Tower Crane Market Size, Share & Industry Analysis, By Type (Hammerhead Cranes, Flat Top Cranes, Luffing Jib Cranes, and Self-erecting Cranes), By Lifting Capacity (Upto 5 Tons, 6 to 20 Tons, 21 to 50 Tons, and More than 50 Tons), By Design Type (Top Slewing Crane and Bottom Slewing Crane), By Fuel Type (Electric, Diesel, and Hybrid), By End User (Construction Companies, Mining, Utilities, and Others), and Regional Forecast, 2026-2034

Tower Crane Market Size

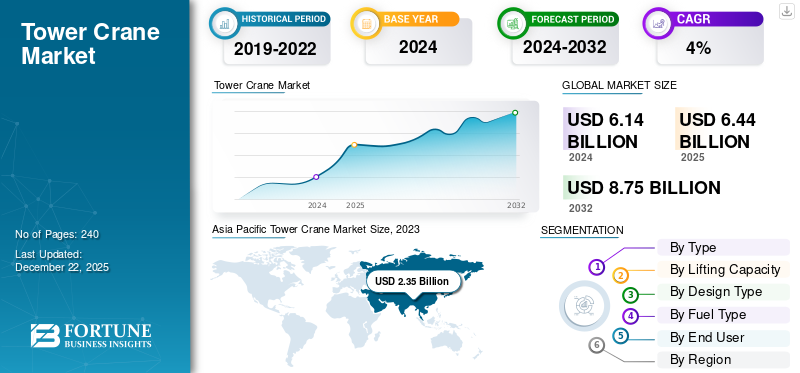

The global tower crane market was valued at USD 6.44 Billion in 2025. The market is projected to grow from USD 6.57 Billion in 2026 to USD 9.91 billion by 2034, exhibiting a CAGR of 5.30% during the forecast period. Asia Pacific dominated the global market with a share of 39.70% in 2025.

A tower crane is used in construction and other industries to lift and move heavy materials. These cranes are essential for constructing tall buildings and large structures due to their ability to lift heavy loads to significant heights and their capability to operate in confined spaces. A mast, slewing unit, counter jib, trolley, and hoist are some of the components used in the manufacturing of such products. These types of cranes are found in applications for end users, such as construction companies, mining, and utilities.

Rapid urbanization populations necessitate the construction of residential buildings, commercial complexes, and urban infrastructure, which creates the demand for such products to fuel the market growth. In addition, the rising construction of skyscrapers and the construction of high-rise buildings requires the usage of such equipment for lifting materials to great heights, which drive sthe growth of the market. For instance, according to the source of Tradesmen International, the construction industry growth globally increased by 8% in 2022 as compared to 2021. Moreover, according to the Wall Street Journal, Saudi Arabia plans to invest around USD 1,000 billion for the construction of high skyscrapers, driving the growth of the tower crane market.

The COVID-19 pandemic had a significant impact on the tower crane industry, owing to disruption in the supply chain and delays in construction projects, which restrict the growth of the market. Whereas, after the COVID-19 pandemic, the adoption of technologies, such as remote monitoring and digital solutions in such equipment, accelerated, which is expected to drive the tower crane market growth.

Tower Crane Market Trends

Technological Advancements in the Product to Fuels Market Growth

Major players such as Xuzhou Construction Machinery Group Co. Ltd, Zoomlion Heavy Industry Science, Liebherr International AG, Action Construction Equipment Limited, Yongmao Holdings Limited, Wolfkran Holding AG, and The Manitowoc Company Inc, among others, are engaged in introducing new tech advanced crane into the market. For instance, in February 2024, Terex Corporation launched a new CTT 152-6 flat-top crane for the market. It operates with the use of two winches such as 18 KW and 22 KW. It has a lifting capacity of 150 tons. It has features such as performance, safety, reliability, and efficiency in the construction sector. All such factors are the latest tower crane market trends.

Download Free sample to learn more about this report.

Tower Crane Market Growth Factors

Increasing Urbanization and Government Initiatives for Building Infrastructure to Drive Market Growth

Increasing urbanization globally, including developed as well as developing economies, creates demand for such cranes for sustainable development practices fuels the market growth. In addition, the demand for high-rise residential and commercial buildings across GCC, Dubai, India, and Japan, among others, to fuel the growth of the market. For instance, according to the World Bank Group Source, the degree of urbanization in China increased by 6.6% in 2023 compared to 2020. Moreover, several government initiatives, such as Housing for All, Make in India, and Smart Cities Mission, which promotes the adoption of such cranes, are expected to drive the growth of the market. For instance, according to the India Brand Equity Foundation, the government of India planned to invest around USD 33.4 billion for the Ministry of Roads for the years 2024 to 2025. All such favorable instances uplift the growth of the market.

