Ophthalmic Devices Market Size, Share & COVID-19 Impact Analysis, By Surgical (Implants, Consumables, and Equipment) and Vision Care (Contact Lenses and Ocular Health) By End User (Hospitals, Ophthalmic Clinics and Others) Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

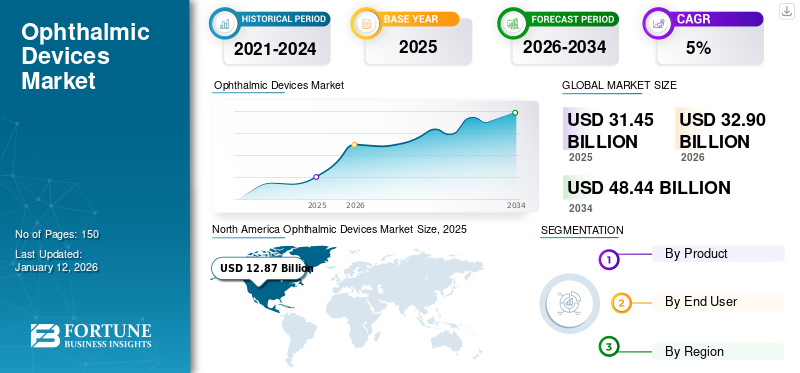

The global ophthalmic devices market size was valued at USD 31.45 billion in 2025. The market is projected to grow from USD 32.9 billion in 2026 to USD 48.44 billion by 2034, exhibiting a CAGR of 5% during the forecast period. North America dominated the ophthalmic devices market, accounting for a 40.92% market share in 2025.

The demand for quality eye care is rapidly increasing with the rise in the prevalence of vision disorders worldwide. According to a joint report published by World Health Organization (WHO) & Brien Holden Vision Institute in 2015, myopia and high myopia is anticipated to affect 52% and 10% of the global population by 2050. The ophthalmic diagnostics devices include surgical devices and vision care products/devices that aid in the improvement of vision disorders.

The technological advancements in various devices such as intraocular lenses and rapid rise in the number of eye surgeries are likely to accelerate the demands for ophthalmic devices in the forthcoming years. According to the article published by the American Academy of Ophthalmology (AAO) in 2018, around 3.9 million Cataract surgeries were performed in the U.S.

Market players are focusing to strengthen the R&D domain for the development of novel devices for the treatment of vision errors. For instance, in January 2018, Hoya Corporation launched its new research & development (R&D) facility in Singapore for the development of technologically advanced intraocular lenses. Such development is likely to provide a huge opportunity for the ophthalmic device manufacturers to capture the large customer base and aid in the acceleration of the ophthalmic device market growth.

Global Ophthalmic Devices Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 31.45 billion

- 2026 Market Size: USD 32.9 billion

- 2034 Forecast Market Size: USD 48.44 billion

- CAGR (2025–2032): 5.00%

Market Share:

- Leading Region: North America dominated with a 40.92% share in 2025, driven by rapid adoption of advanced intraocular lenses, high volume of eye surgeries, and presence of major market players offering a wide product portfolio.

- Leading Product Segment: Vision care segment holds a significant market share, boosted by increasing adoption of contact lenses and ocular health products. The surgical segment is also growing, supported by rising cataract and retinal surgeries and innovations in intraocular lenses (IOLs).

Key Country Highlights:

- United States: The high volume of ophthalmic surgeries (e.g., 3.9 million cataract surgeries as per AAO 2018) and strong R&D focus by companies (e.g., Alcon, Johnson & Johnson) propel market growth. The presence of advanced healthcare infrastructure and favorable reimbursement policies further aid adoption.

- Europe: Significant growth expected due to government investments in R&D, innovation in surgical instruments, and new product launches such as Alcon’s Vivity presbyopia-correcting IOL.

- Asia Pacific: Expected to witness rapid growth driven by rising incidence of cataract, glaucoma, and dry eye disease (e.g., estimated 275 million dry eye disease cases in India by 2030). Increasing adoption of advanced devices in emerging countries like China and India supports expansion.

- Latin America & Middle East & Africa: Market growth fueled by increasing manufacturer presence and rising awareness of contact lenses and ophthalmic health products.

COVID-19 Analysis

Decline in Surgical Procedures amid COVID-19 to Affect Sales Revenue

The COVID-19 outbreak has had a negative impact on this market of ophthalmic devices. The significant decline in the number of ophthalmic procedures due to the COVID pandemic has led to a decline of revenues generated by market players from the sales of implants, consumable, and equipment.

The surgical segment is projected to witness a higher decline in revenues including cataract surgeries, vitreoretinal surgeries, and other procedures, which has been responsible for lower sales of Implants, equipment, and consumables. According to the analysis of an estimated 228 hospitals in the U.S. (which accounts for over 2 million patient visits annually), showed that there was a massive decline of around 81% patient visits for ophthalmology during March and April 2020, as compared to 2019. These statistics also suggested that during the same observation period, cataract surgical procedures registered a 97% decline, followed by an 88% decline in glaucoma procedures.

