Bitumen Market Size, Share & Industry Analysis, By Type (Paving, Oxidized, Cutback, Emulsion, and Polymer Modified), By Application (Roadways, Waterproofing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

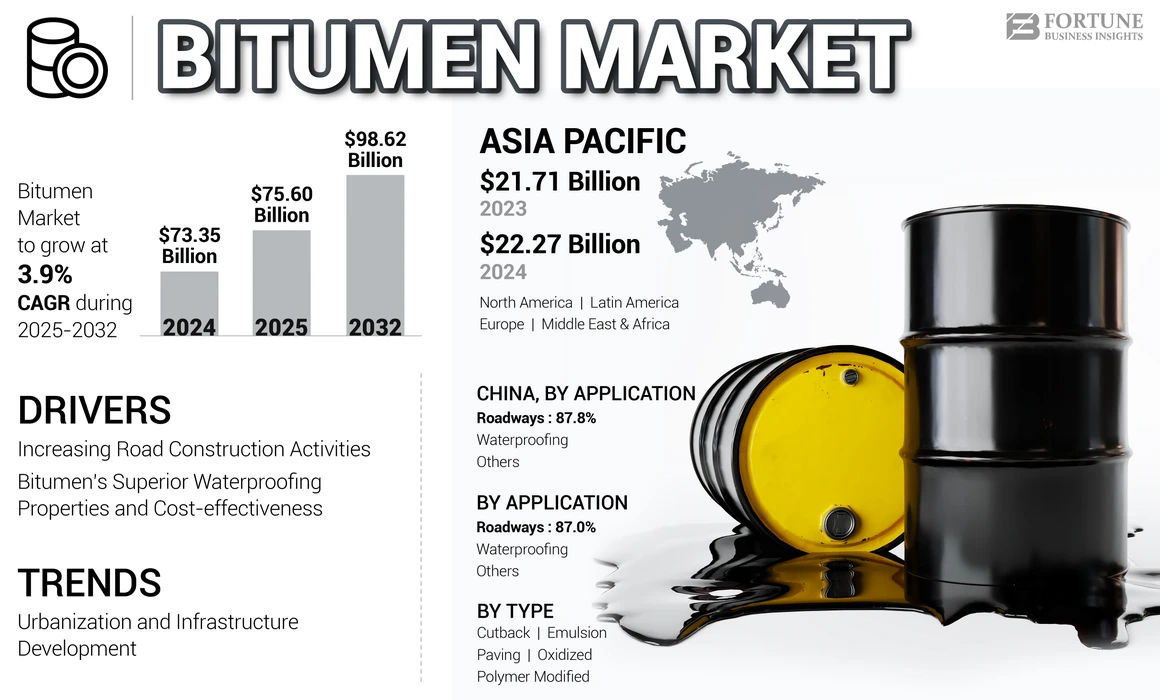

The global bitumen market size was valued at USD 73.35 billion in 2024. The market is projected to grow from USD 75.60 billion in 2025 to USD 98.62 billion by 2032, exhibiting a CAGR of 3.9% during the forecast period. Asia Pacific dominated the bitumen market with a market share of 30.36% in 2024. China Petroleum and Chemical Corporation, Exxon Mobil Corporation, Shell plc, Gazprom Neft, and NYNAS are the key players operating in the industry.

Bitumen is a substance derived from the distilling crude oil, recognized for its waterproof and adhesive characteristics. It is frequently utilized in the construction sector, particularly for roads and highways, roofing, and other industrial applications. The production process involves distillation, which eliminates lighter fractions of crude oils such as gasoline and diesel, leaving behind the heavier product. Additionally, deposits can form naturally at the bottoms of ancient lakes, where prehistoric organisms have decomposed under heat and pressure.

In transportation infrastructure, bitumen acts as a binder for aggregates in asphalt concrete, enhancing road performance and longevity. With the global increase in vehicle usage, the demand for high-quality roadways has surged, prompting advancements in technology, including polymer-modified bitumen that offers superior resistance to deformation and cracking.

In the energy sector, it is a crucial hydrocarbon source and a contributor to renewable energy development through processes such as refining and upgrading. Its role in producing fuels and other petroleum products underscores its significance in meeting global energy demands amid the transition to sustainable practices.

