Penetration Testing Market Size, Share & Industry Analysis, By Deployment Mode (On-Premise and Cloud), By Testing Type (Network Penetration Testing, Web Application, Mobile Application, Social Engineering, Cloud Penetration Testing, and Others), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-Users (BFSI, IT and Telecommunications, Healthcare, Retail and Consumer Goods, Government and Public, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

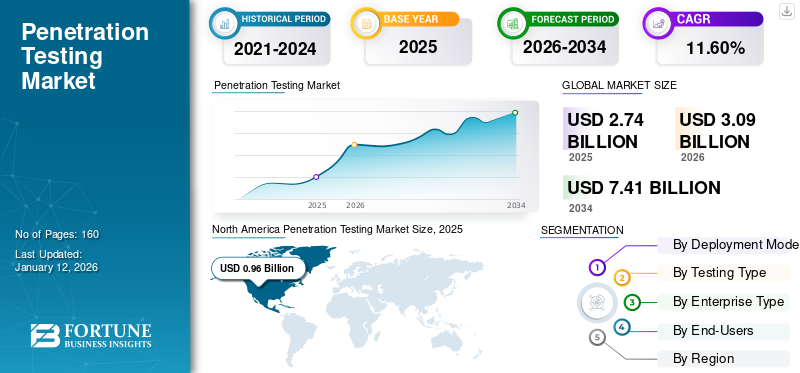

The global penetration testing market was valued at USD 2.74 billion in 2025. The market is projected to grow from USD 3.09 billion in 2026 and reach USD 7.41 billion by 2034, exhibiting a CAGR of 11.60% during the forecast period. North America dominated the global market with a share of 35.10% in 2025.

Penetration testing is a security process where cyber experts attempt to identify and exploit vulnerabilities in a computer system. It is also known as pen testing. Various attacks that could put the company at risk are frequently simulated in this test. A pen test could help assess the system's robustness to detect whether it can avoid attacks from authentic and unauthorized users.

Global Penetration Testing Market Overview

Market Size:

- 2025 Value: USD 2.74 billion

- 2026 Value: USD 3.09 billion

- 2034 Forecast Value: USD 7.41 billion

- CAGR (2026–2034):11.60%

Market Share:

- Regional Leader: North America held about 35.10% of the market in 2025 due to high cybersecurity adoption and strict regulations.

- Fastest‑Growing Region: Asia Pacific is expected to grow at the highest CAGR, driven by digital transformation and rising cyberattacks.

Industry Trends:

- Increasing adoption of cloud-based penetration testing and Penetration Testing as a Service (PTaaS).

- Integration of AI and automation tools to enhance testing efficiency.

- High demand for web application and cloud infrastructure testing.

- Growing adoption among SMEs through subscription-based models.

Driving Factors:

- Rising cybersecurity threats, ransomware attacks, and data breaches across industries.

- Strict compliance requirements under GDPR, HIPAA, and PCI DSS.

- Expansion of cloud computing, remote work, and hybrid IT environments.

- Increasing need for frequent, cost-efficient, and automated security assessments.

High penetration of cloud computing solutions and services and an increasing number of data centers are accelerating the growth of the global market. Additionally, strict government regulations to surge the adoption of penetration testing solutions and services are positively impacting the growth of the market. The increasing integration of technologies such as ML and AI in penetration testing and the rising trend toward the adoption of penetration testing as a service (PTaaS) and remote working security assessments also provide favorable opportunities for the growth of the market.

However, a lack of qualified security professionals and high implementation costs are hindering the growth of the penetration testing market. On the contrary, the growing popularity of PTaaS for remote workers and security assessments is expected to provide valuable opportunities for market expansion during the forecast period.

The onset of the COVID-19 pandemic has added momentum to the evolution of the market due to the rapid shift of organizations into a virtual mode of operation. This led to a rapid rise in the number of cyberattacks, which resulted in increased deployment of effective methods and techniques for securing user data safety and privacy. According to the Federal Bureau of Investigation (FBI), data show a 400% increase in cybercrime during the pandemic.

Penetration Testing Market Trends

Rising Impact of DevSecOps Tools and Social Engineering Trends to Propel Market Growth

Organizations are using DevSecOps tools to respond to the rapid changes in testing requirements. DevSecOps is a key element of applying security in the DevOps architecture. It creates a culture of security as code in which users can automatically create security workflows. It uses efficient methodologies to integrate security testing into the development process, which can benefit penetration testers.