Amid the COVID-19 pandemic, the vision care segment is anticipated to register a negative impact on sales of contact lenses, which is compensated by the growth in sales of ocular health products, such as eye-drops. There was an increased demand for eye-drops and other ocular health products for various conditions such as dry eye diseases. The major reasons were cited to be panic-buying and stockpiling of these commodities, due to uncertainty of the national lockdowns, supply chains, etc.

Many companies are maintaining key inventory at major distribution centers away from high-risk areas and working with external suppliers to maintain the continuity of the company's supply chain during the pandemic

LATEST TRENDS

Download Free sample to learn more about this report.

Introduction of Technologically Advanced Ophthalmic Devices to Surge Demand

The introduction of innovative equipment, consumables, contact lenses, etc., has led to a higher demand for these devices among healthcare providers and patients. For instance, the new micro-invasive glaucoma (MIGs) surgical implants have become one of the fastest-growing technologies for the treatment of mild to moderate glaucoma. These innovative implants are highly efficacious and are likely to fill the gap in the treatment of glaucoma. Market players are focusing on launching novel micro-invasive glaucoma surgical implants that will propel the growth of the global ophthalmic devices market during the forecast period.

DRIVING FACTORS

Increasing Prevalence of Vision Disorders to Drive the Demand

There has been a significant increase in the prevalence of ophthalmic disorders, including cataract, diabetic retinopathy, myopia, age-related macular degeneration, etc. The increasing prevalence of ophthalmic disorders, along with the increasing initiatives undertaken by national and regional agencies to promote eye health are responsible for higher diagnosis rates in developed and emerging countries.

- According to Centers for Disease Control and Prevention (CDC) the number of diabetic retinopathy cases in America is expected to rise from 7.7 in million in 2010 to 14.6 million in 2050.

- According to a recent report published by American Academy of Ophthalmology, an estimated 7.32 million people in the United States will have primary open-angle glaucoma by 2050.

Such a rapid rise in the prevalence of eye diseases are likely to fuel the demand for surgical and vision care devices at a significant rate. This, coupled with increasing per capita healthcare expenditure, and favorable reimbursement policies for ophthalmic procedures has propelled the number of patients undergoing surgical procedures. This rise in the number of ophthalmic surgeries is fueling the demand for ophthalmic surgical devices, further augmenting the market growth in the future.

RESTRAINING FACTORS

Low Treatment Rate in Emerging Nations and High Cost of Devices to Restrict Market Growth

Various factors including lower per capita healthcare expenditure, limited product accessibility, and lack of awareness about ophthalmic diseases, leads to a lower number of patients undergoing treatment in emerging nations. For instance, according to the article published in 2018 in The Ophthalmologist: Clinical and Therapeutic Journal, the cataract surgery rate in China was 2,450 per million inhabitants which were lower in comparison to cataract surgery rate in the U.S. that was around 11, 920 per million inhabitants.

Additionally, most of the ophthalmic instruments are highly expensive. For instance, according to the article published by Las Vegas eye institute, the cost of Femtosecond lasers is around USD 200,000 to USD 400,000. Such high cost limits the acceptance of these highly advanced lasers especially in small and mid-sized eye clinics in developed and emerging countries, which in turn is likely to restrain the overall growth of the market.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Vision care Segment to Hold the Significant Share of the Global Market

Based on the product, the market for ophthalmic devices is segmented into surgical & vision care. The vision care segment holds a major share of the market and is anticipated to grow at a significant rate in the forthcoming years. This is due to the rising shift of patients from traditional eyeglasses to contact lenses. Additionally, the growing focus of players towards the launch of new contact lenses is anticipated to promote the usage of the product during the forecast period.

According to the data published by the Centers for Disease Control and Prevention (CDC), an estimated 45 million people in the U.S. were using contact lenses. This is expected to contribute to the gradual rise of the vision care segment.

The tremendous rise in the number of cataract and retinal surgeries, along with the introduction of new IOLs by the key players are leading to the increase in the adoption of IOLs, and other devices, further accelerating the growth of the surgical segment. In August 2019, Alcon introduced the AcrySof IQ PanOptix Trifocal Intraocular Lens (IOL), the only and primary trifocal lens for patients receiving cataract surgery in the U.S.

By End User Analysis

Ophthalmic Clinics to Hold a Dominating Position in the Global Market

On the basis of the end-user, the global market is segmented into hospitals, ophthalmic clinics, and others. The ophthalmic clinic segment dominated the global market in 2024. The rising awareness about the benefits provided by ophthalmic clinics including reduced waiting time is expected to favor the segment growth. These benefits, along with the increasing adoption of advanced devices in clinics are some of the factors expected to attract a large patient pool for the treatment in these settings.

The others segment is likely to witness a strong growth in the coming years owing to the growing shift of patients towards Ambulatory Surgical Centers (ASCs) and multispecialty clinics for cataract and other daycare procedures. This is likely to increase demand for these devices from healthcare facilities, especially in the U.S., and Europe.