GLOBAL BITUMEN MARKET OVERVIEW

Market Size & Forecast:

- 2024 Market Size: USD 73.35 billion

- 2025 Market Size: USD 75.60 billion

- 2032 Forecast Market Size: USD 98.62 billion

- CAGR: 3.9% from 2025–2032

Market Share:

- Asia Pacific led in 2024 with a 30.36% share, raising form USD 21.71 billion in 2023 to USD 22.27 billion in 2024, driven by urbanization, infrastructure expansion, and road construction.

- By type: Paving segment dominated due to high demand in road construction.

- By application: Roadways segment held the largest share (87% in 2024), followed by waterproofing applications.

- By innovation: Polymer-modified, bio-based, and recycled bitumen are gaining traction for improved performance and sustainability.

Key Country Highlights:

- China & India: Strong growth from rapid infrastructure projects and highway expansion.

- United States: Large-scale infrastructure and highway construction driving demand (USD 12.72 billion in 2024).

- Germany, U.K., France: Steady demand from road maintenance and urbanization.

- Brazil & Mexico: Significant consumption from construction and logistics expansion.

- Saudi Arabia & UAE: Production and adoption fueled by infrastructure and road projects.

Bitumen Market Trends

Urbanization and Infrastructure Development to Foster Market Growth

As countries urbanize, the demand for robust infrastructure, particularly road construction and maintenance, is on the rise. Urbanization, driven by population growth and economic development, necessitates the establishment of modern transport systems that can facilitate mobility and connectivity within urban centers. With increasing numbers of vehicles on the road, maintaining and upgrading existing infrastructures becomes essential, leading to a heightened demand for bitumen, a crucial component in road construction.

The correlation between urban growth and infrastructure projects is evident in emerging economies where rapid demographic changes often outpace existing facilities. Governments and private sectors are investing significantly in infrastructure projects, including highways, bridges, and pavements, to enhance economic activities and improve the quality of life for urban dwellers. This expansion creates favorable market conditions for bitumen, as its properties make it ideal for enduring and sustainable road surfaces.

- Asia Pacific witnessed a bitumen market growth from USD 21.71 billion in 2023 to USD 22.27 billion in 2024.

Furthermore, the trend toward environmentally friendly and resilient transport systems is paving the way for innovation in bituminous products, including polymer-modified bitumen, which offers improved performance. As urbanization accelerates globally, the market is poised for growth, aligning with the goals of modernizing transport systems and supporting sustainable infrastructure development.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Road Construction Activities to Propel Market Growth

The global demand for bitumen is on a significant upward trajectory, primarily driven by the surge in road construction activities across various regions. As countries strive to enhance their infrastructure to support rapid urbanization and economic growth, it has emerged as a critical material in the construction and maintenance of road networks.

Countries such as India and China are at the forefront of this growth, backed by extensive government initiatives aimed at upgrading and expanding their road networks. In India, for instance, the government's ambitious Bharatmala Pariyojana aims to develop over 34,800 kilometers of highways by 2027-2028, significantly increasing demand for bitumen. Similarly, China's ongoing investments in infrastructure through initiatives such as the Belt and Road Initiative highlight the increasing need for quality road construction materials, including bitumen.

Bitumen’s Superior Waterproofing Properties and Cost-effectiveness to Boost Market Growth

Bitumen is inherently hydrophobic, meaning it repels water. This property is crucial for creating effective barriers against moisture ingress in structures such as roofs, basements, and foundations. In large-scale infrastructure projects such as bridges and tunnels, bituminous materials are employed to ensure long-lasting protection against water ingress.

Compared to other waterproofing materials, bitumen is often more affordable and requires minimal maintenance, making it a cost-effective solution for long-term waterproofing needs. Products such as Weberdry PUR, which are cold-applied and form a seamless membrane upon curing, are suitable for various applications, including foundations and retaining walls. Thus, many commercial structures utilize bituminous waterproofing systems due to their reliability and performance under various environmental conditions.

The growing demand for bitumen products in waterproofing applications stems from their unique properties, such as impermeability, adhesion, flexibility, cost-effectiveness, and self-healing capabilities. As construction practices evolve toward more sustainable and durable solutions, its versatility positions it as a key material in modern waterproofing systems across various sectors.