Social engineering strategies are on the rise, making social engineering tests important to organizations. The employees are exposed to various ways hackers attempt to trick them into revealing company information assets while experiencing simulated attacks. Companies are reducing the risk of phishing attacks by detecting vulnerable employees through social engineering penetration tests.

Download Free sample to learn more about this report.

Penetration Testing Market Growth Factors

Rising Need to Identify Cybersecurity Threats and Risks Across Enterprise Networks to Aid Market Growth

Due to the growing number of cyber-attacks, organizations use penetration testing services in their systems to manage a massive amount of data or business on the internet. Cyber-attacks are rising, and hackers are attacking networks, endpoints, and other IT infrastructure. These cyber-attacks have caused significant financial losses for individuals, businesses, and governments. According to CheckPoint’s cybersecurity report, compared to 2021, global cyber-attacks increased by 38% per week on corporate networks in 2022.

Furthermore, data privacy concerns are growing due to increasing digitization trends in various sectors. The proliferation of the internet and the growing adoption of smart devices in sectors, such as healthcare, BFSI, and retail, among others, are trying to streamline their operations to reduce overall costs while leaving no room for human error. Therefore, such factors are driving market growth.

RESTRAINING FACTORS

Growing Need for Improvising Data Inconsistency to Hamper Market Growth

While specifying software testing requirements, developing detailed test cases can be hindered by communication gaps. There are several reasons for the lack of communication, such as misinterpretations, differences between customer and developer time zones, and changes in working hours. Such a lack of communication affects the organization’s progress and market growth.

Due to the dependency of software test analysis on code sources and their quality, inconsistencies in data can affect business decisions and company productivity. In addition, companies may have two or more copies of the same data, affecting their storage and computation. The market growth can be hindered by problems related to data accuracy and consistency.

Penetration Testing Market Segmentation Analysis

By Deployment Mode Analysis

Secured Encryption and Threat Identification by Cloud-Based Offerings to Boost Segment Growth

Based on the deployment mode, the market is segmented into on-premise and cloud. The cloud is expected to grow at a higher CAGR during the forecast period. Several companies are moving to the cloud to improve productivity and support communication and collaboration. However, businesses are managing to receive secure authentication or encryption from most cloud services. Organizations understand the need to introduce cloud-based pen testing to protect all endpoints and identify threats, vulnerabilities, or gaps. Cloud deployment is growing, as cloud-based pen testing solutions are easy to upgrade and manage.

In terms of market share of 54.30%, the on-premise segment dominated the market in 2026. Sensitive and regulated data is often stored at on-premises servers in large enterprises. Knowledge transfer is a priority for many organizations using on-premises pen testing services. The segment’s market dominance is influenced by data security due to information stored on-premise and local security control.

By Testing Type Analysis

Rising Adoption of BYOD Trend to Increase the Demand for Mobile Application Segment

Based on the testing type, the market is segmented into network penetration testing, web applications, mobile applications, social engineering, cloud penetration testing, and others. Mobile applications are expected to grow at a higher CAGR during the forecast period. This is due to the BYOD (Bring Your Own Device) trend, and it is increasingly common to use personal devices on the job or anywhere. The levels of exposure have increased sharply over the last few years, with these devices constantly connected to the internet. Therefore, this increases the risk of cyber threats in mobile apps; hence, organizations have started adopting pen testing services for mobile applications.

Regarding market share of 24.19%, network penetration testing dominated the market in 2026. The growing need to identify exposed vulnerabilities and security weaknesses in network infrastructure, such as servers, firewalls, switches, and routers, as well as the increasing penetration of integrated security solutions and IP traffic, has contributed to the large market share of this segment.

By Enterprise Type Analysis

Increasing Need for Penetration Testing Solutions to Improve Security Awareness in SMEs to Aid Market Expansion

Based on enterprise type, the market is segmented into large enterprises and small & medium enterprises (SMEs). The Small & Medium Enterprises (SMEs) segment is expected to grow significantly at a higher CAGR during the forecast period. Attackers target small businesses due to inadequate security infrastructures and insufficient cyber awareness training. This has led to an increase in the use of penetration testing among SMEs. Moreover, it also helps reduce operational and capital costs, leading to increased investment. Hence, the adoption is expected to increase market opportunities over the coming years.

