Laser Cutting Machines Market Size, Share & COVID-19 Impact Analysis, By Technology Type (Fiber Lasers, CO2, Solid State, and Others (Semiconductor), By Function Type (Semi-Automatic and Robotic), By End-User (Automotive, Metal & Fabrication, Electronics, Energy & Power, and Others (Medical) and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

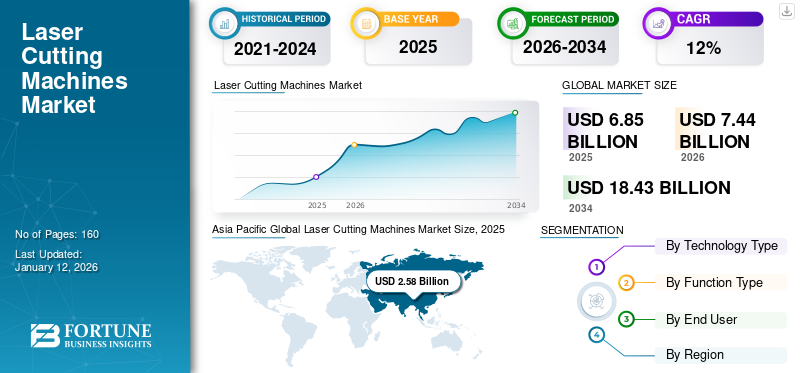

The global laser cutting machines market size was valued at USD 6.85 billion in 2025. The market is projected to grow from USD 7.44 billion in 2026 to USD 18.43 billion by 2034, exhibiting a CAGR of 12% during the forecast period. The Asia Pacific dominated the laser cutting machines market, accounting for a 37.60% share in 2025.

Laser cutting machines are advanced manufacturing tools that utilize laser-guided systems for cutting operations across various industries globally. Moreover, precise and automated cutting processes assist shop floors in executing operations effectively and precisely, resulting in reduced material wastage.

Furthermore, growing industrialization and government policies are promoting and expanding the application of cutting machines in the automotive manufacturing sector. The rapid growth of electric vehicles in regions such as Europe, Asia Pacific, and the U.S. is further accelerating the adoption of laser cutting machines in the automotive, metal fabrication, and consumer electronics industries.

Global Laser Cutting Machines Market Overview

Market Size:

- 2025 Value: USD 6.85 billion

- 2026 Value: USD 7.44 billion

- 2034 Forecast Value: USD 18.43 billion

- CAGR: 12% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific held the largest share in 2025 (37.60%)

- Technology Segment Leader: Fiber lasers dominated due to rising adoption in sheet metal applications

- Function Type Leader: Robotic segment expected to grow at the highest CAGR

- End-User Leader: Automotive sector accounted for the dominant share, driven by productivity and precision

Industry Trends:

- Increasing integration of IoT and Industry 4.0 in laser cutting technologies to improve productivity

- Growing automation in production with robotic laser systems for full autonomy

- Emergence of high-power laser machines, such as 24kW systems, enhancing processing speed by up to 80%

- Rising demand for 3D and precision laser cutting systems across sheet metal and complex manufacturing applications

Driving Factors:

- Growing industrialization post-pandemic and rising investments in production expansion

- Increased steel demand in automotive manufacturing—especially with EV growth in Asia Pacific, Europe, and the U.S.

- Operational efficiency and material savings achieved through advanced laser systems

- Rising per capita income and government subsidies for EVs stimulating demand in emerging economies like India

COVID-19 IMPACT

Economic Burden on the Supply Chain Hampered Market Growth in the Short-term

COVID-19 imperiled production capacities globally, leading to minimized demand for fabrication and manufacturing applications from end-users. Additionally, the decline in laser demand for sheet metal operations across the industry impacted revenues, hampering the market growth in the short term. The pandemic decelerated the economic growth of various regions due to slowed investments in production facilities and decreased capacities. It also caused significant changes in global trade policies, resulting in stringent restrictions on the movement of goods such as lasers, chemicals, and other commodities across geographies. These factors placed economic pressure on the supply chain of goods, impacting the market growth in the short term.

- For instance, in February 2021, according to Laser Focus World, macro application sales for sheet metal cutting declined by 11% in 2019, which recovered to 3% in 2020, led mainly by fiber lasers.

