U.S. Reciprocal TARIFFS 2025

Trade Disruption or Strategic Realignment?

Why Is the U.S. Reigniting Tariff Talks in 2025?

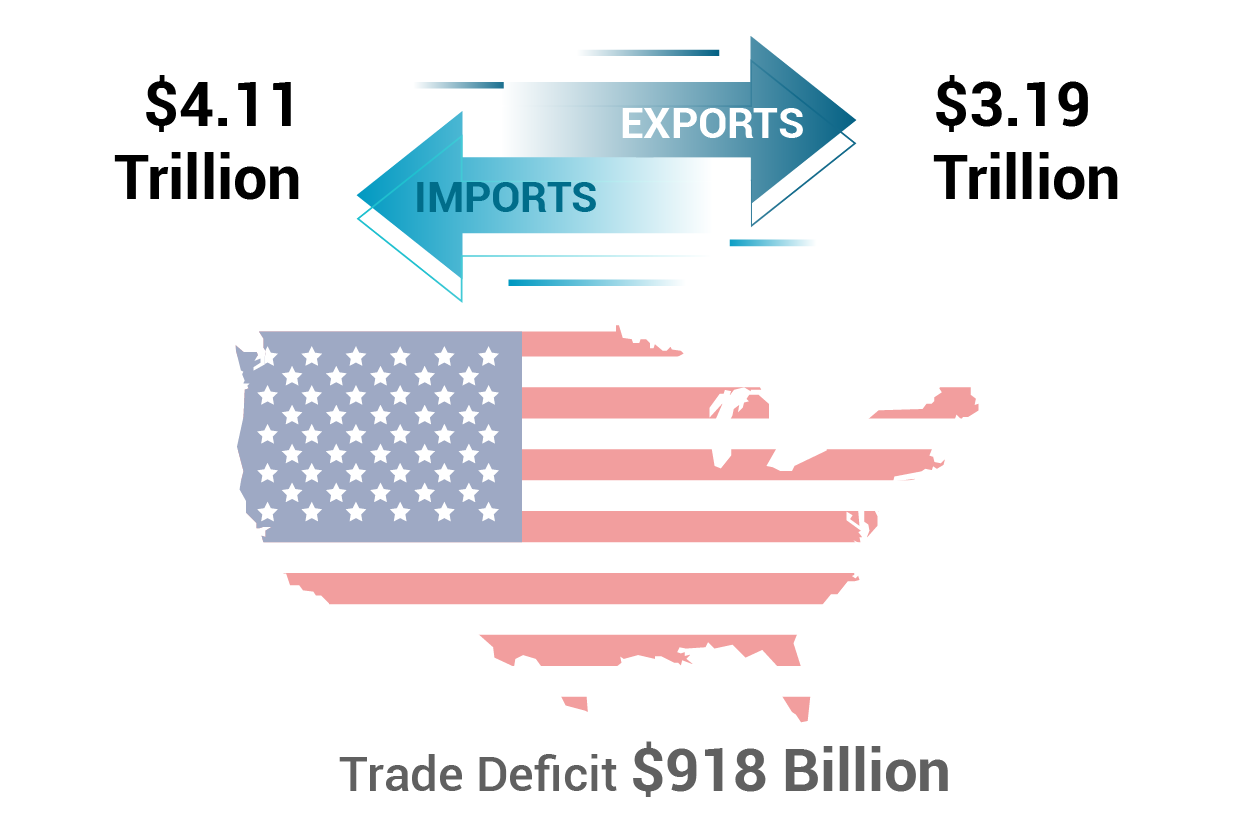

In response to the growing imbalance in international trade, former President Donald Trump has called for reciprocal tariffs. At the heart of this policy shift is the U.S. trade deficit, which hit a staggering USD 918 billion in 2024 – a 17% increase over 2023.

U.S. Trade Snapshot (2024)

Top 10 Countries Contributing to the U.S. Trade Deficit (2024)

$295.2

Billion

$236.8

Billion

$181.5

Billion

$123.5

Billion

$86.8

Billion

$85.2

Billion

$70.6

Billion

$68.7

Billion

$66.2

Billion

$45.6

Billion

Why Is the U.S. Considering Reciprocal Tariffs?

Protect domestic companies from foreign competition

Generate additional revenue for the Federal government

Encourage domestic manufacturing and supply chain localization

Leverage tariffs during international trade negotiations

Current U.S. Tariffs on Major Trade Deficit Countries

A uniform 10% tariff is being applied to all imports during this period.

U.S. tariff on imports from EU 20%

U.S. tariff on imports from Vietnam 46%

U.S. tariff on imports from India 26%

U.S. tariff on imports from South Korea 25%

U.S. tariff on imports from Japan 24%

All tariffs listed above are paused for 90 days as of April 10, 2025.

