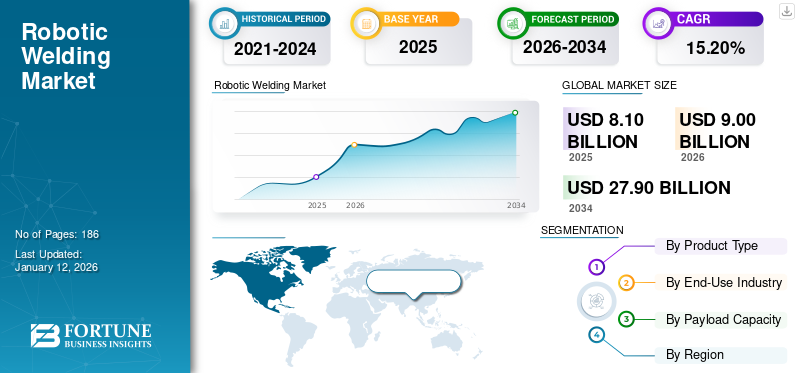

Robotic Welding Market Size, Share & Industry Analysis, By Product Type (Welding Robots and Welding Cobots), By End-Use Industry (Automotive Transportation, Aerospace & Defense, Metal & Machinery, Electrical & Electronics, Shipbuilding, Construction, and Others), By Payload Capacity (Upto 5 Kg, 5-10 Kg, 10-20 Kg, and Above 20 Kg), and Regional Forecast, 2026-2034

ROBOTIC WELDING MARKET SIZE AND FUTURE OUTLOOK

Robotic welding is an advanced robotic technology in which programmable robotic systems are utilized to perform welding and material handling operations with high precision and consistency. These systems minimize human intervention while ensuring superior surface finish, repeatability, and operational efficiency across manufacturing environments.

Download Free sample to learn more about this report.

The increasing deployment of robotic welding is primarily driven by factors such as rapid industrialization, growing adoption of automation across automotive and metal industries, need for high-quality welds, rising labor costs and availability, and the integration of Industry 4.0 technologies such as AI and IoT to support smart manufacturing. Additionally, the introduction of collaborative robots (cobots) encourage adoption by facilitating human-robot engagement, and their ease of integration into production lines.

Some of the notable players in the market are ABB Ltd., Carl Cloos Schweisstechnik GmbH, DAIHEN Corporation, FANUC Corporation, Fronius International GmbH, Kawasaki Heavy Industries, Ltd., and KUKA AG.

MARKET DYNAMICS

Market Drivers

Labor Shortages and Skill Gap is Driving Market Growth

A surge in labor shortages and a skill gap experienced in the welding industry greatly influences the robotic welding market growth. The workforce is aging and lack of new workers are entering the industry which has caused an extreme shortage of skilled welders prompting manufacturers to look for automated solutions. Robotic welding systems serve as a method to improve efficiency, ensure a stable quality of welds, and alleviate the challenges of finding skilled welders.

The American Welding Society estimates that by 2029, the sector will have a deficit of around 320,500 welders, a 42% increase required above existing personnel. The shortage highlights the increasing need for robotic welding to sustain manufacturing in addition to the pressure of increasing welding costs.

Market Restraints

High Costs and Integration Complexity Hinder Growth and Limit Market Scalability

The main barrier to adoption of robotic welding systems is the high initial upfront costs and complex integration processes. There is substantial capital associated with purchasing, programming, and servicing robots, sensors, controllers, and software. Small and medium companies are especially disadvantaged because they have low production volumes and often face difficulty acquiring capital. In addition, integrating robotic welding into existing manufacturing processes involves complexity and technical knowledge that results in a long lead time for implementation and longer payback periods. In developing economies, financial and technological constraints inhibit large scale deployments of the technology, thus constraining widespread adoption of robotic welding machine despite the advantages of increased productivity and operational efficiency.

Market Opportunities

Rising Adoption of Welding Cobots Creates Opportunities for Innovation

The increased use of collaborative robots or cobots in welding applications is creating new opportunities for innovation and expansion of market. Welding cobots are user-friendly, adaptable in programming, and able to operate safely in conjunction with people. These features make cobots an affordable option for a lot of small and medium sized companies interested in automation.