Market Restraints

Toxicity of Certain Chemicals Used in Bituminous Products May Hamper Market Development

The toxicity of certain chemicals present in bituminous products raises significant health and environmental concerns that may adversely affect the bitumen market growth. Bitumen contains various chemical compounds, including polycyclic aromatic hydrocarbons (PAHs), which are known carcinogenic. Exposure can occur via inhalation of fumes, skin contact, or ingestion, especially during construction processes. Studies indicate that bitumen fumes can lead to acute health effects such as respiratory irritation, nausea, and skin problems. At the same time, chronic exposure is linked to serious conditions such as asthma and potential cancer risks.

Regulatory bodies such as the International Agency for Research on Cancer (IARC) classify certain bituminous emissions as possibly carcinogenic to humans. This classification has prompted calls for improved safety measures, including better monitoring of emissions and exposure levels. As awareness of the health and environmental impacts of toxic chemicals grows, there is a burgeoning demand for safer, eco-friendly alternatives to traditional bituminous products.

Innovations in bio-based binders and recycled materials are gaining traction, offering potential solutions to mitigate these risks. The toxicity of chemicals in bituminous products poses a dual challenge for the market. Companies that proactively address these concerns and invest in safer alternatives are likely to gain a competitive edge in the market.

Market Opportunities

Growing Demand for Bio-Based and Recycled Bitumen to Act as Market Opportunity

The global demand for sustainable infrastructure solutions has catalyzed the growth of green technologies within the bitumen industry. Innovations such as bio-based and recycled bitumen are emerging as pivotal opportunities for market expansion. Bio-based bitumen, derived from renewable resources such as plant materials, presents an eco-friendly alternative to conventional petroleum-based products. This innovation reduces carbon footprint and meets the increasing regulatory requirements for sustainability in construction.

Similarly, the utilization of recycled bitumen, obtained from reclaimed asphalt pavement, offers a dual benefit—reducing waste while conserving natural resources. These green technologies significantly diminish the environmental impact associated with traditional methods of production, aligning with global efforts toward circular economy practices.

Market players that adopt bio-based and recycled bitumen technologies are poised to gain a competitive edge as governments and companies increasingly prioritize sustainable building materials. The ongoing shift toward greener infrastructure solutions creates a fertile ground for investment and innovation, driving growth in a market evolving to meet the sustainability challenges of the 21st century. As awareness and demand for eco-friendly products rise, the bitumen industry is poised for a transformative shift, making it an exciting opportunity for stakeholders and investors.

Market Challenges

Volatility in Crude Oil Prices to Act as a Challenge for the Market

As a byproduct of petroleum refining, bitumen is closely tied to crude oil fluctuations, leading to significant implications for pricing, supply, and demand dynamics within the industry. Crude oil prices have experienced sharp shifts due to geopolitical tensions, OPEC production strategies, and economic factors affecting global energy demand. When crude oil prices rise, the production costs for bitumen also increase, leading to higher market prices. This can lead to higher costs for infrastructure projects, particularly in road construction and maintenance, which might lead to delays or reductions in their implementation. Moreover, the unpredictability of crude oil prices complicates long-term planning for businesses reliant on bitumen. Companies face challenges in setting stable budgets, forecast demands, and managing inventory effectively. This uncertainty can hinder market growth and innovation, as stakeholders may hesitate to commit to significant investments. Ultimately, as crude oil prices continue to fluctuate, players in the market must employ adaptive strategies to mitigate risks, ensuring they remain viable in a shifting economic landscape.

Impact of COVID-19

The COVID-19 pandemic broke out at the end of 2019 and impacted the economies of the countries such as China, the U.S, and Germany, which were compelled to take essential steps to prevent the further impact of the virus. During the onset of the pandemic, many countries imposed restrictions on the distribution and transportation of materials, disrupting the value chain for bitumen manufacturers.

The bitumen supply chain relies heavily on crude oil, and fluctuations in oil prices during the pandemic created volatility in the availability and cost of raw materials. This instability impacted production schedules and pricing strategies across the industry. The pandemic affected cash flow across various sectors, leading to reduced investments in infrastructure projects. This decline in capital expenditure had a direct adverse effect on bitumen consumption for applications such as road construction and waterproofing. Road construction projects also got delayed owing to stringent lockdown restrictions imposed by governments to combat the virus's impacts. The unavailability of labor and transportation issues exacerbated the situation, leading to a significant drop in production capacity. As the supply chain returns to normal after the lifting of restrictions, the players operating in the market have sought novel strategies for mitigating the impact of corona on their annual performance. Thus, all these factors collectively disrupted the supply and demand dynamics of the industry during the COVID-19 pandemic.