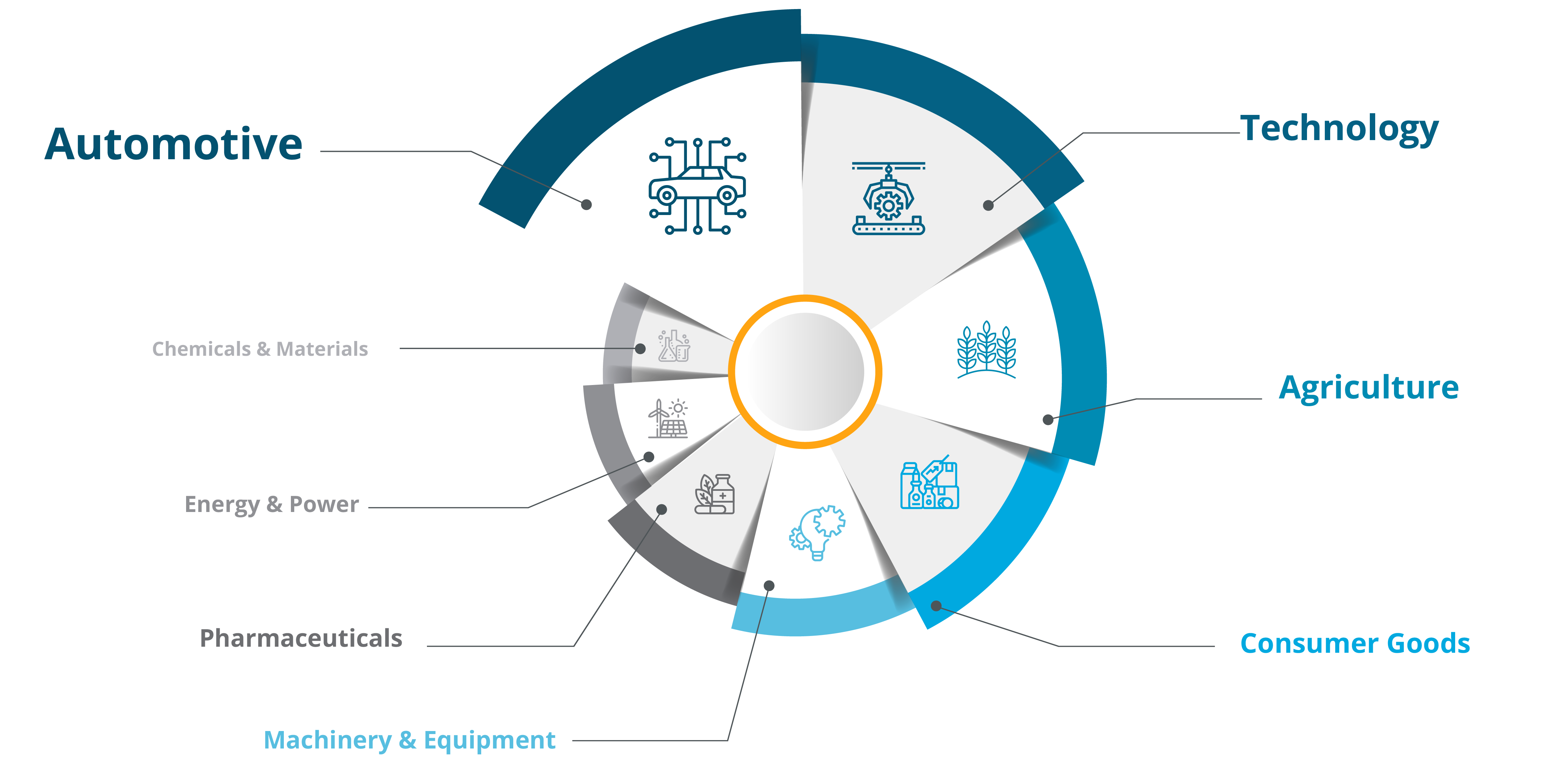

Industries Most Impacted by the Reciprocal tariff Policy

These industries are highly integrated with global supply chains or are dependent on imported components and raw materials.

Potential Economic Impact of Tariff Volatility

- Higher prices for end consumers

- Disruption in cross-border supply chains

- Delays in foreign and domestic capital investments

- Slower GDP growth and employment uncertainty

- Uncertainty in trade finance and credit availability

- Volatile export revenues for producers & manufacturers

How We Help You Navigate the Tariff Challenge

Our expert insights help you not only manage uncertainty but turn it into strategic advantage:

Market Impact Reports

Data-driven analysis on growth shifts, competitive movement, and customer behavior

Custom Deep Dives

Root cause assessment across regions – from price shocks to trade realignments

Strategic Playbooks

Case studies showing how leading firms are adapting sourcing,pricing, and product strategies

Consulting Support

Evaluate threats and opportunities, reshape your go-to-market plans, and de-risk your roadmap