AdBlue Market Size, Share & Industry Analysis, By Usage Method (Pre-Combustion and Post-Combustion), By Application (Commercial Vehicles, Passenger Cars, Railway Trains, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

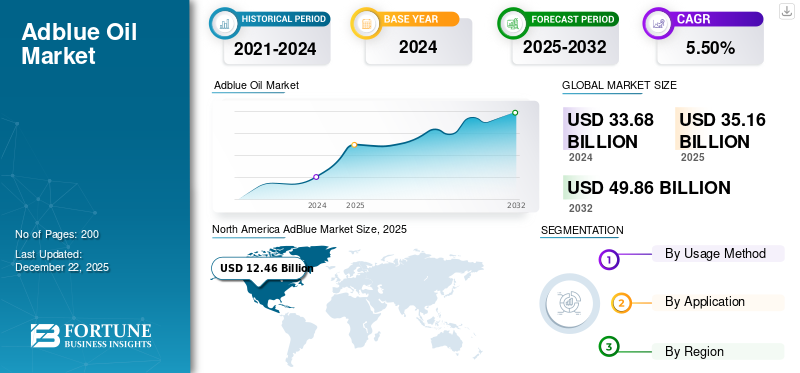

The global AdBlue market size was valued at USD 35.16 billion in 2025. The market is projected to grow from USD 36.89 billion in 2026 to USD 55.18 billion by 2034 at a CAGR of 5.50% during the forecast period of 2026-2034. North America dominated the adBlue market with a market share of 37% in 2025.

AdBlue, also known as diesel exhaust fluid, is a high-purity, non-toxic, colorless liquid composed of 32.5% urea and 67.5% deionized water. This is used in diesel engines' selective catalytic reduction (SCR) systems to reduce harmful nitrogen oxide (NOx) emissions. When injected into the exhaust stream, it undergoes a chemical reaction that converts NOx gases into harmless nitrogen and water vapor, helping vehicles meet stringent environmental regulations such as Euro 6. It is essential for modern diesel vehicles equipped with SCR technology, especially in trucks, buses, and some passenger cars. The product is sensitive to temperature extremes and must be stored between -11°C and 30°C to maintain stability. It is available at fuel stations, auto parts stores, and service centers, and its use is mandated to comply with emissions laws in Europe, North America, and other regulated markets. Proper handling and usage are crucial to avoid contamination and ensure the optimal functioning of the SCR system.

The market refers to the global industry surrounding the production, distribution, and sale of products to reduce nitrogen oxide (NOx) emissions from diesel engines. As environmental regulations tighten worldwide, especially in sectors such as automotive, agriculture, and industrial machinery, the demand for this product has risen significantly. The market encompasses many stakeholders, including chemical manufacturers, logistics providers, and vehicle OEMs. Major factors driving the AdBlue market growth include increasing diesel vehicle sales, stringent emission standards such as Euro 6 in Europe and BS-VI in India, and the growing focus on sustainable transportation. Yara International ASA, Kingspan, Ford Motor Company Limited, TotalEnergies, and BASF are a few key players operating in the market.

AdBlue Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 35.16 billion

- 2026 Market Size: USD 36.89 billion

- 2034 Forecast Market Size: USD 55.18 billion

- CAGR: 5.50% from 2026–2034

Market Share:

- North America dominated the AdBlue market with a 37% share in 2025, supported by strict emission regulations, widespread adoption of SCR systems in commercial fleets, and strong infrastructure availability.

- By usage method, the post-combustion segment is expected to retain the largest market share in 2025, driven by the expansion of SCR-equipped vehicle fleets and growing adoption of telematics systems for fluid monitoring.

Key Country Highlights:

- United States: Growth is fueled by EPA-driven regulations and strong adoption of SCR systems in heavy-duty trucks, off-road equipment, and diesel passenger vehicles.

- China: Implementation of China VI standards and rapid adoption of SCR systems in commercial and passenger diesel vehicles support market expansion.

- India: Bharat Stage VI emission norms and rising diesel vehicle sales drive significant demand for AdBlue in both commercial and passenger fleets.

