Organic Fertilizers Market Size, Share & Industry Analysis, By Source (Animal Origin and Plant Origin), By Form (Dry and Liquid), By Crop Type (Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Turf and Ornamental), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

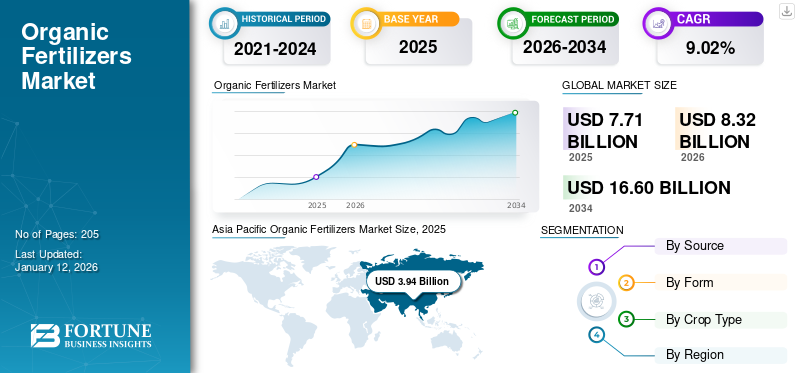

The global organic fertilizers market size was valued at USD 7.71 billion in 2025. The market is projected to grow from USD 8.32 billion in 2026 to USD 16.6 billion by 2034, exhibiting a CAGR of 9.02% during the forecast period. Asia Pacific dominated the organic fertilizers market with a market share of 47.13% in 2025.

Organic fertilizers are sustainable inputs produced from natural sources such as animal waste and plant matter, offering necessary nutrients to plants. These fertilizers are a good source of essential nutrients such as phosphorus, potassium, zinc, copper, magnesium, and others. Compared to inorganic fertilizers, organic ones are biodegradable and release nutrients slowly, providing a sustained supply to plants. Moreover, it improves soil fertility and soil texture by imparting organic matter to the soil.

Increasing awareness of organic farming and mounting government support are prime factors supporting the organic fertilizer demand. A few of the active players in the organic fertilizers industry include Darling Ingredients Inc., Yara International ASA, Hello Nature (Italpollina S.p.A.), and others.

Global Organic Fertilizers Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 7.71 billion

- 2026 Market Size: USD 8.32 billion

- 2034 Forecast Market Size: USD 16.6 billion

- CAGR: 9.02% from 2026–2034

Market Share:

- Asia Pacific dominated the organic fertilizers market with a 47.13% share in 2025, driven by high adoption of animal manure-based fertilizers, their cost-effectiveness, and efforts to reduce chemical fertilizer use for sustainable agriculture.

Key Country Highlights:

- United States: Government grants like USDA’s USD 2.6 million to Perfect Blend LLC and USD 4.9 million to Palindromes Inc. support organic fertilizer innovation and promote sustainable agriculture.

- Germany, Spain, and France: Strong awareness of organic food and strict EU regulations support local production of organic fertilizers and market growth.

- India: Expanding use of animal-origin fertilizers to enhance crop yield and reduce chemical dependency aligns with government initiatives promoting organic farming.

- Brazil: Rapid adoption of sustainable fertilizers as farmers seek natural solutions for soil health, supported by new guidelines and incentive programs.

- Middle East & Africa: Growing need for food security and low-input sustainable agriculture is driving demand for organic fertilizers that improve soil biota and fertility.

MARKET DYNAMICS

Market Drivers

Rising Adoption of Organic Farming Bolsters Usage of Organic Fertilizers

In a world where ecological challenges are becoming highly chronic and health ailments are coming to the forefront, organic farming is no longer considered a trend. This approach to organic farming is recognized as the inevitable future of global agriculture, and it focuses on environmental sustainability and biodiversity conservation. However, the organic phenomenon began in the 1940s to minimize the detrimental impact of conventional fertilizers; its adoption rate has improved in the last few decades.

Surging demand for safer food options and rising environmental concerns are promoting the awareness of organic farming, leading to a greater market for organic-based fertilizers ensuring long-term nutrient availability and ecosystem protection. In recent years, a significant shift has been noticed in consumer behavior, mainly fueled by the Millennials and Gen Z generations. This younger generation is more aware of health concerns and environmental challenges and is prioritizing products aligning with their values, further driving the adoption of organic farming globally. This is expected to boost the organic fertilizers market growth in the coming years.

