Cephalosporin Market Size, Share & Industry Analysis, By Generation (First Generation, Second Generation, Third Generation, Fourth Generation, and Others), By Route of Administration (Oral and Parenteral), By Disease Indication (Urinary Tract Infections, Skin & Soft Tissue Infections, Respiratory Infections, Meningitis, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

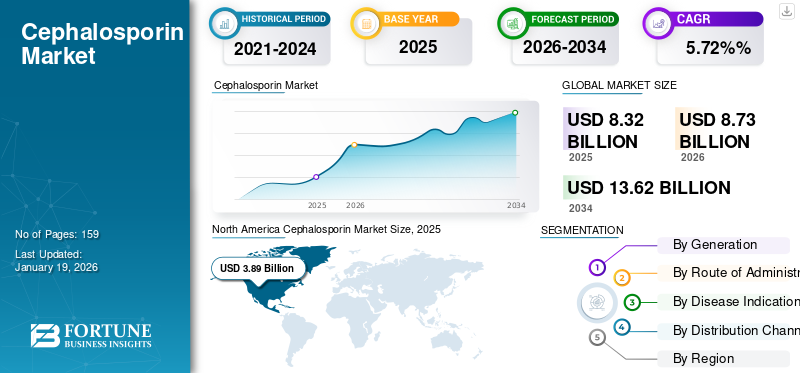

The global cephalosporin market size was valued at USD 8.32 billion in 2025. The market is projected to grow from USD 8.73 billion in 2026 to USD 13.62 billion by 2034, growing at a CAGR of 5.72% during the forecast period. North America dominated the cephalosporin market with a market share of 47.05% in 2025.

The market is projected to depict an upward trajectory during the forecast period. Various established players such as GSK plc., Sandoz Group AG, Merck & Co., Inc., and Pfizer Inc. operating in the market are focusing on developing various pipeline candidates to support the rising demand for drugs.

Cephalosporin belongs to the class of β-lactam that blocks the activity of enzymes responsible for making peptidoglycan, an important component of the bacterial cell wall, resulting in the death of bacteria. Cephalosporin is indicated for treating skin infections, pneumonia, meningitis, respiratory tract infection and other. As bacterial strains resist these drugs, the need for drugs effective against AMR strains bolsters. To support these factors, new generations of cephalosporins are introduced. There are five generations of cephalosporins drugs administered for various gram positive and gram negative bacteria. Such factors propel the growth of the global cephalosporin market as pharmaceutical companies increasingly focus on launching new products followed by accelerated approvals by various regulatory bodies.

- For instance, in April 2024, Basilea Pharmaceutica Ltd received approval from the U.S. FDA for ZEVTERA (ceftobiprole medical sodium for injection), indicated for the treatment of adult patients with Staphylococcus aureus bloodstream infections (bacteremia) (SAB), including those with right-sided infective endocarditis, and adult patients with acute bacterial skin and skin structure infections (ABSSSI) and also for adult and pediatric patients (3 months to less than 18 years old) with community-acquired bacterial pneumonia (CABP).

Furthermore, the global market is expected to grow with a significant CAGR in the forecasted years. The growth is attributed to the advantages of administering these antibiotics, such as fewer side effects and wide-spectrum antibiotic activity.

MARKET DYNAMICS

MARKET DRIVERS

Increasing New Product Launches by Key Players to Propel Market Growth

The growing population of antibiotic resistant bacteria has resulted in the growing need for development of novel drugs effective against AMR. To address this rising demand, many established players in the market have streamlined their resources for research and development of new antibiotic products, thus diversifying product offerings. These novel antibiotics, such as ceftaroline and ceftobiprole, promise effectiveness against AMR bacteria strains.

- For instance, in July 2022, in Europe, Mast Group Ltd. launched Ceftobiprole, a broad-spectrum 5th-generation cephalosporin for treating community-acquired pneumonia (CAP) and hospital-acquired pneumonia (HAP). These developments support the rising demand for such products, driving the global cephalosporin market growth.

MARKET RESTRAINTS

Adverse Effects Associated with These Antibiotics to Impede Market Growth

The adverse effects associated with cephalosporin is one of the factors hampering its adoption and market growth. There are various side effects associated with the administration of these drugs such as gastrointestinal (nausea, vomiting, diarrhea), and allergic reactions (anaphylaxis, urticaria, skin rash). Additionally, the toxicity associated with all generations of these antibiotics has shifted the focus of health authorities toward safe administration of the drug.

