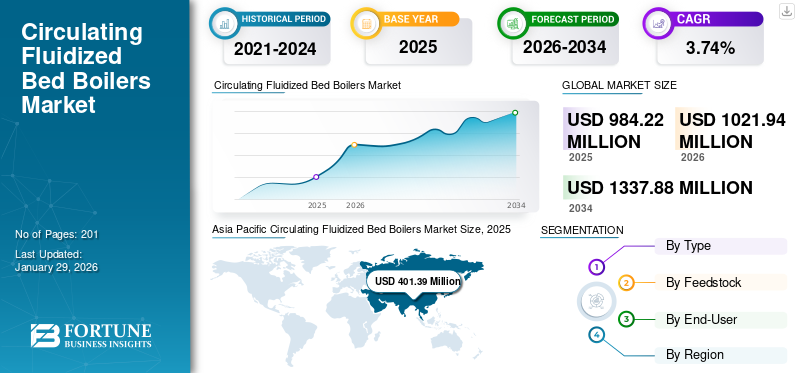

Circulating Fluidized Bed Boilers Market Size, Share & Industry Analysis, By Type (Subcritical CFB Boiler, Supercritical CFB Boiler, and Ultra-Supercritical Boiler), By Feedstock (Coal, Petcoke, Biomass, and Others), By End-User (Oil and Gas, Power, Chemical, and Others), and Regional Forecast, 2026-2034

Circulating Fluidized Bed Boilers Market Size

The global circulating fluidized bed boilers market size was valued at USD 983.07 million in 2025. The market is projected to grow from USD 1,018.50 million in 2026 to USD 1,366.59 million by 2034, exhibiting a CAGR of 3.74% during the forecast period.

The Circulating Fluidized Bed (CFB) boilers market is rising primarily due to their ability to deliver cost-efficient, environmentally compliant, and fuel-flexible steam and power generation across industrial and utility applications. CFB boilers can efficiently utilize low-grade coal, petcoke, biomass, and industrial waste fuels, allowing operators to reduce fuel procurement costs and mitigate supply risks. These boilers significantly lower combustion temperatures, reduce nitrogen oxide emissions, while in-bed sulfur capture minimizes sulfur dioxide emissions, eliminating the need for complex downstream treatment systems. This helps industries to comply with tightening environmental regulations and function on low capital and operating costs. Vendors are providing circulating fluidized bed boiler products that enable efficient combustion of low-grade fuels. The growth of the bubbling fluidized segment is driven by its ability to efficiently burn biomass, agricultural waste, and low-grade fuels while maintaining stable combustion and stringent emission regulations across industrial and power generation applications. A few other wide ranges of fuels, include low-grade coal, biomass, and industrial waste, which are used while meeting stringent emission regulations.

In February 2023, Sumitomo Heavy Industries' subsidiary, Sumitomo SHI FW (a joint venture between Sumitomo Heavy Industries and Foster Wheeler), provided a CFB boiler to Solvay's manufacturing facility for production of soda and sodium bicarbonate, to reduce the carbon footprint of its operations. Recycled wood chips are used as fuel in the boiler to produce low-carbon electricity at the Rheinberg Solvay factory. The current coal-fired boiler is replaced with a new model which contributes to a reduction of 295,000 tons in Solvay's yearly CO2 emissions.

Sumitomo Heavy Industries and Babcock & Wilcox are providing circulating fluidized bed boiler products that offer high fuel flexibility, efficient steam and power generation for industrial and utility applications with lowered CO2 emissions.

CIRCULATING FLUIDIZED BED BOILERS MARKET TRENDS

Surge in Popularity of CFB Boilers in the Oil and Gas Industry to Boost Market Growth

The growing popularity of circulating fluidized bed boilers in the oil and gas sector is a major driver of the market's overall expansion. Unlike conventional boilers, CFB boilers can effectively simplify the difficult-to-burn fuel byproducts such as petroleum coke, heavy residues, sludge, and other low-grade refinery wastes. Hence the refineries and petrochemical plants are increasingly adopting them.

