Oil and Gas Drill Bit Market Size, Share & Industry Analysis, By Type (Roller Cone Cutter Bits {Milled-Tooth Bits (MT), Tungsten Carbide Inserts (TCI)} and Fixed Cutter Bits {Diamond Impregnated and Polycrystalline Diamond Compact (PDC)}), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

Oil and Gas Drill Bit Market Size and Future Outlook

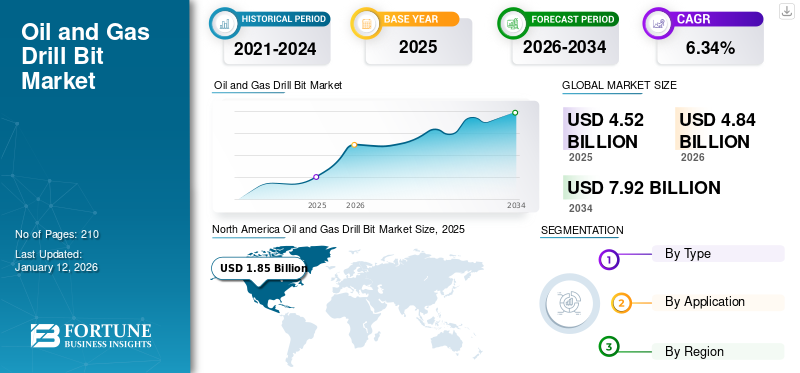

The global oil and gas drill bit market size was valued at USD 4.52 billion in 2025 and is projected to grow from USD 4.84 billion in 2026 to USD 7.92 billion by 2034, exhibiting a CAGR of 6.34% during the forecast period.The North America dominated the oil and gas drill bit market with a share of 40.86% in 2025. Additionally, the U.S. Oil and Gas Drill Bit Market is predicted to grow significantly, reaching an estimated value of USD 2.41 billion by 2032.

Drill bits are a crucial component that are used in every phase of oil extraction, from exploration to production, and their effectiveness significantly affects the efficiency, cost, and safety of drilling operations. It is the tool attached at the bottom of the drill string to excavate the rock formations. The rotation of the drill string and weight put on provides the power to the drill, which further carries out the crushing, scraping, or grinding of the bottom rock formation as the drilling goes on.

The market share is propelled by the extensive use of these drill bits in the oil & gas industry. These drill bits maximize the rate of penetrating rock formations by providing a long service life. These drill bits play a crucial role in creating wellbores, which allow the extraction of oil & gas from underground reservoirs. Also, drill bits optimize the drilling efficiency as they are designed for specific geological conditions and rock types. The drill bits support the exploration & development activities related to new oil & gas reserves.

Baker Hughes is one of the major players and holds a prominent share of the oil and gas drill bit market. The company has drill bits manufacturing and R&D facilities in Texas, U.S., and Dhahran, Saudi Arabia. Baker Hughes has developed a state-of-the-art Drilling Technology Laboratory with a focus on developing innovative, cost-saving technologies. The company offers Dynamus Extended-life Drill Bit for applications in Hard, interbedded formations, tough-to-drill carbonates, and others. Some of the other offerings include Dynamus AntiWalk Drill Bit Technology, Talon Strike PDC Drill Bit, TerrAdapt Adaptive Drill Bit, and many others.

MARKET DYNAMICS

MARKET DRIVERS

Growing Exploration and Production Activities to Propel Market Growth

The market is expanding majorly due to the growing Exploration and Production (E&P) operations in the oil and gas field. The increasing worldwide energy requirement, along with the exhaustion of traditional oil and gas reserves, is propelling the search for new and unconventional hydrocarbon resources. This has increased the drilling operations across multiple areas, such as offshore, deepwater, and unconventional formations. Consequently, the need for high-performance drill bits that can manage difficult drilling situations and provide dependable outcomes is increasing. This is anticipated to drive the demand for drill bits in the years ahead.

Growing Need to Enhance Operational Efficiency Drives Market Growth

The high costs associated with the exploration and production operations necessitate the need for tools that assist in reducing operational expenses. Thus, drill bits that enable faster penetration rates, minimize downtime, and enhance durability are highly demanded. Operational efficiency is essential for oil and gas operators, as industry volatility highly impacts project costs. Companies are adopting advanced tools and technologies to optimize drilling operations and enhance overall efficiency.