Increasing Government Support via Grants and Initiatives Supports Use of Natural Fertilizers

The governments of numerous countries play a substantial role in promoting organic fertilizers through grants and policies that encourage farmers to use organic and natural farming techniques. These initiatives are designed to strengthen agricultural practices, promote the advantages of the organic process, and support farmers across the globe. For ages, synthetic fertilizers have been known to enhance crop yield by offering essential nutrients to plants. However, their extensive use leads to soil degradation and environmental pollution. As a result, such disadvantages of traditional fertilizers create awareness regarding sustainable fertilizers, which are backed by government support. For instance, in March 2023, Perfect Blend LLC, a U.S.–based fertilizers firm, received a grant of USD 2.6 million from the U.S. Department of Agriculture (USDA) Fertilizer Production Expansion Program, which is used to create fertilizers from fish waste or raw manure.

Market Restraints

Inconsistent Nutrient Content in Organic Fertilizers and Slow Nutrient Release Limits its Usage

One of the pivotal problems in the organically produced fertilizers industry is its inconsistent nutrient content. Compared to conventional fertilizers, organically sourced fertilizers have lower nutrient content, which means that farmers/growers need to utilize larger quantities to achieve the desired results. Hence, such inconsistency of natural fertilizers impedes their utilization rate worldwide.

Slow nutrient release is also a prominent challenge that impedes the utilization of natural fertilizers in the agricultural field. Compared to synthetic fertilizers, these products release nutrients slowly, which acts as a restraint for farmers seeking quick results. Hence, such instances inhibit the application of natural fertilizers globally.

Market Opportunities

Growing Focus on Regenerative Agriculture Opens Chances of Growth

Regenerative agriculture is recognized as a holistic approach that concentrates on improving and restoring soil health and is gaining popularity in the food & beverage landscape. This revolution in farming goes beyond reducing harm, and it progressively emphasizes enhancing crop diversity, boosting food security, and preserving soil health that is obtained via natural fertilizers. In today’s health-centric era, global consumers are highly concerned regarding climate change and its effect on food systems. This increasing concern is driving a rapid shift to sustainable practices, with most of the individuals seeking brands that prioritize social and environmental sustainability. Due to this increasing requirement, prominent companies are also trying to invest in regenerative agriculture. For instance, Yara International ASA, a Norway-based firm, created a regenerative agriculture toolbox and introduced initiatives to help farmers opt for sustainable practices.

ORGANIC FERTILIZERS MARKET TRENDS

Increasing Demand for Custom Organic Fertilizer Blends is the Current Trend

The global agriculture industry is experiencing a trend for customized organic fertilizer blends, which pave the way toward growth possibilities. This need for tailored organically produced fertilizers is augmented by rising consumer demand for precisely customized and sustainable agricultural practices, where farmers can customize fertilizer compositions to particular crop needs and soil conditions.

In today’s time, farmers are mainly focusing on soil testing results to determine specific nutrient deficiencies and subsequently formulating custom blends to address such needs precisely. Moreover, growers are trying to use a blend of animal and plant-origin-based fertilizers, such as blood meal and compost, which allows customized nutrient profiles. Thus, the dominating players in the agriculture market should invest their efforts in the fields of tailored organic fertilizer blends, which can be utilized on a large scale by farmers. Asia Pacific witnessed a growth from USD 3.11 Billion in 2023 to USD 3.36 Billion in 2024.

Download Free sample to learn more about this report.

Impact of COVID-19

The rise and widespread of the COVID-19 pandemic created a disturbance in nearly all the global sectors, tremendously disrupting the economy. Quarantine regulations, travel restrictions, and social distancing resulted in a major reduction in the labor workforce across the industrial sectors. One of the main sectors exposed to the virus attack was the fertilizers industry. Natural fertilizers are majorly produced either from plant or animal by-products. With respect to animal origin, the manufacturers utilize animal meal and bone meal for the production of natural fertilizers, which are obtained after slaughtering the animals. However, due to the pandemic, slaughterhouses were forced to shut down their operations, which impacted production. Despite various challenges in the fertilizers industry, the demand for organic food products increased during the pandemic.

SEGMENTATION ANALYSIS

By Source

Animal Origin Led Market as It is Rich in Major Nutrients

Based on source, the market is segmented into animal origin and plant origin. Out of both categories, the animal origin segment accounted for the largest global organic fertilizers market share of 62.26% in 2026. Products such as blood meal, fish emulsion, and fish meal, among others, are rich in major nutrients such as Nitrogen (N), Phosphorus (P), Potassium (K), and Calcium (Ca), which are essential for promoting plant well-being. Moreover, these nutrients also refine the soil's health and structure, enhance soil organic matter, and boost the soil’s water retention capacity.