- For instance, in March 2023, the New Zealand Medicines and Medical Devices Safety Authority reported findings from the Medicines Adverse Reaction Committee (MARC) meeting highlighting neurotoxic effects associated with these antibiotics, including encephalopathy, seizures, and myoclonus. The risk of cephalosporin-induced neurotoxicity is high in older adults, individuals with pre-existing central nervous system (CNS) disorders, and those receiving high intravenous doses.

- Healthcare professionals are advised to consider cephalosporins as a potential cause of neurotoxicity in patients presenting these risk factors and experiencing unexplained, new-onset neurological symptoms. Such events may obstruct its adoption and number of prescriptions, restricting market growth.

MARKET OPPORTUNITIES

Ongoing Studies Incorporating Nanoparticles and Advancements in Drug Delivery Systems to Provide Prominent Opportunity

Successive generations have been developed to increase the effectiveness of these antibiotics over the years. However, bacterial pathogens have gained resistance to almost all the generations of cephalosporins with time. Thus, studies are carried out to effectively convert old-generation cephalosporin antibiotics into active nano-antibiotics via AuNPs. These nano-antibiotics are aimed to increase potency of old generation versions of these drugs, leading to reduced drug wastage and more patient satisfaction.

Furthermore, ongoing studies include the application of silver nanoparticles that enhance the activity of cephalosporin. These encapsulated liposome polymeric nanoparticles allow controlled drug release, reducing dosing frequency and improving drug delivery. Additionally, use of nanoparticles allows to overcome the challenges in regards to low plasma half-life of these antibiotics.

- For instance, in January 2023, a report by NIH titled ‘Nano-Conversion of Ineffective Cephalosporins into Potent One Against Resistant Clinical Uro-Pathogens via Gold Nanoparticles’ concluded ineffective cephalosporins could be resuscitated into effective nano-antibiotic with the aid of AuNPs. Such advancements aim to shift the market paradigm and offer lucrative opportunities.

MARKET CHALLENGES

Regulatory Hurdles to Restrict the AMR Spread Impede Market Growth

The global market is regulated strictly to control development of antibiotic resistance. Despite numerous initiatives by the government to fight AMR, a rise in antibiotic resistance has been reported. These factors pose a considerable challenge to the market.

- For instance, in October 2024, the Indian Council of Medical Research (ICMR) reported a high rate of resistance among UTI-causing E. choli and Klebsiella pneumoniae as well as Acinetobacter baumannii against drugs carbapenems, fluoroquinolones and third generation cephalosporins.

CEPHALOSPORIN MARKET TRENDS

Rising Popularity of Combination Therapies is a Prominent Trend Observed in Market

The rising prevalence of antibiotic-resistant bacteria and the need for antibiotic-resistant strains to combat AMR are few emerging concerns. The rising popularity of combination therapies for its effective protection is a prominent trend observed in the market. The combination therapies help to overcome antimicrobial resistance mechanisms developed by bacteria, thus leading toward prevention of the exhaustion of therapeutic options available for life-threatening conditions. Thus, there is an urgent need for emergence of new pharmaceuticals with higher clinical efficacy in the industry.

Furthermore, many research organizations are studying the combination of cephalosporin to treat Multidrug-resistant (MDR) strains of bacteria.

- For instance, in May 2024, as per the report published by NIH, a study was performed by the Faculty of Medicine, Wroclaw Medical University, Ludwika Pasteura, Poland, on the use of novel β-lactam antibiotics in combination with cephalosporins for the treatment of ventilator-associated pneumonia (VAP). They found that the combinations, including cefoperazone-sulbactam, ceftolozane-tazobactam, ceftazidime-avibactam, and cefiderocol (a siderophore cephalosporin), have shown promising clinical outcomes in trials and studies. They offer comparable or superior effectiveness to traditional treatments, with a lower risk of adverse effects, underscoring their potential as a critical part of future antimicrobial approaches. Such studies offer global market trends during forecast timeframe.

Furthermore, rising preference of injectable forms of these antibiotics is another mounting trend observed in the market. Injectable versions of these antibiotics provide easy administration and targeted results. Many key players are focusing on expanding their production capacity for cephalosporin injectable.