MARKET RESTRAINTS

Environmental and Legal Concerns to Hamper Market Expansion

Drilling firms encounter various complex legal and safety issues across the globe. Businesses must follow regulations closely to ensure environmental protection, guarantee worker safety, and uphold operational integrity. This also entails acquiring permits, guaranteeing compliance with environmental evaluations, and adhering to offshore drilling safety measures. Not adhering to them may lead to significant fines and delays in operations.

The oil and gas sector is increasingly criticized owing to the industry's environmental impacts. The extraction and combustion of fossil fuels significantly contribute to greenhouse gas emissions and climate change. This has resulted in tighter regulations and an increasing need for cleaner energy alternatives. These significantly impact the industry's drilling operations and thereby hamper demand for drill bits.

MARKET OPPORTUNITIES

Growing innovations in Drilling Technology Provides a Profitable Opportunities

The market is experiencing substantial expansion owing to innovations in drilling technology. The advent of novel and innovative drill bit designs, including Polycrystalline Diamond Compact (PDC) bits and high-performance insert bits, has improved drilling efficiency and shortened drilling duration. These high-performance drill bits provide enhanced penetration speeds, extended durability, and superior hole quality, resulting in greater productivity and cost efficiency for drilling operators.

Additionally, the incorporation of automation and digital technologies in drilling activities is supporting market expansion. The implementation of automated drilling technologies and data analysis allows for greater precision in managing drilling parameters, leading to improved drilling efficiency and minimized risks. With the increasing need for efficient and affordable drilling options, the market for advanced drill bits is projected to grow over the coming years.

MARKET CHALLENGES

Uncertain Nature of Oil & Gas Industry Prices Could Significantly Challenge Market Growth

Fluctuations in crude oil prices greatly influence the market. These fluctuations significantly influence Exploration and Production (E&P) activities, which directly affect the demand for drill bits. During a drop in prices for oil and gas, companies cut back on E&P budgets to minimize costs, delaying or canceling new exploration projects. This decline in activities reduces the need for drilling tools, thereby negatively impacting the market. Moreover, low oil prices may shift industry focus from high-cost, complex projects, including deepwater or ultra-deepwater drilling, to more economical onshore projects, thereby affecting the demand for specialized drill bits required in offshore projects.

OIL AND GAS DRILL BIT MARKET TRENDS

Growing Offshore Exploration to Encourage Market Expansion

The expansion of offshore exploration activities is a significant factor driving the market. With declining production rates in mature onshore fields, the industry is shifting its focus toward offshore reserves, such as deepwater and ultra-deepwater regions, to meet the energy demand. Companies are actively seeking and developing offshore projects and steering their investments in offshore exploration. Such projects largely demand drill bits, which offer durability, efficiency, and reliability in complex and harsh environments.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the market. Widespread lockdown, travel restrictions, and reduced industrial activity led to a sharp decline in global energy demand. Further, a reduction in oil and gas prices pushed companies to limit exploration and production activities, thereby affecting demand for drilling equipment, including drill bits, as projects were halted or canceled.

SEGMENTATION ANALYSIS

By Type

Fixed Cutter Bits Dominate as They are Used for Drilling Hard and Abrasive Rock Formations

Based on type, the market is classified into Roller Cone Cutter Bits and Fixed Cutter Bits. The Roller Cone Cutter bits segment is further bifurcated into Milled-Tooth Bits (MT) and Tungsten Carbide Inserts (TCI). Similarly, Fixed Cutter Bits is further divided into Diamond Impregnated and Polycrystalline Diamond Compact (PDC).

The fixed cutter bits, especially Polycrystalline Diamond Compact (PDC) bits cut through rock by shearing it rather than crushing it, as roller-cone bits do. This shearing process is more effective, particularly in harder formations, and results in a greater rate of penetration. Thus, owing to the versatility of fixed cutter bits in various rock formations, they are widely used in various oil & gas drilling operations. The segment is likely to attain 76.07% of the market share in 2026.

