Protein Microarray Market Size, Share & Industry Analysis, By Type (Analytical, Functional, and Reverse Phase), By Offering (Products and Services), By Application (Diagnostics, Proteomics, and Others), By End User (Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

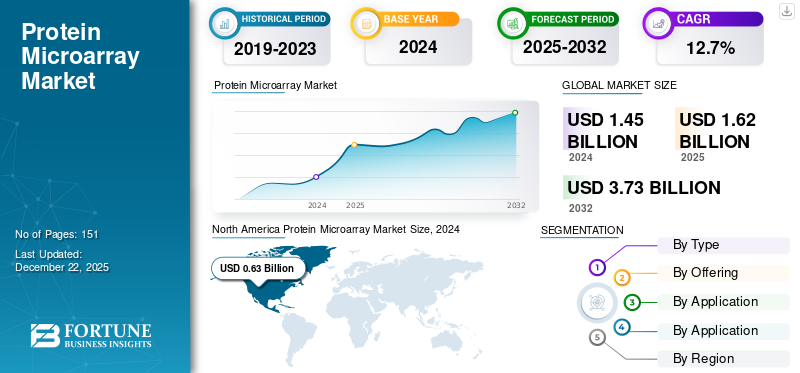

The global protein microarray market size was valued at USD 1.45 billion in 2024. The market is projected to be worth USD 1.62 billion in 2025 and reach USD 3.73 billion by 2032, exhibiting a CAGR of 12.7% during the forecast period. North America dominated the protein microarray market with a market share of 43.45% in 2024.

Protein microarrays, also known as protein chips, are a rapidly growing class of proteomic technologies. This discipline is becoming an essential tool in molecular biology and biochemistry. The market is experiencing significant growth, driven by advancements in proteomic technologies and its increasing applications in drug discovery, diagnostics, and personalized medicine. Different operating players in the market are actively engaged in the development of new products and offering new services to capture the untapped avenues of the market. A few of the prominent market players include Creative Biolabs, Agilent Technologies Inc., and RayBiotech, Inc. The market is poised for substantial growth; however, addressing challenges such as regulatory variability and technological barriers will be crucial for sustained expansion.

MARKET DYNAMICS

MARKET DRIVERS

Advancements in Proteomics Research to Boost the Market Growth

In recent years, the market has witnessed significant growth majorly due to the technological advancements in proteomics research. This has enabled a comprehensive and accurate analysis of protein structure, expression, functions, and interactions in complex biological systems. This has resulted in the development of protein microarrays with enhanced sensitivity, throughput, and multiplexing capabilities. It has also allowed researchers to analyze proteins simultaneously in a high-throughput manner. The confluence of this has significantly driven the protein microarray market growth.

A few advancements in these microarrays include high sensitivity/specificity, reduction in biological sample volume, and proteins can be tracked simultaneously. Additionally, innovations such as label-free detection methods and AI-driven data analysis have enhanced the accuracy and efficiency of these microarrays, making them more accessible and reliable for researchers.

MARKET RESTRAINTS

High Costs of the Product Obstructs the Market Growth

In spite of growing demand for protein microarrays in proteomics research as well as diagnostics, factors such as the high cost of these products and technological complexities limit the market growth to a certain extent. The development and implementation of these microarray technologies can be expensive, potentially limiting their adoption, especially in resource-constrained settings. As the cost associated with functional protein-microarrays is comparatively higher, the adoption and consumption of a large number of protein chips is not practically feasible, in turn hampering the overall market growth.

MARKET OPPORTUNITIES

Growing Shift Toward Personalized Medicine to Offer Lucrative Growth Opportunities for the Market

The shift toward tailored healthcare solutions has increased the utilization of these microarrays in clinical diagnostics, enabling treatments based on individual protein profiles. These microarrays facilitate disease diagnosis, biomarker discovery, and monitoring of treatment responses by analyzing protein levels and interactions in a large number of samples. This technology also enables high-throughput screening and characterization of proteins, aiding in personalized treatment approaches. This has created significant opportunities for the operating players in the market.

MARKET CHALLENGES

Challenges in Development of Protein Microarrays to Hinder Market Growth

One of the major factors affecting the adoption of protein microarrays is technology-related challenges including sensitivity, specificity, and reproducibility of these microarrays. This also hinders the product’s broader application. The development of these products involves complex biochemical interactions and intricate manufacturing processes. This creates technological complexities, in turn challenging the overall market growth. The designing of protein biochips requires a deep understanding of microfabrication techniques, protein biochemistry and data analysis methodologies. This further requires skilled professionals to handle such products.

