Styrene Butadiene Rubber Market Size, Share & Industry Analysis, By Type (Emulsion SBR (ESBR), Solution SBR (SSBR), and Others), By Application (Tire, Footwear, Polymer Modification, Adhesives, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

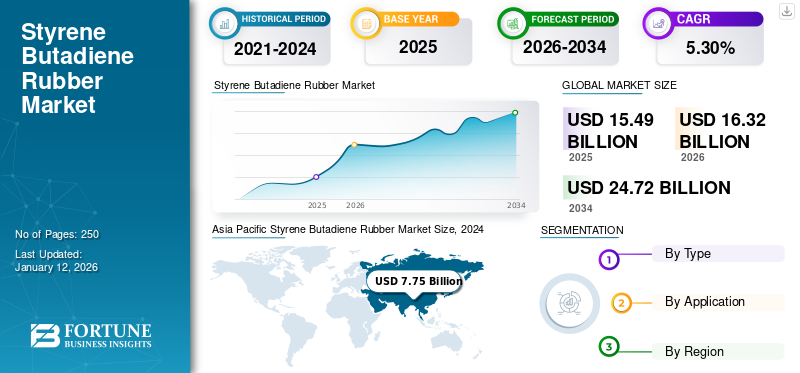

The global styrene butadiene rubber market size was valued at USD 15.49 billion in 2025. The market is projected to grow from USD 16.32 billion in 2026 to USD 24.72 billion by 2034, exhibiting a CAGR of 5.30% during the forecast period. Asia Pacific dominated the styrene butadiene rubber market with a market share of 53% in 2025.

Styrene Butadiene Rubber (SBR), a synthetic rubber made by polymerizing styrene and butadiene, is one of the fastest-growing types of rubber in the market. The strong product demand in tire manufacturing drives the market due to its excellent abrasion resistance, durability, and cost-effectiveness compared to natural rubber. Styrene butadiene rubber is increasingly used in footwear, conveyor belts, industrial hoses, and adhesives, further boosting market growth. Furthermore, technological advancements such as solution polymerization and the development of eco-friendly SBR grades are improving the performance and sustainability of products. Reliance Industries Limited, LG Chem., Vizag Chemicals, Arlanxeo and Zeon Corporation

are a few major players in the market.

- As per the Ministry of Chemicals and Fertilizers, Government of India, the installed capacity for SBR in India increased from 492,000 tons in 2018-19 to 570,000 tons in 2022-23, reflecting a CAGR of 3.7% over this period.

Styrene Butadiene Rubber Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 15.49 billion

- 2026 Market Size: USD 16.32 billion

- 2034 Forecast Market Size: USD 24.72 billion

- CAGR: 5.30% from 2026–2034

Market Share:

- Asia Pacific dominated the styrene butadiene rubber market with a 53% share in 2025, driven by rapid industrial growth, expanding automotive manufacturing, and rising demand for high-performance tires across China, India, and Southeast Asia.

- By type, Emulsion SBR (ESBR) is expected to hold the largest market share in 2025 due to its extensive use in tire manufacturing, footwear, adhesives, and other general-purpose rubber products, supported by cost-effectiveness and good abrasion resistance.

Key Country Highlights:

- United States: Growth is supported by rising vehicle production, particularly electric and hybrid models, which drive demand for high-performance tires and SBR-based automotive parts.

- China: Expanding automotive, footwear, and construction industries fuel strong demand, with the country also leading global tire exports worth USD 21.3 billion in 2023.

- Japan: Demand is driven by advanced automotive production and the use of high-performance materials for durable and sustainable tire applications.

- Europe: Strong automotive sector and stringent environmental regulations support demand, with Germany leading electric vehicle exports worth USD 40.1 billion in 2023.

- Brazil: Rising automotive production and footwear manufacturing drive SBR consumption, supported by growing industrial activities and infrastructure projects.

STYRENE BUTADIENE RUBBER MARKET TRENDS

Shift Toward Sustainable and High-Performance Materials is Driving Market

The market is witnessing a shift toward sustainable and high-performance rubber materials, driven by increasing environmental regulations and demand for fuel-efficient, durable tires. Manufacturers focus on producing bio-based and solution styrene butadiene rubber variants that offer improved rolling resistance, enhanced wet grip, and lower carbon emissions. This trend is mainly prominent in the automotive and footwear sectors, where performance, safety, and sustainability are becoming key purchasing factors.

MARKET DYNAMICS

MARKET DRIVERS

Growing Expansion of Automotive and Tire Industry to Drive Product Demand

The rapid expansion of the automotive industry is driving a significant increase in the use of SBR for tire production. With rising vehicle manufacturing and ownership across the globe, the demand for durable, high-performance, and cost-efficient tires has increased, directly boosting the demand for these products. Additionally, technological innovations in the automotive sector, including developing electric and fuel-efficient vehicles, drive the demand for specialized tires manufactured with solution-polymerized SBR grades. As a result, the growing automotive industry is expected to fuel product consumption across tire production continuously.