Diamond-impregnated drill bits are expected to grow fastest over the forecast period. As traditional oil reserves diminish, there is an increasing necessity to investigate unconventional reserves, including shale gas and tight oil, which demand advanced drilling techniques. Drill bits that are infused with diamonds excel in these tough conditions because of their resilience and capacity to penetrate hard rock layers. Moreover, businesses have dedicated resources to research and development to enhance the efficiency and lifespan of these drill bits through optimized designs for improved performance and lowered operational expenses.

The roller cone cutter bits segment is likely to grow with a considerable CAGR of 6.11% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment to Dominate Market Owing To Increasing Demand for Oil and Gas Resources

Based on application, the global market is segmented into onshore and offshore.

The onshore segment held a significant market share of 76.07% in 2026, owing to the growing exploration efforts for oil and gas reserves driven by heightened demand for these resources. The market experienced an increased demand for effective drilling technologies to tap into onshore oil and gas resources. Onshore drilling continues to play an important role in the energy industry as it is cost-efficient and easier to access than offshore drilling. Additionally, businesses have introduced high-tech and upgraded drill bits, including PDC bits and diamond-impregnated variants, to enhance the efficiency of drilling activities.

The offshore segment is also anticipated to grow exponentially during the forecast period. The increase in market growth is due to the growing exploration of deepwater and ultra-deepwater reserves. These reserves typically necessitate specialized drilling methods and tools designed to manage difficult drilling scenarios, including elevated pressures and temperatures. Thus, the demand for advanced drill bits capable of effectively penetrating tough rock formations and enduring harsh conditions is anticipated to grow, therefore driving segmental growth.

OIL AND GAS DRILL BIT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Oil and Gas Drill Bit Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increase in Exploration Activities to Propel Regional Growth

North America dominated the market with a revenue share of USD 1.85 billion in 2025 and USD 1.98 billion in 2026. The region currently holds the largest oil and gas drill bit market share owing to the increase in the exploration activities being carried out around the region at both offshore and onshore locations. The shale gas exploration activities have been the major factor driving the growth of the oil and gas drill bit market in the region. Further, the region’s well-established energy infrastructure and focus on optimizing drilling operations encourage innovation and adoption of advanced technologies.

U.S.

Increasing Investment in Oil & Gas Industry to Support Market Growth in the U.S.

The market expansion in the U.S. is fueled by increasing exploration and drilling operations to meet the growing need for oil and gas resources. Additionally, heightened investments from businesses to discover new sites for the extraction of oil and gas resources have resulted in a greater demand for drill bits and other drilling tools within the nation. The U.S. market is predicted to gain USD 1.62 billion in 2026.

Europe

Increasing Energy Demand in the Region to Support Market Growth

Europe is the second leading region set to be worth USD 1.18 billion in 2026, exhibiting a CAGR of The market for oil and gas drill bits in Europe is anticipated to expand considerably during the forecast period, driven by rising energy demand. The U.K. market is expected to grow with a value of USD 0.09 billion in 2026. As Europe strives for energy security and aims to lessen dependence on outside sources, there is an increased demand for effective drilling technologies to tap into local oil and gas reserves. European countries are prioritizing domestic production to reduce dependence, thereby driving exploration activities in both conventional and unconventional resources. Norway is set to be valued at USD 0.24 billion in 2025, while Russia is projected to stand at USD 0.56 billion in the same year.

Asia Pacific

Expanding Oil & Gas Industry in the Region to Support Market Growth

Asia Pacific is the fourth largest market set to reach USD 0.54 billion in 2026. The expanding oil and gas industry in the Asia Pacific region is anticipated to support the growth of the region's oil and gas drill bit market. China is poised to be valued at USD 0.34 billion in 2026. The rapid urbanization and industrialization is developing demand for energy. China, India, and Southeast Asia are experiencing an increase in energy consumption, necessitating increased exploration and production activities. Offshore oil and gas exploration efforts have also increased in the region, where challenging environments require advanced drill bit technologies to obtain resources. Such activities demand specialized drill bits capable of withstanding extreme environments. The Southeast Asia market is anticipated to hold USD 0.08 billion in 2025, while India is expected to capture a value of USD 0.06 billion in the same year.

