Utility Asset Management Market Size, Share & Industry Analysis, By Type (Public Utility, Private Utility), By Component (Software, Hardware, Services), By Application (Electric {Transformers, Substations, Transmission & Distribution System}, Gas, Water), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

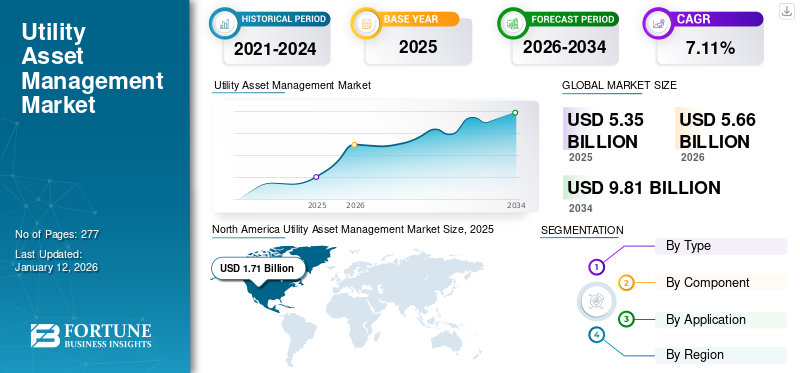

The global utility asset management market size was valued at USD 5.35 billion in 2025. The market is projected to be worth USD 5.66 billion in 2026 and reach USD 9.81 billion by 2034, exhibiting a CAGR of 7.11% during the forecast period. North America dominated the utility asset management industry with a market share of 32.06% in 2025. Additionally, the U.S. utility asset management market is predicted to grow significantly, reaching an estimated value of USD 2.35 billion by 2032.

Utility Asset Management (UAM) comprises software, hardware, and services essential for monitoring, managing, and improving the functional ability of critical assets. The essential assets include gas, water, and electric utilities. Electric utility consists of the transmission and distribution cables, substations, grid networks, and transformers required to transmit electricity in residential homes and commercial buildings. Water utility involves the assets utilized in municipal and industrial wastewater operations. Gas utilities include the support essential for power generation from natural gas, such as power plants, turbines, steam generators, and others. UAM is an integrated, data-driven ecosystem that gathers and analyzes information for informed decisions and higher asset efficiency

The global COVID-19 pandemic was unprecedented and staggering, with utility asset management experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. This unprecedented situation of COVID-19 also affected the global utility asset management market growth, as numerous state-owned and privately operated utilities have been scarred. The demand for utility assets received a considerable depression across the commercial and industrial sectors. Consequently, this affected the investment potential of the organizations and governments, limiting the setup of new grid infrastructures.

Utility Asset Management Market Trends

Rapidly Rising Energy Production and Demand Coupled with Growing Electrification Targets in Remote Locations to Propel Market Growth

Various administrations have introduced substantial electrification objectives for distant places unveiling immense opportunities for the UAM market size. Continuous plans to extend electricity supply to remote sites are anticipated to initiate a multi-fold increase in the setup of new transmission & distribution lines along with integrating modern electrical systems for efficient grid connections.

As per the Rural Electrification Corporation (REC) Limited, owned and operated by the Government of India, the number of total electrified villages in the country stands at just over 18,370 till 2018. However, over 51.7% or around 19,680 of the entire villages remain untouched, with the electric power depicting significant potential for new network infrastructures. Furthermore, the world has also observed a steep increase in the deployment of green energy technologies to support the stringent emission regulation norms set to boost the industry landscape further.

Integration of Big Data Analytics and Artificial Intelligence (AI) to Compliment Industry Outlook

A smart asset management model based on Big Data analytics and AI improves operational performance in several ways. Companies should prioritize based on regulatory requirements, asset criticality, and other factors. Smart Asset Management (SAM) solutions can reduce utility capital, Operations & Maintenance (O&M). The key feature of utility asset management is its ability to interpret asset performance assessment in real-time, using technological intelligence, such as SCADA, Computerized Maintenance Management System (CMMS), and Enterprise Asset Management (EAM).

Download Free sample to learn more about this report.

Utility Asset Management Market Growth Factors

Growing Measures to Combat Increasing Number of Unexpected Long Power Outages to Favor Overall Market Growth

The increasing amount of sudden power failures across different countries, owing to factors such as abrupt grid problems, faults in transmission & distribution lines, weather problems, natural disasters, and many others, is projected to propel the utility asset management industry. Many governments in both emerging countries worldwide increasingly view utility asset management as a strategic investment to upgrade infrastructure, which will focus on maintaining its long-term power grid and help minimize losses due to lack of regular maintenance and service. Additionally, unexpected power outages have significantly affected different residential, commercial, and industrial operations, generating a solid demand for revolutionizing transmission & distribution lines along with other electrical power grid infrastructures with more resilient systems.