Welding cobots have the versatility to complete various functions in the automotive, construction, and heavy equipment sectors without the expense of incorporating additional variations into the existing installation. As manufacturers seek out more flexible manufacturing systems, cobots make robotic welding accessible and fuel market growth by ensuring developments in intelligent software, augmented reality training, and sensor-based precision.

ROBOTIC WELDING MARKET TRENDS

Real-Time Weld Defect Detection Emerges as a Major Market Trend

A significant trend in the robotic welding industry is the ability to use deep learning to identify defects in real time. Current artificial intelligence systems are now able to integrate not only visual signals but also sound signals to detect welding defects such as porosity, cracks, and undercuts with a high accuracy level.

For defects detected by multiple sensors, the area under the curve (AUC) is at least 0.92, indicating that this approach is more effective than a single sensor. This process allows for continuous quality assurance while reducing waste and repair costs, as well as taking robotic welding to the next level of automation, reliability and quality in the inspection process.

SEGMENTATION ANALYSIS

By Product Type

Extensive Use in Automotive and Heavy Industries Boosts Welding Robots Segment Growth

Based on the product type, the market is segmented into welding robots and welding cobots.

In 2026, the welding robots segment holds the highest market share 79.78% due to their superior reliability, accuracy, and high production efficiency. The welding robots segment is widely utilized in automotive manufacturing and heavy industry manufacturing applications to enhance productivity, maintain consistent weld quality, and enable greater reductions in operational downtime.

The welding cobots segment is forecasted to achieve the highest CAGR of 21.6% due to their lower cost, ease of integration into existing manufacturing environments, and their ability to safely work in conjunction with human workers. These advantages are making them ever more appealing, which is greatly contributing to their adoption across industries as this segment is rapidly growing and impacting the future of automated welding solutions.

By End-Use Industry

Automotive Transportation Segment Dominates Market Owing to Its Extensive Use for Precision and Speed

Based on end-use industry, the market is divided into automotive transportation, aerospace & defense, metal & machinery, electrical & electronics, shipbuilding, construction, and others.

In 2026, the automotive transportation industry held the highest portion of the market with a share of 42.33%. The industry's reliance on robotic welding for greater accuracy, high speed in operation, and maximized mass production has sustained its top ranking in the market. These benefits aid in enhanced manufacturing quality, cost savings, and uniform output, upholding its leadership.

The construction sector is expected to grow at the highest CAGR of 15.2% throughout the projected timeline. The growth in global infrastructure projects and rising use of automation in the welding of structural components is driving the speed of this growth. The efficiencies, accuracy, and safety benefits of robotic welding have made it a critical technology in current construction methods.

By Payload Capacity

Ability to Handle Large, Complex, and High-Strength Components Augments the Above 20 Kg Segment Growth

Based on the payload capacity, the market is divided into upto 5 kg, 5-10 kg, 10-20 kg, and above 20 kg.

In 2026, the segment above 20 kg payload capacity accounted for the largest proportion of the global market,with a share of 42.56% worth USD 3.19 billion. Heavy-payload robotic welding systems dominate the market due to their effectiveness in handling large, complicated, and resilient parts, thus becoming a must-have in automotive, shipbuilding, aerospace, and heavy machinery applications.

Payload capacities of up to 5 kg robots are expected to have the highest CAGR of 16.1% in the market. This high growth is fueled by the increased use of lightweight and space-saving welding robots and collaborative robots (cobots) by small and medium-sized enterprises (SMEs) and electronics companies requiring precision, flexibility, and low-cost automation for compact production lines.

To know how our report can help streamline your business, Speak to Analyst

ROBOTIC WELDING MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

Asia Pacific

Asia Pacific region dominated the market. The size of the market in the region has been valued at USD 3.86 billion in 2025. The region is witnessing rapid adoption of robotic welding driven by large-scale automotive, electronics, and heavy machinery manufacturing. Supportive government initiatives, rising labor costs, and growing demand for automation, along with China’s leadership in industrial robot installations, are also driving the market growth.

India and China have a notable robotic welding market share in the region, contributing to growth potential, with a projected market value of USD 0.49 billion and USD 2.11 billion respectively in 2026.

North America

North America is experiencing moderate growth, increasing from USD 1.39 billion in 2023 to USD 1.50 billion in 2024. This can be attributed to continued automation, increased productivity needs of the labor force, and expansion of manufacturing operations.