- According to the Ministry of Heavy Industries, the Indian automotive industry produced approximately 28 million vehicles in 2023-24. This vehicle production growth has directly increased tire demand, thereby increasing the consumption of styrene butadiene rubber.

MARKET RESTRAINTS

Continuous Fluctuations in Raw Material Prices Restrict Market Growth

Alterations in raw materials prices, such as butadiene, styrene, and petroleum-based feedstock, can significantly impact the profit margins and the production costs for SBR manufacturers. An increase in the prices of these materials raises production costs, negatively affecting profitability. Many companies are considering alternatives, such as bio-based butadiene and cost-efficient manufacturing techniques, to mitigate these risks. As a result, fluctuations in raw material prices are likely to constrain the market's growth during the forecast period.

MARKET OPPORTUNITIES

Increasing Use of Sustainable Practices and Technological Advancements to Create Market Opportunities

The demand for SBR is set to rise due to the increasing emphasis on sustainable practices and technological innovations across various industries. Sustainable initiatives, including using renewable feedstock, developing eco-friendly alternatives, and recycling technologies, are reducing the environmental footprint of SBR production. Additionally, innovations in polymer science, such as the development of advanced polymer blends, nanoscale enhancements, and new crosslinking techniques, are improving the performance and sustainability of products. As automotive, footwear, and adhesives increasingly incorporate SBR for their superior properties, these technological and sustainability trends are expected to drive the styrene butadiene rubber market growth during the forecast period.

- According to the National Rubber Policy 2019 by the Government of India, the consumption of synthetic rubber (SR) in India is projected to reach 1.2 million tons by 2025. SBR and PBR (Poly Butadiene Rubber) accounted for 63% and 34% of SR production in the country, respectively. This indicates a significant increase in demand, driven by sustainable practices and technological advancements in the industry.

MARKET CHALLENGES

Performance Limitations and Stringent Environmental Regulations Create Challenges for Market Growth

Styrene butadiene rubber, while widely used, faces performance limitations in certain applications, such as low-temperature flexibility and wear resistance, which may limit its use in specific industries. Additionally, the growing pressure for sustainable manufacturing practices and implementing environmental regulations, especially related to reducing carbon emissions and hazardous chemical use, require producers to invest in cleaner production methods and eco-friendly alternatives. This regulatory pressure, combined with the increasing competition from alternative materials, is pushing manufacturers to innovate and enhance the performance and sustainability of their products.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Emulsion SBR Leads Market Due to Its Increased Usage in General-Purpose Applications

Based on type, the market is classified into Emulsion SBR (ESBR), Solution SBR (SSBR), and others.

The Emulsion SBR (ESBR) segment holds the largest styrene butadiene rubber market share due to its increased usage in tire manufacturing, footwear, adhesives, and other general-purpose rubber products. Its cost-effectiveness, ease of processing, and good abrasion resistance make it the best choice in industries across emerging and developed economies. Rapid industrialization, increasing automotive production, and consistent demand for general rubber products drive segment growth.

On the other hand, the Solution SBR (SSBR) segment is expanding due to the rising demand for high-performance and fuel-efficient tires. This type offers superior rolling resistance, better wet grip, and enhanced durability, making it ideal for premium tire applications. With stricter fuel efficiency and emission regulations globally, tire manufacturers are increasingly adopting SSBR to meet performance and sustainability standards, further boosting market expansion.

By Application

Tire Segment Boosts Product Demand with Rising Vehicle Production and Emission Regulations

Based on application, the market is segmented into tire, footwear, polymer modification, adhesives, and others.

The tire segment holds the dominant position in the market. This surge is driven by expanding global automotive production, increasing replacement tire cycles, and shifting toward fuel-efficient, low-rolling-resistance tires that leverage solution SBR. Additionally, growing demand for commercial and passenger vehicles in emerging economies and continuous advancements in tire formulation technologies continue to drive the segment.

In the footwear segment, styrene butadiene rubber is used for its durability, cushioning, and cost-effectiveness, making it the material of choice for midsoles, outsoles, and padding. The rise of health-conscious lifestyles and the popularity of athleisure have increased demand for performance-driven athletic and casual shoes. With increasing urbanization, consumers seek footwear that perfectly merges style with functionality, a quality that SBR provides.

In the polymer modification segment, styrene butadiene rubber is used for blending with polymers such as polyvinyl chloride, asphalt binders, and thermoplastics to improve toughness, weather durability, and flexibility. Its key uses include modified bitumen for paving roads, roofing membranes, sealants, and durable plastic components. Large-scale infrastructure projects in transport and industrial construction drive demand for these enhanced polymer formulations, delivering extended service life and superior performance.

