Sports Footwear Market Size, Share & Industry Analysis, By Gender (Men, Women, and Kids), End-User (Professional Users and Recreational Users), Distribution Channel (Online and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

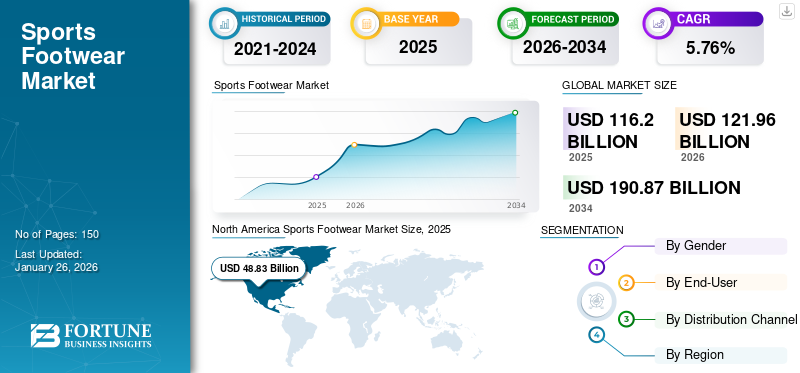

The global sports footwear market size was valued at USD 116.2 billion in 2025. The market is projected to be worth USD 121.96 billion in 2026 and reach USD 190.87 billion by 2034, exhibiting a CAGR of 5.76% during the forecast period. North America dominated the sports footwear market with a market share of 42.02% in 2025.

Sports shoes are mainly designed for active sports or other kinds of physical exercises. They are essential for a sportsperson as they provide flexibility, stability or motion control, traction on roads, torsional stability, and other benefits. The demand for the product is growing at a remarkable rate owing to the rising number of sports tournaments.

Moreover, sports disciplines, such as football, baseball, hockey, and others, witness a high number of participants, which will propel the market growth. According to the Australian National Cricket Census, cricket has been witnessing increasing participation from males and females over the years. Therefore, a rise in the number of sports participation is likely to support the market.

Prospective industry participants are likely to emphasize sports shoe technology in the near term to stay competitive. The rising number of sports-related injuries across countries creates a significant demand for technologically advanced sports shoes. Advances in sports shoe technology have enabled major changes in structural integrity and cushioning to provide adequate user comfort.

Physical distancing is the best preventive measure to limit the spread of the coronavirus. Therefore, most of the activities where the mass gathering is possible and not essential were stopped by local governments worldwide during the pandemic. Major sports events, such as the Olympics, FIFA, and others scheduled in 2020, were postponed or canceled. Sports academies, as well as clubs, were all shut down in response to governmental regulations. Moreover, schools and colleges were also closed down and are not reopened yet in most countries, limiting sports activities in these institutions. Therefore, lockdown rules have severely impacted the sports footwear industry.

GLOBAL SPORTS FOOTWEAR MARKET SNAPSHOT

Market Size & Forecast:

- 2025: USD 116.2 billion

- 2026: USD 121.96 billion

- 2034: USD 190.87 billion

- CAGR (2026–2034): 5.76%

Market Share:

- North America led with 42.02% share in 2025, driven by strong participation in outdoor and recreational sports, rising fitness awareness, and robust e-commerce infrastructure.

- Men’s footwear dominates due to higher participation in physical activities, but women's segment is growing with increased involvement in professional and amateur sports.

- Recreational users represent the largest end-user group, while professional athletes fuel demand for high-performance gear.

- Offline retail remains dominant, though online channels are the fastest-growing due to better accessibility and discounts.

Key Country Highlights:

- U.S.: Reached USD 33.68 billion in 2026. High sports participation rates and growing demand for technologically advanced footwear drive market leadership.

- China & India: Rapidly growing middle class, urbanization, and interest in cricket, football, and basketball are spurring market growth.

- Germany & France: Consumers prefer eco-friendly and performance-enhancing sports shoes, driven by sustainability trends.

- U.K.: Investments in women's cricket and other sports increasing demand for female sports footwear.

- U.A.E. & Saudi Arabia: Rising urbanization and fitness awareness driving premium sports footwear sales.

- Japan & South Korea: Global export leaders in smart, lightweight, and multifunctional sports footwear innovations.

Sports Footwear Market Trends

Growing Preference for Eco-friendly Shoes a Prominent Trend

The use of environment-friendly materials to manufacture sports shoes is one of the major trends that will positively impact market growth. The rising demand for sustainable shoes among consumers is happening because of the surging focus on preserving the environment. Furthermore, various manufacturers are making efforts to cater to customer needs and constantly focus on manufacturing sustainable and eco-friendly shoes. For instance, in April 2019, Adidas launched its first environmentally friendly 100% recyclable running shoes.