OTHER CHALLENGES

Data Complexity to Pose Challenge for Market Growth

Managing and interpreting the vast amount of data generated by protein-microarrays requires sophisticated analytical tools and expertise. This results in the installation of advanced tools and employing highly skilled personnel in turn increasing the overall expenses. In resource-limited settings, this is a major challenging factor for the growth of the protein based microarray solutions.

PROTEIN MICROARRAY MARKET TRENDS

Growing Focus on Biomarker Discovery is a Key Market Trend

Recently, different pharmaceutical companies, as well as research institutes are actively engaging in the discovery of novel biomarkers. There is a growing emphasis on identifying biomarkers for diseases such as cancer and autoimmune disorders, where protein microarrays play a pivotal role in detecting disease-specific proteins. These biomarkers are aimed at innovative drug development and disease diagnosis. This is majorly due to the high demand for personalized medicine, the need for early disease detection, enhanced drug discovery & development, and the rising prevalence of chronic diseases resulting in increasing demand for advanced drugs.

OTHER TRENDS

Integration with Genomics is a Prominent Trend Reshaping the Market Expansion

The convergence of proteomics and genomics is enhancing the understanding of complex diseases, leading to more effective therapeutic strategies. This integration allows researchers to correlate gene expression data with protein function and interactions, ultimately leading to a more holistic view of the proteome.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Wide Adoption in Research & Development Supported the Analytical Segment Growth

On the basis of type market segment, the market is segmented into analytical, functional, and reverse-phase.

In 2024, the analytical segment held the highest protein microarray market share and is anticipated to maintain its dominance throughout the study period. Different factors, such as the wide adoption of analytical microarrays in research & development, have driven the segment growth. Antibody microarray is one of the key types of analytical microarray. This is used in the assessment of protein expression levels and binding affinities.

The functional microarrays segment is projected to witness a notable growth rate during the forecast period. The increasing usage of functional microarrays in the study of various interactions, including protein-RNA, protein-DNA, protein-drug, and others, has supplemented the segmental growth.

By Offering

Increasing Usage Of Protein Microarray Reagents And Kits Boosted The Segmental Dominance

Based on offering, the market is divided into products and services.

In 2024, products segment held the leading position in the global market. The dominance is driven by the increasing usage of protein microarray reagents and kits in research and development by pharmaceutical companies coupled with advancements in instruments used for the same.

Alternatively, services segment is anticipated to witness a considerable growth throughout the forecast period. Some of the factors contributing to the segment growth include increasing number of service providers coupled with the growing demand for services due to upsurged applications of these microarrays in various fields. This includes applications in proteomics, diagnostics, and others.

- For instance, Creative BioLabs is one of the leading service providers in this market.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Adoption of the Product in Proteomics to Impel the Segment Expansion

Based on application, the market is categorized into diagnostics, proteomics, and others.

The proteomics segment accounted for the largest global market share in 2024. These microarrays are considered to be a powerful tool in the field of proteomics. It allows high-throughput analysis of protein expression, functions, and interactions, while proteomics focuses on the comprehensive study of proteins in a biological system. They can be used together for diverse applications, including disease diagnostics, biomarker identification, functional proteomics, and drug discovery.

The diagnostics segment is expected to grow at a moderate rate in the near future. These microarrays have gained higher prominence in the past few years, especially in the field of diagnostics.

By End User

Increasing Adoption of Protein Microarrays in Research Resulted in Dominance of Pharmaceutical & Biotechnology Companies Segment

Based on end users, the market is categorized into pharmaceutical & biotechnology companies, diagnostic laboratories, and others.

The pharmaceutical & biotechnology companies segment accounted for the largest market share in 2024. The increasing adoption of these microarrays in research applications, coupled with a growing shift by pharmaceutical companies towards the development of personalized medicine, has supported the segment’s growth.

The diagnostic laboratories segment is expected to witness a considerable growth rate in the coming years. Protein-microarrays are valuable diagnostic tools as they allow simultaneous analysis of multiple proteins, aiding in the detection of disease markers, identification of disease states, and monitoring of treatment responses.

PROTEIN MICROARRAY MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Protein Microarray Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, the North America region generated a revenue of USD 0.63 billion in 2024 and captured a leading market position. The region’s dominance can be attributed to advancements in proteomics coupled with substantial research funding. In addition, the strong presence of biotechnology companies, advanced healthcare infrastructure, and significant government and private investments in proteomics and genomics further supplement the regional growth.

