STATCOM Market Size, Share & Industry Analysis, By Rated Power (Low Power STATCOM, Medium Power STATCOM, and High Power STATCOM), By End-User (Utility, Steel Manufacturing, Renewable Energy, Mining, Hydrogen Power Plant, and Others), and Regional Forecast, 2026-2034

STATCOM Market Size

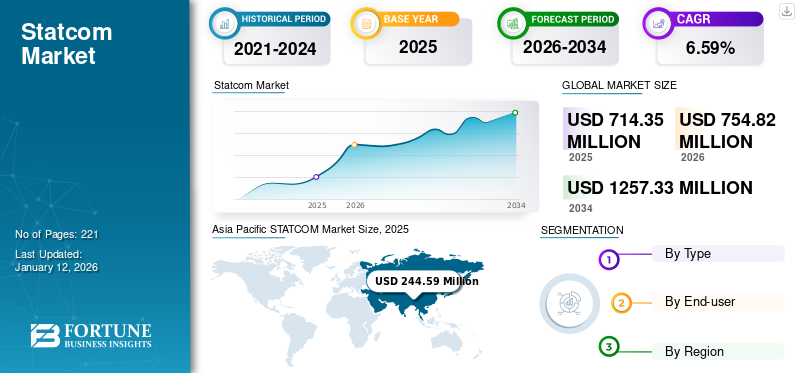

The global STATCOM market size was valued at USD 714.35 million in 2025. The market is projected to grow from USD 754.82 million in 2026 to USD 1,257.33 million by 2034, exhibiting a CAGR of 6.59% during the forecast period. Asia Pacific dominated the global market with a share of 34.24% in 2025. The Statcom market in the U.S. is projected to grow significantly, reaching an estimated value of USD 182.64 billion by 2032, driven by the increasing demand for power transmission and HVDC systems.

A STATCOM (Static Synchronous Compensator) is a shunt-connected, reactive compensation device applied in the transmission networks to provide or absorb reactive current and regulate voltage at the point of connection to a power grid. It utilizes force-commutated devices such as IGBT, GTO, and others, to control the reactive power flow through a power network, thereby increasing the stability of the power network. The robust growth in the renewable energies has necessitated the demand for STATCOM for stabilizing the electric grid and combat intermittency, further enhancing the market growth.

The market has witnessed significant growth owing to a substantial increase in smart grid infrastructure development and smart meter roll-outs, which are set to boost the pace of industry expansion. For instance, in January 2022, the U.S. Department of Energy launched the “Building a Better Grid” initiative to catalyze the countrywide development of upgraded and new high-capacity electric transmission lines. The initiative would involve industry and community stakeholders to identify the needs of national transmission and support the buildout of high voltage. These long-distance transmission facilities are crucial for achieving the goal of 100% clean electricity by 2035. Such government initiatives are anticipated to propel the product adoption in the coming years.

The global impact of COVID-19 on this market is moderate. The pandemic hampered the growth rate of the market, affecting power grid installation due to disruption of the raw material supply chain and hindrance in business activities due to social distancing norms. The imposition of travel restrictions hampered the rail sector, affecting the progress of electrification projects. The slowdown of industrial activity hampered steel demand, affecting production and the STATCOM adoption in the steel manufacturing sector. Amid increasing efforts for renewable energy development over the COVID-19 period, the requirement for robust power grids became evident. The global countries witnessed huge investments and expansion plans for the renewable energies by the government of their respective government which creates a positive impact on the STATCOM market. The requirement for STATCOM subsequently grows for stabilizing the power grids.

STATCOM Market Trends

Growing Renewable Energy Demand Globally to Escalate the Product Requirement

Globally, the demand for renewable energy is increasing at a steady pace. The governments of numerous countries across the globe have started focusing on increasing clean electricity generation to limit carbon emissions. For instance, the 28th Conference of Parties (COP28) of the United Nations Framework Convention on Climate Change (UNFCCC), held in Dubai (30th November- 12th December 2023), called for agreement on a global target of tripling renewable energy capacity from current levels by 2030. The switch to renewable energies, especially wind power, requires additional overland lines capable of transporting electricity over long distances. Power supply bottlenecks have to be eliminated. Moreover, the technical basis has to be established to account for the fact that electricity trading is increasingly carried out across borders. Considering this, grid operating companies have increased investments in developing robust power grids, accelerating the adoption of STATCOMs.

According to the Long-Term Strategy of the U.S.: Pathways to Net-Zero Greenhouse Gas Emissions by 2050, the country has set a goal of 100% clean electricity by 2035, a crucial foundation for net-zero emissions no later than 2050. The decarbonization targets of the U.S. have led to the development of various on-grid renewable energy power generation, transmission, and distribution systems. Efforts are being made for voltage regulation, ensuring the power grid's reliability as renewable energy sources are brought online, enabling further decarbonization of the country's energy mix. This is expected to enhance product demand in the country.

