Solvents Market Size, Share & Industry Analysis, By Product Type (Alcohols, Ketones, Esters, and Others), By Application (Paints & Coatings, Printing Inks, Industrial Cleaning, Adhesives, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

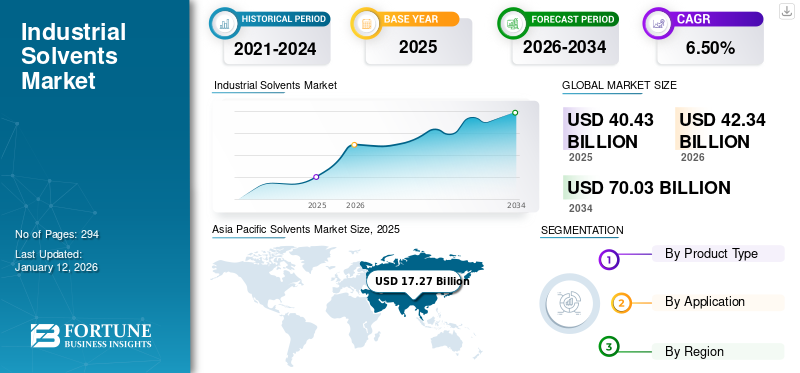

The global solvents market size was valued at USD 40.43 billion in 2025. The market is projected to grow from USD 42.34 billion in 2026 to USD 70.03 billion by 2034, exhibiting a CAGR of 6.50% during the forecast period. Asia Pacific dominated the permanent magnet market with a market share of 43% in 2025.

A solvent is a substance that dissolves a solute to form a solution. While most solvents are liquids, they can also exist in solid or gaseous forms. Common categories include methanol, ethanol, butanol, propylene glycols, glycol ethers, butyl glycol ethers, acetone, esters, toluene, and hydrocarbons. These substances are capable of dissolving, absorbing, and diluting other materials into a fine, uniform distribution without chemically altering them.

Increasing innovation and technological advancements in the chemical industry, along with increasing demand for bio-based products driven by stricter environmental regulations, are expected to fuel market demand. In addition, the rapid expansion of the paints and coatings industry is anticipated to significantly contribute to global market growth over the forecast period.

- For instance, according to the U.S. Census Bureau, total construction spending in the U.S. remained strong, with an estimated annual rate of about USD 2,169.5 billion in August 2025. It is further reflecting continued investment in residential, private, and public construction activity. High construction spending directly boosts demand for paints and coatings used in architectural and protective applications.

Furthermore, many key industry players, such as Exxon Mobil Corporation, Shell plc, BASF, LyondellBasell Industries Holdings B.V., and Honeywell International Inc., operating in the market, are focusing on developing various innovative products to support the rising demand.

SOLVENTS MARKET TRENDS

Shift Toward Bio-Based and Environmentally Friendly Solvents is the Latest Trend

The solvents industry plays a crucial role in various industries, including pharmaceuticals, coatings, adhesives, and cleaning products. However, traditional hydrocarbon solvents have significant environmental and health impacts due to the presence of Volatile Organic Compounds (VOCs), toxic chemicals, and the energy-intensive processes associated with their production and disposal. As global awareness of environmental issues increases, the need for sustainability in the market has become paramount. The shift toward bio-based solvents involves replacing traditional VOCs with safer, bio-based, or less toxic alternatives. The drive for sustainability in the market is influenced by several factors, including regulatory pressures, consumer demand for eco-friendly products, and the growing recognition of corporate social responsibility. This shift encompasses the development of green solvents, the implementation of sustainable manufacturing practices, and the establishment of recycling and recovery systems

- For instance, in the U.K., a suite of governmental strategies such as the National Materials Innovation Strategy, K. Packaging Pact and Delivering a Net Zero NHS Strategy explicitly prioritize bio-based chemicals and materials (which encompass bio-based solvents) as central to economic growth and environmental benefit.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Product demand from Paints & Coatings Industry to Boost Market Growth

The market is witnessing substantial growth, significantly driven by the increasing demand from the paints and coatings industry. Solvents are vital components in the formulation of paints and coatings, acting as carriers for pigments, resins, and other additives.

As the construction and automotive sectors expand, along with rising consumer interest in home improvement, the demand for paints and coatings is surging. This essay delves into the dynamics of the market, the factors fueling the growth of the paints and coatings industry, and the implications for the market. Solvents serve several critical functions in the formulation of paints and coatings including dissolution, application properties, drying and cleaning. Given these functions, the choice of solvent significantly impacts the performance and environmental footprint of paints and coatings.