As per market share, large enterprises dominated the market in 2026 with 55.46%. Large enterprises have adopted pen-testing solutions and services due to a rising focus on developing strategic IT initiatives and constantly implementing threat protection solutions to stay ahead of cybercriminals.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Need for Securing Highly Sensitive Data to Grow Market Share in BFSI

Based on end-users, the market is categorized into BFSI, IT and telecommunications, healthcare, retail and consumer goods, government and public, and others. Among these, the BFSI segment dominated the market with a share of 26.00% in 2026. The growth is attributed to the high volume of sensitive personal and financial data for individuals, governments, and companies that are often exposed to breaches and rapid increases in transactions using cloud-based UPI.

Healthcare is expected to grow significantly at a higher CAGR during the forecast period. The growth is attributed to the rising adoption of electronic health records and telehealth solutions, making healthcare organizations more vulnerable to cybercrime.

REGIONAL INSIGHTS

Geographically, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Penetration Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.96 billion in 2025 and USD 1.05 billion in 2026. The growth of this region is attributed to an increase in the number of cyber-attacks on networks, particularly for private and public companies, a rise in demand for advanced security and vulnerability management solutions within the healthcare sector, and increased investment in research and development. The U.S. market is projected to reach USD 0.66 billion by 2026. In addition, the leading players in the region continue to collaborate and innovate their product portfolios. For instance,

- In November 2022, Cobalt, a pen testing company, partnered with NTT DATA, the systems integration division under NTT Group. This partnership enables NTT DATA to provide its clients with more comprehensive security services in the United States.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to grow at a significantly higher growth rate during the forecast period. In the Asia Pacific region, data analytics is enhancing governments and businesses. The increasing use of software testing supports the market growth in the region due to the complex coding environment. The Japan market is projected to reach USD 0.20 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

The Middle East & Africa is expected to register the second-highest CAGR during the forecast period. The rapid expansion of innovation and data digitization in this region has led to a proliferation of pen-testing technologies.

The UK market is projected to reach USD 0.14 billion by 2026, and the German market is projected to reach USD 0.10 billion by 2026.

Key Industry Players

Growing Market Players’ Focus on Merger & Acquisition, Partnerships, and Product Development Strategies to Propel Market Growth

Prominent players operating in the global market focus on providing better testing tools for the operational efficiency of businesses. These companies focus on acquiring small and local firms to expand their business presence. Moreover, mergers & acquisitions, strategic partnerships, and leading investments in device technologies help increase the market demand.

List of Top Penetration Testing Companies:

- CrowdStrike (U.S.)

- Rapid7 (U.S.)

- Synopsys, Inc. (U.S.)

- Secureworks, Inc. (U.S.)

- Invicti (U.S.)

- IBM Corporation (U.S.)

- ASTRA IT, Inc. (U.S.)

- Indusface (India)

- BreachLock Inc. (The Netherlands)

- THREATSPIKE LABS (U.K.)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Chubb, the publicly traded property and casualty insurance company, announced a partnership with NetSPI, a proactive security provider, to improve its customers' cyber risk profiles through improved attack surface management and penetration testing solutions.

- August 2023: Coalfire announced the launch of Hexeon, a comprehensive offensive security software as a service (SaaS) to monitor and assess risks throughout its vulnerability management lifecycle. The solution provides enhanced context for threat exposures and allows continued interaction with their pen testers.

- June 2023: BreachLock, a provider of pen testing services, launched the latest solution called Red Teaming as a Service (RTaaS). By offering comprehensive assessment at a reduced cost, this innovative solution aims to change the way Red Teaming services are provided radically.

- March 2023: Redington's Ltd partnered with Indusface, an application security SaaS company offering enterprises comprehensive security solutions for their applications. Through this partnership, Redington customers benefited from the platform's extensive security offering, particularly AppTrana, which helped them develop and maintain robust security strategies for their applications.

- June 2022: Bugcrowd announced that its Penetration Test as a Service (PTaaS) product portfolio is expanding significantly, including new offerings such as basic pen tests and standard pen tests. This launch aims at the purpose-built digital business where pen testing keeps pace with agile and constant development.

REPORT COVERAGE

The global penetration testing market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2032 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode

By Testing Type

By Enterprise Type

By End-Users

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 7.41 billion by 2034.

In 2025, the market value stood at USD 2.74 billion.

The market is projected to grow at a CAGR of 11.60% during the forecast period (2026-2034).

BFSI is likely to lead the market.

The increasing need to identify cybersecurity threats and risks across enterprise networks to aid market growth.

CrowdStrike, Rapid7, Synopsys, Inc., Secureworks, Inc., Invicti, IBM Corporation, ASTRA IT, Inc., Indusface, BreachLock Inc., and THREATSPIKE LABS are the top players in the global market.

North America is expected to hold the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us