RESTRAINING FACTORS

High Initial Investment and Operational Costs to Hinder Market Growth

The high initial cost of purchasing such equipment can be challenging for smaller construction companies or those with limited budgets. The costs associated with the installation, setup, and dismantling of these cranes can be substantial, especially for complex or large-scale projects. This system requires regular maintenance and inspection, which incurs additional operational costs, which are not bearable for small as well medium scale enterprises, to restrict the market growth. The cost required for such a system ranges from USD 1 million to USD 15 million, depending on the size of the crane. Moreover, these systems require annual operational and maintenance costs ranging from USD 5,000 to USD 20,000. All such factors restrain the growth of the market.

Tower Crane Market Segmentation Analysis

By Type Analysis

Hammerhead Cranes to Dominate Market Due to Growing Construction Activities to Trigger Market Growth

Based on type, the market is segmented into hammerhead cranes, flat top cranes, luffing jib cranes, and self-erecting cranes.

As per our analysis, hammerhead cranes to dominate the market in terms of revenue share in 2026 due to growing construction activities, particularly for high-rise buildings, industrial projects, and infrastructure developments. Moreover, government investments in bridges, railways, and airports fuel the growth of the hammerhead crane market. This segment captured 38.05% of the market share in 2026.

Luffing jib is anticipated to grow at the highest CAGR during the forecast period due to factors such as increasing urbanization, expansion of high-rise buildings, and rising government investment in infrastructure projects, including transportation, education, and healthcare sectors, to fuel the growth of the luffing crane.

Flat-top crane is projected to grow moderately during the forecast period, owing to the integration of smart technologies such as remote monitoring, Internet of Things (IoT), and automated control systems. These technologies enhance operational safety and efficiency, fueling the market’s growth.

Self-erecting cranes is projected to grow at decent growth because it offer several features such as quick setup, compact in size as compared to other types, easy to install, and monitor. These type of cranes are largely used in residential construction, small and medium-scale projects, and other infrastructure-related work. All such factors drive the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Lifting Capacity Analysis

6 to 20 Tons Cranes Dominates Owing to High Demand from High Skyscrapers and Infrastructure Development

Based on lifting capacity, the market is segmented into upto 5 tons, 6 to 20 tons, 21 to 50 tons, and more than 50 tons.

As per our estimate, 6 to 20 ton cranes dominated the market in terms of revenue share in 2026 and are growing at the highest CAGR, due to growth in mid-sized buildings and rising investment in renovation of infrastructure projects. Moreover, their widespread use in mid-sized buildings and moderate construction projects fuels the market growth. The segment is set to gain 37.44% of the market share in 2026.

Upto 5 tons is projected to grow at steady growth during the forecast period, owing to rapid urbanization and rising demand for residential spaces. Moreover, it is widely used in small- and medium-scale construction projects, including residential, low-rise commercial buildings, and light industrial applications. This segment is likely to document a considerable CAGR of 5% during the forecast period (2026-2034).

21 to 50 tons cranes are anticipated to grow moderately during the forecast period due to a surge in demand from large-scale infrastructure projects, industrial applications, and high-rise buildings across the globe. In addition, the expansion of industrial sectors such as energy, manufacturing, and mining increases the requirement for robust lifting equipment, further fueling the market’s growth.

More than 50 tons are set to grow at a decent growth rate during the forecast period, as these cranes are specially designed for handling extremely heavy loads and complex construction tasks. Moreover, they offer several advantages such as high lifting capacity, advanced technological features, and suitability for high-rise construction buildings. All such favorable instances drive the market’s growth.

By Design Type Analysis

Top Slewing Crane to Dominate Owing to Rising Adoption from Large-Scale Infrastructure Projects and High-Rise Buildings

Based on design type, the market is segmented into top-slewing crane, and bottom-slewing crane.

As per our analysis, the top-slewing crane will dominate the market in terms of revenue share in 2023 and is projected to grow at the highest growth. It is owing to these systems having high lifting capacity, being versatile, robust, and suitable for large-scale infrastructure projects. Furthermore, innovations in crane technology, including automation, remote monitoring, and enhanced safety features, improve operational efficiency and safety. These advancements make top-slewing cranes more attractive for complex construction projects. This segment is anticipated to capture 68% of the market share in 2025.

The bottom slewing crane is anticipated to grow with a CAGR of 4% during the forecast period, owing to these cranes being designed for smaller scale projects. Rapid urbanization and growth in residential construction across the globe raise the demand for such products, which, in turn, fuels the market growth.

