Solar Carport Market Size, Share & Industry Analysis Report, By Type (One-Row Vehicle Arrangement Carport, Two-Row Vehicle Arrangement Carport, and Two-row Dual Slope Vehicle Arrangement Carport), By Capacity (Less than 500 kW, 500 kW to 1 MW, and Above 1 MW), By Design (T-frame Structures and V-frame Structures), By Application (Commercial and Others) and Regional Forecast, 2025-2032

Solar Carport Market Analysis (2025-2032)

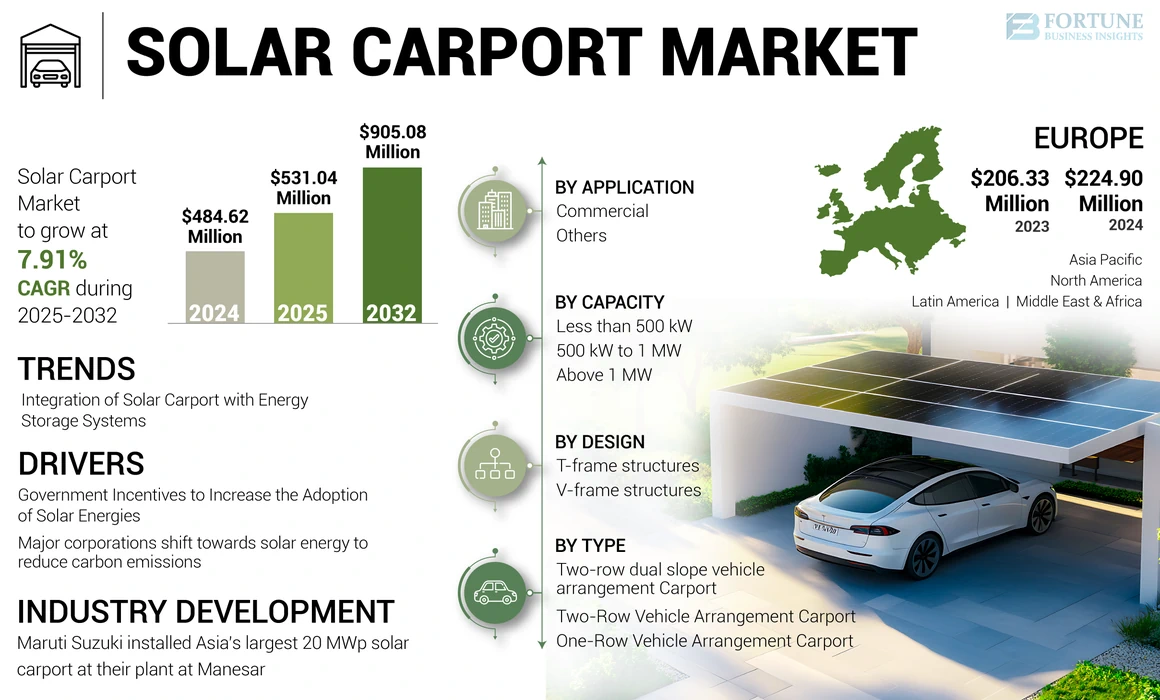

The global solar carport market size was valued at USD 484.62 million in 2024 and is projected to grow from USD 531.04 million in 2025 to USD 905.08 million by 2032, exhibiting a CAGR of 7.91% during the forecast period. Europe dominated the global solar carport market with a 46.40% market share in 2024.

In a solar carport, solar panels or modules are installed over parking spaces. The canopy area is slightly sloped, providing a perfect platform for the seamless mounting of solar panels and adding to the aesthetics of the car park. The electricity generated by these carports is immediately available for on-site use. These carports now have charging infrastructure for charging electric vehicles, which accounts for a significant portion of clean energy transactions. For shade and protection, it is used very well.

The growing integration of smart charging technologies and grid-connected systems is accelerating the solar carport market. The use of IoT-based energy management platforms allows for real-time monitoring and load balancing, resulting in optimal energy utilization for electric vehicles and nearby facilities. This digitalization trend, aided by favorable renewable energy policies, is expected to improve operational efficiency and drive widespread adoption of solar carport infrastructure worldwide.