The global construction sector is expanding rapidly, driven by urbanization, infrastructure development, and increasing housing demand. As per, India Brand Equity Foundation, India's government increased capital expenditure by 11.1% to USD 133 billion in FY 2024-25, equating to 3.4% of GDP, with a focus on infrastructure such as roads, railways, housing, and urban development. These investments directly stimulate the construction sector through projects such as transit-oriented developments, industrial parks, and 30 million additional homes under PMAY. This growth fuels the need for paints and coatings for both interior and exterior applications. High-performance coatings are required for new buildings, renovations, and maintenance, creating a significant demand for solvents.

Growing Demand For Eco-friendly Solvents Due To Environmental Consciousness and Regulations to Bolster Market Growth

The rise of environmental consciousness among consumers is a significant driving force behind the demand for eco-friendly solvents.

In recent years, there has been a notable shift in consumer and industrial preferences toward eco-friendly solvents, driven by increasing environmental consciousness. This transition is reshaping the global market, encouraging manufacturers to innovate and adapt their product lines to meet the demands for more sustainable and less harmful alternatives.

Eco-friendly solvents, often referred to as "green solvents," are derived from renewable resources or have low environmental impact compared to conventional organic solvents. These solvents include water-based solvents, bio-based solvents, and those with low volatile organic compound (VOC) emissions. Examples of eco-friendly solvents include ethanol, isopropanol, and plant-derived alternatives such as terpenes and glycerol.

MARKET RESTRAINTS

Hazardous Impacts Caused By Chemical Based Certain Solvents to Hamper Market Growth

Chemical solvents play a vital role in numerous industries, including paints and coatings, pharmaceuticals, and cleaning products. Hazardous impacts from certain chemical-based solvents restrain solvent-market growth as they trigger stricter regulation, worker-exposure controls, product bans in consumer uses, higher compliance costs, and accelerated substitution. However, the hazardous impacts associated with many chemical solvents are increasingly coming under scrutiny, which poses significant challenges to market growth.

One of the primary concerns regarding chemical solvents is their potential health hazards. Many organic solvents, such as benzene, toluene, and xylene, are known to be toxic. Prolonged exposure can lead to various types of health issues, such as skin irritation, respiratory problems, neurological conditions, and even cancer. For instance, benzene is a recognized carcinogen that can cause leukemia and other blood-related diseases. Workers in industries that frequently use these solvents, such as paint manufacturing and cleaning services, are particularly at risk, leading to increased occupational health concerns and associated costs for companies.

MARKET OPPORTUNITIES

Solvent Recovery and Recycling May Create Lucrative Growth Opportunities

Solvent recovery, often termed as solvent reclamation or solvent recycling, is a vital economic factor in defining the possibility of a new project or capacity expansion. Environmental guidelines, new solvent expenditures and waste disposal costs can simply outdo the cost of solvent recovery apparatus and operations. In-process solvent retrieval is extensively used as a substitute to solvent replacement to decrease waste generation.

Solvent recovery and recycling present attractive growth opportunities by enabling industries to reduce raw material costs, minimize waste, and comply with increasingly stringent environmental regulations. Rising solvent prices and VOC emission norms are encouraging the adoption of closed-loop recovery systems, while technological advancements have improved recovery efficiency and solvent quality. Additionally, growing emphasis on sustainability and circular economy practices is driving demand, positioning solvent recovery and recycling as a cost-effective, compliant, and strategically valuable growth avenue across the solvents value chain.

MARKET CHALLENGES

Price Volatility Of Petrochemical Raw Materials To Pose a Critical Challenge To Market Growth

Price volatility of petrochemical raw materials represents one of the most significant challenges for the global market, directly affecting production economics, pricing strategies, and long-term planning. Conventional solvents are primarily derived from petrochemical feedstocks such as crude oil, natural gas, naphtha, and refinery intermediates. Fluctuations in crude oil and natural gas prices, driven by geopolitical tensions, supply disruptions, OPEC production decisions, refinery outages, and shifts in global demand translate rapidly into unstable solvent production costs.

This volatility creates margin pressure for solvent manufacturers, as raw materials account for a substantial share of total production costs. Sudden increases in feedstock prices cannot always be passed on to end users immediately due to fixed-price contracts, competitive market dynamics, or customer resistance, particularly in price-sensitive industries such as paints & coatings, adhesives, and industrial cleaning. As a result, manufacturers often experience compressed margins and earnings unpredictability.

Segmentation Analysis

By Product Type

Increased Demand for Ethanol and Methanol To Propel Segmental Growth

On the basis of product type, the market is segmented into alcohols, ketones, esters, and others.

The alcohols segment accounted for the largest solvents market share in 2023. The growth is due to the increasing demand for ethanol, methanol, n-butanol, and isopropanol for various applications. Ethanol finds its consumption in perfumes, vegetable essences, and printing inks drugs, whereas methanol is highly utilized in inks and adhesive applications. Hence, the increasing adoption of these products will boost the segment’s growth.