According to Climate Central, about 83% of reported major power outages in the U.S. between 2000 and 2021 are due to weather-related events. The average annual number of weather-related power outages increased by over 80% since 2011. Between 2000 and 2021, there were more than 1,500 weather-related power outages. In 2022, more than 15 weather-related disasters caused a loss of USD 1 billion. This has resulted in the utilities focusing on grid resiliency, disaster readiness, grid and asset reliability, and aging assets.

Increasing Investments to Install Automated Monitoring and Tracking Systems

A positive outlook of national administrations to support the expansion of smart grid infrastructures coupled with providing financial assistance and deploying different technologies, including peak load management, outage management, asset management, and distribution management, are likely to augment the market size.

The China National Energy Administration and the National Development and Reform Commission stressed the importance of smart grid development to improve functionality. The objective was to optimize the allocation of energy resources in the network to promote the efficient use of electrical components and distribution and transmission networks. The China Electricity Commission also issued 483 standards, including various standards for power grid maintenance and online monitoring of transmission and distribution equipment.

Additionally, with the increase in population, governing bodies are now focusing on efficiently using electricity to meet the growing demand. Minimizing concerns over transmission and distribution losses and adopting the Internet of Things to improve energy conservation and consumption efficiency are fueling the growth of the global market. For instance, in January 2024, REC Power Development and Consultancy Limited (RECPDCL), which is a subsidiary of the Maharatna CPSE REC Limited, signed a MoU with the Gujarat government for a smart metering project worth USD 252 million in Paschim Gujarat Vij Company Ltd. (PGVCL).

RESTRAINING FACTORS

Capital Intensive Deployment with Limited Technical Expertise to Restrain Market Growth

The requirement of unpredictable, costly installation procedures coupled with high risks while maintaining the needed equipment for longer durations across various technologies, such as predictive maintenance, corrective maintenance, and condition-based maintenance, may hamper the market growth.

Additionally, the unavailability of precise technical knowledge while placing the tools and connecting the hardware, coupled with errors in prioritizing the functional layouts, can significantly impact the system's efficiency, leading to constrained repair durations and over-maintenance potentials.

Utility Asset Management Market Segmentation Analysis

By Type Analysis

Private Utility Segment to Dominate the Market Owing to its Wide Range of Electricity Networks

By type, the market is bifurcated into public utility and private utility. The public utility segment held the major market share of 55.83% in 2026 and is expected to dominate during the forecast period. Vast electricity networks of non-government companies and increasing investments to revolutionize the grid to lower power outage problems are set to favor the segment outlook.

By Component Analysis

Software Segment is Leading the Global Market due to its Wide Adoption in the Utilities Sector

By component, the market is trifurcated into software, hardware, and services. The software segment dominated the market with a share of 46.82% in 2026, owing to the mounting requirement for remote and mobile detection, inspection, and diagnostic tools in vast networks.

Major players in the market have launched asset management software. For example, IBM’s Maximo application suite is a single, integrated cloud-based platform that uses IoT, AI, and analytics to enhance performance, extend the lifecycles of critical assets, and decrease operational downtime and costs. It also offers enhanced reliability with AI-powered monitoring, inspection, and predictive maintenance systems.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Growing Demand Backs Electric Utility Segment for Transmission & Distribution’s Predictive Maintenance

Based on application, the market is trifurcated into electric, gas, and water. The electric segment dominated the market with a share of 77.92% in 2026 with a major utility asset management market share and is expected to hold the majority market share during the forecast period. Transformer is a vital part of the power transmission network. Management solutions have significantly incorporated the system to assess and optimize operating conditions, life expectancy, and failure reduction.

The growing concerns to upkeep reliable operations at lower costs and increasing usage of asset lifecycle planning, prediction, and condition-based maintenance activities are some of the key factors behind the electric segment growth in the market.

REGIONAL INSIGHTS

North America Utility Asset Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market has been analyzed geographically across five main regions, including Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America dominated the global UAM market in 2024. The deregulation of the electric industry is likely to drive the region’s market. The deregulation of the power sector in various nations has facilitated many private organizations to achieve their strategic goals to reduce the cost of electricity to end consumers and to have minimum losses by monitoring & tracking their networks regularly. The U.S. market is projected to reach USD 1.81 billion by 2026.

Europe

The UK market is projected to reach USD 0.26 billion by 2026, while the Germany market is projected to reach USD 0.39 billion by 2026.

Asia Pacific

Furthermore, Asia Pacific also held a substantial portion of the market in 2024. The factors contributing to the growth of the market include the upgrade of power distribution and transmission infrastructure by installing automated monitoring and tracking systems. Industries, such as fertilizers, automotive, petrochemical, and chemical, are witnessing steady growth in the region, which led to increased electricity demand and proper maintenance of various components of the electricity grid. The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.51 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

Middle East & Africa

Besides, the Middle East & Africa, with a negligible utility asset management system, is expected to provide a huge opportunity to the companies involved in the UAM market shortly between 2026 and 2034.