The COVID-19 pandemic led to disruptions in global supply chains, affecting solar components and equipment production and delivery. Restrictions on international trade and factory closures caused delays in the manufacturing and installation of these types of carport systems. Subsequently, several solar PV carport projects get delayed or put on hold due to lockdowns, travel restrictions, and social distancing measures. Moreover, some governments had to redirect their resources and attention toward managing the pandemic, causing delays or changes in renewable energy policies and incentives.

Solar Carport Market Trends

Integration of Solar Carport with Energy Storage Systems to Spur Market Opportunities

Solar carport installations were becoming more scalable and modular, allowing for easy expansion and customization based on specific energy needs. This flexibility made them suitable for various applications and site requirements. Nowadays, PV carports can incorporate battery storage systems to store excess energy generated during the day. This stored energy can be used during high demand or power outages, providing backup power and enhancing grid resilience. For example, in April 2023, Six Flags partnered with Solar Optimum & DSD Renewables to install a 12.37 MW solar-based carport and battery storage system in Los Angeles. Integrating carports with energy storage systems opens up new market opportunities for this industry.

The growing adoption of electric vehicles (EVs) and increased investment in decentralized renewable power systems are driving up demand for hybrid solar carports in commercial and municipal infrastructures. As governments set zero-emission mobility targets, the solar carport market is positioned as a critical enabler of sustainable urban energy ecosystems, linking solar generation and e-mobility infrastructure expansion.

Download Free sample to learn more about this report.

SOLAR CARPORT MARKET GROWTH FACTORS

Government Incentives to Increase the Adoption of Solar Energies Aid Market Growth

Many governments and local authorities provide incentives and support for renewable energy projects, including solar carports. These incentives can include tax credits, grants, rebates, or favorable net metering policies that make PV carport installations financially attractive. For example, in 2020, the French Senate passed a bill making solar panels mandatory in car parks with at least 80 spaces. From July 2023, car parks with 80 to 400 spaces must meet this requirement within five years. Properties with more than 400 parking spaces must achieve this goal within three years from July 2023. At least half of the area of a parking lot must have solar panel systems. According to the government, this plan could generate 11 GW of electricity.

In addition, at the 2023 PV Symposium in Bad Staffelstein, Germany, Fritz Haider from the Fraunhofer Institute for Solar Energy Systems ISE demonstrated Germany's large, untapped parking lot PV potential. With this, the government wants to create incentives for these carports as clean energy sources to boost market growth.

The growing alignment of public policy with net-zero emission targets in the European Union and Asia-Pacific is driving up solar carport investment. National renewable energy agencies are increasingly incorporating solar carports into smart city infrastructure plans and e-mobility programs. These developments are expected to increase deployment rates and sustain demand in both developed and emerging economies.

Major Corporations Shift towards Solar Energy to Reduce Carbon Emissions to Propel Market Growth

Solar carports are being widely adopted across various sectors, including commercial and industrial facilities, parking lots, and residential complexes, with growing demand for renewable energy to reduce carbon emissions and the need to maximize space utilization. This has resulted in integrating solar carports in electric vehicle (EV) charging stations, enabling EV owners to charge their vehicles while taking advantage of solar power conveniently.

For example, in April 2023, iSun, Inc., one of the leading solar energy and clean mobility infrastructure companies, received a 2.2 MW solar carport contract to one of the nation’s largest financial institutions in Ohio for USD 7.7 million. The project highlights Sun’s ability to originate projects and create value for new customers, including through turnkey engineering services with growing EV Infrastructure. It is scheduled to begin by the second quarter of 2023.

In November 2023, Plymouth Marine Laboratory (PML) started the operation of a new solar photovoltaic carport in England. This installed carport is projected to save 65 tons of carbon dioxide each year. Moreover, this project aligns with its commitment to achieving Net Zero carbon for PML activities by 2040, which aligns with the UKRI environmental sustainability strategy.

Corporate ESG strategies and renewable energy procurement commitments are driving widespread adoption of solar carport infrastructure among global businesses. Multinational corporations in the automotive, technology, and retail sectors are increasingly collaborating with clean energy developers to integrate solar carports into corporate campuses and logistics hubs, bolstering the global solar carport market's long-term sustainability prospects.