By Fuel Type Analysis

Diesel Cranes Set to Observe Substantial Growth Rate Owing to Benefits Associated

Based on fuel type, the market is segmented into fuel type, into diesel, electric, and hybrid.

As per our estimates, diesel cranes will dominate the market in terms of revenue share in 2026 and are projected to grow at a substantial rate because they offer several advantages such as high power output, robustness, and easy-to-move from one location to another. It is commonly used in remote locations and large-scale construction projects, where electricity access is limited. Diesel-operated cranes are used in large-scale construction projects such as dams, bridges, and highways. This segment is foreseen to hit 47.64% of the market share in 2026.

Electric-powered cranes are predicted to grow at a steady rate during the forecast period, owing to their suitability for urban construction projects and areas with stable electricity supply. It offers several features such as environment friendly, lower operating costs, and stringent environmental regulations in European countries, which fuels the adoption of electric-powered tower cranes in the market. This segment is predicted to dominate the market with a share of 5% in 2025.

Hybrid cranes are anticipated to grow moderately during the forecast period, due to it using a combination of diesel and electric power. They offer features such as versatility, flexibility, reduced fuel consumption, lower emissions, and enhanced efficiency and safety. Moreover, rapid urbanization and infrastructure development are the factors driving the growth of the hybrid crane market.

By End User Analysis

Construction Companies Set to Dominate Market Owing to Rising Investment in Infrastructure Buildings

Based on end user, the market is segmented into construction companies, mining companies, utilities, and others. Others segment include logistics center.

As per our analysis, construction companies accounted for the largest market share in 2026 and are projected to grow at a substantial rate. Increasing investment in construction buildings and government initiatives creates demand for this crane, to fuel the growth of the market. This segment is foreseen to capture 59.21% of the market share in 2026.

Mining sector is projected to grow steadily during the forecast period, due to the construction of infrastructure related to mining operations, such as processing plants and storage facilities. In addition, the expansion of mining across the globe, which needs these systems to handle large materials and equipment efficiently, further drive the market growth. This segment is set to record a significant CAGR of 5.10% during the forecast period (2025-2032).

Utilities will grow moderately because these cranes are being used for maintenance and upgradation of existing facilities, ensuring continued efficiency and reliability. The expansion and modernization of the utility network require heavy lifting and precise positioning of equipment, which drive the market growth.

Others segment include logistics centers. This segment is anticipated to grow decently during the forecast period, owing to the rapid growth of e-commerce and the need for efficient warehousing and distribution. All such factors contribute positively to tower crane market share.

REGIONAL INSIGHTS

The market covers five major regions mainly as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Tower Crane Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.52 billion in 2025 and USD 2.62 billion in 2026 and is anticipated to grow substantially during the forecast period, owing to rapid urbanization and rising investment in the construction and industrial sectors. Moreover, economic development in countries such as China, India, Southeast Asia, and South Korea, which trigger the demand for such equipment, drives the market growth. For instance, according to the Source of India Brand Equity Foundation (IBEF), the Indian government planned to invest around USD 5,000 billion for the infrastructure sector by 2025. All such favorable instances drive the growth of the market. India is expected to hold USD 1.23 billion in 2025, while Japan is predicted to be valued at USD 0.35 Billion in the same year.

China to Dominate Owing to Growth in the Number of Construction Projects

China dominates the global tower crane market owing to rapid urbanization and an increasing volume of construction projects, including residential, commercial, and infrastructure developments. Additionally, the high demand for both top slewing crane and bottom slewing cranes drives market growth. Additionally, government investment in the expansion of construction and commercial projects creates demand for such equipment, which fuels market growth. For instance, according to the International Trade Administration, the Chinese government planned to invest around USD 4,200 billion in infrastructure development. The Chinese market is set to hold USD 1.23 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market poised to be valued at USD 1.41 Billion in 2026. North America is projected to grow steadily during the forecast period due to urban development and the construction of high-skyscraper in the U.S., Canada, and Mexico. The U.S. market is likely to reach USD 1.03 billion in 2026.

Europe

Europe is the second largest market expected to gain USD 1.77 Billion in 2026, exhibiting a significant CAGR of 4% during the forecast period (2026-2034). The U.K. market is set to grow with a valuation of USD 0.3 billion in 2026. Europe is anticipated to grow moderately during the forecast period due to undergoing construction projects, property renovations, and rising investment in the construction sector across Germany, France, and Italy, among others. Germany is set to grow with a valuation of USD 0.44 billion in 2026, while France is poised to be worth USD 0.24 billion in 2025.

