications in 2018. This enabled the company to be present in both the therapeutics and diagnostics segments of the global market. Furthermore, in recent years, strong regulatory approvals, consistent product sales, and a diverse geographical presence have cemented the company’s position in the global market.

- In January 2024, Novartis AG received the U.S. FDA approval for commercial manufacturing of Pluvicto (lutetium Lu 177 vipivotide tetraxetan) at its new large-scale, state-of-the-art radioligand therapy (RLT) manufacturing facility in Indianapolis, U.S.

Some of the other prominent companies in the global market include Cardinal Health, Lantheus Holdings, Inc., Bayer AG, GE HealthCare, Curium, and Jubilant Pharmova Limited. These companies are engaged in new product launches, research and development activities, and strategic agreements to increase their revenue share in the global market.

LIST OF TOP NUCLEAR MEDICINE COMPANIES:

- GE HealthCare (U.S.)

- Lantheus Holdings, Inc. (U.S.)

- Nordion (Canada) Inc. (Sotera Health) (Canada)

- Bracco (Italy)

- Curium (France)

- Bayer AG (Germany)

- Siemens Healthineers AG (Germany)

- Novartis AG (Switzerland)

- Jubilant Pharmova Limited (India)

- Cardinal Health (U.S.)

- Norgine (Netherlands)

- DuchemBio, Co., Ltd. (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 - Curium acquired Eczacıbaşı-Monrol Nuclear Product Co. This acquisition is anticipated to expand its geographical footprints, PET & SPECT infrastructure and facilitate the development of cutting-edge radionuclides and radiopharmaceuticals pipelines for diagnostic and therapeutic purposes.

- February 2024 - Curium announced that the marketing authorization application for PYLCLARI, an innovative (18F)-PSMA PET tracer, has been accepted by the Swissmedic for evaluation.

- February 2024 - Lantheus Holdings, Inc. collaborated with a National Institute on Aging-sponsored study called the Consortium for Clarity in ADRD Research through Imaging (CLARiTI). This agreement allows the consortium to use MK-6240, Lantheus’ clinical-stage F18-labeled PET imaging agent, in its investigation of Alzheimer’s disease.

- January 2024 - Lantheus Holdings, Inc. announced strategic agreements with Perspective Therapeutics, Inc. Under these agreements, Lantheus obtains an option to exclusively license Perspective’s Pb212-VMT-⍺-NET, a clinical-stage alpha therapy developed for the treatment of neuroendocrine tumors.

- November 2023: Bayer AG signed a supply agreement with Ionetix Corporation for the therapeutic radioisotope actinium-225 (Ac-225). As a part of this agreement, Ionetix can provide high-purity, non-carrier-added Ac-225 to Bayer AG.

REPORT COVERAGE

The global nuclear medicine market report provides a comprehensive market overview and a detailed analysis of the market. Some of the key aspects of the market that the report focuses on include the analysis of the segments of type (diagnostics and therapeutics), application, and end user. The report also provides an exhaustive regional analysis. Besides this, it also offers insights into the market dynamics, such as market drivers, restraints, opportunities, and trends. Some of the key insights included in the report are the impact of COVID-19 on the market, key industry developments, the installed base of the gamma cameras, and the PET/PET CT scanners, the PET/PET CT procedural volume, pipeline analysis, and the regulatory overview of key regions. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.90% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 11.77 billion in 2025.

In 2025, the North America market stood at USD 6.2 billion.

The market is expected to exhibit a CAGR of 19.90% during the forecast period.

By type, the diagnostics segment dominated in 2025.

Increased demand for advanced diagnostics and therapeutics, rising prevalence of various forms of cancers and other disorders, new product launches, robust pipelines, and technological advancements.

Cardinal Health, Lantheus Holdings, Inc., Novartis AG, Bayer AG, GE HealthCare, Curium, and Jubilant Pharmova Limited are the top players in the market.

North America dominated the nuclear medicine market with a market share of 52.70% in 2025.

Strong product pipelines and innovative launches, increasing government support rise in initiatives to maintain a robust supply of these products, and the surge in prevalence of chronic diseases.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us