3D Cell Culture Market Size, Share & Industry Analysis, By Type (Scaffold-Based, Scaffold-Free, and Others), By Application (Cancer Research, Tissue Engineering & Regenerative Medicine, Drug Discovery & Development, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Laboratories, and Others), and Regional Forecast, 2026-2034

3D Cell Culture Market Size

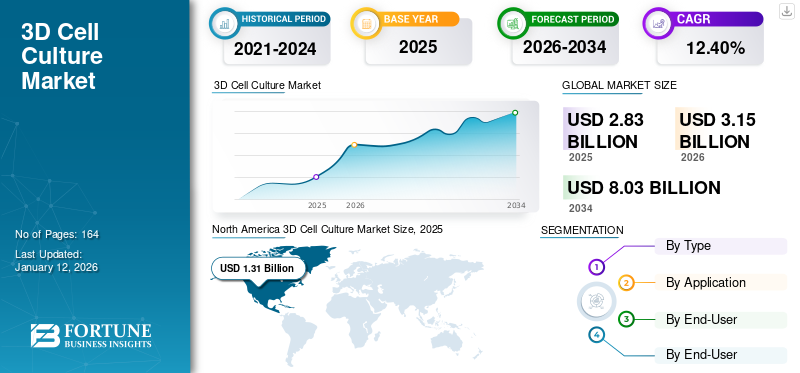

The global 3D cell culture market size was valued at USD 2.83 billion in 2025. The market is projected to grow from USD 3.15 billion in 2026 to USD 8.03 billion by 2034, exhibiting a CAGR of 12.40% during the forecast period. North America dominated the global market with a share of 46.43% in 2025.

A culture environment that allows cells to grow and interact with the surrounding extracellular framework in three dimensions is called 3D cell culture. The rising prevalence of chronic diseases and increasing preference for alternatives to animal testing are projected to fuel global 3D cell culture market growth.

- For instance, according to Pan American Health Organization 2023 estimates, around 20 million new cancer cases will be registered globally.

Some typical application areas of these cultures include cancer research, drug discovery, regenerative medicine, and cell therapy. The substantial utilization of this technique in these application areas is projected to augment the market expansion. Furthermore, key players' increasing focus on introducing advanced products and entering untapped geographic areas is expected to propel market growth.

3D Cell Culture Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.83 billion

- 2026 Market Size: USD 3.15 billion

- 2034 Forecast Market Size: USD 8.03 billion

- CAGR: 12.40% from 2026–2034

Market Share:

- North America dominated the global 3D cell culture market with a 46.43% share in 2025, supported by a strong concentration of pharmaceutical and biotech firms, robust R&D funding, and significant usage in cancer research and drug discovery.

- By Type, the Scaffold-Based segment held the largest market share in 2024 due to its extensive use in drug development and tissue engineering, along with increasing product partnerships and accessibility in high-growth markets.

Key Country Highlights:

- Japan: Demand is driven by the adoption of 3D cell cultures in regenerative medicine and innovations in scaffold technologies, with companies like REPROCELL and strategic academic collaborations supporting market expansion.

- United States: A global hub for biotech R&D, the U.S. leads in cancer research, drug development, and automation in cell culture, reinforced by major players like Thermo Fisher and Corning expanding their product portfolios.

- China: Growing investment in life sciences, increasing number of biotech startups, and the rising focus on alternatives to animal testing are propelling market demand for 3D cell culture technologies.

- Europe: Market growth is supported by strong distribution networks, research funding, and advancements in bioprinting technologies. Strategic collaborations, such as CELLINK’s distribution expansion in Portugal and Spain, are enhancing product reach across the region.

COVID-19 IMPACT

Lab Closures Led to a Negative Impact on the Market in 2020

In 2020, the COVID-19 pandemic had a slight negative impact on the global market. Travel restrictions, supply chain disruptions, the government mandated-lockdowns resulted in laboratories closures, impacting the market negatively.

- According to an article published by the FACETS in 2022, researchers across the world experienced an unprecedented wave of laboratory closures during the initial response to the COVID-19 pandemic, halting most research activities to prevent the spread of the virus in 2020.

In terms of revenue, the market witnessed a decline in 2020 compared to the prior year. Some significant companies experienced a decrease in their sales of cell culture products during the COVID-19 pandemic. However, the market returned to pre-pandemic level in 2021 with companies registering positive growth in revenues.

