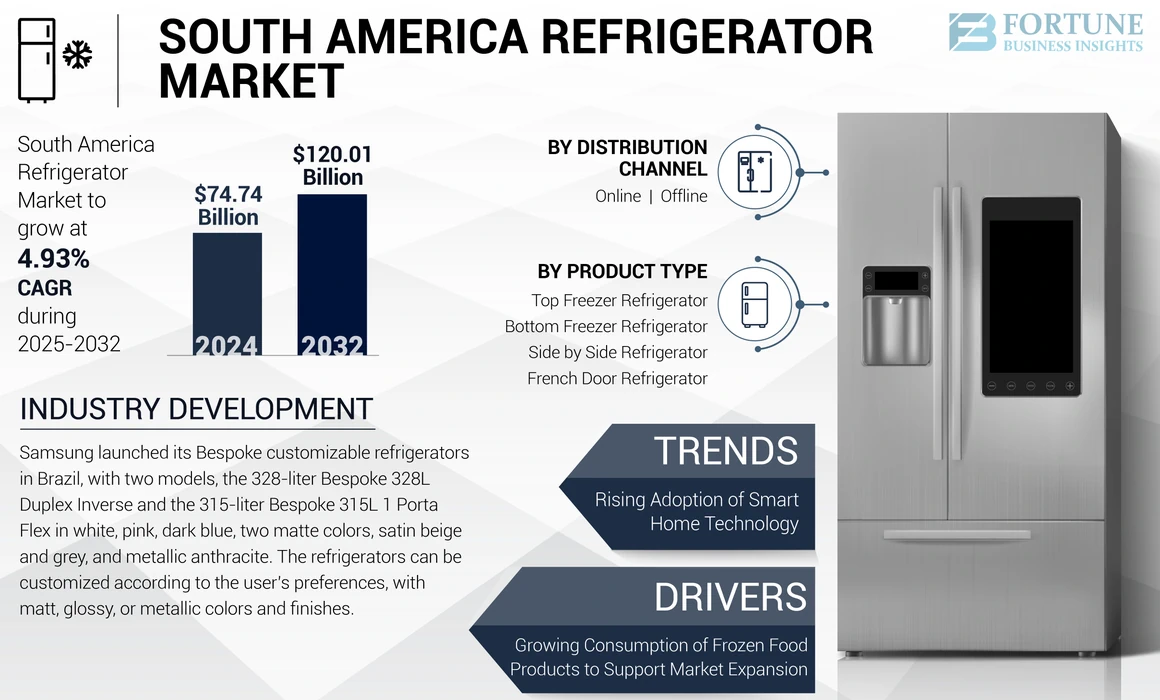

South America Refrigerator Market Size, Share & Industry Analysis, By Product Type (Top Freezer Refrigerator, Bottom Freezer Refrigerator, Side by Side Refrigerator, French Door Refrigerator), By Distribution Channel (Online, Offline), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

South America is the fourth largest region in the global refrigerator market. The South America refrigerator market size is projected to grow at a CAGR of 4.93% during the forecast period. The global market of refrigerator is projected to grow from USD 74.74 billion in 2024 to USD 120.01 billion by 2032.

The consumer spending of countries in this region experiencing surging progress toward home appliances products has escalated the consumption of refrigerators as consumers are progressively influenced by the latest products available. Furthermore, the urban population witnessing increasing growth over the years is a significant factor in strengthening the market. This is attributed to the fact that people in urban places are influenced by various promotional campaigns they see and hear regularly. The statistical data by the World Bank.Org states that 81.12% of the populace in Latin America and the Caribbean reside in urban areas. This constitutes an increase from 80.87% compared to the previous year.

The South America refrigerator market share covers the following countries/regions - Brazil, Argentina, and the rest of South America.

SOUTH AMERICA REFRIGERATOR MARKET LATEST TRENDS

Rising Adoption of Smart Home Technology

Consumer preference is shifting toward innovative multi-utility and energy-efficient products, surging the region's demand for smart and multi-functional home appliances. The demand for multi-feature appliances is growing owing to the increasing number of single-person/nuclear households, rising urbanization, and increasing consumer preference for saving cost and space. The growth of household appliances is increasing owing to the growing popularity, awareness, and energy-conserving appliances in the region. Smart home technology is one of the significant trends in this region. Manufacturers are introducing more connected home appliances, which offer customized functionalities for consumers' needs and preferences with smartphone apps and voice assistants with convenient control from anywhere in the home.

Manufacturers in South America are focusing on launching new products to garner more consumer base and to hold a strong foothold in the region. For instance:

- In August 2022, Samsung launched two models, 315L Porta Flex and 328L Duplex Inverse, of its Bespoke refrigerators in Brazil with customizable features and colors by consumers according to their tastes and preference.

- In August 2021, Toshiba launched its Lifestyle home appliance with a Greatwaves washing machine, SmartPlate microwave, and French Door Convert Zone refrigerator in Brazil.

