Healthcare Architecture Market Size, Share & Industry Analysis, By Facility Type (Hospitals, ASCs, Long Term Care Facilities & Nursing Homes, Academic Institutes, and Others), By Service Type (New Construction and Refurbishment), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

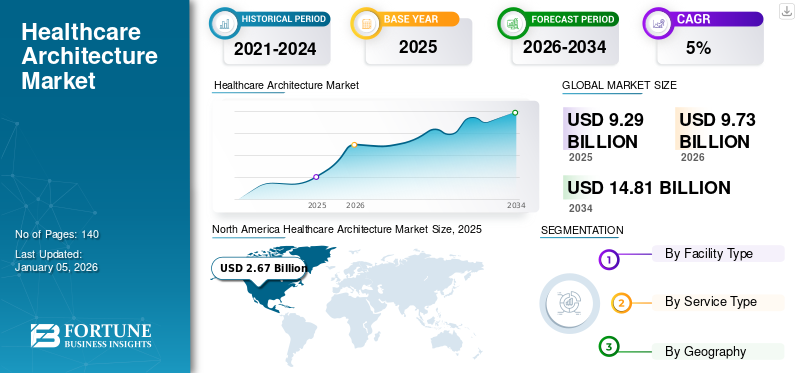

The global healthcare architecture market size was valued at USD 9.29 billion in 2025. The market is anticipated to grow from USD 9.73 billion in 2026 to USD 14.81 billion by 2034, exhibiting a CAGR of 5.39% during the forecast period. North America dominated the healthcare architecture market with a market share of 28.69% in 2025.

Healthcare architecture refers to the designing and planning of healthcare facilities to create spaces that support the efficient and effective delivery of healthcare services. The architecture of hospitals is critical for maintaining public health as it influences the behavioral pattern of patients and provides ease in working in such spaces. According to the Cybermetrics Lab and the Spanish National Research Council (CSIC) research group, due to the increased requirement for new hospitals, several new hospital facility constructions and refurbishments are in the pipeline globally, with some of the investments amounting to USD 500 million. A growing number of hospitals in developed and developing nations is expected to boost the expansion of the healthcare architecture industry during the forecast period.

The major factor responsible for the market growth is the increasing rate of hospitalization and rising demand for advanced healthcare infrastructure to equip the facility with advanced medical products. Moreover, the rising investment in the healthcare infrastructure and increasing awareness about healthcare architecture are other significant factors driving the healthcare architecture market growth.

The COVID-19 pandemic negatively impacted the market due to the imposition of lockdowns, displacement of laborers and architects to their native places, and the restricted supply of raw materials. In addition, during the initial phase of the COVID-19 pandemic, the healthcare system was unprepared to combat the patient load and other challenges with existing infrastructure. The above factors led to the overall slowdown of the market. Moreover, the pandemic delayed several strategic plans and achievements of the companies operating in the market and pushed the targets to 2023, hampering the market growth.

- For instance, Stantec witnessed a slight decline in revenue for consecutively two years. The company witnessed a revenue decline of -2.0% and -3.2% in 2020 and 2021, respectively.

However, post-COVID, the market indicated considerable growth and returned to the pre-pandemic level, owing to the readiness of healthcare institutions for such an unexpected pandemic. Thus, the government's increasing attention to evolving healthcare infrastructure helped the market recover rapidly from the impact of the COVID-19 pandemic.

Global Healthcare Architecture Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 8.29 billion

- 2026 Market Size: USD 9.73 billion

- 2034 Forecast Market Size: USD 14.81 billion

- CAGR: 5.39% from 2026–2034

Market Share:

- North America dominated the healthcare architecture market with a 28.69% share in 2025, driven by rising investments in healthcare infrastructure, increasing demand for advanced facility designs, and robust adoption of healthcare architecture services across hospitals and specialized centers.

- By facility type, Hospitals are expected to maintain their leading market share due to the rising number of government-aided hospital projects and expanding access to healthcare infrastructure in emerging economies.

