Skill Gaming Market Size, Share & Industry Analysis, By Skill Type (Physical and Mental), By Game Genre (Card Based, Board Based, Dice Based, Tile Based, Word and Number Based, and Puzzle Based and Animated Games), and Region Forecast, 2026-2034

Skill Gaming Industry Analysis

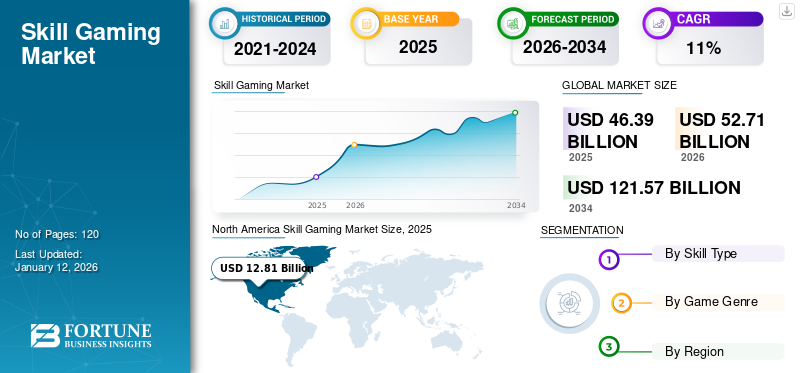

The global skill gaming market size was valued at USD 46.39 billion in 2025 and is projected to grow from USD 52.71 billion in 2026 to USD 121.57 billion by 2034, exhibiting a CAGR of 11% during the forecast period. North America led the skill gaming industry in 2025, capturing a 27.70% market share.

Skill gaming is a game in which the outcome is influenced by the player's skill rather than purely based on chance or luck. The scope of this market study includes the platforms and games which require the players to utilize real currency and compete with other players based on their skill level. Such games are categorized into board games, sportsbooks, casino games, word games, puzzle games, and poker.

Gamers and developers are attracted to skill gaming for mental challenges, social interaction, and competitive opportunities. These games provide a sense of achievement when a player successfully outmaneuvers their opponent. At the same time, they are less addictive and comply with regional regulations compared to games of chance. However, skill-based online games are complementary to other offline games and are often referred to as a ‘gateway’ product.

With COVID-19, more home quarantine and shelter-in-place orders left millions of people with fewer entertainment choices, and gaming was one of the favorite sports in an isolated social landscape. People went for various gaming options such as TV gaming, PC gaming, and mobile gaming.

Numerous players across the globe believed that gaming helped them maintain their mental health during lockdowns. According to the World Economic Forum Report 2022, as per the European gamers survey, 16% of gamers felt positive after spending time on multiplayer gaming.

Hence, the overall gaming sector grew rapidly as thousands of new users splashed out on consoles and gaming during lockdowns. As per Global Entertainment and Media Outlook, 2022-26 Report of PwC, the global gaming industry is predicted to reach USD 321 billion by 2026.

Thus, it opened up numerous opportunities for skill gaming in the market.

Skill Gaming Industry Trends

AI-powered Hyper-Personalization and Recommendation Propels the Growth of Skill-based Gaming

Artificial Intelligence (AI) refers to flexible and responsive video game involvements in gaming. Artificial Intelligence has transformed gaming into an enhanced-involvement experience.

AI applications in developing games make them more versatile and fun, with improved user journeys, better level progression, and imparting skills to Non-Playable Characters (NPCs), along with increased engagement and training. Hence, the industry has pushed the technology possibilities and is an early innovator of AI across several areas of its construction and game mechanics. According to a Forbes study on the Future of NPCs, 99% of respondents say that advanced AI NPCs would progress gameplay, and 81% are interested in paying more for such games where they are included.

Thus, the technology is being adopted and used in the industry, and the key players are advancing their solutions with new investments, innovations, partnerships, and collaborations. For instance,

- In March 2023, Skillprint, an AI-empowered platform, introduced new ratings for neuroscience research and machine learning-based games. The ratings consider various criteria, assessing games' impact on a person's mind, attitude, and specific skills to match persons with the potential games for them. It uses AI technology and constructs years of intellectual research to learn people's games and collect unique insights.

Such innovations and advancements with the implementation of artificial intelligence technology enhance the development of skill gaming.

Download Free sample to learn more about this report.