In July 2024, ANDRITZ supplied a fluidized bed boiler system for a mono-incineration plant, highlighting the growing adoption of technology for efficient waste and by-product management solutions.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increased Adoption of Biomass and Implementation of Waste-to-Energy Techniques Assist in Complying Strict Environmental Laws

One of the primary factors driving the expansion of CFB boilers is the increasing utilization of biomass and Waste-to-Energy (WTE). The CFB technology is particularly adept at burning low-quality. As countries and organizations mandate these sectors to cut on carbon emissions, biomass is a desirable carbon-neutral fuel, and the WTE systems assist in tackling the issues of waste management and energy demand. CFB boilers operate at lower, consistent temperatures and provide excellent fuel-air mixing. This allows them to handle a wide range of moisture levels irrespective of the particle size and calorific values that typically arise in biomass and waste fuels.

Governments worldwide are implementing stringent environmental laws and providing incentives for landfill reduction and renewable energy which significantly highlights the importance of biomass and waste-to-energy (WTE). As CFB boilers naturally create fewer NOx and SO₂ emissions and enable in-bed desulfurization, its purpose and strategy complies with these environmental regulations.

In March 2025, Fortum and Sumitomo Heavy Industries upgraded the CFB boiler at the Częstochowa CHP factory in Poland. The boiler's fuel combination was changed from approximately 70% coal + 30% biomass to 100% approved renewable biomass as a result of the modification.

MARKET RESTRAINTS

High Maintenance and Installation Costs of CFB Boilers to Hamper Market Growth

Circulating Fluidized Bed (CFB) boilers offer significant benefits, such as fuel flexibility and minimal emissions. However, their upfront installation and maintenance costs are expensive to those of traditional boiler systems. The initial investment on the CFB boilers is higher as it needs a fluidization air system, bed material handling units, refractory linings, and advanced emission control systems. Additionally, CFB boilers are less appealing to cost-sensitive businesses or areas that have limited financial resources. Most capital expenditures are associated with engineering, manufacturing, and commissioning of these specialized components.

The higher lifecycle costs associated with these technologies make them less attractive to small and medium-sized businesses. Large industrial consumers can opt to avoid CFB technology in favor of less expensive options, such as subcritical coal boilers or gas-fired boilers. Businesses prefer them only if they can afford to meet their electricity needs and standards of fundamental steam at a reduced cost.

MARKET OPPORTUNITIES

Government Support for Clean Energy Initiatives Create Growth Opportunities

Many regions, particularly those with high population densities, such as India and China, prioritize industrialization and infrastructure development. The growth of the circulating fluidized bed boilers market is driven by the expanding population in the region and the significant demand for energy production across several nations. The DOE's Bioenergy Office in the U.S. is releasing funding calls and grants for bioenergy and waste-to-energy initiatives, establishing direct routes for facilities powered by biomass or waste

In February 2024, Valmet delivered a partial bioconversion for PT. Cikarang Listrindo Tbk's coal-fired circulating fluidized bed (CFB) boiler in Babelan, Indonesia. By reducing reliance on fossil fuels and lowering CO2 emissions, the investment demonstrates Cikarang Listrindo's commitment to environmentally responsible operations and cleaner energy production.

MARKET CHALLENGES

Operational Complexities to Impede Market Growth

Various factors such as operational complexities, the need for exact process control and higher maintenance intensity hinders the CFB boilers market. To ensure effective combustion and low emissions, CFB boilers must maintain a steady fluidization of the bed material, continuous circulation of solids, and precise control of air distribution and fuel feeding. Any imbalance can result in lower efficiency, higher wear, or operational instability.

Furthermore, the rapid movement of particles leads to the erosion of boiler parts resulting in higher maintenance expenses and increased downtime. The operational and maintenance difficulties increase operating risks and smaller industrial users or facilities with limited technical knowledge. This ultimately restricts wider adoption and slows down the circulating fluidized bed boilers market growth.

Segmentation Analysis

By Type

Subcritical CFB Boiler Leads Due to Wide Adoption in Industrial and Mid-Scale Power Applications

Based on type, the market is classified into subcritical CFB boiler, supercritical CFB boiler, and ultra-supercritical boiler.

The subcritical CFB boiler dominates the segment due to its established dependability, reduced capital costs, and widespread use in medium-scale power applications and industry. As a result, the subcritical CFB boiler is the most popular type of circulating fluidized bed boiler.

Supercritical CFB boiler is the second-dominant segment as it offers improved thermal efficiency, reduced fuel consumption, and better compliance with stringent emission standards. The sub-segment is projected to grow at a CAGR of 4.03% during the forecast period.

