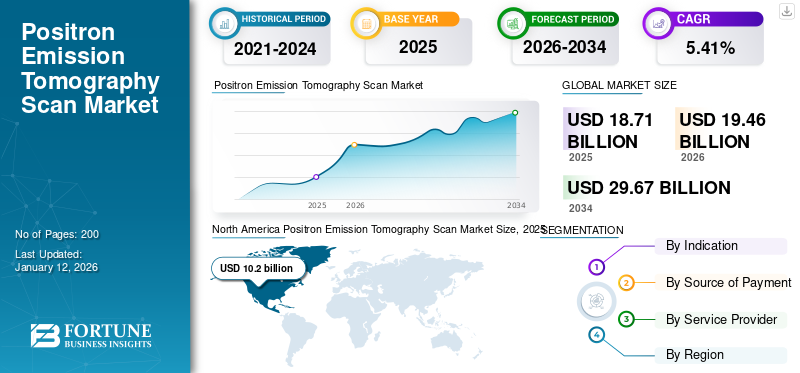

Positron Emission Tomography Scan Market Size, Share & Industry Analysis, By Indication (Oncology, Cardiology, Neurology, and Others), By Source of Payment (Public and Private Health Insurance/Out-of-pocket), By Service Provider (Hospitals, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global positron emission tomography scan market size was valued at USD 18.71 billion in 2025 and is projected to grow from USD 19.46 billion in 2026 to USD 29.67 billion by 2034, exhibiting a CAGR of 5.41% during the forecast period. North America dominated the positron emission tomography scan market with a market share of 52.38% in 2025.

A positron emission tomography (PET) scan refers to a type of nuclear medicine imaging technique that provides detailed images of the body’s internal structures and functions. As compared to the other imaging techniques that primarily show the anatomical structure (such as CT or MRI), the technology of positron emission tomography (PET) focuses on the functional activity of tissues, making it particularly valuable in the assessment of metabolic processes, such as oxygen utilization, glucose metabolism, and blood flow. The growing prevalence of key diseases, such as cancers, coronary artery disease, Parkinson's disease, Alzheimer's disease, and epilepsy, and the prominent usage of PET scans for these disease diagnoses, including for neuroimaging, propels the market growth.

- According to the estimates published by NHS England, around 180,000 PET-CT scans are carried out each year in the U.K. Such significant growth in the number of PET scans propels the market growth in key countries.

Moreover, the significant advancements in healthcare infrastructure due to the surge in healthcare spending and suitable reimbursement for imaging procedures in various countries are driving the market growth. Also, prominent market players are engaged in strategic initiatives and product launches, which promotes market expansion. Additionally, developments, such as portable positron emission tomography scan systems is expected to boost their utilization in several healthcare settings, thereby fueling the market growth.

During the COVID-19 pandemic, the global market witnessed negative growth due to the effective implementation of several lockdown measures. This resulted in the postponement or suspension of many ongoing and scheduled imaging procedures, which included nuclear imaging. Furthermore, a drop in the number of positron emission tomography scans was observed in 2020. Since 2021, owing to the positive outcomes observed, positron emission tomography has expanded, which is anticipated to maintain steady market growth during the forecast period.

Global Positron Emission Tomography (PET) Scan Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 18.71 billion

- 2026 Market Size: USD 19.46 billion

- 2034 Forecast Market Size: USD 29.67 billion

- CAGR: 5.41% from 2026–2034

Market Share:

- North America dominated the positron emission tomography scan market with a 52.38% share in 2025, driven by strong healthcare infrastructure, favorable reimbursement policies, and the widespread availability of advanced imaging centers.

- By indication, oncology held the largest market share in 2024, attributed to the rising incidence of cancer and increasing adoption of PET scans for early detection, diagnosis, and treatment monitoring.

Key Country Highlights:

- United States: The country is witnessing increased adoption of PET scans due to advancements in hybrid imaging systems, AI-driven diagnostic tools, and a growing focus on personalized medicine in oncology and neurology.

- Europe: Rising prevalence of chronic diseases, expansion of PET scanner installations, and favorable clinical guidelines are propelling the market growth across major European countries.

- China: Significant investments in healthcare infrastructure and a growing focus on early disease detection are accelerating the adoption of PET scans across hospitals and diagnostic centers.

- Japan: The increasing demand for advanced diagnostic imaging technologies and the integration of PET scans in clinical practice for neurological and cardiovascular assessments are driving the market growth.

Positron Emission Tomography Scan Market Trends

Utilization of Hybrid Imaging Systems (PET/CT and PET/MRI) for Enhancement of Accuracy

One of the most significant trends in the market is the integration of PET with CT (computed tomography) and MRI (magnetic resonance imaging). The hybrid imaging system is a combination of the functional imaging capabilities of PET with the high-resolution anatomical imaging of CT and MRI. This system helps clinicians to obtain more accurate, comprehensive images, treatment planning, improving diagnosis, and monitoring.