- For instance, Corning Incorporated recorded net sales of USD 446.0 million in 2020 from its cell culture segment, which was a decline of -4.1% as compared to 2019. The cell culture segment recorded sales of USD 563 million which increased by 26.2% in 2021 compared to 2020 due to the global demand for research and development products.

The resurgence of laboratory activities, and increased research and development initiatives, particularly in the usage of tissue models for COVID-19 investigation had enormously contributed to market growth rate returned to pre-pandemic levels in 2022.

3D Cell Culture Market Trends

Development of Technologically Advanced Techniques

In recent years, there has been a surge in initiatives to research and develop advanced techniques and products. One of the new advancements is microfluidics, providing a versatile platform for cell culture and facilitating more complicated cell-based assays. In addition, a culture system with machine learning-enabled solutions could help in selecting 3D cultures. It can also increase reliability, reproducibility, and reduce the research's costs and time requirements for potential preclinical study. Similarly, prominent players' increased focus and initiatives on developing innovative products are expected to drive trends in the global market.

- For instance, in June 2021, Sphere Fluidics and ClexBio collaboratively launched the biocompatible CYTRIX Microfluidic Hydrogel Kit. This product combines ClexBio’s novel CYTRIX Hydrogel with Sphere Fluidics’ specially designed Pico-Gen double aqueous biochip, allowing the plug-and-play generation of defined, reproducible, and tailorable hydrogel microstructures for various applications such as 3D cell culture, organoids, and single-cell analysis. More companies are launching new and advanced products, contributing to the global market expansion.

Download Free sample to learn more about this report.

3D Cell Culture Market Growth Factors

Surge in Research Initiatives for Chronic and Infectious Diseases to Boost Market Growth

In recent years, numerous research initiatives are being carried out for chronic and infectious diseases, including congenital issues, cancer, and COVID-19. These cells investigate and study disease propagation and progression, drug discovery, and compound screening. Due to such a scenario, the demand for advanced cell culture techniques has increased. This factor will eventually contribute towards the market growth.

- According to an article published by BioMed Central in 2022, 3D culture has the potential to bridge the gap between in vitro and in vivo models. Techniques such as liquid-based, scaffold-based, and emerging systems, such as microfluidic platforms and bio printing incorporate morphological features that 2D cultures cannot attain. It can be significantly used for oncology research and personalized medicine. Such advantages are expected to drive the demand for these products in the forecast timeframe.

Rising Focus on Developing Animal Testing Alternatives to Drive Market Growth Prospects

The market is witnessing increased initiatives to develop alternatives for animal testing. Three-dimensional cell culture represents an excellent alternative to the animal model. These cell cultures can replicate a living organ’s biological levels of organization and microarchitecture. The growing initiatives to replace animal testing with alternative products such as reconstructed skin models, and cell culture techniques, is anticipated to propel market growth during the forecast period.

- In August 2023, PeptiMatrix the latest spin-out company from the University of Nottingham introduced an innovative platform, aiming to replace the use of animals in research. Developed by researchers from the University of Nottingham, National Centre for the Replacement, Refinement, and Reduction of Animals in Research (NC3Rs), Biotechnology and Biological Sciences Research Council (BBSRC), and Engineering and Physical Sciences Research Council (EPSRC), the fully synthetic self-assembling peptide hydrogel (SAPH) platform addresses all current shortcomings available in vitro models. Thus, increased initiatives for developing animal testing alternatives are anticipated to augment the overall growth in the global market.

RESTRAINING FACTORS

High Cost of Biological Research and Inconsistent Results to Hinder the Market Expansion

One of the substantial hindrances to market growth is the substantial cost and inconsistent results associated with 3D cell culture. Furthermore, due to its advanced nature, these products are typically priced higher than regular/traditional or 2D cell cultures. Such high cost hinders product adoption among research organizations and academics in both developed and developing countries.

- According to an Investigational New Drugs article published in 2022, despite the many advantages of 3D models over established 2D assays, their limited use in early drug discovery stages is due to high effort and cost.

Furthermore, these systems are labor-intensive and time-consuming, sometimes delivering inconsistent results. Such factors restrain the market growth across the globe.

3D Cell Culture Market Segmentation Analysis

By Type Analysis

Scaffold-Based Segment held a Leading Share owing to its Extensive Use in Drug Development and Tissue Engineering

In terms of type, the market is segmented into scaffold-based 3D, scaffold-free, and others.