Ketones are extensively utilized as a solvent owing to their low molecular weight. They find their application in adhesives, surface coatings, chemical intermediates, and printing inks.

The esters segment is anticipated to rise with a CAGR of 6.00% over the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Paints & Coatings Segment to Lead Market Due to Rapid Growth of Construction Industry

Based on the application, the market is segmented into paints & coatings, printing inks, industrial cleaning, adhesives, and others.

Amongst these, the paints & coatings segment accounted for the dominant market share in 2025 and is expected to grow at the highest CAGR owing to its high usage in the construction industry. The rapid growth of the construction industry, coupled with advancements in paints to make them more sustainable, is contributing to the growth of this application segment.

Printing inks is the second-leading segment in the market. Solvents, such as methanol, ethyl acetate, and aromatic hydrocarbons, are used in printing applications. The rising product demand to remove dirt, flux, greases, containments, and baked-on oils in various industries will fuel the industrial cleaning segment. The growth of the adhesive segment is attributed to the increasing product demand from composites, metals, glass, and plastic applications.

Solvents Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Solvents Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 17.27 billion in 2025 and USD 18.13 billion in 2026 and secure the position of the largest region in the market driven primarily by rapid industrialization, expanding manufacturing capacity, and rising downstream demand in major economies such as China and India. Strong growth in automotive production, pharmaceuticals, electronics manufacturing, and paints and coatings continues to underpin solvent consumption across the region.

Japan Solvents Market

The Japan market value in 2026 is estimated at around USD 0.90 billion, accounting for roughly 2.1% of global Solvents revenues. Japan contributes through high-purity Solvents components used in industrial cleaning, optics, and printing inks devices.

China Solvents Market

China’s market is projected to be one of the largest worldwide, with 2026 revenues estimated at around USD 12.63 billion, representing roughly 30.1% of global Solvents sales.

- According to the Coatings World, China is the largest architectural paint and coatings market globally. A huge construction sector and existing housing stock are boosting the demand for architectural coating products, which in turn is driving the solvents market growth.

India Solvents Market

The India market for solvents in 2026 is estimated at around USD 1.81 billion, accounting for roughly 4.3% of global solvents revenues. India’s solvent market is also expanding rapidly, supported by growth in construction, automotive manufacturing, pharmaceuticals, and packaging industries. Environmental governance in India, led by frameworks such as the Environment (Protection) Act, places growing emphasis on controlling air pollution and limiting VOC emissions from industrial activities.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to hold a significant share in 2026, valuing around USD 13.37 billion. North America is expected to be the second-leading region in the market and recorded a value of USD 12.77 billion in 2025. The rapid growth in the automotive industry and the increasing demand for industrial cleaners to remove oil and grease from vehicles will drive market growth in this region.

U.S. Solvents Market

Based on North America’s strong contribution and the U.S. dominance within the region, the U.S. market can be analytically approximated at around USD 11.57 billion in 2026, accounting for roughly 28.5% of global Solvents sales. The U.S. represents the largest solvent market in North America, accounting for a dominant share of regional consumption. Market growth is underpinned by the country’s diverse and well-established manufacturing base, particularly in automotive, aerospace, construction materials, and consumer goods. These industries rely heavily on solvents for coatings, adhesives, surface treatments, and industrial cleaning, ensuring stable baseline demand.

Europe

Europe is projected to record a growth rate of 5.77% in the coming years and reach a valuation of USD 8.24 billion by 2026. The rising use of alcohol in the cosmetic and food & beverage industries is anticipated to boost product demand in Europe. Moreover, the increasing use of bio-based products as an alternative to chemical-based products will propel market growth in the region.

U.K. Solvents Market

The U.K. market in 2026 is estimated at around USD 0.81 billion, representing roughly 2.0% of global Solvents revenues.

Germany Solvents Market

Germany’s market is projected to reach approximately USD 3.04 billion in 2026, equivalent to around 7.5% of global Solvents sales.

South America and Middle East & Africa

The market in South America is characterized by robust growth potential driven by key industries, such as automotive, pharmaceuticals, mining, and agriculture. While challenges related to regulatory compliance and economic volatility persist, the trend toward sustainability and technological innovation presents lucrative opportunities. The South America market is set to reach a valuation of USD 1.43 billion in 2026. In South America, the demand is primarily linked to electronics assembly, research applications, and luxury goods, rather than upstream manufacturing. The region has limited LED wafer fabrication and semiconductor production capacity, which restricts large-scale usage.

The Middle East & Africa reached a valuation of USD 0.98 billion in 2025.