Skill Gaming Market Growth Factors

Turbocharging Gaming Speed of 5G Network Enhances the Development of Skill-based Games

Unlimited internet facilities and emerging 5G coverage are progressively becoming the new norm globally, significantly complementing mobile gaming. 5G network is 10 times faster than 4G, making it a better choice for gamers. 5G offers better download speeds and lesser latency during gaming. The 5G connectivity enables smoother gameplay for games based on the internet for cloud access and multiplayer support. Gamers enjoy the gaming experience even on affordable smartphones with 5G technology.

With their flexible usage, smartphones with 5G services have attracted millions of sports games, such as esports fans worldwide. Developments in 5G technology are driving mobile internet networks, thereby making such gaming more viable and stable. For instance,

- In August 2022, India Gaming Conclave 2022 Industry stakeholders and leaders' discussion conveyed the upcoming plans of the gaming industry in India. They stated the growth of the gaming industry is accelerated with the adoption of 5G, smartphone gaming devices, and cloud gaming, among other technological developments.

Hence, 5G acts as a catalyst that is fueling the gaming industry's flourishment.

RESTRAINING FACTORS

Restrictive Legislation and Unclear Regulations Regarding Skill Gaming Impede the Market Development

Rules and legislation regarding different industries vary from country to country in various regions. These are also termed barriers to entry, meaning any factors or laws that impede or prevent specific technological development or newcomers into an industry or market, thus limiting the growth of that industry in that region. When it comes to skill-based games, they are also often confused with gambling, which is restricted in several countries. While games of pure chance are constrained under most laws, there is a confused perception regarding skill-based games containing a major element of skill that depends on chance and the extent.

Skill Gaming Market Segmentation Analysis

By Skill Type Analysis

Increasing Demand for Smartphones and Advances in Internet Technology to Boost the Segmental Growth

The market is categorized into physical and mental based on skill type.

Mental segment holds a major market share of 76.65% in 2026 and the highest CAGR during the forecast period. Increasing demand for smartphones, advances in internet technology, and the rising purchasing power of users are some factors driving the growth of the mental skill games market. As a result of the digital revolution, the prevalence of cloud platforms for storing data has led to a rapid increase in online transactions and customer payments. Physical segment is growing at a considerable CAGR during the forecast period (2023-30).

By Game Genre Analysis

To know how our report can help streamline your business, Speak to Analyst

Board Based Segment to Dominate due to Consumers' Tendency to Switch to Alternative Board Games

By game genre, the market is categorized into card based, board based, dice based, tile based, word and number-based, and puzzle based and animated games.

The card based segment led the market accounting for 29.98% market share in 2026. Board based segment contributed to a significant market share in 2024 due to consumers' tendency to switch to alternative board game products, which has increased significantly over the past five years. Gaming innovation plays a key role in the undersupplied board game market of the region. Further, one advantage of board games over video games is their higher value proposition to the general public and investors. Tile based segment is expected to grow at the highest CAGR during the forecast period (2023-2030).

REGIONAL INSIGHTS

The market has been segmented into major regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Skill Gaming Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 12.81 billion in 2025 and USD 14.47 billion in 2026. North America dominated with the highest skill gaming market share in 2024. The North America gaming market has experienced exceptional growth in recent years due to the proliferation of mobile devices and the availability of new consoles in North America. The U.S. is one of the largest markets in the gaming industry and has the most extensive game library available to the public. Increasing affordability for people in the region and a strong economic backbone coupled with modern technology are driving the market growth. Further, augmented reality is seamless for mobile gaming due to its immersive and interactive technology. Thus, North American vendors are creating a number of new entries in the category. The U.S. market is projected to reach USD 8.75 billion by 2026.

Europe

Europe is expected to grow with a notable CAGR during the forecast period. The popularity of esports in Europe has spurred the market growth due to its competitiveness. The growth of the gaming sector has led to the development of new gaming platforms, such as subscription-based services and cloud gaming, that give players access to various games. Moreover, increased investment in the gaming industry has led to funding for gaming start-ups and the development of new technologies. For instance, In April 2023, MYSTiC GAMES, the game developer, invested USD 1.30 million in a seed funding round to create a unique multiplayer mobile gaming experience powered by blockchain technology. The UK market is projected to reach USD 1.59 billion by 2026, while the Germany market is projected to reach USD 1.85 billion by 2026.