By Feedstock

Coal is the Leading Feedstock Due to its Abundant Availability and Cost-Effectiveness

In terms of feedstock, the market is categorized into coal, petcoke, biomass, and others. The coal segment dominates the circulating fluidized bed boilers market share due to the widespread availability of coal and its cost advantage. The ability of CFB boilers to burn low-grade coal while meeting emission regulations efficiently.

Petcoke is the second largest segment due to low cost with high calorific value and ability of CFB boilers to handle its high sulfur content while maintaining efficient emission compliance.

The biomass segment will grow at a CAGR of 6.50% during the forecast period of 2026-2034.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Reliable Process Steam to Drive Segment Growth

In terms of end-user, the market is categorized into oil and gas, power, chemical, and others. The oil and gas segment dominates the circulating fluidized bed boilers market due to high demand for reliable steam and captive power. It is also because of the fuel flexibility for refinery by-products and stringent emission compliance requirements in downstream operations.

The chemical segment is growing due to rising demand for reliable, fuel-flexible, and emission-compliant steam and power generation in chemical manufacturing facilities. The segment is expected to grow at a CAGR of 3.66% during the forecast period.

Circulating Fluidized Bed Boilers Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Circulating Fluidized Bed Boilers Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant circulating fluidized bed boilers market share in 2025, valued at USD 401.39 million, and is anticipated to take a leading share in 2026 with USD 417.45 million. The region is growing due to rapid industrialization, expansion of power and process industries, abundant availability of low-grade fuels, and tightening emission regulations across the region.

China Circulating Fluidized Bed Boilers Market

In 2025, the Chinese market reached USD 150.25 million. China is growing due to large-scale industrial demand, abundant availability of low-grade coal, stricter emission regulations, and the need for efficient and cost-effective power and process steam generation. For instance, in March 2025, at Yunnan Provincial Energy Investment Group Co., Ltd.'s Honghe Power Plant, the first 700-megawatt ultra-supercritical Circulating Fluidized Bed (CFB) coal-fired power unit in the world created and provided by Dongfang Electric Corporation (DEC) is connected to the grid for testing.

India Circulating Fluidized Bed Boilers Market

The Indian market in 2025 reached USD 92.25 million, accounting for roughly 9.38% of the global market share.

North America

North America was valued at roughly USD 187.77 million in 2025 and is anticipated to reach USD 194.36 million in 2026. The market is expected to grow modestly over the forecast period, driven mainly by retrofit and modernization demand (life-extension, reliability enhancements, emissions-related upgrades) and niche biomass/WTE and industrial applications where CFB fuel flexibility provides an advantage. While new coal CFB additions are limited, the installed base—together with select industrial decarbonization opportunities—supports a steady market outlook.

U.S. Circulating Fluidized Bed Boilers Market

The U.S. market achieved USD 154.51 million in 2025, accounting for ~15% of the global CFB boiler revenue. The growth is expected to be led by retrofit cycles and selective biomass/WtE or industrial steam projects rather than large-scale coal new-build activity.

Europe

Europe accounted for an estimated USD 273.48 million in 2025 and is projected to hit USD 283.11 million in 2026. The region’s market is shaped by new coal power builds and by biomass and waste-to-energy (WTE) projects, along with targeted retrofits that improve fuel flexibility and emissions performance. The region’s transition policies and industrial decarbonization initiatives support selective investments in CFB for biomass and multi-fuel applications, particularly in CHP, district heating, and certain industrial steam applications. As a result, Europe is expected to showcase stable, low-single-digit growth through 2034, with demand concentrated in biomass/WTE-led applications and life-extension work.

U.K Circulating Fluidized Bed Boilers Market

The U.K. market in 2025 captured USD 53.95 million, representing 5.4% of the global market share.

Germany Circulating Fluidized Bed Boilers Market

Germany’s market for circulating fluidized bed boiler in 2025 reached USD 42.62 million, roughly 4.3% of the global market

Latin America & the Middle East Africa

Latin America and the Middle East & Africa (MEA) accounted for an estimated USD 70.25 million in 2025 and approximately USD 50.19 million respectively. In Latin America, demand is primarily linked to biomass- and residue-based energy projects (notably in agro-industrial and pulp & paper sectors), along with selective CHP installations and retrofit activities. In MEA, market activity is more episodic, driven by industrial power and steam projects, including applications using petcoke or mixed solid fuels, as well as occasional modernization of existing units. Overall, the CFB boiler market in these regions is expected to grow at a moderate rate through the forecast period, with annual revenues influenced by the timing and scale of individual projects rather than a continuous pipeline of new builds.

