Surgical Lights Market Size, Share & Industry Analysis, By Technology (LED, and Halogen), By End User (Hospitals & ASC’s, Specialty Clinics, and Others (Procedure Rooms, etc.)) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

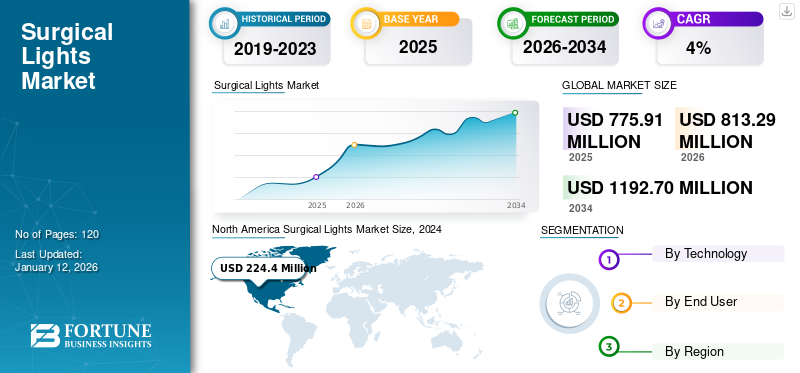

The global surgical lights market size was valued at USD 740.8 million in 2024. The market is projected to grow from USD 775.9 million in 2025 to USD 1,100.0 million by 2032, exhibiting a CAGR of 4.6% during the forecast period. North America dominated the global market with a share of 32.99% in 2024.

Surgical lights are center-stage medical devices used in procedure rooms and surgical suites. These devices are pivotal in offering efficient illumination at an operating site, for providing optimum visualization to the surgeon. They offer various features including negligible amount of heating over longer durations, shadow-less illumination, and pure white light, which allows the staff to efficiently perform the surgical procedures. There are various types of operating lights, used for different procedures in a healthcare facility. Also, manufacturers offer products with varied brightness ranges (maximum 160,000 Lux) and different dimensions of surgical lights, including a single head, and dual head.

Surgical Lights Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 740.8 million

- 2025 Market Size: USD 775.9 million

- 2032 Forecast Market Size: USD 1,100.0 million

- CAGR: 4.6% from 2025–2032

Market Share:

- North America dominated the surgical lights market with a share of 32.99% in 2024, driven by the consolidation of healthcare infrastructure and rapid adoption of advanced LED lighting technology.

- LED technology segment is expected to grow fastest due to benefits such as longer lifecycle, better illumination quality, and cost efficiency compared to halogen lights.

Key Country Highlights:

- United States: Increasing number of surgical procedures and ambulatory surgery centers (ASCs) are driving demand for surgical lights. Strong healthcare infrastructure and adoption of technologically advanced LED lights are key growth factors.

- China: Rapid hospital infrastructure development and entry of private healthcare players fuel the demand for surgical lights, especially LED-based systems.

- India: Expansion of private and public healthcare facilities, with increasing operating room counts, is accelerating surgical lights demand.

- Germany & France: Declining number of hospitals leads to relatively sluggish growth in surgical lights demand compared to other regions.

LATEST TRENDS

Download Free sample to learn more about this report.

Technological Advancements in Surgical Lights to Drive the Market Growth

Technological advancements in these devices have been a mainstay factor for growth in this market globally. The shift of technology from halogen lights to LED (Light Emitting Diode) technology has played a crucial role in fueling the demand for these devices in the operating lights market. Several market players are constantly focusing on R&D to offer advanced operating lights in the market. For instance, in 2024, BihlerMed, a leading provider of medical illumination technology and devices, introduced the innovative SurgiLight surgical lighting system by partnering with View Medical. The product offers an ergonomic flexible shaft that remains fixed-in-place once adjusted, permitting for more agile and precise positioning of the light source.

The gradual shift of technology from halogen to LED is gaining pace especially in emerging countries such as China, India, and Brazil, where healthcare facilities are now focusing on replacement of halogen lights with LED lights. The overall cost benefits, combined with improved efficiency during the surgical procedure offered by LED lights, are propelling the growth of the global operating lights market during the forecast period.