The scaffold-based segment held a leading market share of 58.88% in 2026, relying on scaffold element to provide physical support to cells, allowing them to aggregate, proliferate, and migrate. Moreover, certain players are engaged in strategic partnerships to supply these products in high-growth nations. Thus, robust usage and application of this technique in drug development and tissue engineering promotes the global expansion of the segment.

- In August 2023, InSphero AG and Advanced BioMatrix signed a partnership to make their patented Akura Plate Technology available to researchers in the U.S. market. This initiative would expand the application range of these cell culture into scaffold-based models.

The scaffold-free segment accounted for a comparatively lower share in 2024. This technique is cultivated in specialized cell-repellant culture plates that cause cells to self-aggregate. Due to its small scale and easily modifiable platform, this technique provides high throughput screens. The scaffold-based technique can affect cancer progression and drug resistance adversely. It also influences cell behavior, which can harm disease modeling. Due to the drawbacks of scaffold-based techniques, the market is witnessing growth in adopting scaffold-free products globally.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Robust Efficacy of these Techniques in Cancer Research Propels the Segmental Growth

In terms of application, the global market for 3D cell culture is segmented into cancer research, tissue engineering & regenerative medicine, drug discovery & development, and others.

The cancer research segment held a dominant market share of 39.55% in 2026. 3D cultures facilitate a better understanding of cancer biology's various aspects, such as tumor progression, tumor microenvironment, gene and protein expression, pro-oncogenic signaling pathways, and drug resistance. The robust efficacy of these techniques in cancer research propels the growth of the segment.

The tissue engineering & regenerative medicine segment is expected to grow at a lucrative rate over the forecast period. The rising adoption of these products to replicate the microenvironment in tissue engineering and regenerative medicine contributes to the segment’s growth in the forecast period.

Moreover, the drug discovery & development segment growth is attributed to strategic activities by prominent players to provide solutions for high throughput screening (HTS) of these cultures in drug discovery.

- For instance, in September 2021, UPM Biomedicals signed an agreement with PerkinElmer Health Sciences, Inc. to act as a distributor of the UPM GrowDex and GrowDase range of products. This partnership facilitates researchers a complete solution for high throughput screening (HTS) of 3D cell cultures in early drug discovery. Such initiatives are expected to drive market growth.

The others segment is projected to account for a suitable share by 2032 due to the robust application of these products in multiple cell expansion and research processes.

By End-User Analysis

Rising Investment Initiatives of Pharmaceutical & Biotechnology Companies Boosted the Pharmaceutical & Biotechnology Companies

In terms of end-user, the global market for 3D cell culture is pharmaceutical & biotechnology companies, academic & research laboratories, and others.

The pharmaceutical & biotechnology companies segment accounting for 50.46% market share in 2026. The segment growth is attributed to the growing research initiatives and investment activities by market players to boost product adoption across the globe.

- For instance, in March 2023, ZEISS invested in life science start-up InSphero to further advance the adoption of 3D microtissues in research and drug development. Such initiatives are expected to drive the market growth.

The academic & research laboratories segment is expected to grow due to the rising adoption of these products for studying the morphological events of human cells, from development to organ formation, and understanding the mechanism of diseases. This makes it a valuable tool for drug discovery and development and in preclinical studies, contributing to the segment’s growth in the forecast period.

The others segment is anticipated to account for a suitable share by 2032 due to the growing utilization in cosmetics, food and beverage, and other industries.

REGIONAL INSIGHTS

In terms of geography, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America 3D Cell Culture Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America region held the dominant share in the global market. North America generated USD 1.31 billion of the global 3D cell culture market revenue in 2025. The U.S. is considered a prominent center for research and development activities. In addition, many research centers, academic institutions, and biotechnological companies that carry out multiple research procedures are prominent contributors to the region's dominance. The U.S. market is projected to reach USD 1.35 billion by 2026.

Asia Pacific

Similarly, the Asia Pacific region held the fastest CAGR due to the increasing research initiatives in key countries such as China, Japan, and India. The growing number of research laboratories and increased initiatives of market players to enter into developing geographical areas contributes to the region's growth. The Japan market is projected to reach USD 0.15 billion by 2026, the China market is projected to reach USD 0.26 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

Europe

Europe held a substantial share in the global market. More robust product adoption, strong focus on research initiatives, and easier availability of products ultimately results in the market's growth in the region. The European market is growing due to the vital distribution initiatives by key players to enhance customer reach and advance its application areas. Such factors are propelling the market growth. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.18 billion by 2026.