RESTRAINING FACTORS

Space Constraints and Structural Considerations Likely to Hinder Solar Carport Market Growth

Solar carports, which provide shelter for vehicles while incorporating solar panels to generate electricity, have gained popularity as a sustainable solution for renewable energy generation. However, space and site constraints and structural considerations likely hinder the market growth. For instance, PV carports require substantial space to accommodate vehicles and solar panels. Finding suitable locations with sufficient space for installation can be challenging, especially in urban areas with limited land availability.

Additionally, existing parking lots or structures may need retrofitting to accommodate solar panels, which can add to the overall cost and complexity. Subsequently, these carports must be designed to withstand various environmental factors such as wind, snow loads, and seismic activity. Ensuring the structural integrity of the carport while incorporating solar panels requires careful engineering and design considerations. Retrofitting existing carports to support the additional weight of solar panels can be technically challenging.

The high initial installation costs and lengthy payback periods for large-scale systems continue to be significant challenges for small and medium-sized businesses. In emerging markets, inconsistent policy frameworks and limited access to financing slow the growth of the solar carport market, particularly in the commercial and municipal segments.

SOLAR CARPORT MARKET SEGMENTATION ANALYSIS

By Type Analysis

Two-row Dual-slope Vehicle Arrangement Carport Segment Dominates the Market Owing to Growing Adoption in Commercial Application

Based on the type the market can be segmented based on type into one-row vehicle arrangement carports, two-row vehicle arrangement carports, and two-row dual slope vehicle arrangement carports. Two-row vehicle arrangement is a type of carport with two tracks. It is best suited for commercial use as it is compact and accommodates multiple vehicles, one of the most widely used types of carport. For context, in March 2022, PowerPark installed their customized two-row PV carport with a capacity of 5.6kW, and the structure can accommodate two vehicles. Based on this factor, the two-row vehicle segment will dominate the solar carport market forecast timeframe.

On the other hand, a one-row vehicle arrangement is a type of carport with only one row/car of parking spaces. It is generally smaller than two-row vehicle arrangement carports and is best suited for narrow lots, pathways, fenced areas, multi-family, retaining walls, affordable housing, and other purposes. With the growing adoption of passenger electric cars, the one-row vehicle arrangement structure will likely experience significant adoption.

The structural innovation landscape is being shaped by an emerging demand for modular solar carport configurations and a growing emphasis on dual-use land optimization. Developers are increasingly favoring scalable dual-slope systems capable of supporting both solar generation and EV charging infrastructure, a trend expected to significantly increase installation rates in the global solar carport market over the next decade.

By Capacity Analysis

Above 1 MW Segment to Grow Rapidly Led by Rising Commercial Applications

The market is segregated based on capacity into less than 500 KW to 1 MW, 500 KW, and above 1 MW.

Above 1 MW capacity solar carports are the largest installed carport capacity majorly across the commercial sector, resulting in the dominating market share for the global market. For example, in April 2023 iSun, Inc. announced that it had received a 2.2 MW contract to provide a solar carport to one of the nation’s largest financial institutions in Ohio. This contract expands iSun’s growing EV infrastructure presence into the Ohio market.

Subsequently, less than 500kw and 500kw to 1 MW segments are expected to grow during 2023-2030 due to their increasing use in the industrial and residential segments. For example, in June 2022, Greenskies Clean Focus completed 258 kW of carports at two schools in Connecticut.

The rise of community-scale renewable projects, as well as corporate sustainability goals, is driving demand for larger installations, particularly those over 1 MW. This segment is being boosted by power purchase agreements (PPAs) and renewable energy mandates, which are positioning large-scale systems as a critical component of the global solar carport market expansion.

By Design Analysis

The T-frame Structures Segment Dominates the Market Owing to Wider Coverage Area

On the basis of design, the market share is segmented into V-frame and T-frame. The T-frame segment dominates the market share owing to wide application in commercial spaces like multi-story car parks and paid-for parking for customers owing to minimum ground footprint with heavy-duty construction and a framework that allows unhindered opening of car doors results in its wide adoption.