Download Free sample to learn more about this report.

STATCOM Market Growth Factors

Increased Focus on Voltage Stability to Drive the STATCOM Market Growth

In power systems, maintaining voltage stability is one of the biggest problems. Flexible AC Transmission System (FACTS) devices are being utilized to overcome voltage instability problems. These are new devices originating from technologies capable of altering phase angle, impedance, and voltage at particular points in power systems. Their fast response offers a high potential for the enhancement of power system stability apart from steady-state flow control. Voltage stability problems typically occur in heavily loaded systems. This condition can be handled by increasing the generation or reducing the transmission losses. Henceforth, voltage stability must be improved by providing suitable reactive power compensation. During contingency events, STATCOM provides fast-acting dynamic reactive compensation for voltage support. The solutions are extensively adopted to ensure voltage stability.

Government-backed Transmission & Distribution Network Expansions to Boost Market Growth

WorldBank’s Tracking SDG7: The Energy Progress Report states that the share of the world’s population with access to electricity rose from 83% in 2010 to 91% in 2020, increasing the number of people with access by 1.3 billion globally. The number without access declined from 1.2 billion people in 2010 to 733 million in 2020. With increased digitalization and urbanization, the demand for remote electrification has increased manifold. The growing efforts by governments to develop robust transmission and distribution lines for electricity supply to remote locations are anticipated to drive product adoption. In October 2023, the extension of transmission lines picked up stride and a total of 1,820 ckm was set up, almost twice the target of 962 ckm. The government is looking at expanding and upgrading the transmission system to as it looks to integrate 500 GW of renewable-energy capacity by 2030.

RESTRAINING FACTORS

High Costs incurred in STATCOM Installation May Open the Substitute Pathways

Traditionally, a two-level Voltage Source Inverter (VSI) with a series coupling inductor is used as the main building block of the static compensator. However, the output voltage of the VSI is characterized by high harmonics that require bulky and costly filters. Furthermore, for high and medium-voltage interconnections, it is mandatory to use the line frequency step-up transformer to match the output voltage of the VSI with the utility grid. This increases the cost, size, weight, and power losses of the overall solutions and affects the system dynamics. The product adoption may also be affected by the high usage of its substitute product, Static Var Compensator (SVC).

Even though STATCOM is more effective in improving the transient stability and transmission limit and damping low-frequency oscillation, its comparatively higher cost is a significant disadvantage.

STATCOM Market Segmentation Analysis

By Rated Power Analysis

Rising Need for Voltage Stabilization Leads the market Growth for Medium Power STATCOM

Based on rated power, the global market is categorized into low power STATCOM (less than 20 Mvar), medium power STATCOM (20-100 Mvar), and high power STATCOM (greater than 100 Mvar).

The Medium Power STATCOM (20-100 MVar) segment is anticipated to hold a dominant market share of 43.78% in 2026. The increasing requirement for voltage stabilization and support requirement for poor power factor in utility transmission and distribution is the prominent factor behind the maximum utilization of medium voltage solutions.

The growth prospect of low-power compensators is higher in the long run. Growing electricity consumption globally across residential, commercial, and industrial sectors increases electricity production. With the increased electricity production from renewable sources, the low voltage segment growth is steady in the long run.

High power compensators would also attain a steady growth in the forecast period as they are used to maintain voltage fluctuations and flickers of the electric furnace and increase the line transmission capacity of the hub substation of the electrical transmission system. Electric arc furnaces are used for steel manufacturing globally, so with their increased use, the product demand will also increase.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

The Rising Installations of Power Grids to Enhance the Utility Segment in the Market

Based on end-user, the STATCOM market is segmented into utility, steel manufacturing, renewable energy, mining, hydrogen power plants, and others.

In 2026, the utility segment is projected to lead the market with a 42.94% share. Increasing applications, including reactive power optimization of load-center substation and voltage stability, are driving the product requirement across utility (transmission and distribution) sectors.

Electricity generation from renewable energy, comprising wind, solar, and others, is increasing at a significant pace across the globe. Low voltage ride-through function in the wind and solar farms fuels the product demand across renewable energy sectors.

Additionally, the hydrogen power plants segment is estimated to grow considerably in the coming years owing to the growing application of hydrogen as a fuel and energy storage system. Hydrogen power plants are being established and gaining investments to store renewable electricity during times of peak or excess generation. The stored power can later be used during periods of peak demand, increasing the reliability and resilience of the power grid.