OUTH AMERICA REFRIGERATOR GROWTH FACTORS

Growing Consumption of Frozen Food Products to Support Market Expansion

The significant growth in the middle-class population is driving the market growth of household appliances in Brazil, Argentina, Colombia, and other parts of South America. According to World Bank, household consumption in Brazil was USD 906.06 billion, in Argentina was USD 247.27 billion, and in Colombia was USD 189.69 billion in 2020.

- Rising consumer demand for newer kinds of home appliances mainly drives the consumption rate of the refrigerator in South America. The surging sales of residential units in South American countries are crucial for market enlargement. This can be attributed to consumers usually spending more on kitchen appliances for their new homes. For instance, the data released by the Global Property Guide mentions that Sao Paulo State in Brazil sold 4,341 new residential units in July 2020.

Moreover, continual governmental efforts to boost the FDI inflows and the economy will help the market sustain in the region. According to the World Investment Report 2020 published by the United Nations Conference on Trade and Development (UNCTAD), FDI inflows in Brazil reached USD 640,000 million in 2019, 20% up over 2018.

RESTRAINING FACTORS

To know how our report can help streamline your business, Speak to Analyst

Supply Chain Disruptions and Energy Consumption May Hamper the Market Growth

The rapid spread of COVID-19 pandemic has disturbed the South America refrigerator market growth, owing to the haul in the logistics system and fluctuation in the distribution network across the world. Moreover, labor shortages and shutdowns of retail stores also declined the sales volume of the entire market during the pandemic.

Higher electricity cost due to the usage of refrigerators is restraining the market growth. Additionally, the higher cost of technologically advanced washing machines will likely limit their demand among the middle & lower-income groups of the population. Higher repair & maintenance cost of such items is expected to limit their demand among South American consumers.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, Samsung Group, Haier Inc., Electrolux AB, and LG Corporation are the key players in the South America market due to their diversified product offerings and active involvement in R&D investments to accelerate product launches and approvals over the forecast period.

Other prominent players such as Hitachi, Ltd., Whirlpool Corporation, and Voltas Limited lead the market due to their robust distribution network and diverse product portfolio. Other significant players are Panasonic Holdings, Sharp Corporation, and Toshiba Corporation. These companies are focused on strengthening their product portfolio and distribution network through strategic collaboration and partnerships to increase their market share in the South America market.

List of Top South America refrigerator Companies:

- Haier Inc. (China)

- LG Corporation (South Korea)

- Samsung Group (South Korea)

- Whirlpool Corporation (U.S.)

- Voltas Limited (India)

- Electrolux AB (Sweden)

- Panasonic Holdings Corporation (Japan)

- Sharp Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- August 2022: Samsung launched its Bespoke customizable refrigerators in Brazil, with two models, the 328-liter Bespoke 328L Duplex Inverse and the 315-liter Bespoke 315L 1 Porta Flex in white, pink, dark blue, two matte colors, satin beige and grey, and metallic anthracite. The refrigerators can be customized according to the user’s preferences, with matt, glossy, or metallic colors and finishes.

- October 2022: Whirlpool announced opening a factory in Argentina with a USD 52 million investment and planning to export more than 70% of the local production. The plant implements cutting-edge technology in global manufacturing, allowing production development based on sustainable operations, ensuring the safety of workers and increasing product quality.

- September 2020: Electrolux Group relaunched its Continental brand of home appliances in the Brazil market, introducing a new generation of products. The product line includes stoves, cooktops, built-in ovens, refrigerators, microwaves, and ducted and ductless range hoods.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report provides qualitative and quantitative insights into the market and a detailed analysis of the South America market size & growth rate for all possible segments in the market. The report elaborates on the market dynamics and competitive landscape. The report presents various key insights: an overview of the number of procedures, an overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.93% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Product Type, Distribution Channel, and Country/ Sub-Region |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By Country/ Sub-Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the South America refrigerator market is projected to grow at a CAGR of 4.93% during the forecast period. This makes it the fourth-largest regional market globally, contributing to the global refrigerator market, which is expected to rise from USD 74.74 billion in 2024 to USD 120.01 billion by 2032.

Key drivers include urbanization, rising middle-class consumption, increased demand for frozen and convenience foods, and a growing preference for smart and energy-efficient appliances, particularly in countries like Brazil, Argentina, and Colombia.

Emerging trends include the adoption of smart home technology, customizable refrigerators, and multi-functional appliances that cater to nuclear families and compact living spaces. Samsungs Bespoke refrigerator launch in Brazil highlights the regional interest in personalization.

Brazil is the leading country in the region, followed by Argentina and Colombia. Brazil, in particular, is seeing high residential sales, increased household consumption, and growing demand for innovative appliances.

Major players include Samsung Group, LG Corporation, Haier Inc., Whirlpool Corporation, Electrolux AB, and Panasonic Holdings. These companies invest heavily in R&D, product innovation, and local manufacturing to capture market share.

With over 81% of Latin Americas population living in urban areas, urban consumers are more exposed to advertising, new technologies, and modern lifestyle needs, resulting in increased demand for advanced refrigeration solutions.

Yes, customizable models like Samsungs Bespoke series, which allow users to choose colors and finishes, are gaining popularity among style-conscious consumers who seek both functionality and aesthetics.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us