Among the plant-based sources, compost, alfalfa meal, and others are used to manufacture natural fertilizers. However, expensive production costs associated with some of the plants are one of the reasons for their lower acceptance in the market. This could increase fertilizer usage in the soil to make up for the lower availability of nutrients in the soil.

By Form

Dry Form Dominated Market Owing to its Ease of Use and Efficiency

Depending on form, the global market is divided into dry and liquid.

The dry segment accounts for the largest share of the global market and is exhibited to capture a share of 66.59% in 2026. Several animal and plant-based fertilizers are available in dried forms, such as powder and pellets. The adoption rate of such fertilizers is growing as they are easier to store and transport from one area to another. As these products come in soluble form and can be mixed with water-based on necessity, the application of nutrients is easier and more flexible.

The liquid segment secured the second position in the global market and is anticipated to grow at a highest CAGR of 8.25% during the study period (2025-2032). Compared to dried forms, it is difficult to store liquid fertilizers. If stored under incorrect temperatures and in incorrect areas, the product can freeze or evaporate, which in turn will impact the quality and efficacy of the final product.

By Crop Type

To know how our report can help streamline your business, Speak to Analyst

Cereals Commanded Market Due to Their Large Cultivation Area

On the basis of crop type, the market is distributed into cereals, pulses and oilseeds, fruits and vegetables, and turf and ornamental.

Out of all the categories, cereals dominated the global market and held the major market share in 2024. Cereals are a staple item in most of the consumer’s diet worldwide and are the main source of essential nutrients, which include minerals and vitamins. A few of the popular cereal grains grown across the globe include rice, wheat, maize, sorghum, and others. However, with time, global consumers are seeking organic cereals, which are free from hazardous pesticides and fertilizers. Thus, to produce such crops, natural fertilizers are widely used to facilitate their growth. This segment is anticipated to reach a market share of 40.38% in 2026.

- The pulses and oilseeds segment is expected to hold a 20.26% share in 2024.

Fruits & vegetables emerged as the fastest-growing segment and ranked second in the global fertilizers market. The increasing acceptance of organic fruits and vegetables and their growing consumption is one of the major factors that is encouraging farmers to adopt organic fruit cultivation and enhance sales of natural fertilizers. This segment will exhibit a CAGR of 9.03% during the forecast period (2025-2032).

Organic Fertilizers Market Regional Outlook

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Organic Fertilizers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific emerged as the biggest and fastest-growing market for natural fertilizers globally. The region dominated the market with a valuation of USD 3.63 billion in 2025 and USD 3.94 billion in 2026. Predominantly, Asian countries prefer animal manure for the production of organically sourced fertilizers, as it is proven to improve nutrient availability and minimize the risk of soil erosion. Compared to plant-origin-based fertilizers, animal-sourced fertilizers are economical and eco-friendly, which helps to minimize the utilization of chemical fertilizers. Moreover, animal manure aerates the soil and is considered a good source of micro- and macronutrients for crop development. These advantages enhance its usage in organic fertilizer production.

Europe

Europe is considered the second-largest market and exhibited a CAGR of 8.27% during the forecast period (2025-2032). The region is expected to be valued at USD 2.06 billion in 2025. This strong growth is accredited to strict EU regulations on inorganic fertilizers and improved consumer spending on organic products. The U.K. market is growing and is expected to reach a market value of USD 0.17 billion in 2026. Along with this, the European region is considered a strong local producer of natural fertilizers, highlighting its commitment to sustainable agricultural practices. In Germany, Spain, and France, most individuals are deeply aware of the importance of organic food products. As a result, the companies in the region are working toward improving the local production of organic inputs, which will promptly help in the development of organic food items. Germany is anticipated to be worth USD 0.22 billion in 2026, while France is expected to be valued at USD 0.32 billion in the same year.

North America

North America is the third leading region anticipated to capture a share of USD 1.69 billion in 2026. Organic farming has emerged as one of the few areas of the North American agricultural system, and it has grown consistently over decades. The surge in organic cultivation across North America mainly coincides with the rising America’s appetite for organic foods. With the increasing demand for organically-sourced products, the number of certified organic farms has also increased over time. This rise in demand and production has led to the widespread utilization of natural fertilizers. Moreover, the government is focusing on providing support to the key players/startups in the region either by offering grants or with the help of promotional campaigns. For instance, in March 2023, Palindromes Inc., a U.S.-based firm, was offered a grant of nearly USD 4.9 million to strengthen its use of renewable energy in order to produce climate-friendly fertilizers.