Rising Participation in Sports by Kids and Teenagers to Augment Growth

The global footwear market is expected to witness significant growth during the forecast period 2024–2032, owing to the greater sports participation by kids and teenagers. Nowadays, most of the young population is engaged in sports activities to keep themselves fit and healthy. For instance, as per the September 2019 data published by the National Federation of State High School Associations, in the year 2018-2019, the United States had 7,937,491 students participating in high school sports. Furthermore, the demand for the product is high due to the increasing awareness regarding sports, surging involvement of countries in different sports and games, and rising preference for fitness among kids.

- North America witnessed footwear market growth from USD 48.83 billion in 2025 and USD 51.33 billion in 2026.

Download Free sample to learn more about this report.

Sports Footwear Market Growth Factors

Increasing Participation in Physical Activities and Sports to Bode Well for Market Growth

The increasing prevalence of chronic diseases due to the lack of exercise and the growing health-conscious population, especially in urban regions, would drive the global market. The rising focus on developing gyms and sports infrastructure in various emerging countries is likely to increase sports shoe demand. As per the International Health & Fitness Association 2019 Report, the global fitness club witnessed a membership growth of 183 million.

Furthermore, the increasing awareness regarding health and fitness has simultaneously surged the number of participants engaging in physical activities and sports, thereby showing positive growth in the market. Additionally, the rising innovation in sports shoes, such as increased functionality and lightweight shoes for running, would influence the development of the market. To target more consumers, manufacturers are providing customizable options for fast-moving preferences.

Surging Government Initiatives will Support the Growth of Market

The increasing purchasing power and rising disposable incomes of consumers have propelled the sports footwear market growth. The rising income level has resulted in a willingness to pay extra for several performance characteristics, such as waterproof quality, moisture management, temperature control, and friction regulation. Additionally, the increasing number of different retail outlets and hypermarkets, and supermarkets is expected to help the market gain impetus in the forecast period.

Global, regional, and local government bodies focus on health and new strategies to draw the attention of the population towards the benefits of physical activities. Government bodies of several developed countries are constantly engaged in the process of establishing compelling healthcare offerings. This would simultaneously increase the sports footwear business, as a significant portion of the population will be inclined towards sports and fitness activities. Moreover, governments across the globe are focusing on increasing investments made in sports, which would have a positive impact in surging the consumption rate. For instance, PRS India. Org data declares that the Ministry of Youth Affairs and Sports allocated USD 314.8 million for 2019-2020. Therefore, this kind of initiative will boost the future of sports and provide an impetus to the growth of the market.

In April 2023, the England and Wales Cricket Board (ECB) made significant investments to promote women's cricket in the U.K. and provide more opportunities to female cricketers in the U.K. An increase in investments in quality coaches will improve women's cricket in the U.K. The rising popularity of women's cricket in the U.K. is attributable to an expanding base of base, sponsors, and broadcasters. Such factors trigger the demand for cricket/sports footwear across countries.

RESTRAINING FACTORS

Availability of Low-cost Local Products to Limit Demand for Branded Footwear

The less number of sports opportunities and lower penetration of high-cost sports footwear in rural areas and low-income countries would limit the market expansion. Moreover, the availability of low-cost counterfeit products and the emergence of several small-scale market players have posed challenges to the high-cost branded footwear.

Sports Footwear Market Segmentation Analysis

By Gender Analysis

To know how our report can help streamline your business, Speak to Analyst

Men Gender is Expected to Hold Major Share Owing to Greater Sports Participation Rate

The men segment is expected to dominate the global market throughout the forecast period due to the male population being inclined towards sports and other physical activities. According to the U.S. Bureau of Labour Statistics, on average, in a day in 2021, men spent around 5.6 hours in leisure & sports activities, while women were engaged for 4.9 hours.

- The women segment is expected to hold a 33.87% share in 2026.

Besides, the rising participation of females in various sports activities at national and international levels is propelling the growth of women's sports footwear. Additionally, the increasing involvement of women in several sports activities is likely to support the growth of the global market.

By End-User Analysis

Recreational Users Segment to Hold a Significant Share

The recreational users segment is anticipated to hold the largest share of 59.92% in 2026. Recreational users participate in sports mainly for being physically fit, for enjoyment & entertainment, or for socializing. On the other hand, professional users usually opt for high-quality footwear, which would help enhance the performance in their sports discipline and boost the consumption among this segment.

By Distribution Channel Analysis

Offline Segment to Support the Growth of the Global Market

The offline segment is expected to lead the market share of 64.93% in 2026. This segment includes retail stores, such as supermarkets, brand outlets, and discount stores. Some of the prominent companies aim to open retail stores in developing economies to expand their geographical presence and increase their customer base. For instance, in October 2019, PUMA, the multinational sportswear brand, opened its first redesigned and interactive retail store in India.