Laser Cutting Machines Market Trends

Integration of IoT and Industry 4.0 in Modern Laser Engineering is Leveraging Trend

Modern engineering has been transforming production styles and capacities globally by integrating industrial IoT and automation. This automation has extended production capacities, offering features such as low labor costs and minimized operational expenses, enhancing the potential of laser-cutting machines. These machines provide operational efficiency with great productivity, thus are expected to bolster the laser cutting machines industry size during the forecast period.

- For instance, in October 2024, TRUMPF, a global laser-cutting manufacturer, unveiled the upgraded version of the TRULaser 5000 series equipped with a laser providing twice the power. It has an output of 24KW and can boost productivity to 80%.

Download Free sample to learn more about this report.

Laser Cutting Machines Market Growth Factors

Growing Industrialization and Automotive Demand Driving Laser Cutting Market Potential

Industrialization across the globe decelerated during the pandemic but recovered significantly in the post-pandemic era with investments in operational capacity expansion. Moreover, the demand for steel in automotive manufacturing is expected to increase, driving the demand for laser cutting in industrial operations. These machines are advanced equipment offering maximum production output with substantial savings through operational costs. The availability of such features and operational excellence is expected to drive the laser cutting machines share during the forecast period.

- For instance, Yamazaki Mazak, a leading tool manufacturer, offers 3D Fiber Laser Cutting Machines with a high feeding rate for thin or thick sheets and free control over the diameter and shape of the laser.

RESTRAINING FACTORS

High Initial Cost and Frequent Maintenance May Hamper Market Growth

Laser metal cutting is a precision tool that utilizes high-cost laser technology for accurate cuts, driving the demand for cutting machines. However, the high precision engineering and ultra-precision cuts result in high initial installation costs, putting pressure on investors’ budgets. Additionally, the availability of a large number of complex parts requires frequent maintenance, which could hamper the laser cutting machines market growth in the short term.

Laser Cutting Machines Market Segmentation Analysis

By Technology Type Analysis

Fiber Lasers Segment to Dominate Due to Rising Adoption of Cutting Machines

Based on technology type, the market is classified into CO2, solid state, and others (semiconductors). The fiber lasers segment is poised to dominate the market, with a share of 29.44% in 2026, driven by the increasing adoption of cutting machines for sheet metal cutting. Additionally, their excellent operational capabilities and production efficiency are expected to drive the demand for laser cutters.

Furthermore, numerous orders for CO2 gas lasers and solid-state lasers for metal fabrication and industrial engineering applications are expected to generate subsequent revenue for both laser cutting technologies.

Moreover, the steady demand for semiconductor lasers in small amplitude applications and laser engravings provides a stable growth trajectory.

By Function Type Analysis

Robotic Segment Poised for Highest CAGR Fueled by Full Autonomy and Peak Productivity

Based on function type, the market is bifurcated into semi-automatic and robotic. The robotic segment is expected to grow at the highest CAGR during the forecast period due to its fully autonomous operation and maximum productivity. Moreover, robotic laser cutting machines have a dominant role in production lines, generating revenue for cutting machine manufacturers.

In contrast, the semi-automatic segment dominated the market with a share of 56.32% in 2026 and is expected to witness stable growth during the forecast period due to subsequent demand from small production sites and manufacturing units in developing countries.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment to Dominate Owing to Superior Productivity Offered by the Product

By end users, the market is classified into automotive, metal & fabrication, electronics, energy & power, and others (medical). The automotive segment is poised to observe the largest market share of 41.80% in 2026. Laser-cutting machines find dominant applications in the production lines of automotive and continuous manufacturing due to their capabilities, such as precision cuts, low production delays, and exceptional productivity.

In contrast, the metal & fabrication and electronics segments are expected to witness stable growth during the forecast period due to high infrastructural development and investments across geographies supported by expanding PCB manufacturing clusters in Asia.

Furthermore, the demand for laser cutters in energy & power and other medical facilities, owing to their precision in small-scale works and absence of adverse effects, is fueling the growth of the global market.

REGIONAL INSIGHTS

Based on region, the market has been studied across North America, Europe, the Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Global Laser Cutting Machines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.58 billion in 2025 and USD 2.85 billion in 2026 & is leading the global laser-cutting market, attributed to a large consumer base and significant growth in automation, including the integration of robotic lasers in automotive production. Additionally, supportive government policies to boost automobile sales are expected to further bolster the market share of laser cutting machines in the region in the long term. The Japan market is projected to reach USD 0.55 billion by 2026, the China market is projected to reach USD 1.37 billion by 2026, and the India market is projected to reach USD 0.44 billion by 2026.