DRIVING FACTORS

Growing Demand for Advanced Healthcare Facilities to Foster Market Growth

Healthcare systems in emerging countries are witnessing an influx of private players, entering directly or through public-private-partnerships (PPPs), leveraging the lucrative demand for advanced healthcare facilities in these countries. Presently, prolonged patient waiting time, unmet medical needs, and rising healthcare-associated indirect expenses are likely to increase the demand for new healthcare facilities globally. Moreover, high investments by various governments are offering significant growth opportunities for healthcare facilities, especially in emerging countries. For instance, in January 2020, Aster DM Healthcare, a private hospital group in Qatar is expanding its services by opening new hospitals and other healthcare centers in India and the GCC region. The group plans to set up new hospitals with 350 and 600 beds in Bengaluru, 500 beds in Chennai, and few other hospitals in other cities of India.

Similar examples of public-private partnerships are witnessed in countries such as Brazil, China, among others, where the public healthcare system is overburdened with the flow of patients. This, along with the lack of advanced facilities, has opened doors for the entry of private players. Further to this, it has led to the expansion of existing facilities, leading to an increasing number of operating rooms per hospital that is expected to fuel the demand for these equipment in operating rooms.

Upsurge in Surgical Procedures to Stoke Demand

The life cycle of a surgical light is measured in hours. Advanced LED lights offers a life cycle of an estimated 40,000 hours to 60,000 hours. Increasing number of cardiovascular, neurological, and dental surgical procedures are prominently responsible for the usage of lights for longer duration, which is leading to a comparatively faster replacement of these lights in operating rooms. For instance, according to European Union Statistics, an estimated 5 million cataract surgeries were performed in Europe in 2017. The number is expected to increase twofold by 2020. This is projected to fuel the demand for new products and eventually boost the growth of the operating lights market during the projected timeframe. Also, the exponential increase in the prevalence of chronic conditions, coupled with rising per capita expenditure, is anticipated to boost the number of surgical procedures, resulting into the growth of the market by 2032.

RESTRAINING FACTORS

Risk of Burns Due to the Use of High Lux Light Sources is Likely to Hamper the Market Growth

In spite of the tremendous technological advancements in surgical lights, it has certain disadvantages, which are likely to hamper the market growth. Heat is formed from the light source in the form of infra-red that is harmful to any person in the contact of radiation. This is anticipated to offer an uncomfortable working environment not only for the patient but the whole surgical team, as well as the surgeon. Moreover, it is likely to obstruct the operation by affecting the wound tissue to dry out, particularly during longer procedures. This may also lead to burns to the patient, as well as staff when exposed directly. Some light sources, such as halogen lighting, are ineffective owing to the amount of energy consumed which leads to heat. Thus, all the aforementioned factors are anticipated to hinder the market growth.

SEGMENTATION

By Technology Analysis

To know how our report can help streamline your business, Speak to Analyst

LED Segment to Grow at a Faster Pace

Based on technology, the market is segmented into LED and halogen. LED dominated the technology segment in 2024 accounting for the highest surgical lights market share. The increasing preference for LED technology in healthcare settings is driving the global market. Furthermore, certain benefits offered by LED lights such as long term cost reduction, quality, and quantity of illumination for deep cavities and adequate intensity of illumination are anticipated to boost the adoption of LED lights during the projected period. This is further augmented by the introduction of advanced LED lights by market players, with operational benefits over halogen lights, which has proven to be instrumental in growing preference of surgeons and other key decision-makers towards LED technology.

By End User Analysis

Hospital and Ambulatory Surgical Centers (ASCs) Accounted for Highest Market Share in 2019

In terms of the end user, the market is segmented into hospital & ambulatory surgical centers (ASC), specialty clinics, and others (Procedure Rooms, etc.).

Exponential growth in the number of advanced healthcare facilities, especially in countries such as Saudi Arabia, UAE, China, and India, and the increasing demand for hospital operating rooms are leading to the surging demand for these products in the global market. For instance, IHH Healthcare, in an alliance with the Shanghai Hongxin Medical Investment Holding Co. Ltd., and Taikang Insurance Group, constructed a 450-bed hospital in 2017, in Shanghai, China. Furthermore, in 2017, Columbia China undertook the construction of a new 500-bed hospital in Zhejiang Province. The rapidly developing hospital infrastructure in China, along with other countries, is projected to drive the demand for new unit shipments of these products from hospital & ASC’s operating rooms during the forecast period.

