Screening Equipment Market Size, Share & Industry Analysis, By Product Type (Vibrating Screens, Trommel Screens, and Others), By Technology (Dry Screening and Wet Screening), By Mobility (Fixed and Mobile), By Feed Material (Ores and Minerals, Aggregates, and Waste), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

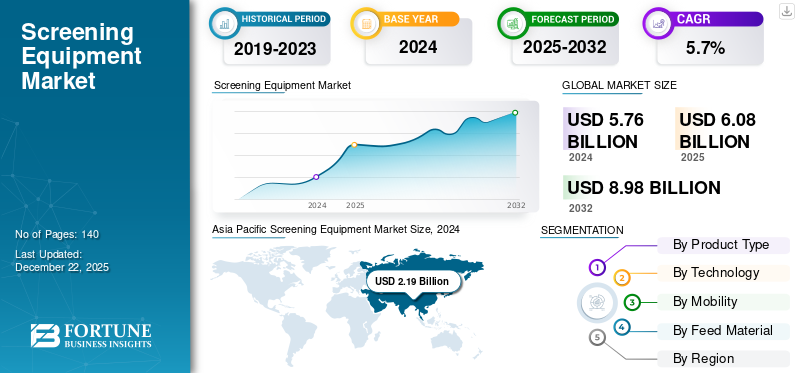

The global screening equipment market size was valued at USD 6.08 billion in 2025 and is projected to grow from USD 6.42 billion in 2026 to USD 9.30 billion by 2034, exhibiting a CAGR of 4.70% during the forecast period.

Screening equipment is a type of machinery that separates materials, aggregates, and ores into different sizes using a screen surface. This technology has many applications, such as construction materials, recycling, mining, and other industrial applications. This equipment is used for separating crushed mined materials into sizes that are useful for removing fine particles, and dewatering the material. Major players, including Metso Outotec, Terex Corporation, Wirtgen Group, Sandvik AB, and Epiroc AB, are striving to expand their presence through market expansion and sustainable product development.

Increasing investment in mining, especially in underground mining projects from all over the globe, thus adding to the demand for this equipment to separate ores and minerals from the material that has been collected, is possessing the growth of the market.

- For example, according to the source of India Investment Grid, the Indian government planned to invest about USD 7.32 billion into 30 mining projects throughout India.

Download Free sample to learn more about this report.

Global Screening Equipment Market Overview

Market Size:

- 2025 Value: USD 6.08 billion

- 2026 Value: USD 6.42 billion

- 2034 Forecast Value: USD 9.30 billion

- CAGR: 4.7% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific dominated the global market in 2025 due to rapid industrialization, urbanization, and infrastructure expansion in countries like China, India, and Japan

- Product Segment Leader: Vibrating screens led the 2025 market in revenue and are expected to maintain their dominance through 2034

- Technology Leader: Dry screening holds the largest share due to its efficiency and lower energy use, while wet screening is seeing fast adoption

- Mobility Leader: Mobile screening equipment was the top segment in 2025, preferred for its flexibility and lower setup cost

- Feed Material Leader: Ores & minerals accounted for the largest segment, driven by increased global demand in mineral processing

Industry Trends:

- Growing adoption of eco-friendly, energy-efficient screening systems with better dust and noise control

- Rising integration of IoT, AI, and real-time monitoring for predictive maintenance and performance optimization

Driving Factors:

- Expansion of mining and quarrying operations supported by public and private investments

- Rising construction and infrastructure activities in emerging markets increasing demand for high-efficiency screening equipment

MARKET DYNAMICS

SCREENING EQUIPMENT MARKET TRENDS

Growth Adoption of Sustainability and Eco-Friendly Designs Bolster the Market Demand

Growing environmental issues are persuading manufacturers to develop more sustainable screening solutions. It means creating machines that use less energy, employing materials that have higher amounts of recycled material, and improving noise and dust suppression methods. Equipment that incorporates better separation and waste reduction technologies, which support circular economy concepts in the aggregates sector, is becoming more popular. In particular, electric-powered screening plants are more popular for stationary and semi-stationary applications, and there are hybrid solutions for mobile units as regulations become stricter and companies are looking to operate more sustainably.

- For example, according to a press release from Metso Corporation in April 2025, their screening solutions comply with EU safety standards (EN 1009-1:2020) and prioritize operational safety. Metso's stationary screens are thoughtfully designed with safety as a top priority, ensuring that all maintenance practices meet the stringent safety standards established by the European Union.

MARKET DRIVERS

Rising Mining and Quarrying Activities and Investment in Construction Activities to Drive Market Growth

Rising demand in metals and minerals is creating a need in the mining sectors for dedicated mobile crushing and screening equipment to separate and process the ore materials. In addition, there is a growing number of new and existing metal and mineral mining projects in developing countries and developed economies, which in turn is increasing the demand for crushing and screening equipment fueling the growth of the market. Furthermore, local and government authorities are making large investments in the construction of both residential and commercial buildings which is supporting the screening equipment market growth.

- For example, the European Commission stated that the mining and quarrying sector in Europe generated over USD 193.5 billion in 2022, a 70% increase compared to 2021.