Middle East & Africa and South America

The MEA region is the fourth largest market foreseen to be worth USD 0.41 billion in 2026. Middle East & Africa and South America region is anticipated to grow at decent growth during the forecast period, due to significant investments in infrastructure projects such as highways, bridges, railways, and airports. Moreover, rising constructions of high skyscrapers and growth in the mining industry, create the demand for tower cranes, driving the market growth. The GCC market is likely to stand at USD 0.16 Billion in 2025.

KEY INDUSTRY PLAYERS

Major Players Engaged in Adopting Product Development, Product Launch, and Acquisition as Key Developmental Strategies to Intensify Market Competition

Major players in the global tower cranes market, such as Xuzhou Construction Machinery Group Co. Ltd, Zoomlion Heavy Industry Science & Technology Co. Ltd, Liebherr International AG, The Manitowoc Company Inc, Sany Heavy Industry Co. Ltd, and Action Construction Equipment Limited, and among others. These players are engaged in adopting business expansion, acquisition, and product development as key strategic moves to strengthen their market competition. For instance, in September 2023, Xuzhou Construction Machinery Group Co. Ltd (XCMG) introduced a new XGT15000-600S crane for construction and other sectors. It is a super tower crane that is specially designed for exploration and construction activities. It has a lifting capacity of 600 tons and a height of 400 meters. It offers several advantages, such as robust lifting capacity, smooth operation, high efficiency, and precise control.

List of Top Tower Crane Companies:

- Xuzhou Construction Machinery Group Co. Ltd (China)

- Zoomlion Heavy Industry Science & Technology Co. Ltd (China)

- Liebherr International AG (Switzerland)

- The Manitowoc Company Inc (U.S.)

- Sany Heavy Industry Co. Ltd (China)

- Terex Corporation (U.S.)

- Action Construction Equipment Limited (India)

- Wolfkran Holding AG (Switzerland)

- Comansa (Spain)

- Yongmao Holdings Limited (China)

KEY INDUSTRY DEVELOPMENT:

- June 2024: Terex Corporation signed a distributor agreement with EWPA based in Western Poland. The basic aim of this agreement was to provide a supply chain of tower cranes through diversified geographical locations.

- May 2024: Potain, a subsidiary of The Manitowoc Company, introduced a new MDLT 1109 crane for construction, mining, utilities, and logistics centers. It is designed with a top-slewing crane. It has a lifting capacity of 40 tons and operates with a height of 80 meters.

- March 2024: Comansa introduced a new luffing crane, CML800, for the Chinese market. It has a lifting capacity of 50 tons, and a working radius of 65 meters. It is mainly used in the construction and mining sector.

- May 2023: Zoomlion Heavy Industry Science & Technology Co Ltd introduced a new R2000- 720 tower crane. It has a lifting capacity of 720 tons, which can lift 500 cars to 130 floors. It offers several features, such as the largest lifting capacity, balancing weight capability, and robust model. It is used in the construction, logistics, and mining sectors.

- March 2023: Terex Corporation introduced a new CTL1600 luffing jib crane for the U.K. market. It has a material lifting capacity of 66 tons and operates with a height of 75 meters. It is used in the construction and mining sectors.

REPORT COVERAGE

The tower crane market report provides an in-depth analysis of the industry dynamics and competitive landscape. It also provides market estimation and forecast based on type, lifting capacity, design type, fuel type, end user, and regions. It provides various key insights, recent industry developments in the market such as mergers & acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Lifting Capacity, By Design Type, By Fuel Type, By End User, and By Region |

|

Segmentation |

By Type

By Lifting Capacity

By Design Type

By Fuel Type

By End User

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the market was valued at USD 6.34 Billion in 2025

In 2034, the market is expected to record a valuation of USD 9.91 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.30% during the forecast period.

The hammerhead cranes segment is expected to lead the market over the forecast period.

Increasing global urbanization and rising investment in construction buildings are the driving factors for market growth.

Xuzhou Construction Machinery Group Co. Ltd, Zoomlion Heavy Industry Science & Technology Co. Ltd, Liebherr International AG, The Manitowoc Company, Sany Heavy Industry Co. Ltd, Terex Corporation, Action Construction Equipment Limited, Wolfkran Holding AG, Comansa, and Yongmao Holdings Limited are the leading companies in this market.

Asia Pacific dominated the global market with a share of 39.70% in 2025.

Technological advancements in tower cranes and sustainable, eco-friendly electric cranes are the latest trends in the market.

Based on end user, construction companies are expected to lead the market over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us