Key Country Highlights:

- United States: The focus on modernizing healthcare facilities and increasing federal funding for infrastructure improvements are major factors driving the demand for healthcare architecture services.

- Europe: The adoption of innovative healthcare design frameworks, such as hospital reference architecture tools, and the rise in chronic illness cases are influencing the region's healthcare architecture landscape.

- China: Government initiatives to expand healthcare access and increased healthcare spending are accelerating new hospital construction and refurbishment projects across the country.

- Japan: The high demand for technologically advanced hospital designs and the well-established healthcare infrastructure are fostering the growth of healthcare architecture services in the country.

Healthcare Architecture Market Trends

Rising Adoption of Neuroaesthetics and Growing Inclination toward Space Repurposing

With the onset of the COVID-19 pandemic, the real estate industry adopted the concept of neuroaesthetics and the requirement of repurposing spaces. Neuroaesthetics deals with the perception, thoughts, and emotions shaped by the architectural environment around a person. The neuroaesthetics concept in health space design is trending and can be used to create responsive spaces that promote faster healing. Several hospitals are employing the therapeutic arts to facilitate healing transformation. They are additionally designing a pioneering restoration center, tailored to be accessible to staff, clinicians and faculty, aimed at bolstering their mental health, aiding of recovery and fostering resilience. For instance, the acute psychiatric inpatient units at the Dandenong Hospital in Melbourne, Australia, have wide corridors and a layout that meanders through landscaped courtyards. Such design elements could prove advantageous for individuals with dementia who may tend to wander.

- For instance, according to an article published in MDPI in 2021, the application of neuroscience in architecture is gaining prominence. Designing buildings with neuroscientific explorations can improve human cognitive-emotional response.

Moreover, repurposing healthcare spaces can play a significant role in revitalizing communities. Adaptive reuse of existing healthcare buildings offers huge potential to address the healthcare system's needs. Repurposing and structuring of space are becoming a popular strategy for hospital systems to expand services away from their hospitals. It requires less capital and repurposed space can be operational more quickly than new construction.

Thus, implementing neuroaesthetics architecture and repurposing space gained huge attention after the COVID-19 pandemic and is expected to positively influence the market.

Download Free sample to learn more about this report.

Healthcare Architecture Market Growth Factors

Increasing Rate of Hospitalizations is Driving the Growth of the Market Globally

The growth of the global market is primarily driven by the increasing rate of hospitalizations, which can be attributed to the rising diagnoses of acute and chronic diseases, growing incidences of traumas, and the increasing demand for preventive medical care. In many regions, there has been an increasing trend of medical tourism, which requires an extensively developed medical infrastructure that is expected to support market growth during the forecast period.

- For instance, according to an article published in January 2022, the U.S. witnessed a sudden surge in hospitalization rates due to omicron-driven COVID-19 cases. According to the data tracked by the Department of Health and Human Services, more than 5,400 hospitals in the U.S. witnessed increased hospitalization rates, indicating the demand for well-developed healthcare infrastructure.

In addition, the opening of new hospitals, surgical centers, and rehabilitation facilities to provide patient care across the world is one of the factors contributing to the market growth.

- For instance, in April 2023, UC Davis Health announced the opening of a rehabilitation hospital located at the Sacramento medical center campus. This hospital is fully equipped with cutting-edge facilities where the patient can practice their daily activities. The facility includes 12-bed units for brain injury patients and four private rooms specifically designed for bariatric patients.

Moreover, a significant range of funds allocated by the government to the healthcare sector of emerging economies is estimated to boost the market by the end of the forecast period.

RESTRAINING FACTORS

High Cost and Technical Requirements to Limit the Market Growth

Healthcare architecture is one of the complex architecture types and is associated with several regulations. Hospital architecture demands meticulous planning at each level, from dimensions to construction details, as it is meant to fulfill the needs of patients and caregivers. Being a specialized sector, the balance between art, cost, time, technique, and requirements is challenging and limiting the market growth.