- For instance, in June 2024, Sands Active Ltd. revealed the introduction of cephalosporin injectable plant in Sri Lanka. The facility was launched to boost the nation’s ability to produce high-quality injectable antibiotics, vital for treating a variety of bacterial infections.

Download Free sample to learn more about this report.

Segmentation Analysis

By Generation

Broader Antibiotic Spectrum of Third Generation Cephalosporins to Propel Segment’s Growth

Based on generation, the market is divided into first generation, second generation, third generation, fourth generation, and others.

After discovering these antibiotics, scientists altered its structure to improve its effectiveness against a wide spectrum of bacteria. Similar consequent changes led to the development of further generations.

The third generation of cephalosporin is expected to dominate the market share during forecast years. This is attributed to its wide applications in treating various skin & soft tissue infections, respiratory infections, and strep throat infections and favorable pharmacologic characteristics.

The first generation of cephalosporin holds a stable CAGR over the forecast period. This treats uncomplicated urinary tract infections and skin and soft tissue infections.

- For instance, in January 2025, the U.K. Health Security Agency published the updated status of four cephalosporins from watch category to access category, namely cefadroxil, cefalexin, cefazolin, and cefradine. They were reclassified in the U.K. to first-line use showcasing potential by moving.

The second generation is estimated to have a considerable market share in the global market. This is largely used for treating respiratory infections and pharyngitis. Additionally, key companies focus on strategic activities such as mergers and acquisitions to reinforce their market share. These developments boost the market share of the segment.

- For instance, in October 2021, Sandoz Group AG completed the acquisition of the cephalosporin business of GSK plc, which included Zinnat, a second-generation cephalosporin indicated for the treatment of pharyngitis and many others.

Other segments are inclusive of the fourth generation cephalosporins and fifth generation of cephalosporins. These newer generations offer protection against antibiotic-resistant strains.

By Route of Administration

Novel Product Launches in Oral Drugs to Propel Growth of the Segment

Based on route of administration, the market is segmented into oral and parenteral.

The oral segment is expected to grow significantly over the forecast period. The rising number of patients opting for self-administration of drugs and new product launches are major factors anticipated to boost segment growth. Catering to its high market share, many companies are focusing on the product approval by different regulatory bodies to launch their oral cephalosporins.

- For instance, in December 2024, Fairdeal Corporation received U.S. FDA approval for Cefixime 400mg tablets indicated to treat different bacterial infections such as urinary tract infections, pharyngitis, and tonsillitis, among others.

On the other hand, the parenteral segment is expected to grow with a significant CAGR. The surge in technological advancements and accurate dosage delivery of drugs through syringes are likely to upsurge the demand for a parenteral route of administration during the forecast period. Furthermore, many new product launches, research and development by industry players in the market will catalyze the segment growth.

- For instance, in December 2023, Shionogi & Co., Ltd. launched Fetroja (cefiderocol), an intravenous infusion 1g vial in Japan. The medication is operative against strains resistant to carbapenem drugs among sensitive strains of Escherichia coli, Citrobacter species, Klebsiella pneumoniae, Enterobacter species, Serratia marcescens, and Proteus species, among others.

By Disease Indication

Novel Product Launches to Combat Rising Prevalence of Urinary Tract Infections Propels Segmental Growth

Based on disease indication, the market is segmented into urinary tract infections, skin & soft tissue infections, respiratory infections, meningitis, and others.

The urinary tract infections segment is expected to hold maximum share during the forecast period. This is due to the rising prevalence of hospital-acquired urinary tract infections and effectiveness of fourth generation of cephalosporin.

- For instance, in January 2025, the manual published by National Healthcare Safety Network (NHSN) reported that urinary tract infections (UTIs) were the fifth most common type of healthcare-associated infection, with an estimated 62,700 UTIs in acute care hospitals in 2015. Many first-generation and fourth-generation cephalosporins showcased effectiveness against urinary tract infections such as cefpodoxime.

The skin & soft tissue infections are expected to grow with a significant CAGR during the forecasted period. The skin & soft tissue infections are caused by Staphylococcus aureus, Pseudomonas aeruginosa. This condition can lead to inflammation and potentially serious complications. Cephalosporins can treat different conditions including cefuroxime, ceftazidime, and ceftaroline. These factors influence the demand for cephalosporin positively. Owing to this, many key companies are focusing on product offerings and consequent approvals for regulatory bodies.