Asia Pacific

Asia Pacific is the fastest-growing region for skill-based gaming. The need for regulations arose after increased money laundering and addiction incidents from skill gaming. India is one of the world's top four gaming markets in Asia Pacific. The gaming industry welcomed the move as the regulatory certainty lends legitimacy. Thus, it expands the scope of investment in skill gaming while protecting the interests of experienced players in Asia Pacific. The Japan market is projected to reach USD 4.86 billion by 2026, the China market is projected to reach USD 6.31 billion by 2026, and the India market is projected to reach USD 2.5 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa and South America are growing at a considerable CAGR during the forecast period. The industry has witnessed many innovations from vendors such as increased use of technology as providers integrate digital components into their games to enhance the gaming experience. Regional providers focus on introducing new themes and mechanics to create engaging experiences.

KEY INDUSTRY PLAYERS

Companies are Focused on Partnerships and Expanding their Product Offerings

Companies form strategic alliances and collaborations to enlarge the business, products, technologies, and other offerings with year-on-year revenue growth. Partnerships and collaborations vary per the business requirements, such as the enlargement of the product portfolio, which helps expand the global presence and acquire a new customer base. Market players such as FanDuel, Dream11, Skillz, and GameTaco, among others, form alliances with other players to streamline and nurture their business portfolios. For instance,

- March 2022: FanDuel partnered with Game Taco to introduce FanDuel Faceoff over the iOS platform. The FanDuel Faceoff includes advanced dedicated dimension games in its offerings. The collaboration between the two firms is a multi-year deal. It provides FanDuel's consumers access to Game Taco's content library, which comprises licensing deals with brands such as Trivial Pursuit, Scrabble, and more.

List of Top Skill Gaming Companies:

- Skillz, Inc. (U.S.)

- Arkadium, Inc. (U.S.)

- AviaGames, Inc. (U.S.)

- GameDuell GmbH (Germany)

- GSN Games (U.S.)

- Junglee Games (U.S.)

- Big Fish Games (U.S.)

- Sports Technologies Private Limited (India)

- Triumph LLC (U.S.)

- Game Taco Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Big Fish Games, a casual game developer, announced plans to launch a studio in New Orleans to tap into Louisiana's growing creative tech sector. The company aims to exceed 40 employees in New Orleans over the next few years. It is partnering with GNO, a regional economic development non-profit, to establish relationships with local universities and digital training schools. Such partnerships will also expand the company's diversity, equity, and inclusion initiatives to deploy a diverse and inclusive talent pipeline.

- March 2023: AviaGames launched Pocket7Games WebGame, a mobile browser-based game solution, enabling gamers to enjoy Pocket7Games titles without requiring an app download. The move is part of the company's expansion plans, aiming to distribute Pocket7Games' selection of skill gaming to more players and create an inclusive gaming space.

- March 2023: Dream11 partnered with Legends League Cricket as the Official Fantasy Partner for the LLC Masters tournament. The tournament featured three teams - Asia Lions, India Maharajas, and World Giants - and showcased renowned cricketers for ten days at the Asian Town Cricket Stadium in Doha, Qatar, which resulted in increased reputation and business growth.

- February 2023: Arkadium has partnered with The Portugal News to offer readers free, high-quality online games. The games were organized into categories such as word, card, puzzles, casino, and arcade games and accessible through desktops, laptops, tablets, and phones. The selection included classic games such as chess, die-based games, backgammon, brain teasers, such as crossword puzzles and Sudoku, and casino slots and Mahjongg for leisure play.

- February 2022: Mobile Premier League (MPL), a sports and skill gaming app, has acquired Germany-based GameDuell to expand its European presence and enter the mobile free-to-play gaming market. The terms of the deal were not disclosed. However, it enabled MPL to operate in Europe, Asia, and North America. The company offers over 40 online skill games in seven languages. It has raised more than USD 17.0 million from investors, such as Wellington Partners and Burda Digital Ventures, since its founding in 2003.

REPORT COVERAGE

The global skill gaming market research report highlights leading regions worldwide to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers some drivers and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Skill Type

By Game Genre

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global size market is projected to reach USD 121.57 billion by 2034.

In 2025, the market value stood at USD 46.39 billion.

The market is projected to grow at a CAGR of 11% during the forecast period.

Turbocharging the gaming speed of the 5G network enhances the development of skill-based games.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us