MARKET RESTRAINTS

High Capital Investment to Restrict Market Growth

Screening equipment requires a significant capital investment that needs to consider machinery purchases, installation, modifying, and transportation costs. Additionally, the initial costs are limited to maintenance, energy consumption, and continuous labor training, all of which significantly contribute to the overall expenses of this equipment. There are numerous capital expenditures that must be carried out to purchase this equipment, with the extensive capital investment this presents, the acquisition of screening equipment is meaningfully problematic for end users, regardless of size, restricting the market growth. For example, the costs of screening equipment typically range from USD 2,000 and USD 10,000 with multiple end users all with differing individual costs.

MARKET OPPORTUNITIES

Technological Advancements in Equipment Design to Provide Opportunity for Market Growth

Terex Corporation, Metso Outotec, Sandvik AB, and Asetek Industries Inc. are involved in creating new products with IoT, AI, machine learning, electric screening equipment, and smart control. After implementing technological advancements in equipment design, it offers real-time monitoring, provides predictive maintenance in the quarrying, mining, and construction sectors, which are the current equipment trends.

- For example, In June 2024, Prostack, a Terex Corporation subsidiary, presented a new MAGNA crushing and screening equipment, for mining, construction, and quarrying applications. Features include robustness consumption, which provides better productivity, high throughput capacity, high capacity machine, and bigger application to screening.

Segmentation Analysis

By Product Type

Vibrating Screens Set to Dominate Owing to Rising Demand from Mining and Quarrying Sector

Based on product type, the market is classified into vibrating screens, trommel screens, and others. Others consist of flip-flow screens.

Vibrating screens are dominated the market in 2024 and are also set to continue their dominance with the highest growth rate during the forecast period, on account of increasing demand for metals and minerals from the population at large. Furthermore, this leads to the increasing demand for vibrating screens that separate minerals and ores on surface screens, which drives market growth.

- For instance, according to a source on the Minerals Council of Australia, global investment in the mining sector had a higher increase than USD 100 billion per year from the existing level.

Trommel screens will grow at a moderate rate due to their applications in solid waste management, food processing, and mining sectors. Furthermore, this product is used in the construction and demolition sector to separate demolition waste and debris from construction waste, which drives market growth.

Others are flip-flow and star screening equipment. They are expected to grow at a decent rate due to low adoption of this equipment in end user markets, such as construction, mining, and aggregate processing, which contribute positively to the screening equipment market share.

By Technology

Dry Screening Dominates with Lower Costs and Energy Use

Based on technology, the market is divided into dry screening and wet screening.

Dry screening technology is expected to dominate the market capturing the largest market share throughout the forecast period based on factors such as operating costs, energy consumption which is less than wet screening machines, ease of maintenance. Additionally, they can also be used in other industrial applications such as construction, mining, recycling and forestry. These factors greatly enhance market growth.

Wet screening technology is expected to have the highest growth rate in the forecast period as a result of factors such as the rising demand for technologies they offer in slurry handling, mineral processing operations, coal washing, and are utilized to reduce dust emissions during mineral processing. Furthermore, they have features for much greater operation speed, very low maintenance time, and robustness, which drives market growth.

- In January 2023, GN Solid Control, a wholly owned subsidiary of Hebei GN Separation Equipment Co. Ltd launched a new double-deck vibrating screen for the manufacturing, construction, and recycling applications. This screen will mainly be used for medium and fine-grade materials, wet, dry, and sticky materials. It can also support both wet and dry materials.

By Mobility

Mobile Equipment Led the Market Owing to Large Demand from Mining, Recycling, and Construction Sectors

Based on mobility, the market is classified into fixed and mobile.

In 2024, mobile equipment led the market with respect to revenue market share and is expected to grow at a substantial rate throughout the forecast period. Mobile screens require low-investment, are easily portable, and less dependent on a single site. Additionally, this equipment is mostly used for recycling and construction by separating materials and ores from mixed forms, further fueling market growth.

Fixed screens are expected to grow at a moderate pace during the forecast period. These screens provide fast operations, have higher throughput capacity, large screen surface area, lower maintenance costs and noise-free machines. All of these aspects contribute to the growth in the market.

By Feed Material

Ores & Minerals to Dominate Owing to Rising Quarrying and Mining Activity

Based on feed material, the market is classified into ores and minerals, aggregates, and waste.

Ores and minerals material is projected to dominate the market and is anticipated to experience the highest growth in the market, owing to growing demand for metals, ores and minerals in developed as well as developing economies. In addition, rising concerns about waste management practices, and rising processing of lower grade ores that require specialized screening solutions, bolster the market growth.

Aggregates is anticipated to experience a steady growth during the forecast period, owing to stable demand for these equipment in the construction and mining sector. Moreover, ongoing projects in the construction, and mining sectors, which in turn, raise the demand for such equipment.

Waste material is projected to contribute a decent share in the global market, owing to the expansion of waste management, construction, and mining industries. In addition, stringent regulations about waste management practices, which leads to an increased demand for efficient screen machines, drive the market growth.