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific STATCOM Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 244.59 million in 2025 and USD 261.08 million in 2026. It is the largest region for electricity production and consumption due to the presence of a vast population. Additionally, the region has the largest capacity for renewable electricity generation. The region is also rich in steel manufacturing; many global and regional steel manufacturers operate across the Asia Pacific. An increase in electricity generation and renewable investment supported by various government initiatives has been the primary factor influencing the growing product demand across the region.

Europe is the second-largest market. An increase in smart grid infrastructure development in countries across the region, along with the growing demand for renewable electricity, is surging the product demand.

The North America market is driven by growing electricity consumption across industrial, commercial, and residential sectors. The region also focuses on increasing electricity generation from renewable sources such as wind and solar. Furthermore, the presence of leading manufacturers makes the region one of the prominent destinations.

The Latin America and the MEA region would also experience steady growth in the STATCOM market due to significant development in the renewable energies in GCC countries, Brazil, Mexico, and several others.

Key Industry Players

Demand from Renewable Energies and Other End Users has led to Significant Developments in the Technologies and Product Launches

The market is fragmented, with many players providing flexible AC transmission systems to various end-users. Leading manufacturers hold a dominating presence in high-demanding regions with the maximum need for shunt compensators. In addition, key players are actively operating globally and adopting organic and inorganic growth strategies to strengthen their positions in the market. Some players are focused on specific regions to cater to the increasing product demand across the utility and renewable energy sectors.

The competition among top players in the market is very high as they are targeting to capture the maximum STATCOM market share. Companies with unique offerings in terms of technology, portfolio, design, efficiency, and others would capture the maximum end-user attention amid the strong competition among the top-notch players. Industry players are considering to bring their products with extra benefits, advancements, and innovation. Besides, leading market players are focusing on developing low to medium-voltage solutions to cater to the upcoming demand from renewable end-users. In addition, they are focused on providing hybrid compensator systems for better grid stabilization.

List of Top STATCOM Companies:

- GE (U.S.)

- ABB (Switzerland)

- Ingeteam SA (Spain)

- Siemens (Germany)

- NIDEC (Japan)

- Hitachi Energy (Switzerland)

- Hyosung Heavy Industries Corporation (South Korea)

- Jema Energy (Spain)

- Mitsubishi Electric (Japan)

- Sieyuan (China)

- American Superconductor (U.S.)

- Rongxin Power Ltd (RXHK) (U.K.)

- NR Electric Co. (China)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 - TECO Electric & Machinery Co., Ltd. announced a contract worth USD 149.6 million with Taipower for the STATCOM engineering project in Changhua County. The project is set to be completed in the first half of 2027 and would consist of a step-up substation and a 161 kV STATCOM, totalling 400 MVAR in scale, half of Taipower's total STATCOM capacity.

- April 2023 - GE Renewable Energy’s Grid Solutions business won five FACTS (Flexible AC Transmission Systems), reflecting consumers’ confidence in GE’s technology to increase the controllability and power transfer capability of their alternating current grids. The agreement includes a FSC (Fixed Series Compensation) bank reconfiguration project for the Public Service Company of New Mexico (PNM) in the U.S. and a STATCOM project for the Saudi Electricity Company, which is one of the largest electricity producers in North Africa and the Middle East.

- February 2023 - Hitachi Energy established its factory in Chennai to meet the increasing demand for electricity. The new factory would manufacture advanced power electronics for HVDC Light®, HVDC Classic, and STATCOM, together with a MACH™ control and protection system. In addition, it would deliver advanced solutions to support the acceleration of energy transition, allowing Hitachi Energy to increase its manufacturing potential.

- September 2022 - GE agreed with Germany's transmission system operator (TSO) 50Hertz to deliver STATCOMs (Static Synchronous Compensators) in the coming years. Each STATCOM system would supply ±300 Mvar at Elia Group's 50Hertz Transmission GmbH (50Hertz) substation in Bad Lauchstadt.

- March 2022 - Hitachi Energy was nominated as a technology partner for the world’s lengthiest AC power-from-shore project in Norway. Using power from the mainland grid, which is renewable hydropower, minimizes NOAKA’s carbon footprint. To ensure the safe and reliable transmission of electricity, Hitachi Energy’s solution gathered two power quality technologies: a thyristor-controlled series of capacitors and high-performance STATCOM called SVC Light.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.59% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Rated Power

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights study shows that the global market was USD 714.35 million in 2025.

The global market is projected to a record CAGR of 6.59% during the forecasted period.

The Asia Pacific market size stood at USD 244.59 million in 2025.

Based on end-users, the utility segment holds a dominating share in the global market.

The global market size is expected to reach USD 1,257.33 million by 2034.

Increased focus on voltage stability for various end uses across the globe will drive the market growth.

GE, ABB, Siemens, and Hitachi Energy are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us