U.S.

The U.S. held the highest market share in the North America region, driven by strong regulatory support from agencies such as the U.S. FDA and NIH, resulting in innovation in diagnostics and therapeutics using these microarrays. Additionally, the country is home to several well-established market players offering advanced products & services for protein microarray analysis.

- For instance, a research study was published in PubMed in January 2025, in which a team of researchers from the U.S. developed a customizable multiplex protein microarray for antibody testing.

Europe

European region exhibits steady growth due to robust healthcare infrastructure and ongoing research initiatives. The region focuses on personalized medicine and rare disease diagnostics, thus increasing the demand for these microarrays in the region. European countries, including Germany, U.K., and France, are leading in clinical research collaborations and biotechnology incubators. Additionally, EU funding and policies support translational proteomics, enhancing the adoption of these technologies.

Asia Pacific

The market in the Asia Pacific region is anticipated to experience the highest growth rate during the forecast period, driven by increased investments in biotechnological research and expanding pharmaceutical sectors. The region is witnessing massive investments in biotechnology research by China, India, South Korea, and Japan. Government initiatives such as "Made in China 2025," supporting domestic biotech manufacturing and diagnostic innovations, and increasing academic and industrial collaborations to advance proteomics research are some other key factors propelling regional market growth.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa regions experienced a smaller share of the market due to relatively lower adoption of these microarrays. However, with improving healthcare infrastructure these regions are anticipated to witness a moderate growth in the coming years.

COMPETITIVE LANDSCAPE

Key Market Players

Leading Companies Focus on Collaborations to Boost Their Market Presence

Several companies are at the forefront of the protein microarray market, including Creative Biolabs, Agilent Technologies Inc., RayBiotech, Inc., and others. These companies are investing in research and development to introduce innovative products and expand their market presence. Creative Biolabs is one of the prominent players in the global market. The company offers all three platforms, namely analytical, functional, and reverse phase microarray, in its offerings. The companies’ offerings are for research applications.

Some other key players in the market include Sengenics Corporation LLC., CDI Labs, Creative Proteomics, Bio Rad Laboratories Inc., and Arrayit Corporation (ARYC).

LIST OF KEY PROTEIN MICROARRAY COMPANIES PROFILED

- Creative Biolabs (U.S.)

- Agilent Technologies Inc. (U.S.)

- RayBiotech, Inc. (U.S.)

- Sengenics Corporation LLC. (U.S.)

- CDI Labs (Puerto Rico)

- Creative Proteomics (U.S.)

- Bio Rad Laboratories Inc. (U.S.)

- Arrayit Corporation (ARYC) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Sengenics Corporation LLC launched the i-ome discovery platform, a comprehensive protein microarray platform analyzing over 1,800 autoantigens. This advancement aims to enhance disease diagnosis and therapeutic interventions by leveraging AI-based pipelines for accurate autoantibody detection.

- March 2023: Spectrum Solutions acquired Alimetrix, Inc., and Microarrays, Inc., for expansion of its lab capabilities and testing capabilities.

- March 2022:-Sengenics introduced the i-Ome Protein Array Kit, which contains slide-based, high-density protein microarrays.

- May 2020: PEPperPRINT GmbH announced the availability of PEPperCHIP Pan-Corona Spike Protein Microarray to support the coronavirus research.

- February 2020: PEPperPRINT GmbH launched PEPperCHIP SARS-CoV-2 Proteome Microarray for the detection of IgG and IgM antibody responses on the epitope level in patient sera for vaccine development or in-vitro diagnostic test.

REPORT COVERAGE

The global protein microarray market analysis provides a detailed analysis of the industry. It emphasizes key aspects, such as major companies, types, offerings, applications, and a few others. In addition, the protein microarrays market report includes detailed insights into market dynamics, new products & services launches, and key industry developments such as mergers, partnerships, & acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.7% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Offering

By Application

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.45 billion in 2024 and is projected to reach USD 3.73 billion by 2032.

In 2024, the North America market value stood at USD 0.63 billion.

The market is expected to exhibit steady growth at a CAGR of 12.7% during the forecast period.

In terms of the offering segment, the products segment led the market in 2024.

The growing usage of protein microarrays in diagnostics & proteomics is a key factor driving market growth.

Creative Biolabs, Agilent Technologies Inc., and RayBiotech, Inc. are some of the major players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us