REGIONAL INSIGHTS

North America Surgical Lights Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Regionally, the market is fragmented by North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The market in North America generated revenue of USD 224.4 Million in 2024 and is anticipated to grow at a steady pace over the projected timeframe. The consolidation of the hospital and healthcare infrastructure in the U.S. and Canada, along with the rapid adoption of technologically advanced LED lights by healthcare settings in these countries, is pivotal for the market growth in North America. In addition to this, an increasing number for surgical procedures in the U.S. and substantial growth in the number of ambulatory surgery centers in the country are fueling the demand for replacement and new shipments of surgical lights. Thus, the aforementioned factors are attributable to the growth of the market in North America.

Europe is projected to register a comparatively lower CAGR during the forecast period. The decline in the number of hospitals, especially in major European countries such as Germany, France, and Italy has been instrumental in the lackluster demand for these lights in the region.

Asia Pacific is expected to register a significant CAGR during the forecast period and account for a dominant market share by 2032. A rapidly developing hospital infrastructure in Asia Pacific, combined with the increasing number of private players entering the hospital sector, is projected to lead a high demand between 2025-2032. Latin America and the Middle East & Africa are among the other lucrative regional markets. A strong focus by regional government agencies to offer a developed and advanced hospital infrastructure to patients in countries such as Brazil, Mexico, U.A.E., Saudi Arabia, and others is anticipated to drive the adoption of LED lights in these regions during the forecast period.

KEY INDUSTRY PLAYERS

HillRom Services, Inc. and Getinge AB are among the Dominant Players in the Surgical Lights Market

Hillrom Services Inc., Stryker, Getinge AB, and Steris Plc, are some of the leading players in the market. A strong brand presence, diverse offerings, and core competencies in the market for surgical lights segment are some of the major factors attributable to the dominance of these players in the market. For instance, the acquisition of Trumpf Medical by Hillrom Services Inc., and Maquet by Getinge AB have consolidated their market positions with a diverse portfolio of products, combined with a strong brand presence in the global market.

LIST OF KEY COMPANIES PROFILED:

- HillRom Services Inc. (Indiana, United States)

- Stryker (Michigan, United States)

- Getinge AB (Sweden)

- Steris plc. (Ohio, United States)

- S.I.M.E.O.N. Medical GmbH & Co. KG (Tuttlingen, Germany)

- Technomed India (Chennai, Tamil Nadu)

- Skytron (MI, United States)

- BihlerMED (Phillipsburg, New Jersey)

- Dr. Mach GmbH & Co. KG (Ebersberg, Germany)

- Other Players

KEY INDUSTRY DEVELOPMENTS:

- January 2019 – Getinge AB, announced the launch of its new Maquet PowerLED II, at the Arab Health, held in Dubai. Through this, the company aims to strengthen its market share.

REPORT COVERAGE

The surgical lights market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, competitive landscape and leading technology of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth rate of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Million) |

|

|

By Technology

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global surgical lights market was valued at USD 740.8 million in 2024 and is projected to reach USD 1,100.0 million by 2032, driven by technological innovation, increasing surgical procedures, and expanding hospital infrastructure worldwide.

LED technology dominates the surgical lights market due to its energy efficiency, longer lifespan, better illumination quality, and reduced heat output compared to traditional halogen lights.

The surgical lights market is expected to grow at a compound annual growth rate (CAGR) of 4.6% during the forecast period of 2025 to 2032, fueled by rising demand for LED-based surgical lighting systems and upgrades in healthcare infrastructure.

The LED segment is expected to be the leading segment in this market during the forecast period.

Rapidly developing hospital infrastructure in emerging countries is leading to an increasing number of new operating theaters. This growth in number of operating theaters is projected to fuel the demand for new operating lights, and drive the market.

Gettinge AB, Steris Plc., Stryker, and HillRom Services Inc., are major players of the global market.

Asia Pacific dominated the market share in 2024.

Emerging trends include the transition from halogen to LED, integration of smart technologies, ergonomic lighting designs, and increased adoption in outpatient care facilities and remote surgery environments.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us