Sterilization Indicator Tape Market Size, Share & Industry Analysis, By Type (Steam Indicator Tapes and Hydrogen Peroxide Tapes), By End-user (Healthcare Facilities, Pharmaceutical & Medical Device Companies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

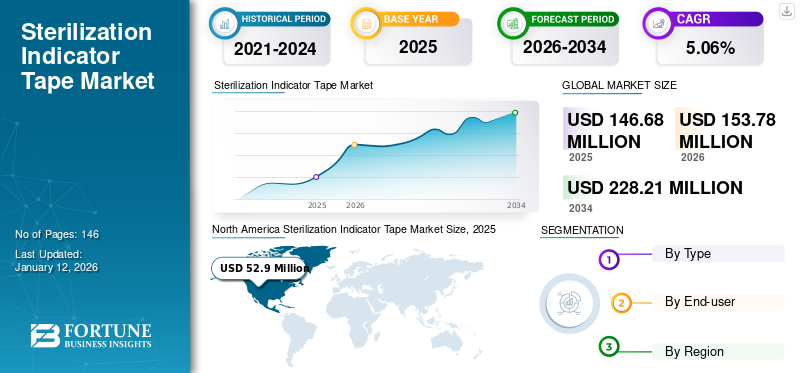

The global sterilization indicator tape market size was valued at USD 146.68 million in 2025 and is projected to grow from USD 153.78 million in 2026 to USD 228.21 million by 2034, exhibiting a CAGR of 5.06% during the forecast period. North America dominated the sterilization indicator tape market with a market share of 36.10% in 2025.

In the present scenario, there has been a sustained and intense need for efficient sterilization monitoring, especially in healthcare facilities. Due to the growing prevalence of Healthcare-Associated Infections (HAIs) and surgical-site infections (SSIs), the demand for sterilization monitoring products such as indicator tapes in healthcare facilities and pharmaceutical companies has increased, contributing to the sterilization indicator tape market growth.

- For instance, according to an article published by the University of Minnesota, the Standard Infection Ratio (SIR) for Central Line-associated Bloodstream Infection (CLABSI) increased by 47.0% in the fourth quarter of 2020 compared to the same period in 2019. Similarly, METHICILLIN-RESISTANT Staphylococcus AUREUS (MRSA) also increased by 33.8% in the same period. The rising incidence of such infections has led to the adoption of sterilization equipment such as sterilizers and indicator tapes.

Furthermore, stringent regulatory guidelines regarding the sterilization process in pharmaceutical manufacturing companies to avoid cross-contamination are expected to boost the global market growth during the forecast period.

The COVID-19 pandemic positively impacted the demand for sterilization processing. The number of sterilization procedures increased significantly because of the growing emphasis on the importance of sterile and infection-free medical instruments during dental practice and surgical procedures to avoid contamination, leading to the increased adoption of these indicator tapes.

However, as the number of COVID-19 cases reduced in 2021, healthcare facilities and biopharmaceutical companies adopted changes in their day-to-day operations. These changes led the market to fallback to its pre-pandemic level. The market is anticipated to witness consistent growth patterns over the forecast period.

Global Sterilization Indicator Tape Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 146.68 million

- 2026 Market Size: USD 153.78 million

- 2034 Forecast Market Size: USD 228.21 million

- CAGR: 5.06% from 2026–2034

Market Share:

- Region: North America dominated the market with a 36.10% share in 2025. This leadership is driven by the high adoption of sterilization products, a well-established healthcare infrastructure, an increasing number of hospitals, and stringent regulatory policies for medical device sterilization.

- By Type: The steam indicator tapes segment accounted for the largest market share. As the number of surgical procedures grows, so does the use of reusable instruments. Steam sterilization is the preferred and ""gold standard"" method for these instruments, which in turn drives the high demand for steam indicator tapes to validate the process.

Key Country Highlights:

- Japan: As a major market within the fast-growing Asia Pacific region, Japan is experiencing increased demand for sterilization indicator tapes due to rising pharmaceutical production and a growing emphasis on preventing hospital-acquired and surgical-site infections.

- United States: Growth is fueled by a high incidence of Healthcare-Associated Infections (HAIs), with significant increases noted for conditions like CLABSI and MRSA. Furthermore, substantial investment in pharmaceutical R&D and manufacturing, along with strict regulatory oversight, drives the consistent use of sterilization monitoring products.