India is dominating the demand for cutting machines due to the surging demand for automobiles and an increase in per capita income. Consumers in India are focusing on purchasing more durable automobiles, and government policies are supporting Electric Vehicle (EV) adoption through subsidies. These lucrative opportunities are set to create extensive applications of laser cutting in the automotive industry.

To know how our report can help streamline your business, Speak to Analyst

North America is growing progressively owing to the rising demand for technologically advanced cutting machines that can increase productivity while minimizing operational costs. Thus, advancements such as full-axis control and computer numerically controlled machine integration are dominating the demand for robotic lasers across end users. The U.S. market is projected to reach USD 1.4 billion by 2026.

Europe is anticipated to grow moderately during the forecast period. The slow adoption of EVs and political tensions between countries are weakening the potential of the laser cutting machines industry. In addition, frequent changes in policies and weak industrial manufacturing are set to lead to moderate growth of the market in the region. The UK market is projected to reach USD 0.29 billion by 2026, while the Germany market is projected to reach USD 0.33 billion by 2026.

Laser cutting machines have subtle demand across the Middle East & Africa due to limited metal fabrication and manufacturing facilities. Moreover, there is subtle demand for laser cutters in electronics, which is expanding the product demand in the region.

South America is expected to grow moderately during the forecast period with growing production and increasing demand for laser cutting equipment in the steel fabrication industry.

KEY INDUSTRY PLAYERS

Prominent Players are Integrating IoT and CNC Capabilities to Strengthen their Market Position

Growing automation and integration of AI as advancements to the machines have significantly boosted the demand for robotic lasers. Key players are striving to launch products with Internet of Things (IoT) capabilities, solidifying product adoption across the market. Furthermore, players operating in the market are offering advanced CNC equipped with laser cutting machines, which is driving the demand for such products in the market.

For instance, in June 2025, Trumpf Laser developed a versatile fiber laser offered in the power range of 500 watts to 2000 watts that can manufacture core components for electric motors and hydrogen cells.

List of Top Laser Cutting Machines Companies

- Trumpf (Germany)

- Hanslaser (China)

- HGTECH (China)

- Bystronic (Switzerland)

- Jinan Bodor CNC Machine Co., Ltd. (China)

- Amada (Japan)

- Salvagnini (Italy)

- PrimaPower (Italy)

- Mazak (Japan)

- Messer (Germany)

- Mitsubishi (Japan)

- IPG Photonics (U.S.)

- Epilog Laser (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: xTool launched its powerful and precise 40W laser module with powerful capabilities that can precisely cut and engrave delicate parts.

- October 2024: Trumf, a laser technology leader, unveiled 24 kw Trudisk 24001, a new laser that processes three times faster with varied materials and applications and can cut metal sheets having a thickness of up to 20 mm.

- October 2024: BLM Group, a tube and laser technology manufacturer, launched its new LS7, a system to process sheet metal, which offers high productivity with all feature characteristics and demonstrates high cutting speed and accuracy.

- October 2024: Advanced laser processing solutions leader Coherent launched next-generation 30 kw laser cutting head series BIMO-FSC3 for efficient ring mode laser beam management and dependable operation in harsh environments.

- September 2024: Epilog laser, the leading manufacturer of CO2 and fiber laser engraving, marking systems, and cutting systems, launched a new fusion maker laser system. The product is available in the range of 30-40 watt configuration and features 60-inch per second engraving.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, technology types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology Type

By Function Type

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 18.43 billion by 2034.

In 2025, the market was valued at USD 6.85 billion.

The market is projected to grow at a CAGR of 12% during the forecast period.

By technology type, the fiber lasers segment is expected to lead the market during the forecast period.

Growing industrialization and automotive demand are the key factors driving market growth.

Trumpf, Hanslaser, HGTECH, Bystronic, Jinan Bodor CNC Machine Co., Ltd., Amada, Salvagnini, PrimaPower, Mazak, Messer, Mitsubishi, IGP Photonics, and Epilog Laser are the top players in the market.

Asia Pacific is expected to hold the largest market share during the forecast period.

By end-user, the automotive segment is expected to dominate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us