Furthermore, the V-frame features lightweight and cost-effective steel frames that are adopted and positioned between standard 2.4m car park bays with a typical three-bay span. This results in majorly installing a V-frame structure carport across the residential sector.

Manufacturers are combining corrosion-resistant materials with advanced structural coatings to improve durability and lifecycle performance. This engineering advancement is expected to reduce maintenance costs and increase overall installation cost efficiency, boosting the T-frame design segment's competitiveness in the global solar carport market.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Application Holds Dominating Market Size Owing to Increasing Installation

Based on application, the market is segmented into commercial and other applications. The commercial segment leads the market due to the demand growth for PV carports from various commercial spaces such as institutions, including hotels and restaurants, educational institutes, healthcare facilities, and sports complexes. For example, in December 2022, Servotech Power Systems announced that it had inked a pact with the National Solar Energy Federation of India (NSEFI) to install a solar-powered electric vehicle (EV) charging carport at the Ministry of New and Renewable Energy premises in Delhi.

The other segment includes residential and industrial, which will likely experience considerable growth in the forthcoming period. Factors such as the increasing adoption of clean energy and solar-powered carports being a great alternative for homeowners and industries are driving segmental growth. For example, in January 2023, SunPower signed a new agreement with Metonic to power the Millennium Apartments in California. This project includes approximately 2,200 solar panels, 18 solar carports, and dozens of electric vehicle charging stations, which could serve as an additional revenue stream for the developer. This 330-unit gated community will help meet the increasing demand for housing in and around the Coachella Valley.

Furthermore, rapid urbanization and an increase in green building certifications in commercial real estate are accelerating solar carport deployments. The integration of EV charging networks into corporate and public parking infrastructures is expected to drive strong growth in the commercial application segment, reinforcing its leadership position in the global solar carport market.

REGIONAL INSIGHTS

The market analysis is studied across Europe, North America, Latin America, Asia Pacific, and the Middle East & Africa based on regional analysis.

Europe Solar Carport Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The U.S. solar carport market was valued at USD 44.26 million in 2022, is expected to growth with a CAGR of 8.21% during the forecast period, driven by increasing demand for sustainable energy solutions.

Europe is the leading region in the global market. There is a high number of offerings from commercial solar developers to consumers in the form of large project sizes and significant electricity savings. Furthermore, the market is growing due to the growing awareness of solar energy and its advantages. The increase in the production of electronic vehicles is an important factor boosting the market growth in Europe.

In February 2023, EU’s Directorate General for Mobility and Transport (DG MOVE) approved the setup of an international public-private group called SolarMoves along with TNO (The Netherlands Organization for Applied Scientific Research), Fraunhofer Institute for Solar Energy Systems, Sono Motors, and IM Efficiency. The group will address how solar-powered vehicles can further support the complete transition to an all-electric transport system in the EU.

The increased number of electronic vehicles produced mainly drives the North American market. The government’s support for Renewable Energy is a major factor in this market. For example, in December 2020, it was announced that the North American Union law is to support rapid solar installations to address calls from its citizens and industries for a solution to the energy crisis. To apply these regulations, North American countries will define artificial structures, including buildings, industrial and brownfield sites, and transport infrastructure such as carports, motorways, and railways. The US solar carport market is projected to grow significantly, reaching an estimated value of USD 87.06 million by 2032, driven by the growing adoption of electric vehicles and government incentives to encourage adoption of solar power.

The rising number of research activities in the Asia Pacific region in countries such as China, India, and Japan is expected to exhibit a higher growth rate during the forecast period. Due to rapid urbanization, there is an increase in the number of residential buildings that will boost demand during the forecast period. Various solar projects are under construction for the countries to prioritize green energy goals. For example, in April 2023, The Chinese government announced a target of 160 GW of new solar and wind capacity to be added by 2023. By 2023, non-fossil energy will account for more than 50% of China's power generation capacity.