- China: The market is expanding as part of the high-growth Asia Pacific region, supported by a rapid increase in pharmaceutical and medical device manufacturing. This industrial growth necessitates the use of validation products like indicator tapes to meet global quality and safety standards.

- Europe: The market is propelled by strict sterilization norms and regulatory policies, such as the new European standards for hydrogen peroxide sterilizers. The region's strong emphasis on preventing HAIs and ensuring the sterility of medical devices in its advanced healthcare system supports high adoption rates.

Sterilization Indicator Tape Market Trends

Strong Emphasis on Sterilization in Healthcare Facilities to Surge Demand for Sterilization Monitoring

Healthcare institutions, such as hospitals and speciality clinics, have adopted sterilization as an essential procedure in their day-to-day workflow. The instruments and devices used for surgical procedures are thoroughly sterilized. Furthermore, healthcare facilities have also started adhering to strict sterilization regulations to prevent hospital-acquired infections and avoid further medical complications.

Primarily, hospitals and clinics use steam autoclaves to sterilize surgical instruments such as scalpels, forceps, and lancets. Due to high efficiency, chemical indicator tapes are mainly used to validate the sterilization process to indicate a successful procedure. A successful sterilization process is critical as it helps avoid cross-contamination and prevents the transmission of diseases from patient to patient. It has been noted that failed sterilization processes lead to increased Hospital-Acquired Infections (HAIs), which can cause patient discomfort and hamper patient safety.

- For instance, as per a report published by TriMedika in March 2022, more than 1.4 million people were estimated to suffer from hospital-acquired infections. Furthermore, the report also stated that HAIs have increased by 36% over the last 20 years due to advanced surgical procedures and people's growing resistance toward antibiotics.

These infections can be avoided by adopting a stringent sterilization process in healthcare facilities. Thus, the growing prevalence of Surgical-Site Infections (SSI) and Hospital-Acquired Infections (HAIs) has led to the increased adoption of sterilization processes, leading to the surge in demand for sterilization indicator tapes.

Download Free sample to learn more about this report.

Sterilization Indicator Tape Market Growth Factors

Increasing Product Application in the Pharmaceutical and Biotechnology Industries to Drive Market Growth

Sterilization is one of the most crucial procedures in pharmaceutical and biotechnology businesses. Research and development activities in these companies necessitate a sterile setting with sterilized products and devices. As a result, multiple sterilization equipment, including chemical and biological indicators, are utilized to validate the process to achieve sterility during the development or manufacturing process. The market's expansion is primarily attributed to the widespread use of these goods.

- For instance, according to the Pharmaceutical Research and Manufacturers of America, the PhRMA member companies invested USD 102.3 billion in 2021 to research and develop new products. Growing pharmaceutical research and development activities in developed regions are expected to surge the demand for sterilization validation products, including sterilization indicators such as tapes.

As a result, the rapid expansion of pharmaceutical and biotechnology industries over the past 10 years has increased the number of sterilization procedures. It is likely to encourage using indicator tapes and other sterilization validation products.

The global market growth is fueled by strict sterilization-related regulatory policies and current regulations governing good manufacturing practices. Maintaining the sterility of pharmaceutical and biotechnology products, such as therapies and drugs that save lives, is another critical factor in market expansion. As a result, manufacturers of pharmaceuticals and biotechnology are adopting novel sterilization indicators and contributing to the expansion of the industry for sterilization validation consumables, such as sterilization indicator tape.

Chemical indicators, such as tapes and pellets, are also preferred by manufacturing, research, and development professionals over biological indicators as they are less expensive and can be used for various purposes in the pharmaceutical and biotechnology industries. In addition, the introduction of novel products by market players and growing concerns about the safety and sterility of pharmaceutical products have contributed to the increased global adoption of these products.

Rising Prevalence of Hospital-Acquired Infections to Spur Market Growth

Patients admitted to any healthcare facility or organization can contract nosocomial infections, also known as Hospital-Acquired Infections (HAIs). These infections may spread to a patient during in-patient care up to 30 days after discharge or 48 hours after hospital admission. Inadequate sanitation protocols or an unsuccessful equipment sterilization procedure are the most common causes of these infections.