- According to an article published by the European Journal of Nuclear Medicine and Molecular Imaging in 2023, several guidelines were developed for the integration of PET/MRI into clinical practice. The European Association of Nuclear Medicine (EANM) has published a set of guidelines for the use of PET/MRI in oncology, neurology, and cardiology. The guidelines provide recommendations for patient preparation, image acquisition and reconstruction, data analysis and interpretation, and quality control. Such guidelines propel the technique's adoption in the market.

Advancements in Radiotracer Development

Radiotracers are substances tagged with radioactive isotopes used in positron emission tomography (PET) scanning to visualize biological processes. Advancements in the radiotracer design have significantly boosted the ability to diagnose and monitor diseases, such as cancers, neurological disorders, and cardiovascular conditions.

Expansion of Application of PET in Personalized Medicine and Theranostics

Positron emission tomography (PET) scanning plays a central role in personalized medicine by providing valuable molecular and functional information that helps guide the diagnosis, treatment planning, and monitoring. The novel radiotracers, precision imaging technologies, and integration with genetic and molecular data enable a more targeted, individualized approach to healthcare. Also it helps in improving the outcomes and quality of life for patients across various medical fields, from oncology to neurology and cardiology.

- North America witnessed a positron emission tomography scan market growth from USD 9.37 Billion in 2023 to USD 9.37 Billion in 2024.

Download Free sample to learn more about this report.

Positron Emission Tomography Scan Market Growth Fcators

Rising Prevalence of Chronic Diseases Surges Demand for These Procedures

The rising prevalence of chronic diseases, such as cancers, cardiovascular diseases, neurological disorders, and musculoskeletal conditions, is driving an increased demand for medical imaging technologies, such as positron emission tomography scans. Positron emission tomography scans, in particular, play a crucial role in the early detection, diagnosis, and monitoring of various chronic diseases.

- According to the World Health Organization (WHO), in 2023, the global estimates in 2019 showed over 8.5 million individuals with Parkinson's disease (PD). The growing adoption of PET in neurological and cardiovascular diagnostics propels the global positron emission tomography scan market growth in 2024.

Rising Demand for Accurate and Early Diagnostic Tools

The growing demand for early diagnostics due to rising government initiatives and funding for medical imaging research is propelling the market. Moreover, the growing investments in healthcare infrastructure in various countries boost product adoption in the market.

Research and Developments in PET Technology

Role of Artificial Intelligence and Machine Learning in PET Imaging

Artificial intelligence (AI) is playing an increasingly important role in the positron emission tomography scan market. This advanced technology transforms the way positron emission tomography scans are conducted, processed, and interpreted, leading to improvements in clinical outcomes, diagnostic accuracy, and workflow efficiency.

- According to an article published by the European Journal of Nuclear Medicine and Molecular Imaging in 2022, digital positron emission tomography (PET) detector technologies and artificial intelligence (AI) based image post-reconstruction methods allow for reduced PET acquisition time while maintaining diagnostic quality.

Funding and Grants Supporting PET Research

Funding and grants are essential for advancing research in positron emission tomography (PET). It can support the development of new technologies, improve clinical applications, and drive innovation in the field.

RESTRAINING FACTORS

Limited Reimbursement Policies in Emerging Countries May Limit the Market Growth

Despite increasing demand for positron emission tomography scans in the market, one of the major impediments is the limited reimbursement facilities in emerging countries. Many developing countries are lagging in terms of the installed base of PET scanners and suitable reimbursement, which leads to a reduction in the ability to conduct these scans. Such factors are expected to restrict the market growth during the forecast period.

- For instance, according to an article published by Chambers U.K. in 2024, about 1.0% of dementia patients tested for new Alzheimer's drugs. A study reveals that only a small fraction of U.K. dementia patients receive diagnostic tests, such as positron emission tomography scans, necessary for accessing new Alzheimer's treatments.

High Costs Associated with PET Equipment and Procedures

The high costs of medical devices, such as PET equipment and procedures, are a major hindrance to the adoption of diagnostic imaging procedures among patients. The developing countries have limited healthcare expenditures. This results in the limited availability of advanced healthcare infrastructure, including PET scanners.

Also, the limited availability of radiopharmaceuticals due to the challenges in the sourcing of isotopes used in positron emission tomography scans, such as F-18, further increases the cost of the procedures and hampers the market growth. Furthermore, the stringent regulatory scenario also limits the market growth.