- For instance, in June 2025, JW Pharmaceutical received approval from the Chinese authoritative body National Medical Products Administration (NMPA) for ertapenem, used for treating various bacterial infections including skin and soft tissue infections.

Respiratory infections marked a noticeable share of the cephalosporin market. These drugs are frequently used to treat respiratory infections due to their advantages over other drugs, such as broader spectrum protection and limited side effects.

The meningitis segment is expected to hold a substantial market share. The strong presence of meningitis is supported by its effectiveness as showcased by third-generation cephalosporins to offer new advantages for treating meningitis as they are active at accessible cerebrospinal fluid concentrations.

The others segment is anticipated to hold a stable CAGR during the forecasted period. This segment is inclusive of pharyngitis, ear infections or bone infections. The growth of the segment is attributed to the strategic initiatives by key industry players to launch new products in these sectors and advance their product offerings.

By Distribution Channel

High Volumes of Prescription from Medical Practitioners to Position Hospital Pharmacies as a Dominant Segment

The market is segmented based on distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy.

The hospital pharmacy segment is expected to dominate the cephalosporin market during the forecast period. The significant market share of hospital pharmacies is accredited to high volumes of prescriptions by medical practitioners in hospitals for cephalosporin drugs.

- For instance, in January 2025, the Open Forum Infectious Diseases Journal published an article titled ‘P-1716. Assessing Appropriateness of Cephalosporins Prescription in a Tertiary Care Hospital in South India’ reported that out of 1,376 patients, 428 (31.1%) patients received antimicrobial therapy. Among which 52.8% of patients were prescribed cephalosporins for various indications.

During the forecast period, these high volumes of hospital prescriptions, in turn, lead to an increasing share of hospital pharmacies in the global market.

The retail pharmacy segment is expected to grow substantially during the forecast period. The ease of access and vast distribution network in remote areas are few factors driving the segment's growth. Additionally, various strategic collaborations of key industry players to enhance the accessibility of product offerings also catalyze the market growth.

- For instance, in December 2020, a research article published by the Department of Health Statistics, titled ‘Non-prescription sale of drugs and service quality in community pharmacies in Guangzhou, China: A simulated client method’ reported non-prescription dispensing of drugs was 63.1% in Guangzhou, China and among this cephalosporin held 44.1% share by community pharmacies in China.

The online pharmacy is anticipated to grow with a moderate CAGR from 2025 to 2032. The convenience offered by online pharmacies, accompanied benefits such as cost-saving, privacy, and heightened accessibility to favor its easy adoption.

CEPHALOSPORIN MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Cephalosporin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America dominated the market with a valuation of USD 3.89 billion in 2025 and USD 4.09 billion in 2026. This is attributed to the rising prevalence of staph infections and hospital-acquired infections in the region. The rising demand for effective medications against such infections also drives regional growth.

- For instance, in June 2023, a report published by the Public Health Agency of Canada highlighted the rise of certain healthcare-associated infections (HAIs), including methicillin-resistant Staphylococcus aureus (MRSA) bloodstream infections. Data collected from 88 Canadian care hospitals from January 2017 through December 2021 showed that rates of methicillin-resistant Staphylococcus aureus (MRSA) bloodstream infections (BSIs) increased by 35.0%, climbing from 0.84 to 1.13 infections per 10,000 patient days.

U.S.

The U.S. is dominating the market in North America and its significant share is attributed to developed infrastructure and prominent regional players. Moreover, key players are further focusing on capacity expansion and commercialization of cephalosporin drugs products in the region to augment the global market.

- For instance, in April 2025, F. Hoffmann-La Roche Ltd invested USD 50,000.0 million into the U.S. for expansion of manufacturing capacity.

Europe

Europe is anticipated to hold the second-highest position in terms of revenue share in the global market. The region witnessed the development of the beta-lactamase class of drugs. This led to increasing demand for carbapenem and cephalosporins drugs in the region. Thus, demand for newer drugs that exhibit more effectiveness against resistant bacteria is rising.

- For instance, in August 2021, an article published in the Journal of Antimicrobial Chemotherapy, titled ‘Consumption of cephalosporins in the community, European Union/European Economic Area, 1997–2017’ reported significant increase in consumption of second-and third-generation cephalosporins in the European region—these factors drive the regional growth of the market.