As a result, to stop the spread of HAIs, healthcare facilities worldwide have begun adopting stringent sterilization guidelines that stipulate the use of sterilization equipment. As a result, sterilization monitoring products such as chemical indicator tapes have increased.

- For instance, according to an article published by the University of Minnesota, the Standard Infection Ratio (SIR) for Central Line-associated Bloodstream Infection (CLABSI) increased by 47.0% in the fourth quarter of 2020 compared to the same period in the year 2019. Similarly, methicillin-resistant Staphylococcus aureus (MRSA) also increased by 33.8% in the same period. The rising incidence of such infections has led to the adoption of sterilization equipment such as sterilizers and indicator tapes.

Surgical site infections are also a significant driver of the use of sterilization equipment. These infections frequently occur as a result of carelessness during post-operative care. Some primary causes of SSI in patients include improper sterilization of wound care dressings and medical devices used to monitor patient health.

As a result, to avoid such circumstances, healthcare facilities utilize steam and hydrogen peroxide sterilizers to prevent device contamination. Sterilizers are widely used, which subsequently increases the demand for consumables for these instruments such as biological and chemical indicators. This results in expanding the overall market.

RESTRAINING FACTORS

Low Penetration of Sterilization Monitoring in Developing Countries May Hinder Market Expansion

In developed nations, sterilization indicator products are widely used to monitor the sterilization process in manufacturing and healthcare facilities. However, the sterilization procedure continues to be inconsistent in low-and middle-income nations. Thus, restricting the use of sterilization tapes and affecting market growth.

Strict regulatory policies and routine audits of manufacturing and healthcare facilities in developed countries ensure that sterilization protocols are strictly followed. However, in developing nations, there is lack of strict policies for sterilization monitoring and routine evaluation of sterilizers, which limits the adoption of regulatory guidelines and sterilization norms. Also, hospitals, clinics, nursing homes, laboratories, and local healthcare manufacturers avoid using sterilization indicators as a cost-cutting measure. As a result, Low and Middle-Income Countries (LMICs) suffer disproportionately from untreated post-operative complications such as Surgical Site Infection (SSI).

In addition, ignorance of standardization procedures in healthcare facilities negatively impacts the demand for sterilization indicator tapes. Furthermore, the need for sterilization indicators is expected to decline as healthcare facilities neglect or bypass sterilization validation.

- For instance, according to an article published in the Times of India in January 2023, in Hyderabad, a recent C-section death in the Malakpet area hospital might have been caused due to infection resulting from inadequate sterilization of dressing materials such as gauze pads, which are used post-surgery.

As a result, the demand for sterilization indicator tapes is limited by the aforementioned factors and a lack of adherence to monitoring and routine evaluation of sterilizers.

Sterilization Indicator Tape Market Segmentation Analysis

By Type Analysis

Increased Adoption of Steam Indicator Sterilizers in Healthcare Facilities to Augment Segment Growth

Based on type, the market for sterilization indicator tape is segmented into steam indicator tapes and hydrogen peroxide tapes. The steam indicator tapes segment accounted for the largest share of the market with share of 73.09% in 2026. The adoption of reusable instruments has increased as the number of surgical procedures has grown over the years. Thus, steam sterilization is one of the most preferred methods for sterilizing reusable instruments. Furthermore, steam sterilization remains the gold standard for the sterilization of medical devices. As a result, the use of steam indicator tapes persists as long as reusable instruments are used extensively.

The hydrogen peroxide tapes segment is expected to grow steadily during the forecast period. One of the main drivers of the segmental expansion is the rising demand for heat-sensitive materials to be sterilized with hydrogen peroxide. In addition, during the forecast period, the demand for hydrogen peroxide indicator tapes is anticipated to be influenced by the growing use of hydrogen peroxide in low-temperature sterilization. Hydrogen peroxide sterilization offers benefits such as lower temperature, faster cycles, and compatibility with a broader range of materials compared to steam indicator sterilizers, enhancing the safety of patients, staff, devices, and the overall surrounding environment. These benefits are increasing its adoption in several healthcare facilities, pharmaceutical companies, and other sectors, consequently increasing the demand for hydrogen peroxide-specific indicator tapes.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Significant Efforts to Prevent Cross-Contamination in Healthcare Facilities to Fuel Market Growth