REGIONAL INSIGHTS

North America Ophthalmic Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market size in North America dominated the market with a valuation of USD 12.87 billion in 2025 and USD 13.46 billion in 2026. The rapid penetration of advanced technology intraocular lenses for the treatment of cataract and the presence of leading players in the region offering a wide range of devices is likely to boost the growth of the market in the region. The U.S. market is projected to reach USD 12.61 billion by 2026.

The market in Europe is likely to showcase significant growth. The UK market is projected to reach USD 1.03 billion by 2026, while the Germany market is projected to reach USD 2.31 billion by 2026. This is attributable to the strong government investments taken to strengthen the R&D sector to develop highly advanced ophthalmic surgical instruments. Additionally, key players in Europe are strongly focusing on the launch of innovative devices for treatment for eye disorders. For instance, in March 2020, Alcon announced the launch of Vivity presbyopia-correcting IOL with X-WAVE technology in Europe, which is likely to boost the adoption of IOLs implants for correcting refractive errors in coming years.

To know how our report can help streamline your business, Speak to Analyst

The market in Asia Pacific is expected to experience a comparatively higher growth. Certain factors such as the rising incidence of cataract, glaucoma, and the growing adoption of highly advanced devices for the treatment of cataract and vitreoretinal disorders in emerging nations such as China and India are projected to drive the growth of the market in the region. For instance, according to a study conducted by L. V. Prasad Eye Institute (LVPEI), Hyderabad, an estimated 275 million people in India are anticipated to be affected by dry eye disease by 2030, further increasing the demand for highly advanced devices for the treatment of eye diseases in the region. The Japan market is projected to reach USD 2.77 billion by 2026, the China market is projected to reach USD 3.71 billion by 2026, and the India market is projected to reach USD 0.73 billion by 2026.

The market in Latin America and Middle East & Africa is expected to experience a strong growth owing to the geographical expansion of the manufacturers in the region and the growing awareness about the benefits of contact lenses in the treatment of various symptomatic corneal diseases.

KEY INDUSTRY PLAYERS

Strong Product Portfolio has Propelled Alcon, and Johnson & Johnson Vision Care, Inc.to Lead the Global Market

The global ophthalmic devices market is consolidated by the presence of Alcon, Johnson & Johnson Vision Care, Inc., and Bausch & Lomb Incorporated that are the leading players in the market. A diversified product portfolio, strong geographical presence, and robust research & development domain are some of the factors responsible for the well-built position of these companies in the market.

Other players such as Cooper Companies Inc., BVI, Carl Zeiss Meditec, Essilor international, Hoya, and Nidek Co. Ltd. are emphasizing on the strategies such as partnerships and collaborations with the research organizations and other key players and investments to expand the manufacturing facilities in order to introduce novel ophthalmic products in this key market.

LIST OF KEY COMPANIES PROFILED:

- Alcon (Geneva, Switzerland)

- Carl Zeiss Meditec (Oberkochen, Germany)

- Johnson & Johnson Vision Care, Inc. (Jacksonville, U.S.)

- The Cooper Companies Inc. (California, U.S.)

- BVI (Waltham, U.S.)

- Bausch & Lomb Incorporated (Rochester, U.S.)

- Essilor (California, U.S.)

- Hoya Corporation (Tokyo, Japan)

- NIDEK CO., LTD (Gamagori, Japan)

KEY INDUSTRY DEVELOPMENTS:

- July 2021 – Coopervision announced that Clarity 1 day have become the first net plastic neutral contact lens in the U.S. This is the result of company’s partnership with Plastic Bank.

- September 2020- Vision care division of ZEISS International in conjunction with Voxelight, LLC. Developed ZEISS UVClean technology, an optometry-specific UV-C disinfecting device designed especially for eyecare professionals

- November 2020- Alcon showcased Pivotal data on the novel AcrySof IQ Vivity IOL ahead of the upcoming U.S. launch, along with clinical findings from AcrySof IQ PanOptix Trifocal IOL in AAO 2020 Virtual Annual Meeting

- July 2020- Hoya Vision Care launched Sensity Fast light reactive lenses, a light reactive technology in the photochromic category. It is one of the fastest light reactive lenses, rapidly changing from dark to clear

REPORT COVERAGE

The ophthalmic devices market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products in pipeline, recent key industry developments, and technological advancements. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global ophthalmic devices market size was USD 31.45 billion in 2025 and is projected to reach USD 48.44 billion by 2034.

In 2025, the market value stood at USD 31.45 billion

Growing at a CAGR of 5%, the market will exhibit steady growth in the forecast period (2026-2034).

The vision care is expected to be the leading segment under the technology segment in this market during the forecast period.

The growing demand for effective treatment devices and increase in the prevalence of eye disorders are to drive market growth.

Alcon, Johnson & Johnson Vision Care, Inc., Bausch & Lomb Incorporated, The Cooper Companies are few of the leading players in the global market.

North America dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us