China

Growing Exploration and Production (E&P) Activities to Drive Market Growth

The market for oil and gas drill bits in China is anticipated to witness considerable expansion during the forecast period. The nation's growing need for oil products, fueled by its sizable population and economic growth, is a significant factor attributing to this growth. Moreover, China's initiatives to develop and tap into its local oil and gas reserves are boosting the increasing need for drill bits.

Latin America

Latin America will also witness moderate oil and gas drill bit market growth. The major factors driving the growth in the region are the increased exploration activities being carried out at offshore locations owing to the increased energy demand in the region. Brazil and Mexico are some of the key countries in the region that support the oil and gas drill bit market. Mexico’s oil and gas sector has encouraged foreign investments, leading to increased exploration activities in its offshore areas.

Middle East & Africa

The Middle East & Africa is the third largest market anticipated to acquire USD 0.8 billion in 2026. This region is one of the most prominent oil and gas producers and supplier regions globally. The dependency of the countries on the oil & gas industry for their economy is the major reason driving the growth of exploration activities, which in turn is positively affecting the growth of the market in the region. Further, continued oil and gas exploration activities in the region to maintain the region’s position in the global oil and gas industry are anticipated to boost the demand for drilling activities and support the growth of the drill bit market. The GCC market is estimated to gain USD 0.52 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Offerings from Market Players and their Widening Product Portfolio Aids in Gaining Competitive Advantage

Globally, Schlumberger Limited (SLB), Baker Hughes, National Oilwell Varco, and others, are some of the key market players. SLB is one of the global players offering drill bits and other drilling equipment. SLB’s bit offerings include PDC Bits, Roller Cone Bits, Speciality Bits, PDC Cutters, and MegaDiamond PDC Cutters. SLB’s global reach and wide product offerings enable the company to have a competitive edge in the market.

List of Key Oil and Gas Drill Bit Companies Profiled:

- SLB (U.S.)

- Baker Hughes (U.S.)

- National Oilwell Varco (U.S.)

- Halliburton (U.S.)

- Varel Energy Solutions (U.S.)

- Sandvik AB (Sweden)

- Ulterra (U.S.)

- Palmer Bit Company (U.S.)

- Epiroc (Sweden)

- Western Drilling Tools (Canada)

- Kingdream Public Limited Company (China)

- Torquato Drilling Accessories Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024 – OMNI Oil Technologies (M) Sdn. Bhd., a Malaysia-based designer and manufacturer of drilling, completion, and wellhead parts, launched locally produced Malaysia’s first VDP PDC Steel Body Drill Bits.

- May 2024 – Eprioc acquired Weco Proprietary Limited, a manufacturer of precision-engineered rock drilling parts and provider of related repairs and services based in South Africa. The acquisition is aimed at strengthening Eprioc’s manufacturing capabilities and expanding its product portfolio of spare parts in the African region,

- March 2024 – Drilling Tools International Corp. (DTI) and Superior Drilling Products, Inc. entered into a definitive agreement under which DTI agreed to acquire SDP for a total consideration of approximately USD 32.2 million, payable in cash and DTI stock. SDP is a manufacturer and refurbisher of PDC (polycrystalline diamond compact) drill bits for leading oil field service companies.

- December 2023 – Epiroc, a provider of drill rigs, rock excavation, and construction equipment and tools, introduced a new range of Epiroc Grey line drill bits specifically designed for quarrying and surface construction drilling environments in Europe.

- March 2023 – Sandvik AB introduced the first-of-its-kind opt-out recycling program for customers of carbide drill bits. The company aims to contribute to sustainability goals and help preserve scarce and finite materials used in the manufacturing of drill bits.

REPORT COVERAGE

The global oil and gas drill bit market research report delivers a detailed insight into the market. It focuses on key aspects such as leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.34% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Application, and Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.52 billion in 2025.

The market is likely to grow at a CAGR of 6.34% over the forecast period (2026-2034).

The onshore segment is estimated to dominate the market in the forecast period.

The market size of North America stood at USD 1.85 billion in 2025.

Growing exploration and production activities likely to drive the oil and gas drill bit.

Some of the top players in the market include SLB, Halliburton, NOV, and others.

The global market size is projected to reach USD 7.92 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us