- For instance, according to an article published in March 2023 by Togal.AI, a construction technology company in the U.S., building hospitals costs between USD 60 million and USD 187.5 million on average, where the architect takes around 20% of the project cost.

In addition, there is a high spending on medical devices that is necessitated at the hospitals. For instance, as per data provided by Medical Product Outsourcing (MPO) in April 2021, around USD 200.00 billion was spent by U.S. hospitals on medical devices.

Moreover, different types of healthcare rooms, such as OPD, IPD, administrative, diagnostics, ICU, surgery rooms, and others, require particular temperatures and humidity levels. Such broad necessities with limited resources, limits the creativity and hampers the market growth.

Healthcare Architecture Market Segmentation Analysis

By Facility Type Analysis

Hospitals Segment Dominated Due to Rising Government Emphasis on Improving Healthcare Architecture

Based on facility type, the global market is categorized into hospitals, ASCs, long term care facilities & nursing homes, academic institutes, and others. The hospitals segment accounted for the largest market share of 54.67% in 2026. The segment growth is due to the increase in the number of government-aided hospitals to expand the accessibility to healthcare.

The ASCs segment is set to exhibit significant growth during the forecast period. The increasing preference for ASCs, lower cost of care, and reduced stay are the factors expected to propel the segment growth during the forecast period.

- For instance, according to a news article published in September 2021, the procedures performed at ambulatory surgical centers may cost around 59.0% less than the cost of the same procedures at hospitals.

Moreover, the increasing prevalence of chronic diseases necessitating surgical interventions is fueling segmental growth. In addition, the increasing shift of patient admissions from hospitals to ASCs is one of the factors contributing to the segment growth.

- For instance, as per data provided by Definitive Healthcare, LLC., in January 2023, the total number of outpatient surgical claims procedures conducted at ASCs has been gradually increasing, while these procedures were recorded to slightly decline in the case of hospitals.

To know how our report can help streamline your business, Speak to Analyst

By Service Type Analysis

New Construction Segment Led the Market Due to Expansion of Healthcare Facilities

Based on service type, the market is segmented into new construction and refurbishment. The new Refurbishment segment held the largest market share of 51.07% in 2026 due to the high and sustained demand for the advanced hospital architecture globally. A significant amount of funds allocated by the government to the hospital sector of emerging economies is estimated to boost the market growth by the end of the forecast period.

REGIONAL INSIGHTS

Based on the regional ground, the market is studied across Europe, North America, the Asia Pacific, Latin America, and the Middle East & Africa.

North America Healthcare Architecture Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market is estimated to grow at a substantial CAGR over the forecast period. The region dominated the market with a valuation of USD 2.67 billion in 2025 and USD 2.8 billion in 2026. Rising technological developments, increasing funding for healthcare infrastructure, and surging adoption of healthcare architecture services are the major factors behind the regional growth. The U.S. market is projected to reach USD 2.8 billion by 2026.

- For instance, in September 2021, Human Resource & Service Administration (HRSA) was awarded USD 1 billion in funding by the American Rescue Plan Act to support expansion, construction, renovation, alteration, and other capital improvements to enhance healthcare infrastructure at HRSA-funded health centers.

Europe market accounted for a significant market share in 2024 due to technological advancements and increasing public and private partnerships. Furthermore, rising cases of major illness among the European population necessitate treatment with advanced healthcare facilities, which is one of the factors driving the regional growth. The UK market is expected to reach USD 0.56 billion by 2026, while the Germany market is projected to reach USD 0.99 billion by 2026.

- As per data provided by the Health Foundation in July 2023, approximately 9.1 million individuals in England are anticipated to be living with major illnesses by 2040.

- For instance, according to an article published in June 2022, ZiRA is a Hospital Reference Architecture tool innovated by the Dutch healthcare system. It is a set of interlocking components such as templates, models, and downloadable files that provide architects, managers, and high-level decision-makers tools they can use to describe and understand the current state of their hospital and transform virtually any aspects of their business to achieve desired states.