The U.S. has been the largest contributing market and will reach USD 1.25 billion by 2026. There are many factors driving the U.S. market. The increasing need from automotive, construction, and energy industries are the main drivers for this growth.

Europe

Europe is also estimated to expand with a market value of USD 2.41 billion by 2025, with contributions made by major countries including Germany with USD 0.87 billion, Italy with USD 0.46 billion, and the U.K. with USD 0.30 billion. Also, the region exhibits the highest CAGR globally which is 15.7%. The growth is largely attributed to the significance of Industry 4.0, industries such as automotive and aerospace being reliant upon advanced automation, as well as, the increased interest towards investing in smart manufacturing. This growth is facilitated by the region's emphasis on precision, efficiency, and the adoption of advanced technologies in manufacturing.

South America and Middle East & Africa

The South America and Middle East & Africa markets are gradually growing, valued at USD 0.13 billion and USD 0.08 billion respectively for 2025. Market growth in these regions is impacted by industrial automation, investment in manufacturing and infrastructure, and GCC’s contribution of USD 0.04 billion through widespread technological adoption initiatives.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasize on New Product Offerings to Expand Market Presence

Driven by growing competitive prices and industry demand, welding robots have been subject to new product offerings from prominent manufacturers, which are leading to the adoption of automation technology in industrial welding more effectively than ever. Key players are focusing on improving the programming skills of their welders to gain expertise in handling advanced software controls.

Additionally, the market players are focusing on introducing new technologies in order to develop new machines and systems. For instance, in April 2019, Novarc Technologies partnered with ABICOR BINZEL to expand its spool welding robot equipped with ABICOR BINZEL's seam tracking sensors and welding torches on a global level.

LIST OF KEY ROBOTIC WELDING COMPANIES PROFILED:

- ABB Ltd. (Switzerland)

- Carl Cloos Schweisstechnik GmbH (Germany)

- DAIHEN Corporation (Japan)

- FANUC Corporation (Japan)

- Fronius International GmbH (Austria)

- Kawasaki Heavy Industries, Ltd. (Japan)

- KUKA AG (Germany)

- Yaskawa Electric Corporation (Japan)

- Panasonic Holdings Corporation (Japan)

- Universal Robots A/S (Denmark)

- Lincoln Electric Holdings, Inc. (U.S.)

- Amada Holdings Co., Ltd. (Japan)

- Hyundai Robotics (South Korea)

- Comau S.p.A. (Italy)

- Denso Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- November 2024- LE Robotics (Loyalty Robotics Welding Systems), a leading innovator in automated welding and cutting technologies, has launched a significant advancement in industrial automation. Focused on enhancing productivity and precision, LE Robotics’ solutions address the evolving demands of the welding and cutting sectors, offering improved operational efficiency and cost-effectiveness to enterprises worldwide.

- August 2024-Gauge Capital partnered with AGT Robotics to provide growth capital and recapitalize the company. This would help in enhancing AGT's ability to deliver advanced robotic welding solutions in the steel and metal industry.

- October 2023- Bucket and coupler manufacturer, Miller UK has bolstered its manufacturing capabilities by upgrading its range of state-of-the-art welding robots, significantly increasing production and the safety of its workforce.

- August 2023- Novarc Technologies Inc., a leading provider of advanced robotics solutions, announced the company has successfully completed a Series A fundraising round with Caterpillar Venture Capital Inc., a wholly-owned subsidiary of Caterpillar Inc.). Funding will be used to advance product development in AI-powered robotic welding solutions

- May 2021- The U.S.-based Path Robotics raised USD 56.0 million for aggressive AI-powered expansion. The company pioneered in the robotic welding industry and has developed an autonomous system in the market.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the robotic welding market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 15.20% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

|

Segmentation |

By Product Type

By End-Use Industry

By Payload Capacity

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 8.10 billion in 2025 and is projected to reach USD 27.90 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 15.20% during the forecast period.

Worsening labor shortages and a widening skill gap in welding are pushing manufacturers to adopt robotic welding systems.

ABB Ltd., Carl Cloos Schweisstechnik GmbH, DAIHEN Corporation, FANUC Corporation, Fronius International GmbH, Kawasaki Heavy Industries, Ltd., and KUKA AG are some of the top players in the market.

The Asia Pacific region held the largest market share.

Asia Pacific was valued at USD 3.86 billion in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us