Styrene Butadiene Rubber Market Regional Outlook

By region, the market is categorized into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Styrene Butadiene Rubber Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 8.23 billion in 2025 and USD 8.73 billion in 2026, fueled by rapid industrial growth, expanding automotive manufacturing, and increasing demand for high-performance tires across China, India, and Southeast Asia. Government initiatives supporting electric vehicle adoption, infrastructure development, and industrial expansion are major contributors to rising product consumption. Factors such as increasing disposable incomes, urbanization, and foreign investments in the automotive, footwear, and construction industries are accelerating market growth. The region’s strong manufacturing base, supported by domestic and international players, ensures sustained demand for styrene butadiene rubber.

- According to the World's Top Exports, China exported rubber tires worth USD 21.3 billion in 2023, accounting for 21.8% of global exports. This reflects its strong manufacturing base, enhancing the region's demand for styrene butadiene rubber.

North America

The growth of the North American market is propelled by the expansion of the automotive sector and increasing demand for durable consumer goods. Rising vehicle production, particularly electric and hybrid models requiring high-performance tires, significantly increases product consumption. Additionally, the market benefits from increased construction activities, sealants, and waterproofing materials. Advancements in eco-friendly SBR grades and growing applications across different industries further contribute to the market expansion in the region.

- According to World's Top Exports, the U.S. exported USD 63.0 billion of cars in 2023, accounting for 6.6% of global exports. This boosts demand for SBR, which is widely used in tires and automotive parts.

Europe

The market in Europe is driven by stringent environmental regulations encouraging the use of sustainable and low-emission materials across industries. The region’s strong automotive sector, particularly in Germany, France, and the U.K., significantly contributes to product demand, especially in tire manufacturing. Growth in electric vehicles, green mobility, and infrastructure renovation further boosts product usage in tires, adhesives, and sealants. With an emphasis on sustainability and established industrial demand, Europe remains a key consumer of SBR.

- According to the World's Top Exports, Germany exported USD 40.1 billion worth of electric cars in 2023, accounting for 26.6% of global electric car exports, reflecting its shift toward green mobility and boosting demand for the market in the region.

Latin America

The Latin American market is witnessing growth due to increasing industrial activities, infrastructure projects, and rising automotive production. Government initiatives to boost local manufacturing and investments in transportation and energy sectors are increasing demand for SBR-based products such as tires, adhesives, and sealants.

- Mexico is the leading export market for the U.S. automotive parts and the fourth largest global producer, generating USD 107 billion annually, per the International Trade Administration (ITA).

Middle East & Africa

The market in the Middle East & Africa is driven by abundant petrochemical feedstock in GCC countries and the rapid expansion of regional tire manufacturing hubs. Large-scale infrastructure and industrial projects are boosting demand for SBR-based elastomers in seals, gaskets, and conveyor belts.

- According to Tire World Exports, the African tire market is projected to grow to USD 7.50 billion by 2023 due to the rise in passenger and commercial vehicle sales.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Positions in Market

The global styrene butadiene rubber market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and expanding capacity to increase their market presence. Key global companies include Reliance Industries Limited, LG Chem., Vizag Chemicals, Arlanxeo and Zeon Corporation. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY STYRENE BUTADIENE RUBBER COMPANIES PROFILED

- Reliance Industries Limited (India)

- PetroChina Company Limited (China)

- LG Chem. (South Korea)

- REDCO (Qatar)

- Nam Liong Global Corporation (Taiwan)

- Vizag Chemicals (India)

- Asahi Kasei Corporation (Japan)

- ARLANXEO (Netherlands)

- ZEON CORPORATION (Japan)

- Kumho Petrochemical Co., Ltd. (South Korea)

- The Goodyear Tire & Rubber Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2023: Goodyear Tire & Rubber Company collaborated with Opel to develop an innovative tire for the Opel Experimental concept car, highlighting the increasing demand for advanced tire compounds.

- May 2023: ARLANXEO announced the construction of a synthetic rubber plant in Jubail, Saudi Arabia, set to begin operations in 2027. This move highlights the rising global demand for high-performance rubbers, including SBR.

- May 2023: Idemitsu Kosan, Kumho Petrochemical, and Sumitomo Corporation signed an MoU to develop a sustainable supply chain for bio-based materials. This collaboration marked a significant step toward sustainable innovation in the SBR.

- May 2022: Hankook Tire signed an MoU with Kumho Petrochemical to secure a priority supply of eco-solution-polymerized SBR, highlighting the growing shift in the market toward sustainable and eco-friendly material innovations.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends anticipated to drive the market in the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.30% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 16.32 billion in 2026 and is projected to reach USD 24.72 billion by 2034.

In 2025, the market value stood at USD 8.23 billion.

The market is expected to exhibit a CAGR of 5.30% during the forecast period of 2026-2034.

The Emulsion SBR (ESBR) segment leads the market by type.

The key factor driving the market is the growing automotive and tire industry expansion.

Reliance Industries Limited, LG Chem., Vizag Chemicals, ARLANXEO, and ZEON CORPORATION are the top players in the market.

Asia Pacific holds the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us