Segmentation Analysis

By Type

Paving Segment Held the Key Market Share Owing to High Demand from the Road Construction Industry

By type, the market is segmented into paving, oxidized, cutback, emulsion, and polymer modified.

The paving segment held the prime bitumen market share of 55% in 2024, owing to the high demand from the road construction industry. Paving grade is a critical material in the construction and maintenance of roads, highways, and other infrastructure projects. This high-viscosity substance, derived from the distillation of crude oil, is primarily used in the manufacturing of asphalt mixtures for road surfacing.

The oxidized and cutback segments are expected to show significant growth during the forecast period due to their high viscosity, reduced solubility, and excellent adhesive properties.

The polymer modified segment is expected to grow considerably owing to its exceptional properties and advantages over cutback and oxidized bitumen..

By Application

To know how our report can help streamline your business, Speak to Analyst

Roadways Segment Held Leading Share Due to Increasing Road Construction

In terms of application, the market is segmented into roadways, waterproofing, and others.

The roadways segment dominated the market in 2024 and is expected to continue its dominance during the forecast period owing to increasing road construction activities. In developing countries, bitumen is widely used for the construction of rural roads. The application of bitumen ensures that roads can handle both local traffic and weather conditions while providing a smooth and durable surface. This segment is anticipated to forecast a CAGR of 3.40% during the forecast period.

- The roadways segment is expected to hold an 87% share in 2024.

The waterproofing segment is expected to contribute fairly to the market. The segment is expected to dominate the market share of 9% in 2025. Bitumen’s waterproofing qualities stem from its ability to form a continuous, impermeable layer, preventing water from seeping through surfaces. This makes it an ideal material for protecting buildings and infrastructure from water damage, particularly in areas with high moisture levels or wet climates.

Bitumen Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Bitumen Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the largest and fastest-growing market, driven by rapid urbanization, infrastructural expansion, and an increasing focus on modern transportation networks. The regional market value in 2024 was USD 22.27 billion, and in 2023, the market value led the region by USD 21.70 billion. The Asia Pacific region is home to many emerging economies that are witnessing impressive economic growth rates. The rise of the middle class, increased purchasing power, and expanding industrial sectors have all contributed to the growing demand for infrastructure, including road construction. For example, India and China are witnessing rapid economic development, which leads to increased demand for better transportation networks and urban infrastructure. Countries in Southeast Asia are also witnessing a boost in industrial activities, further driving the demand for roads, highways, and pavements. The market value in China is expected to be USD 3.03 billion in 2025.

On the other hand, India is projecting to hit USD 5.47 billion and Japan is likely to hold USD 3.36 billion in 2025.

- In China, the roadways segment is estimated to hold a 87.8% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America region is to be anticipated the third-largest market with USD 14.43 billion in 2025. North America captures a significant market share, with the U.S. being one of the top consumers due to large-scale infrastructure projects and highway construction. In North America, bitumen plays a significant role in infrastructure development, with its demand driven by both construction activities and innovations in material technology.

The North American market consists primarily of the U.S. and Canada, both of which have well-established infrastructure and substantial demand in road construction, roofing, and waterproofing. The U.S., being the largest consumer, accounted for a market size of USD 12.72 billion in 2024, and the Canadian market also contributed notably, especially in its oil sands operations in Alberta. The U.S. market size is estimated to be USD 13.16 billion in 2025.

Europe

Europe is anticipated to account for the second-highest market size of USD 18.16 billion in 2025, exhibiting the second-fastest growing CAGR of 3.80% during the forecast period. Europe holds a substantial market share as well, with steady demand for road maintenance and construction. In Europe, bitumen is widely used in the construction, infrastructure, and manufacturing industries. Many European countries face aging infrastructure, which creates a significant demand for maintenance and rehabilitation. For example, the U.K., Germany, and France are implementing ongoing road repair programs that require substantial amounts of product. The market value in U.K. is expected to be USD 1.80 billion in 2025.

On the other hand, Germany is projecting to hit USD 1.40 billion and France is likely to hold USD 1.13 billion in 2025.

Additionally, urbanization in Eastern and Western Europe has led to an increased need for new roads, highways, and transportation networks to connect urban centers with surrounding regions, further boosting product demand.