Based on end-user, the market is segmented into healthcare facilities, pharmaceutical & medical device companies, and others. The healthcare facilities segment is projected to account for the largest market share with share of 77.77% in 2026, during the forecast period. The increasing demand for sterilization products in healthcare facilities, including hospitals, clinics, and laboratories for validating successful sterilization processes is supporting market growth. Additionally, surging cases of hospital-acquired infections are encouraging the usage of sterilization tapes to prevent contamination, favoring the market growth in healthcare facilities. As millions of surgeries are conducted in hospitals and other healthcare facilities, a patient’s tissue or mucous membrane comes in contact with the medical device or the surgical instrument, increasing the risk of transmission of pathogens that can lead to infection. In such a way, significant efforts to avoid these infections increase the demand for sterilization indicator tapes in these healthcare facilities.

- For instance, according to an article published in NCBI in May 2022, approximately 170,574 Healthcare-Acquired Infections (HAIs) occur in adults admitted to public hospitals in Australia. Furthermore, these infections lead to 7,583 annual deaths.

The pharmaceutical & medical device companies segment accounted for a lower share and is set to grow significantly during the forecast period due to the rising emphasis on sterilization in pharmaceutical and medical devices manufacturing facilities. The increasing demand for sterilization is attributed to the stringent regulations imposed by regulatory authorities.

REGIONAL INSIGHTS

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Sterilization Indicator Tape Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 52.9 million in 2025. Major factors driving the growth of the market in this region are the higher adoption of these products, the presence of well-established healthcare infrastructure, increasing number of hospitals, and stringent regulatory policies for the sterilization of medical devices in the region. The U.S. market is projected to reach USD 50.6 billion by 2026.

Moreover, increasing research and development activities in the region are responsible for a surge in demand for sterilization validation products, including sterilization indicator tapes.

- For instance, in January 2022, Eli Lily and Company announced its plan to invest USD 1.0 billion to create a new manufacturing plant in Concord, North Carolina. The facility will be used to manufacture parenteral products and devices.

Europe

Europe is projected to hold a significant sterilization indicator tape market share in the near future. Strict sterilization norms to avoid hospital-acquired infections, stringent regulatory policies related to pharmaceutical manufacturing, and emphasis on the sterilization process to ensure the safety and sterility of medical instruments and other devices are expected to bolster regional market growth. The UK market is projected to reach USD 4.7 billion by 2026, while the Germany market is projected to reach USD 8.6 billion by 2026.

- For instance, according to the Association for the Advancement of Medical Instrumentation, EN 17180 is currently a draft European Standard, mentioning the requirements and tests for VH2O2 sterilizers using a vaporized aqueous solution of hydrogen peroxide as the sterilizing agent. These sterilizers are intended to sterilize medical devices, particularly thermolabile and moisture-sensitive.

Asia Pacific

Asia Pacific is projected to record the highest CAGR in the forecast period. The increasing prevalence of hospital-acquired infections and surgical-site infections in the region influence the demand for sterilization products such as sterilizing reusable instruments. The Japan market is projected to reach USD 10.5 billion by 2026, the China market is projected to reach USD 12.9 billion by 2026, and the India market is projected to reach USD 7.6 billion by 2026.

- For instance, according to a report published in the Surgery and Surgical Research, in the year 2019-2020, 23,286 post-operative surgical site infection cases were witnessed in India.

Also, the rising pharmaceutical production in the region is anticipated to increase the demand for sterilization indicator tapes to validate this process.

Latin America

Latin America registered a comparatively lower market share in 2024 and is likely to witness robust growth prospects in the forecast period due to significant increase in medical procedures and sterilization of reusable instruments. Besides, the increasing adoption of steam sterilization in the biotechnology and pharmaceutical industry and industrial research to sterilize instruments would augment growth.

Middle East and Africa

Similarly, the increasing number of healthcare facilities and the focus of government authorities on improving the healthcare infrastructure influences the market growth in the Middle East and Africa. The growing number of healthcare settings will require medical devices and consumables, including sterilization equipment and consumables such as indicator tapes for medical use.

- For instance, according to Uni24.co.za, there are currently 315 government and 215 private hospitals in South Africa.

Key Industry Players

Strong Product Portfolios of 3M, Advanced Sterilization Products (ASP), and STERIS plc Led to their Dominance

The global market includes a significant number of players operating and competing to achieve a dominant position. The market consists of several established players and also emerging companies at the domestic level. However, 3M, Advanced Sterilization Products (ASP), and STERIS plc held a considerable market share in 2024.