Additionally, emerging markets across Latin America and the Middle East are witnessing rising investments in decentralized renewable energy infrastructure. Countries such as Brazil, the UAE, and Saudi Arabia are incorporating solar carport installations into large-scale smart city and mobility projects. This expansion highlights the growing global relevance of the solar carport market, supported by regulatory initiatives and regional decarbonization agendas.

List of Key Companies in Solar Carport Market

Key Players Prioritize Product Enhancements to Meet Rising Demand

The global market consists of various small and medium-sized key market players who offer solar carports as per the requirement for multiple applications. Numerous players are active across the globe, intending to meet the increasing demand in the commercial and industrial sectors, resulting in a highly competitive landscape. For example, FlexiSolar has built one of the U.K.'s largest commercial solar carports for Bentley Motors' manufacturing centre in Crewe, Cheshire. The company has used its V-Frame Double Row Mono Pitch carport design. The carport system has an output of 2.7 MW and can supply 24% of Bentley's electrical energy needs and reduce CO2 emissions by 3,300 tons annually.

Leading manufacturers are focusing on digital integration and predictive maintenance capabilities in carport systems to improve performance efficiency. Partnerships between EPC providers and EV charging technology companies are reshaping the competitive dynamics of the solar carport market, driving innovation and increasing deployment potential in both mature and emerging markets.

LIST OF KEY COMPANIES PROFILED:

- Tata Power (India)

- Antai Technology Co. Ltd (China)

- Kokko Shisetsu Kogyo Co., Ltd (Japan)

- Cenergy Power (U.S.)

- Positive Energy Solar (U.S.)

- CHIKOUSA (U.S.)

- RenEnergy Ltd. (U.K.)

- SunPower Corporation (U.S.)

- Flexisolar (U.K.)

- Schletter (Germany)

- Quest Renewables, Inc. (U.S.)

- Xiamen Mibet New Energy Co., Ltd (China)

- EvoEnergy (U.K)

- KDC Solar LLC (U.S.)

- Enova (UAE)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 - The port authority of New York and New Jersey (PANYNJ) announces a deal with TotalEnergies to begin constructing New York’s largest solar carport project at John F Kennedy International Airport in 2023.

- June 2022 - Maruti Suzuki installs Asia’s largest 20 MWp solar carport in their plant at Manesar. The initiative will contribute 28,000 MWH2 annually to the company’s energy requirements.

- January 2022 – Antai Technology Co. Ltd has shipped 5,036MW of solar systems, taking a record-breaking share in the major solar industry market.

- April 2021 - Sol Systems has completed 6.5MW of solar arrays at seven Walmart stores in California. The portfolio includes a mix of rooftop and parking lot carport solar panels. Retail will consume all the energy. Sol Customer Solutions, a unit of Sol Systems, a joint venture with global infrastructure investment firm Capital Dynamics, developed the portfolio. The construction of the projects started in 2020.

- March 2021 - IKEA has completed a 1.35 MW solar carport in Baltimore, Maryland, US. It plans to build seven more similar projects at other U.S. stores in partnership with New York-based Distributed Solar Development (DSD). These solar carports will help IKEA achieve its target of being powered by 100% renewable energy while increasing energy efficiency by 2025.

- January 2020 - Solarfields and MOJO have constructed the world’s largest solar carport, Lowlands car park, Dronten, Netherlands, and it will cover an area of 35 hectares. The carport comprises 90,000 solar panels producing around 35,000,000 kWh of electricity annually.

REPORT COVERAGE

The market research report presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the market research report. Furthermore, the report covers a detailed analysis of market segments, including applications and regions, helping our readers get a comprehensive global industry overview.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.91% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Design

|

|

|

By Capacity

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per Fortune Business Insights, the global market was valued at USD 484.62 million in 2024.

The global market is projected to grow at a CAGR of 7.91% over the forecast period.

The market size of Europe was valued at USD 224.90 million in 2024.

Based on movement, the commercial application segment holds the dominating share in the global market.

The global market is expected to reach USD 905.08 million by 2032.

The key market drivers are the growing adoption of renewable and green energy targets that fuel investments in the solar industry.

The top players in the market are SunPower Corporation, Tata Power, Flexisolar, Antai Technology Co. Ltd, and Schletter, among other players

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us