The market in the Asia Pacific is set to depict the fastest growth rate over the forecast period. The major factors behind the growth are the increasing population in Asia Pacific countries and the increasing need to use the repurposing space concept to accommodate more people in limited healthcare facilities. Japan is expected to provide the largest market opportunity due to the developed healthcare sector in the country coupled with a high demand for technologically advanced hospital architecture. China also contributes heavily to the regional growth due to increased healthcare expenditure. The Japan market is anticipated to reach USD 0.42 billion by 2026, the China market is projected to reach USD 0.74 billion by 2026, and the India market is expected to reach USD 0.66 billion by 2026.

The rest of the world regional segment is expected to expand at a lower CAGR than other regions during the forecast period. The limited growth opportunity is leading to the lack of demand for the solution.

Key Industry Players

Market Players Focus on Getting Recognition to Capture High Market Share

The market is fragmented, with numerous small & mid-size players operating globally. HDR, HKS Inc, Perkins+Will, and Stantec are the key companies operating in the market in 2024. With the increasing demand for and adoption of healthcare architecture, companies are getting recognition owing to their capabilities to provide master planning with cost-effective designs that further strengthens their market presence.

- For instance, in September 2022, NBBJ, a U.S.-based architecture firm, received AIA Healthcare Design Awards for its two projects.

Recent years have recorded a rising demand for lead design consultants for healthcare facilities in countries such as Australia and the UAE. In addition, a strong network of qualified architects across the globe is another key factor associated with an estimated rise in the number of healthcare architecture firms in the world by the end of the forecast period.

List of Top Healthcare Architecture Companies:

- HDR (U.S.)

- HKS Inc (U.S.)

- PERKINS & WILL (U.K.)

- Stantec (Canada)

- CannonDesign (U.S.)

- NBBJ (U.S.)

- Perkins Eastman (U.S.)

- SmithGroup (U.S.)

- HOK (U.S.)

- EYP Architecture & Engineering (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 - HKS Inc. announced the opening of its first office in Seattle, Pacific Northwest. The establishment of the new office is focused on technology and the healthcare sector and is a part of the company’s expansion to an existing network of 27 offices globally.

- June 2023 – HDR announced its expansion in Southern California owing to the region's increased demand for biotechnology, life sciences, and healthcare facilities. The recent healthcare projects served by the company included a design showroom-turned-laboratory in the iconic Pacific Design Center, a three-phase masterplan and replacement hospital for Sharp HealthCare in San Diego, and Marina Del Rey Hospital for Cedars-Sinai in Los Angeles.

- March 2023 - HDR announced that Henry Ford Health selected the company to lead the collaborative architectural engineering team to design its transformative hospital campus expansion in Detroit. The hospital campus would cover a one-million-square-foot-plus area.

- November 2022 – CannonDesign announced that the company was selected by Memorial Sloan Kettering (MSK) Cancer Center to design its new 30+ story Cancer Care Pavilion devoted exclusively to cancer patient care.

- March 2022 – Stantec announced that the company was selected by Trillium Health Partners to plan and design the Mississauga Hospital facility in Ontario. The project would provide specialized care and tackle future challenges associated with healthcare infrastructure.

REPORT COVERAGE

The healthcare architecture market report provides an in-depth industry analysis. It focuses on segments such as facility type and service type. Besides this, it offers insights related to key market trends. In addition, the report highlights the competitive landscape and several factors contributing to industry growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.39% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Facility Type

|

|

By Service Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is anticipated to grow from USD 9.73 billion in 2026 to USD 14.81 billion by 2034.

The market is projected to grow at a CAGR of 5.39% during the forecast period (2026-2034).

By facility type, the hospitals segment will lead the market.

The increasing rate of hospitalizations and increasing demand for repurposing space are some factors driving the market.

HDR, HKS, Perkins+Will, and Stantec are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us