Saudi Arabia Solvents Market

The Saudi Arabia market is projected to reach around USD 0.72 billion in 2026, representing roughly 1.8% of global solvents revenues.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus On Innovations By Key Players To Propel Market Progress

The global market is moderately consolidated, characterized by the presence of large, integrated multinational chemical companies alongside numerous regional and specialty solvent producers. Competition is shaped by factors such as product range, feedstock integration, pricing, regulatory compliance capabilities, sustainability portfolios, and proximity to end-use industries. Exxon Mobil Corporation, Shell plc, BASF, LyondellBasell Industries Holdings B.V., and Honeywell International Inc. are the largest players in the market.

Other notable players in the global market include Eastman Chemical Company, INEOS, Celenase Corporation, and Ashland. These companies are expected to prioritize new product launches and collaborations to increase their global market share during the forecast period.

LIST OF KEY SOLVENTS COMPANIES PROFILED

- Shell plc (U.K.)

- Eastman Chemical Company (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Ashland (U.S.)

- BASF (Germany)

- Exxon Mobil Corporation (U.S.)

- Celanese Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- INEOS (U.K.)

- Gandhar Oil Refinery (India) Limited (India)

- Vijay Chemsol (India)

- Moksha Chemicals (India)

KEY INDUSTRY DEVELOPMENTS

- October 2024: LyondellBasell (LYB) announced it became the full owner of APK AG in Merseburg, Germany. APK will be fully integrated and continue as part of LYB, a sustainability leader in the chemical industry. It is LYB’s ambition to further develop the company’s unique solvent-based technology for low-density polyethylene (LDPE) and build commercial plants in the future. This will enable LYB to produce new high-purity materials that can be used in applications, such as flexible packaging for personal care products, meeting the demands of customers and brand owners.

- August 2024: Eastman launched a new electronic-grade solvent to deliver superior quality. Eastman electronic grade isopropyl alcohol (IPA) is the latest addition to the EastaPure electronic grade IPA is the latest addition to the EastaPure electronic chemicals line that offers U.S. semiconductor manufacturers a domestically made solvent as reliable in quality as it is in supply.

- May 2024: INEOS announced the acquisition of the LyondellBasell Ethylene Oxide and Derivatives business and production facility at Bayport, Texas. Ethylene Oxide plays an essential role in the day-to-day life of millions of people. It is a key raw material used in large-scale chemical production around the world. It is necessary for the production of pharmaceuticals, cosmetics, semiconductors, polyester, food packaging, construction materials, antifreeze, brake fluids, solvents, paints, soap, and detergents.

- April 2024: BASF launched Efka PX 4360, a solvent-based dispersing agent for industrial coatings. This new solution is specifically developed for solvent-based industrial coatings. It has been designed using BASF's Controlled Free Radical Polymerisation (CFRP) technology to achieve a polymer architecture capable of offering optimal color characteristics, excellent pigment and paint compatibility.

- September 2023: ExxonMobil Marketing (Thailand) Limited (EMMTL) announced its commitment to serve Thai consumers and business sectors with innovative product solutions. The company markets Mobil-branded lubricants and chemical products in Thailand under the theme, “Mobil Gives You Confidence on Every Journey”.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.50% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Product Type, Application, and Region |

|

By Product Type |

· Alcohols · Ketones · Esters · Others |

|

By Application |

· Paints & coatings · Printing inks · Industrial cleaning · Adhesives · Others |

|

By Region |

· North America (By Product Type, Application, and Country) o U.S. (By Application) o Canada (By Application) o Mexico (By Application) · Europe (By Product Type, Application, and Country/Sub-region) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Spain (By Application) o Rest of Europe (By Application) · Asia Pacific (By Product Type, Application, and Country/Sub-region) o China (By Application) o Japan (By Application) o India (By Application) o Southeast Asia(By Application) o Rest of Asia Pacific · South America (By Product Type, Application, and Country/Sub-region) o Brazil (By Application) o Argentina (By Application) o Rest of South America (By Application) · Middle East & Africa (By Product Type, Application, and Country/Sub-region) o Saudi Arabia (By Application) o UAE (By Application) o Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

According to Fortune Business Insights, the global market value stood at USD 40.43 billion in 2025 and is projected to reach USD 70.03 billion by 2034.

In 2025, the market value in North America stood at USD 40.43 billion.

The market is expected to exhibit a CAGR of 6.50% during the forecast period.

By product type, the alcohols segment is expected to lead the market.

The increasing product demand from the paints & coatings industry is expected to be the key factor driving the market.

Exxon Mobil Corporation, Shell plc, BASF SE, and LyondellBasell Industries Holdings B.V. are the major players in the global market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us