Key Industry Players

Panasonic is Focusing on Acquiring New Contracts through its Subsidiaries to Fortify its Position across the Industry

The global market has observed many utility asset management players delivering various products, software, and services to serve different aspects of an electrical power grid. Numerous companies are actively operating at regional and global levels to cater to the specific demands of the utilities.

ABB is estimated to account for a significant market share owing to its extensive range of solution offerings and its substantial brand value & presence across the globe. Furthermore, the company focuses on introducing innovations and investing significantly in product developments to fortify its market position. Other key industry participants include IBM, Schneider Electric, Siemens, Eaton, Sentient Electric, Black & Veatch, and others. They are continuously focusing on expanding their product offering and reach.

For example, in October 2022, Adani PowerLimited (APL) appointed Black & Veatch to optimize operations and improve the reliability and performance of its power assets in India, with goals including an overall reduction in CO2 emissions. The implementation will support the reliable, efficient, and sustainable operation of nearly 12 gigawatts (GW) of thermal power generation infrastructure in India by minimizing unplanned shutdowns and improving operational efficiencies.

LIST OF TOP UTILITY ASSET MANAGEMENT COMPANIES:

- General Electric (U.S.)

- ABB (Switzerland)

- Eaton (Ireland)

- Siemens (Germany)

- DNV GL (Norway)

- Aclara Technologies (U.S.)

- Sentient Energy (U.S.)

- IBM (U.S.)

- Hitachi Energy (Switzerland)

- Black & Veatch (U.S.)

- ABS Group (U.S.)

- Schneider Electric (France)

- IFS (Sweden)

- Getac (Taiwan)

- Fujitsu (Japan)

- Lindsey Manufacturing (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2022 – G.E. Digital's Asset Performance Management (APM) was recognized for leadership in capabilities across oil & gas, utilities, mining, and manufacturing industries. The company's Asset Performance Management (APM) is a package of service and software solutions designed to optimize the performance of critical assets for industrial companies.

- February 2022 – Eaton Corporation partnered with L.G. Electronics to provide flexible load management for distributed renewable energy applications. Through this collaboration, Eaton Corporation has integrated its smart power management technology, including its smart circuit breakers and E.V. chargers, with the LG ThinQ Energy mobile app and L.G. power management solutions to simplify power management Load.

- February 2022 – Siemens Smart Infrastructure in the U.S. unveiled a new sustainable, E.V. charging concept structure designed to electrify fleets and large-scale, high-demand charging applications. The new VersiCharge XL (U.L. Standard) concept was created to quickly and efficiently electrify parking lots and new or existing building structures using a modular and scalable design made in partnership with Nexii Building Solutions using their exclusive low-carbon footprint sustainable building material in the U.S. The solution, which resembles a modern gas station, was developed in late 2021 and installed in just three days at Siemens' Research and Development Centre for Electrical Products and Mobility Solutions in Peachtree Corners, Georgia.

- April 2021 – ABB launched the world's fastest, most sensitive drone-based gas leak detection and greenhouse gas measuring system. The company has introduced HoverGuard, which helps transform safety and environmental measurement capabilities for operators of millions of kilometers of pipelines traversing globally. The latest addition to ABB Ability Mobile Gas Leak Detection System, HoverGuard, provides the solution by finding leaks faster and more reliably.

- September 2020 – G.E. Renewable Energy signed a contract with Norwegian Power Company BKK to deploy its digital Asset Performance Management (APM) solutions to support the digital transformation of Norwegian Power Company BKK. Post-implementation, BKK will use G.E.'s Asset Performance Management (APM) under an initial 5-year license agreement to facilitate the digital transformation of BKK's operations and maintenance practices across a fleet of 30 hydroelectric power stations totalling more than 1.6 GW of capacity.

REPORT COVERAGE

The research reports offer a qualitative and quantitative in-depth industry analysis of the global UAM market. It further details the adoption of utility asset management across several regions. The report provides a detailed competitive landscape by presenting information on key players and their strategies in the market. Information on trends, drivers, opportunities, threats, and market restraints can further help stakeholders gain valuable insights into the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 7.11% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Component

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 5.66 billion in 2026 and is projected to reach USD 9.81 billion by 2034.

In 2026, the region stood at USD 1.81 billion.

Registering a CAGR of 7.11%, the market is projected to exhibit staggering growth during the forecast period (2026-2034).

The private utility segment under the type category is anticipated to hold the leading share in this market during the forecast period.

Increasing investments to upgrade the power transmission & distribution infrastructure by installing automated monitoring and tracking systems is the major factor driving the market growth.

IBM, Schneider Electric, Siemens, Eaton, Sentient Electric, and Black & Veatch are some of the key players operating in this market.

North America dominated the utility asset management industry with a market share of 32.06% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us