GCC

The GCC circulating fluidized bed boilers market in 2025 reached USD 17.16 million, representing roughly 2% of the global market.

COMPETITIVE LANDSCAPE

Key Industry Players

Vendors to Prioritize New Power Generation Projects for Market Expansion

Circulating fluidized bed boilers market vendors are actively undertaking new power and industrial boiler projects to meet rising demand for fuel-flexible and emission-compliant energy solutions. New power plants enable suppliers to install large-capacity CFB boilers that can effectively use a variety of fuels. These mostly include low-grade coal, petcoke, biomass, and industrial waste, making them appealing in terms of a wider range of fuel alternatives for developing nations and areas.

In July 2024, in an exchange filing, Thermax stated that over the course of 23 months, its wholly owned subsidiary, Thermax Babcock & Wilcox Energy Solutions, would provide two 550 TPH circulating fluidized bed combustion (CFBC) boilers. The construction of the initial phase, which is the customer's 300 MW power plant, will be aided by this order.

LIST OF KEY CIRCULATING FLUIDIZED BED BOILERS COMPANIES PROFILED

- Sumitomo Corporation (Japan)

- Babcock & Wilcox (U.S.)

- General Electric (U.S.)

- Hyundai Heavy Industry Co. (South Korea)

- ANDRITZ (Austria)

- Mitsubishi Heavy Industries Ltd (Japan)

- Thermax (India)

- Valmet (Finland)

- Industrial Boilers America (U.S.)

- Alstom (France)

KEY INDUSTRY DEVELOPMENTS

- November 2025: Valmet will provide a CFB boiler, flue gas treatment system, and automation system to Cheng Loong Corporation's (CLC) Houli paper mill in Taiwan. The flue boiler will burn a variety of biomass and waste streams as fuel to generate heat and electricity.

- October 2024: The Mitsubishi Heavy Industries Power Environmental Solutions designed, delivered, and supplied the generators and provided the air quality control systems to various businesses. The MHI Group is committed to increasing the application of sustainable energy power generation systems that utilizes resources efficiently and will have minimal environmental impact.

- July 2024: General Electric (GE) has announced plans to expand its participation in the Circulating Fluidized Bed (CFB) boiler sector by aligning the technology with decarbonization and fuel-flexible power production methods. Recently, GE has concentrated on offering CFB-based solutions to utilities and industrial clients for biomass co-firing, waste-to-energy conversion, and low-emission thermal power production, especially in areas which are far from traditional coal-fired facilities.

- November 2022: Babcock & Wilcox announced that its B&W Environmental and B&W Thermal divisions had won a contract worth approximately USD 24 million comprising to provide auxiliary equipment, cutting-edge emissions control technologies, and two industrial package boilers for an oil refinery in North America. The petroleum refining industry's clients will be able to choose from a variety of adaptable features and options offered by the boilers and emission control systems, allowing them to address their specific needs and challenges.

- February 2022: ANDRITZ announced that the 52.7-MW PowerFluid circulating fluidized bed boiler will be a part of the biomass power plant in Fukuyama, Hiroshima. The boiler will be integrated into a biomass-fired power generation facility that will utilize wood chips, wood pellets, and palm kernel shells as its primary fuel sources.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.74% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, Feedstock, End-User, and Region |

|

By Type |

· Subcritical CFB Boiler · Supercritical CFB Boiler · Ultra-Supercritical Boiler |

|

By Feedstock |

· Coal · Petcoke · Biomass · Others |

|

By End-User |

· Oil and Gas · Power · Chemical · Others |

|

By Geography |

· North America (By Type, By Feedstock, By Application, and Country) o U.S. o Canada · Europe (By Type, By Feedstock, By Application, and Country) o U.K. o Germany o France o Italy o Spain o Russia o Rest of Europe · Asia Pacific (By Type, By Feedstock, By Application, and Country) o China o India o Japan o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Type, By Feedstock, By Application, and Country) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, By Feedstock, By Application, and Country) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 983.07 million in 2025 and is projected to reach USD 1,366.59 million by 2034.

The market is expected to exhibit a CAGR of 3.74% during the forecast period.

In 2025, the oil and gas segment led the market in terms of end-user.

Increased adoption of biomass and implementation of waste-to-energy techniques are key factors boosting market growth.

Sumitomo Corporation, Valmet, Babcock and Wilcox, and other companies are among the prominent players in the market.

Asia Pacific dominated the market and held the highest share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us