- Europe: Strong reliance on diesel-powered transport in countries such as Germany, France, and the U.K., combined with Euro VI standards, sustains high AdBlue consumption.

- Brazil: Gradual adoption of Euro VI-equivalent regulations and modernization of transportation fleets accelerate SCR adoption and AdBlue usage.

AdBlue Market Trends

Digital Integration has Emerged as a Lucrative Market Trend

Digital integration is emerging as a transformative force in the global market, enhancing efficiency, traceability, and compliance across the supply chain. As environmental regulations become more stringent and the need for precision in emission control grows, digital technologies such as IoT, telematics, and cloud-based fleet management systems are increasingly being adopted to monitor and optimize usage. These technologies enable real-time tracking levels in vehicles, ensuring timely refills and preventing malfunction of the SCR system due to low fluid levels. This minimizes vehicle downtime and supports compliance with NOx emission regulations, especially in logistics and transportation fleets.

Moreover, digital platforms facilitate better supply chain management for manufacturers and distributors. Suppliers can manage inventory more efficiently by integrating predictive analytics and demand forecasting tools, reducing wastage, and responding swiftly to regional demand fluctuations. Digital invoicing, automated ordering, and GPS-enabled logistics systems improve delivery accuracy and customer satisfaction. Additionally, connected systems allow for data collection on consumption patterns, which can be used to enhance product formulations and refine emission control technologies.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Infrastructure Expansion and OEM Collaboration Drive Market Growth

The demand for the product continues to rise with the enforcement of stricter emission regulations across regions, ensuring easy and consistent availability has become essential. Infrastructure development, including the installation of dispensers at fuel stations and the proliferation of retail outlets offering various packaging formats, is improving accessibility for both individual vehicle owners and commercial fleet operators. This enhanced availability reduces barriers to adoption in remote or underdeveloped areas with limited access.

Simultaneously, OEMs are crucial in accelerating market growth by partnering with manufacturers to develop integrated SCR systems tailored for new diesel engine models. These collaborations ensure the systems meet regulatory standards and optimize engine performance and fuel efficiency. In many cases, OEMs are integrating AdBlue systems as standard vehicle components, making it easier for consumers to comply with emissions norms without additional aftermarket installations. Furthermore, these partnerships often include branding and supply agreements that ensure a consistent and high-quality product supply, strengthening consumer confidence in the product.

Market Restraints

Raw Material Volatility Constrains Market Growth

AdBlue is composed of 32.5% high-purity urea and 67.5% deionized water, making the availability and cost of urea a critical factor in production economics. Urea is also a key component in fertilizers, and its market is heavily influenced by the agriculture sector, geopolitical dynamics, and energy prices, especially natural gas, which is a primary input in urea production. Fluctuations in these components can lead to unpredictable price spikes or shortages, severely impacting supply chains. For instance, during global energy crises or regional conflicts such as the Russia-Ukraine war, natural gas prices surged, leading to increased urea production costs and disruptions in availability. Some countries even witnessed temporary shortages, prompting government interventions and supply restrictions. This volatility creates operational uncertainty for manufacturers and distributors, who must balance cost management with regulatory compliance and consistent supply to end-users, especially in the transportation and logistics sectors that rely heavily on diesel engines.

Market Opportunities

Eco-Friendly Production Will Create Significant Growth Opportunities

A urea-based solution used in SCR systems to reduce nitrogen oxide (NOx) emissions from diesel engine manufacturers is increasingly adopting greener production technologies that minimize environmental impact during manufacturing. Modern production involves synthesizing high-purity urea and deionized water under controlled conditions to ensure compliance with stringent ISO 22241 standards. Companies are now integrating renewable energy sources, energy-efficient equipment, and closed-loop water systems to reduce carbon emissions and resource consumption during production. Additionally, several players in the market are exploring bio-based alternatives and innovations in urea synthesis to further decrease reliance on fossil-fuel-derived inputs.