Latin America

The market in Latin America is crucial for the region’s construction, infrastructure, and manufacturing industries. Bitumen, a hydrocarbon product derived from crude oil, is primarily used for road construction, paving, and waterproofing applications. Latin American countries such as Mexico and Venezuela have significant refining capacities, while Argentina and Brazil also contribute to production. Brazil, the largest economy in South America, leads the consumption in the region due to its large-scale infrastructure projects. The demand is also strong in Mexico, driven by domestic growth and its strategic role as a logistics hub for North and South America.

Middle East & Africa

The Middle East & Africa region demonstrate diverse economic profiles and market dynamics for the product. The market in the Middle East & Africa is poised for substantial growth of USD 13.22 billion in 2025, due to the rapidly expanding infrastructure and construction sectors in the region. As urbanization, industrialization, and economic growth continue to rise in countries across the Middle East & Africa, demand is expected to increase in tandem. The Middle East, being home to some of the world’s largest oil reserves, plays a crucial role in global production. Countries such as Saudi Arabia, Iran, and UAE are major players in bitumen refining, with their refineries processing large quantities of crude oil into bitumen. These nations are key suppliers to global markets and also major consumers, especially in road construction and maintenance. The Saudi Arabia is expected to hit USD 2.92 billion in 2025.

Competitive Landscape

Key Players in the Bitumen Market

To know how our report can help streamline your business, Speak to Analyst

Market Players are Leveraging Various Strategies to Boost Their Market Presence

China Petroleum and Chemical Corporation, Exxon Mobil Corporation, Shell plc, Gazprom Neft, and NYNAS are the top 5 players operating in the industry. Manufacturers are expanding their businesses to gain competency in the industry and alleviate new entrants’ threats. Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing markets. The global market is fairly fragmented, with the top 5 players accounting for around 35% of the market share.

LIST OF KEY BITUMEN COMPANIES PROFILED

- Asphalt & Bitumen West Co. (Iran)

- Raha Bitumen (Iran)

- Asia Bitumen (Singapore)

- Exxon Mobil (U.S.)

- Shell Plc (U.K.)

- China Petroleum and Chemical Corporation (Sinopec) (China)

- Nynas (Sweden)

- GOIL Ltd (Ghana)

- Gazprom Neft (Russia)

KEY INDUSTRY DEVELOPMENTS

- September 2024- GOIL PLC, in collaboration with Société Multinationale de Bitumes (SMB) from Côte d'Ivoire, developed a state-of-the-art USD 40 million bitumen terminal and production plant. Located in Tema, within the Greater Accra Region of Ghana, the plant has an overall capacity of around 7,500MT.

- September 2024 – Nynas has been awarded the EcoVadis Gold Sustainability rating for 2024, placing it in the top 5% of all rated companies for sustainability performance. This recognition underscores Nynas's commitment to transparency and sustainability in its operations.

- June 2024 - Shell Pilipinas Corp. aimed for at least 10% growth in its bitumen business this year, aligning with the Marcos administration's push for enhanced infrastructure development. Allan Cañedo, the country’s business manager for the construction and road sector, highlighted Shell’s dominance in this market, capturing nearly half of the total volume of bitumen imported by the Philippines in the first quarter.

- March 2023- Hanson UK tested Nynas’s biogenic binder, Nypol RE low-carbon CarbonLock asphalt, which includes Polymer Modified Bitumen (PMB) bio-binders. This trial was conducted in partnership with National Highways on the A30 eastbound near Exeter.

- May 2021- ExxonMobil restarted its bitumen production facility in Singapore, which had been idle for nearly a year. This decision was made in response to favorable market conditions, with the plant capable of producing between 100,000 to 120,000 tons per month. Singapore is a significant exporter of bitumen, having shipped approximately 2.5 million tons in 2020.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and end-use industries. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years.

This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) Volume (Kilo Tons) |

|

Growth Rate (2025-2032) |

CAGR of 3.9% from 2025 to 2032 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 73.35 billion in 2024 and is projected to reach USD 98.62 billion by 2032.

In 2024, the Asia Pacific market size stood at USD 22.27 billion.

Growing at a CAGR of 3.9%, the market will exhibit steady growth during the forecast period.

The roadways segment led the market in 2024.

The growing product demand from industrial applications is a key factor driving market growth.

China Petroleum and Chemical Corporation, Exxon Mobil Corporation, Shell plc, Gazprom Neft, and NYNAS are major players operating in the industry.

Asia Pacific dominated the market in 2024.

Growing roadway infrastructure is expected to foster the growth of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us