These key players account for a significant market share owing to their robust portfolios for sterilization validation and strong distribution networks. These players are actively involved in strategic collaborations and agreements for the development and marketing of products.

- For instance, in June 2021, STERIS plc announced the acquisition of Cantel Medical to expand its offering for sterilization processing products.

Other companies, such as ASP, GKE GmbH, and Terragene, have a strong product portfolio for sterilization indicator products. These companies are steadily marking their presence in the global market by exhibiting their products at world fairs. This initiative helps the companies engage with customers all across the globe, thus slowly increasing their presence worldwide.

List of Top Sterilization Indicator Tape Companies:

- STERIS plc. (U.S.)

- 3M (U.S.)

- Healthmark Industries Company, Inc. (U.S.)

- ASP (U.S.)

- GKE GmbH (Germany)

- Terragene (Argentina)

- Getinge AB (Sweden)

- Propper Manufacturing Co., Inc. (U.S.)

- PMS (Turkey)

- Kartell S.p.A (Italy)

- Deltalab (Spain)

- Defend by Young Mydent LLC (U.S.)

- SHINVA MEDICAL INSTRUMENT Co., LTD. (China)

- Guangdong New Era New Material Technology Co., Ltd. (China)

- Excelsior Scientific (U.K.)

- 4A Medical (Turkey)

- BRAND GMBH + CO KG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 - Shanghai JPS Medical Co., Ltd unveiled their latest innovation, the Advanced Medical Sterilization Indicator Tape. The product was launched to improve the sterilization process for packaging materials and medical instruments, providing a reliable and visual indicator of successful sterilization.

- October 2023 - ASP announced an expansion in its sterilization monitoring portfolio with new steam monitoring products, including SEALSURE Steam Indicator Tape, to help sterile processing departments in healthcare facilities ensure sterility with better efficacy and surety in results.

- October 2023 - GKE-GmbH announced that its sterilization indicators business and its accredited, independent testing lab SAL GmbH were acquired by Mesa Laboratories, Inc., a company designing and manufacturing critical quality control solutions and life science tools.

- December 2022 - Gentinge AB announced that Applied Medical Europe, a product manufacturer for minimally invasive surgery, selected Getinge’s GEE Ethylene Oxide Sterilization System for their new sterilization facility in Amersfoort, the Netherlands.

- April 2022: The U.S. FDA approved 3M Attest Super Rapid Steam Biological Indicator 1592.It is a self-contained biological indicator designed to be used with the 3M Attest Auto-reader 490 having software version 4.0.0 or greater.

- August 2021: Microcare, LLC announced the acquisition of Certol International, a specialty cleaning and disinfectant product manufacturer.

- July 2020: 3M launched Attest Mini Auto-reader 490M, a 24-minute in-house sterilization monitoring solution. The new product is part of the company’s existing portfolio of sterilization equipment, broadening its offering across the globe.

- March 2020: The U.S. FDA approved STERIS VHP LTS-V low-temperature sterilizer for a customer application. The sterilizer is designed to support biotechnology, pharmaceutical and medical device manufacturing and related industries.

REPORT COVERAGE

The research report provides a detailed analysis of the market. It focuses on key aspects such as disease burden – by key region, healthcare overview – selective countries, COVID-19 impact on the sterilization indicator tapes, an overview of customers, industry trends – emerging markets to drive growth, competitive landscape, and key mergers, and acquisitions & partnerships. Besides this, the report offers insights into the market trends and highlights vital industry dynamics. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.06% from 2026-2034 |

|

Unit |

Value (USD million) and Volume (1,000 Units) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 153.78 million in 2026 to USD 228.21 million by 2034.

In 2025, the North American market stood at USD 52.9 million.

Registering a CAGR of 5.06%, the market will exhibit steady growth over the forecast period (2026-2034).

The steam indicator tapes segment is expected to lead this market during the forecast period.

Increasing application of sterilization indicators in the pharmaceutical and biotechnology industry, the rising demand for medical devices, and the strong emphasis on sterilization in healthcare facilities are the major factors driving the growth of the market.

STERIS plc., 3M, Advanced Sterilization Products (ASP), and Getinge AB are some of the major players in the global market.

North America dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us