Screening Equipment Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Screening Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region dominated the market in terms of revenue share in 2024, and is projected to grow at a substantial rate during the forecast period. It is owing to factors such as growth in urbanization, industrialization, government regulations, and stringent waste management practices across China, Japan, and India among others.

- According to an IQPC Corporate report, the mining sector investment in Asia Pacific is projected to reach USD 21.38 billion by 2030.

China dominates the Asia Pacific market due to increased investments in mining, quarrying projects, and construction related projects, which results in the generation of huge debris and waste. The increased demand for specialized cleaning equipment is propelling market growth as it facilitates the separation of debris from waste materials.

- According to China Briefing, under the Belt and Road initiatives taken by China, Chinese government investment in the mining sector reached USD 21.4 billion in 2024.

Europe

Europe is projected to grow at a steady rate during the forecast period, due to growing investment in mining and construction projects across Germany, France, and Italy among others. This led to an increased demand for the product. Moreover, stringent government regulation about implementing waste management practices across European nations drives market growth.

North America

North America is projected to grow at potential rate during the forecast period, owing to strong investment in the mining, construction, and recycling sectors across the U.S., and Canada. Moreover, presence of key players such as Vulcan Industries Inc, Terex Corporation, and Derrick Corporation among others in North America, fuels the market growth during the forecast period.

U.S. is projected to dominate the North American market during the forecast period, owing to factors such as industrialization, and mining investment, which fuels the demand for the product, bolstering the market growth.

Middle East & Africa

Middle East & Africa is anticipated to expand at a steady growth rate during the forecast period, owing to the development of large scale infrastructure projects across GCC, and South Africa, which increases the demand for the product, bolstering the market growth.

South America

South America is projected to grow at a decent growth rate during the forecast period, owing to growing investment in the mining, construction, and recycling sectors to drive the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Product Development, Acquisition, and Product Launch to Strengthen Competitive Landscape

Key players in the market such as Terex Corporation, McCloskey International, Kleemann GmbH, Metso Outotec, Sandvik AB, and Derrick Corporation among others are engaged in adopting product launch, product development and acquisition as key strategic moves to intensify the market competition. For instance, in October 2021, Terex Corporation launched a new M1700X mobile washing screen machine for construction and quarrying applications. It offers features such as robust, long durable, operates with mobile mode, high throughput capacity, operating efficiently, and requiring low maintenance. It is utilized in feed materials such as ores & minerals, aggregates and waste material.

LIST OF KEY SCREENING EQUIPMENT COMPANIES PROFILED

- Terex Corporation (U.S.)

- Metso Outotec (Finland)

- Sandvik AB (Sweden)

- Vulcan Industries Inc (U.S.)

- Kleemann GmbH (Germany)

- Derrick Corporation (U.S.)

- Weir Group PLC (U.K.)

- FLSmidth A/S (Denmark)

- Rubble Master HMH GmbH (Austria)

- GN Separation Equipment Manufacturer (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Vulcan Industries Inc. acquired Wake Store Corp, which supplies minerals and aggregates in the U.S. The acquisition provided screening solutions and increased the service portfolio.

- September 2024: FLSmidth A/S acquired the mining business of ThyssenKrupp AG, TK Mining, for USD 340 million. The main aim of the acquisition was to improve the product portfolio of screening equipment and geographical connectivity.

- August 2024: Terex Corporation acquired Environmental Solutions Group (a subsidiary of Dover Corporation), a U.S.-based waste and recycling company. The acquisition's basic aim was to improve the company's presence in the North American market.

- March 2024: Metso Outotec launched a new series of TSE horizontal triple shaft screening machines for North America and Central America. These high-performance machines separate dry and wet material. They offer features such as superior efficiency, energy efficiency, and a compact size.

- January 2024: Metso Outotec opened a new media factory in Irapuato, Mexico. The new media office acquired 9,000 square meters of space. The factory was built to increase the production capacity of crushing and screening equipment for the mining and aggregates sectors.

REPORT COVERAGE

The global screening equipment market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics, market opportunities and market trends expected to drive the market in the forecast period. It offers information on the market in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions in key countries. The report covers detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.7% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Mobility

|

|

|

By Feed Material

|

|

|

By Region

|

Frequently Asked Questions

The global screening equipment market size was valued at USD 6.08 billion in 2025 and is projected to grow from USD 6.42 billion in 2026 to USD 9.30 billion by 2034, exhibiting a CAGR of 4.70% during the forecast period.

In 2025, the Asia Pacific market value stood at USD 2.25 billion.

The market is expected to exhibit a CAGR of 4.7% during the forecast period.

The vibrating screens segment lead the market by product type.

The key factors driving the market are rising urbanization and infrastructure development.

Terex Corporation, Metso Outotec, Sandvik AB, Asetek Industries Inc, Kleemann GmbH, McCloskey International (U.S.), Weir Group PLC, Thyssenkrupp AG, Rubble Master HMH GmbH, and FLSmidth are the top players in the market.

Asia Pacific dominated the market in 2025.

Technological advancements in screening machines provides opportunity for the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us