Asia Pacific

Asia Pacific is projected to witness the highest CAGR, especially in developing countries such as China, Japan, and India. The region's market share is attributed to its large-scale API production capabilities and increased healthcare investments. Furthermore, regional companies are indulging in strategic investments to gain access to cephalosporin drugs.

- For instance, in May 2023, Hasten Biopharmaceutics purchased the commercial rights for Rocephin, a broad-spectrum cephalosporin in mainland China, from Swiss healthcare firm F. Hoffmann-La Roche Ltd.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa is anticipated to account for a moderate market revenue during the forecast period. The region is expected to witness growth due to increasing awareness of AMR activity and increasing research & investment to overcome current limitations of the current medications.

- For instance, in November 2024, Venus Remedies received good manufacturing practices (GMP) certification from Saudi Arabia for all its production facilities at its unit in Baddi, India. Saudi FCCD & Drug Authority (SFDA), after a review & audit of the company's facilities, granted the certification, which included renewed approval for Cephalosporin & Carbapenem drugs and liquid & lyophilized oncology drugs—these developments bolster the market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Development

The cephalosporin market holds a semi-consolidated market structure featuring prominent players such as Sandoz Group AG, Pfizer Inc., AbbVie Inc., and GSK plc. The substantial share of these companies is due to the strategic activities with the mergers and acquisitions for robust product offerings with a focus on research and development to enhance their market positions.

Generic manufacturers of the cephalosporin drugs also comprise a major market share. Other notable players in the global market include Merck & Co., Inc., Shionogi & Co., Ltd., and Astellas Pharma, Inc. These companies are anticipated to prioritize new product launches and collaborations to boost their cephalosporin market share during the forecast period.

LIST OF KEY CEPHALOSPORIN COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- Merck & Co., Inc., (U.S.)

- AbbVie Inc. (U.S.)

- Bayer AG (Germany)

- Astellas Pharma Inc. (Japan)

- Shionogi & Co., Ltd. (Japan)

- Abbott (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Venatorx Pharmaceuticals, Inc. received a contract from the Biomedical Advanced Research and Development Authority (BARDA), a part of the U.S. Department of Health and Human Services (HHS). The funding supported the development of oral ceftibuten-ledaborbactam etzadroxil for treating complicated urinary tract infections (cUTI), including pyelonephritis.

- July 2023: Orchid Pharma, an Indian-based company, entered into a technology transfer agreement with a multinational biotechnology company for its fermentation-based ‘7ACA project’ under the production-linked incentive (PLI) scheme.

- March 2023: Hikma Pharmaceuticals PLC launched Cefazolin, a first-generation cephalosporin for Injection, indicated to treat certain infections caused by bacteria including skin, bone, joint, genital, and blood, lining of heart chambers and heart valves, respiratory tract, biliary tract, and urinary tract infections and for perioperative prophylaxis.

- June 2022: Shionogi & Co., Ltd. collaborated with the Global Antibiotic Research and Development Partnership (GARDP) to expand access of cefiderocol to 135 countries. GARDP will manufacture and commercialize cefiderocol through sub-licensees in a large range of low and middle income countries that have delayed access to newer antibiotics.

- September 2021: Lincoln Pharmaceuticals acquired a facility in Gujarat, India. The company plans to invest USD 3.6 million for capacity expansion and modernization.

REPORT COVERAGE

The global cephalosporin market report comprises a market analysis emphasizing key aspects such as pipeline candidates, regulatory environment, and product launches. The report also examines the applications of novel therapeutics alongside notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it covers detailed regional analysis of various segments and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Generation

|

|

By Route of Administration

|

|

|

By Disease Indications

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 8.32 billion in 2025 and is projected to reach USD 13.62 billion by 2034.

In 2025, North Americas market size stood at USD 3.89 billion.

Registering a CAGR of 5.70%, the market will exhibit rapid growth over the forecast period (2026-2034).

Based on generation, the third generation segment is expected to lead the market during the forecast period.

The rising prevalence of bacterial infections and broad spectrum protection provided by these drugs are some factors driving the market.

Sandoz Group AG, Pfizer Inc., and GSK plc. are the major players in the global market.

North America dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us