The popularity of natural fertilizers has been increased by the growing need among the U.S. farmers due to the growing adoption of sustainable agricultural practices. As per data provided by the USDA National Agricultural Statistics Service surveys (2011 and 2021), the area of certified organic cropland increased from 2.04 million acres in 2011 to 3.6 million acres in 2021. The major factors impacting the demand for organic fertilizers are the increase in organic production, the rise in environmental concerns, and the growing crisis of chemical fertilizers due to the geopolitical tension in European markets. The U.S. market is set to be worth USD 1.18 billion in 2026.

South America

South America is the fourth leading region, estimated to capture a share of USD 0.27 billion in 2025. The market in South America is experiencing rapid growth within the agricultural sector. The farmers in the region are actively seeking sustainable solutions for nutrient supplementation, disease management, and soil health improvement. Moreover, the countries are implementing new guidelines and incentive programs to promote the adoption of natural fertilizers in the agrarian sector.

Middle East & Africa

Natural fertilizers can serve as a component of transitions to sustainable low-input agriculture across the Middle East & Africa region. These fertilizers play an enormous role in augmenting soil fertility and soil biota. Yield improvements and its support for food security make natural fertilizers a crucial element in the Middle East & Africa agricultural food sector. The UAE market is projected to be worth USD 0.01 billion in 2025.

COMPETITIVE LANDSCAPE

Major Players in the Organic Fertilizers Market

- Global Organic Fertilizers Market Ranking Analysis, By Key Manufacturers, 2024

- Hello Nature (Italpollina S.p.A.),

- Darling Ingredients Inc

- Coromandel International Limited

- Wilbur-Ellis Holing’s, Inc

- Yara International ASA

Key Industry Players

Top Companies Focus on New Launches to Boost Their Profits

Major players in the global market include Hello Nature (Italpollina S.p.A.), Yara International ASA, Wilbur-Ellis Holing’s, Inc., and Coromandel Corporation, among others. All these companies are concentrating on introducing new natural fertilizers in the marketplace, which will enhance its adoption rate. In today’s health-centric era, most consumers are seeking organic products, which can be produced via organically sourced fertilizers.

List of Key Organic Fertilizer Companies Profiled:

- California Organic Fertilizers Inc. (U.S.)

- Coromandel Corporation (India)

- Darling Ingredients Inc. (U.S.)

- Hello Nature (Italpollina S.p.A.) (Italy)

- True Organic Products Inc. (U.S.)

- National Fertilizers Limited (India)

- Sigma AgriScience (U.S.)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- Sustane Natural Fertilizers Inc. (U.S.)

- Yara International ASA (Norway)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Hello Nature, a U.S.-based manufacturer of natural fertilizers, opened its latest 300,000 sq. ft. bio-nutrients facility across the country. This new plant is able to develop 150,000 tons of organically sourced fertilizers, which are majorly based on chicken manure.

- December 2024: Yara International ASA, a Norway-based fertilizers firm, introduced its latest range, “YaraSuna,” during Northern Europe’s agricultural fair, Agromek 2024. This item is mainly designed for regenerative agriculture.

- January 2024: Mivena, a specialty fertilizers firm in the Netherlands, released its new line of vegan liquid and organic granulated fertilizer during the International Horticulture Trade Show in Germany and the Turf Trade Show in the U.K.

- March 2023: Perfect Blend LLC, a U.S.-based company, received an investment of USD 2.6 million, which helped the firm enhance its production capacity to process fish waste as well as raw manure into fertilizers.

- March 2022: Tessenderlo Group, a Belgium-based firm, announced its plans to build a manufacturing line of organically-sourced fertilizers across France. This line produces organic pellets for both conventional and organic agriculture.

REPORT COVERAGE

The market report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market sizing and growth rate for all possible market segments. Key insights presented in the report include an overview of related markets, a competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory environment in critical countries, and current market trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 9.02% from 2026 to 2034 |

|

Segmentation |

By Source

|

|

By Form

|

|

|

By Crop Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 7.71 billion in 2025.

The market is expected to grow at a CAGR of 9.02% during the forecast period (2026-2034).

By source, the animal origin segment led the market.

Rising adoption of organic farming and increasing government support via grants and initiatives bolster market growth.

Darling Ingredients Inc., Coromandel Corporation, and Hello Nature (Italpollina S.p.A.) are a few of the top players in the market.

Asia Pacific held the highest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us