- In September 2023, CELLINK announced a strategic distribution agreement with Paralab to expand its presence in Portugal and Spain. This collaboration brings CELLINK’s state-of-the-art bioprinting solutions to a broader audience in Southern Europe, propelling advancements in the field of regenerative medicine.

Latin America and the Middle East & Africa

Due to limited research activities, Latin America and the Middle East & Africa markets held lower shares. However, key players' growing disposable income and investment initiatives are expected to propel regional expansion.

List of Key Companies in 3D Cell Culture Market

Strategic Initiatives and Expanded Product Portfolio of Thermo Fisher Scientific Inc., Corning Incorporated, and Sartorius AG Helps Them to Dominate the Market

The global market's competitive landscape is consolidated, with a few dominant and multiple small players. Thermo Fisher Scientific Inc., Corning Incorporated, and Sartorius AG are some of the major players that dominated the global 3D cell culture market share in 2024. The dominance of these key players is attributed to strong product portfolio, expanded geographical presence, and new product launches in the market

Additionally, players such as Avantor Inc., MIMETAS B.V., REPROCELL Inc., and others focus on product portfolio expansion and enhancing their product reach to augment their market dominance.

- In June 2023, Inventia Life Science entered a new distribution agreement with Biotron Healthcare PVT Ltd. Under this agreement, Biotron Healthcare PVT Ltd obtained sales rights for Inventia Life Science’s flagship RASTRUM platform to enter the Indian market.

LIST OF KEY COMPANIES PROFILED:

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Corning Incorporated (U.S.)

- Merck KGaA (Germany)

- Avantor Inc. (U.S.)

- MIMETAS B.V. (Netherlands)

- REPROCELL Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Carcinotech collaborated with CELLINK to develop and commercialize protocols for biofabrication 3D bioprinted tumor models based on cancer cell lines. It would improve accuracy and rapidly speed up drug development processes, driving down development costs and enabling an improved output.

- June 2023: 3DBioFibR launched collagen fiber products, μCollaFibR and CollaFibR 3D scaffold. It is useful in tissue engineering and tissue culture.

- June 2023: MatTek Life Sciences and AIM Biotech announced a strategic partnership to provide its clients and customers with a more comprehensive suite of products and services. This includes the innovative organiX and idenTX microfluidic 3D tissue culture platforms and comprehensive drug discovery research services in critical immuno-oncology, vascular biology, and neurobiology therapeutic areas.

- March 2022: CELLINK launched BIO CELLX, the first-of-its-kind bio-dispensing platform to automate 3D cell culture. It eliminates barriers to automating 3D cell-based assays that target cancer research and drug discovery.

- August 2021: Inventia Life Science partnered with BioLamina AB to supply 3D cell culture scaffolds compatible with the RASTRUM platform, containing human recombinant laminin proteins (Biolaminin).

REPORT COVERAGE

The global market report comprehensively analyzes the key segments, such as type, application, end-user, and geography. It encompasses key insights such as the prevalence of chronic diseases, new product launches, key industry developments, technological advancements in the 3d cell culture industry, and the impact of the COVID-19 pandemic on the market. Furthermore, it provides insights into market dynamics, competitive share analysis, and company profiles of key players in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-User

|

Frequently Asked Questions

According to Fortune Business Insights, the global 3D cell culture market was valued at USD 3.15 billion in 2026 and is projected to reach USD 8.03 billion by 2034.

The market is projected to grow at a CAGR of 12.40% during the forecast period.

North America dominated the global 3D cell culture market with a 46.43% share in 2025, primarily due to its robust research infrastructure, presence of leadinga biotechnology firms, and growing investment in advanced therapeutic development.

Based on type, the scaffold-based segment led the global market in 2025.

North America dominated the global market with a share of 46.43% in 2025.

The rising prevalence of chronic diseases, increasing research & development initiatives, and technological advancements are the key factors driving global market growth.

Thermo Fisher Scientific Inc., Corning Incorporated, and Sartorius AG are the key players in the market.

The increasing focus on developing alternatives to animal testing is vital to adopting these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us