Need for Skilled Professionals to Operate Advanced Imaging Systems

One of the critical challenges the industry is facing is the shortage of skilled professionals capable of operating and interpreting the results from advanced imaging systems, including cutting-edge tools such as PET scans, MRIs, CT scans, and functional imaging systems.

- For instance, according to an article published by the Journal of Medical Imaging and Radiation Sciences in 2023, as per an expert report from the German Hospital Institute, 46.0% of hospitals in Germany have staffing problems with radiographers. Such a significant shortage of skilled professionals to operate advanced systems hinders market growth.

Positron Emission Tomography Scan Market Segmentation Analysis

By Indication Analysis

Growing Prevalence of Cancer Led to Oncology Segment’s Dominance in the Market

The market segmentation is into oncology, cardiology, neurology, and others by indication.

The oncology segment held a dominant share with 66.93% in 2026. This growth is primarily driven by the rising global incidence of cancer and the growing focus on early detection, diagnosis, and efficient treatment monitoring. Additionally, enhanced access to healthcare services and diagnostic imaging centers in emerging markets is expected to contribute to a higher share of the oncology indication segment.

- According to Global Cancer Statistics 2022, there were approximately 20.0 million new cases of cancer in the year 2022 (including non-melanoma skin cancers [NMSCs]) alongside 9.7 million deaths from cancer (including NMSC).

The neurology segment held a suitable share due to the growing number of Parkinson’s disease and epilepsy cases and the increasing demand for such advanced imaging technologies.

- The Neurology segment is expected to hold a 18.5% share in 2024.

Moreover, the cardiology and others segment held a prominent share due to rising healthcare infrastructure and research initiatives across the globe.

To know how our report can help streamline your business, Speak to Analyst

By Source of Payment

Increased Dependency on Private Sources of Payment for Imaging Procedures to Enable Dominance of Private Health Insurance/Out-of-pocket Segment

On the basis of the source of payment, the segmentation of the market can be done into public and private health insurance/out-of-pocket.

In 2024, the private health insurance and out-of-pocket segment dominated the global positron emission tomography scan market share. This segment is anticipated to expand further, driven by an increase in patients' disposable income and heightened awareness about the importance of early diagnosis. Additionally, the growing strategic initiatives, such as collaboration partnerships, mergers and acquisitions, services launches, and innovations by major market players to enhance patient care through advanced diagnostic laboratories, are expected to fuel the growth of the private segment further.

The public segment accounted for the largest market share of 84.26% in 2026, owing to the significant reimbursement facilities provided by government bodies and increasing healthcare expenditure in various countries.

- In October 2023, U.S. health officials lifted the curbs on the reimbursement of a non-invasive imaging test called the amyloid PET used to diagnose Alzheimer's, ending a once-per-lifetime limitation that clears the way for its use to determine eligibility for new treatments.

By Service Providers

Hospitals Segment Dominated the Market Share Due to Increasing Healthcare Infrastructure

In terms of service provider, the market is segmented into hospitals, diagnostic centers, and others.

The hospitals segment held a dominating share of the global market with a share of 65.34% in 2026. The segment’s growth is attributed to the increasing healthcare infrastructure and suitable reimbursement facilities for such procedures. Moreover, the significant expansion in number of hospitals worldwide may require installation of PET scans, which is anticipated to increase the scan volume, propelling the segment’s growth.

The diagnostic centers segments held a considerable market share in 2024. The growing strategic activities and product launches of key players are propelling segmental growth.

- In February 2024, Manipal TRUtest launches the First-Ever PET CT Scan Center in Goa, India.

The others segment has a lower share owing to the increasing number of research initiatives and growing adoption of advanced technologies across the globe.

REGIONAL INSIGHTS

In terms of geography, the global market is segmented into North America, Europe, Asia Pacific, and Latin America, and Middle East & Africa.

North America

North America Positron Emission Tomography Scan Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest share in terms of regions and recorded a revenue of USD 10.2 billion in the year 2026. The region's dominance is greatly influenced by the widespread availability of companies providing these solutions and a strong network of imaging centers. Additionally, the healthcare infrastructure and reimbursement by both government and non-government organizations, as well as various initiatives, are helping to boost the market expansion in the region. The U.S. market is projected to reach USD 10.11 billion by 2026.

Europe

Europe held a notable global market share in 2024. The rising prevalence of chronic diseases and healthcare expenditure is expected to boost the market growth in the European region over the study period. The UK market is projected to reach USD 0.63 billion by 2026, while the Germany market is projected to reach USD 1.24 billion by 2026.

- According to the data published by the European Commission in September 2024, the number of PET scanner units increased in France from 5 in 2002 to 216 in 2022.