The online segment is expected to be the fastest growing owing to the increasing internet users and the easy availability and accessibility of a wide range of sports footwear at a reasonable price.

REGIONAL INSIGHTS

North America

North America Sports Footwear Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 48.83 billion in 2025 and USD 51.33 billion in 2026. North America holds a major sports footwear market share, owing to the growing popularity of sports and other similar activities. The large number of people participating in outdoor sports and adventurous activities is likely to positively impact market growth. For instance, according to the Outdoor Participation Trends Report 2022 published by the Outdoor Industry Association, the membership organization’s participant base increased to 164.2 million members, a 2.2% growth compared to 2020.Besides, the booming growth of the e-commerce businesses propelling the purchase of the product is likely to fuel demand. The U.S. market is projected to reach USD 33.68 billion by 2026.

Asia Pacific

Asia Pacific is considered to be the fastest-growing region during the forecast period, 2025–2032. The increasing consumer expenditure, supported by strong economic growth and higher disposable income, is likely to drive the growth of the sports footwear industry in this region. In addition to this, the thriving growth of various sports domains, such as cricket, football, basketball, and others influencing more people to be involved in sports as a hobby or a profession, would help generate traction. The Japan market is projected to reach USD 3.96 billion by 2026, the China market is projected to reach USD 7.97 billion by 2026, and the India market is projected to reach USD 7.57 billion by 2026.

- In China, the women segment is estimated to hold a 33.9% market share in 2024.

The UK market is projected to reach USD 5.52 billion by 2026, while the Germany market is projected to reach USD 9.4 billion by 2026. South America is anticipated to witness considerable growth over the forecast timeframe owing to the declining employment rate across countries, strengthening consumer purchasing power.

Furthermore, the Middle East market is expected to exhibit substantial growth in the near term due to the rising urban population, which would result in the increasing number of people involved in multiple fitness activities. People are progressively conscious of their health and well-being, especially in urban areas, helping to escalate the demand.

To know how our report can help streamline your business, Speak to Analyst

List of Key Companies in Sports Footwear Market

Major Players Emphasize Innovation to Stay Competitive

The global market includes several key players. A few of them include Nike Inc., Adidas Group, MIZUNO Corporation, Puma S.E., Armor Inc., Skechers, USA Inc., Reebok, Converse, Diadora S.p.A., and ASICS corporation. Some of these manufacturers mainly focus on launching innovative and advanced products that may fulfill the customer's requirements.

LIST OF KEY COMPANIES PROFILED

- Nike Inc. (Beaverton, U.S.)

- Adidas Group (Herzogenaurach, Germany)

- MIZUNO Corporation (Chiyoda City, Japan)

- Puma SE (Herzogenaurach, Germany)

- Under Armour, Inc. (Baltimore, U.S.)

- Skechers, USA Inc. (Manhattan Beach, U.S.)

- Fila Holdings Corp (Seoul, South Korea)

- Converse (Boston, U.S.)

- Diadora S.p.A. (Caerano di San Marco, Italy)

- ASICS Corp. (Chuo City, Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2023- Aztecs CC, a U.K.-based cricket club, partnered with Payntr, a Southampton-based sports footwear company offering cricket shoes. Under the partnership, the cricket club provided its members a 20% discount on purchasing Payntr footwear and accessories through its website, using code 'AZTECS20‘.

- October 2022- Nike, a sporting goods company, launched its new store at the Battersea Power Station, London, U.K., offering footwear, apparel, and accessories. The company’s retail director for Ireland and the U.K., Lucy Ramseyer, also announced plans to open more such stores across London in the near term.

- October 2020- Adidas AG, a Herzogenaurach, Germany-based sports apparel and footwear company, launched its flagship store in London, U.K. The new store offers the company’s several collections and limited edition product lines.

- March 2020- Adidas announced its new sports shoe, SL20, with light strike technology.

- August 2018- Reebok launched its first bio-based sports shoe made with 75% of plant-based fibers, such as corn and cotton.

REPORT COVERAGE

The global market research report provides a detailed sports footwear industry analysis and focuses on key aspects such as leading companies, end-users, and leading product types. Besides this, it offers insights into the current sports shoe market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.76% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Gender

|

|

By End-User

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 116.2 billion in 2025 and is projected to reach USD 190.87 billion by 2034.

Registering a CAGR of 5.76%, the market will exhibit steady growth during the forecast period (2026-2034)

The men segment is expected to lead the market during the forecast period.

The increasing sports participation is driving the growth of the market.

Nike Inc., Adidas, Reebok, and others are the key players in the market.

North America is expected to hold the highest share in the market.

By end-users, the recreational users segment is expected to grow at the fastest pace during the forecast period.

The increasing production of products that incorporate technology act as a market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us