Asia Pacific

The Asia Pacific region is projected to expand at the highest CAGR during the forecast period. The increasing number of aging populations and the launch of awareness programs for imaging procedures across the region are anticipated to surge the demand for these solutions across the region. The Japan market is projected to reach USD 0.47 billion by 2026, the China market is projected to reach USD 1.59 billion by 2026, and the India market is projected to reach USD 0.2 billion by 2026.

Latin America, and Middle East & Africa

Latin America and Middle East & Africa markets are expected to grow at a lower share during the forecast period. Some of the reasons for the slower growth in these regions include the limited adoption of advanced technologies due to limited reimbursement facilities.

KEY INDUSTRY PLAYERS

Strong Presence and Strategic Partnerships Led to the Dominance of Some Market Players in 2024

The market is fragmented in nature and consists of certain players who have significant market shares in the key regions. Sonic Healthcare Limited, Apex Radiology, and Alliance Medical Limited have solidified their presence in the market with robust products and established global networks. These companies are concentrating on delving deeper into this market by forming strategic partnerships with academic and research institutes.

Some other prominent players are RadNet, Inc., Novant Health, InHealth Group, and among others. These companies have established their presence and offer a wide range of services with advanced technology in the market.

- In November 2024, GE HealthCare and RadNet Forge collaborated to transform imaging systems and accelerate the adoption of Artificial Intelligence (AI) with smart technology. Such advancements in imaging propel the market expansion.

Future Outlook and Opportunities

The emerging regions, such as Asia Pacific, Latin America, and the Middle East & Africa, are witnessing rapid healthcare growth and increasing demand for advanced imaging technologies, including PET scans. Countries, such as China, Japan, and South Korea are investing heavily in healthcare infrastructure. This has made PET a part of the diagnostic toolkit in both large metropolitan areas and increasingly in rural regions.

Additionally, the potential impact of the introduction of new technologies for the positron emission tomography scan, such as hybrid imaging and integration of artificial intelligence, is expected to foster future market growth.

List of Top Positron Emission Tomography Scan Companies:

- RadNet, Inc. (U.S.)

- Sonic Healthcare Limited (Australia)

- Akumin Inc. (U.S.)

- Apex Radiology (Australia)

- Alliance Medical Limited (U.K.)

- Novant Health (U.S.)

- InHealth Group (U.K.)

- Dignity Health (U.S.)

- Concord Medical (China)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – AGFA HealthCare signed a new deal with Alliance Medical to implement an advanced cloud-based solution across all of Alliance Medical’s U.K. sites.

- January 2024 – InHealth launched the U.K.'s first relocatable radioligand therapy service for cancer care.

- November 2023 – RadNet inked a new hospital joint venture partnership with Cedars-Sinai, a nonprofit academic healthcare organization based in California, to add 10-plus imaging centers.

- October 2023 – Norfolk and Norwich University Hospitals NHS Foundation Trust, Alliance Medical launched PET-CT scanner to improve access to advanced cancer diagnostics for patients in the East of England.

- May 2021 – Radiology Partners launched a new clinical innovation team following its recent partnership with artificial intelligence firm Aidoc, the El Segundo, California, mega practice.

REPORT COVERAGE

The global positron emission tomography scan market report covers a detailed analysis and overview. It focuses on global market analysis on key aspects such as market forecast, source of payment, service providers, and region. Besides this, it offers insights into the market drivers, market trends, restraints, and COVID-19 impact on the market. Moreover, the market research report encompasses several factors that have contributed to the growth of the global market forecast market analysis over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.41% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Indication,Source of Payment, Service Provider, and Region |

|

By Indication |

· Oncology · Cardiology · Neurology · Others |

|

By Source of Payment |

· Public · Private Health Insurance/Out-of-pocket |

|

By Service Provider |

· Hospitals · Diagnostic Centers · Others |

|

By Region |

· North America (By Indication, By Source of Payment, By Service Provider, By Country) o U.S. o Canada · Europe (By Indication, By Source of Payment, By Service Provider, By Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Indication, By Source of Payment, By Service Provider, By Country/Sub-Region) o Japan o China o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Indication, By Source of Payment, By Service Provider, By Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Indication, By Source of Payment, By Service Providers, By Country/Sub-Region) o GCC o South Africa o Rest of Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 19.46 billion in 2026 and is projected to reach USD 29.67 billion by 2034.

In 2025, the North America positron emission tomography scan market size was valued at USD 10.2 billion.

The market will exhibit rapid growth at a CAGR of 5.41% during the forecast period.

By indication, the oncology segment will hold the leading position in the market.

The growing prevalence of key diseases, coupled with technological advancements, are some of the factors driving the demand for positron emission tomography.

Sonic Healthcare Limited, Apex Radiology, and Alliance Medical are some of the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us