Market Challenges

Supply Chain Bottlenecks May Hurdle Market

The production and distribution of the product are closely tied to the availability of key raw materials, including high-purity urea derived from ammonia and natural gas. Disruptions in the supply of these inputs can severely affect the availability and pricing of the product. In recent years, global urea markets have experienced volatility due to geopolitical tensions, energy crises, and trade restrictions, leading to periodic shortages and price spikes throughout the supply chain. Any export restrictions or production slowdowns in these areas, whether due to environmental policies, economic sanctions, or logistical issues, can lead to significant global supply disruptions. Additionally, high transportation costs and limited infrastructure in certain emerging markets exacerbate distribution inefficiencies, leading to inconsistent supply and higher costs for end users.

Impact of COVID-19

Stalled Supply Chain Due to Pandemic Hampered Market Growth

The COVID-19 pandemic had a notable short-term impact on the global market due to widespread disruptions in industrial activity, transportation, and supply chains. Lockdowns and travel restrictions imposed across major economies led to a sharp decline in diesel vehicle usage, especially in commercial and freight transportation and other key sectors that drive the demand. As a result, consumption volumes dropped significantly during the pandemic's peak. In parallel, production faced challenges due to workforce shortages, reduced operating capacities at manufacturing facilities, and logistical hurdles in transporting raw materials such as urea. Additionally, international trade restrictions and fluctuations in natural gas prices affected urea supply, further straining the availability and pricing. However, as economies began to reopen and transportation activities gradually resumed, demand started to recover. The pandemic also highlighted the importance of building resilient and diversified supply chains.

Impact of Trade Protectionism

Many countries offer tax rebates, grants, and subsidies for adopting AdBlue-compatible vehicles in public transportation and commercial fleets. These financial incentives aim to accelerate the transition to cleaner diesel technologies and reduce NOx emissions, directly boosting consumption. However, Urea Export Restrictions, particularly in major producing countries, including China, present a significant risk to global supply chains. Temporary bans or quotas on urea exports are often implemented to prioritize domestic agricultural needs, especially during fertilizer shortages. Since high-purity urea is a critical input, trade barriers create supply shocks, inflate prices, and shortages in dependent regions, including Europe and Southeast Asia. Regulatory Alignments, such as synchronizing Euro VI and BS-VI emission norms, facilitate cross-border trade-in vehicles and components. It creates a consistent demand for SCR systems across different markets, benefiting multinational OEMs and suppliers.

Research and Development (R&D) Trends

Research and development (R&D) activities in the global market increasingly focus on improving product efficiency, enhancing supply chain sustainability, and reducing the overall environmental footprint. As emission regulations become more stringent worldwide, manufacturers and technology providers are investing in innovation to ensure AdBlue remains an effective and reliable solution for NOx emission control in diesel engines. The key trend includes developing high-efficiency SCR systems that require lower consumption while maintaining or improving NOx reduction performance. These technological advancements are especially important for commercial vehicle fleets, where reducing fluid consumption translates into lower operational costs.

Segmentation Analysis

By Usage Method

Post-Combustion Segment Dominated Market Owing to Expansion of SCR-equipped Vehicle Fleets

Based on the usage method, the market is classified into pre-combustion and post-combustion.

The post-combustion segment held the largest AdBlue market share in 2024 and is expected to experience substantial growth, primarily driven by the expansion of SCR-equipped vehicle fleets and the increasing use of telematics systems to monitor levels and contribute to regular post-sale demand. Moreover, growing awareness of the risks associated with poor-quality or counterfeit products leads users to seek certified, high-purity products, sustaining ongoing market engagement.

The pre-combustion segment is projected to experience significant growth with a share of 39.90% in 2026. The segment's growth is driven by the rising enforcement of stringent emissions standards, such as Euro VI, EPA Tier 4, and BS-VI, which have made adopting SCR systems necessary for diesel engine vehicles. As a result, automotive OEMs are increasingly integrating SCR technology in new vehicle models, which directly boosts demand at the point of production.

By Application

To know how our report can help streamline your business, Speak to Analyst

Commercial Vehicles to Dominate Market Due to Their Extensive Use in Logistics, Freight, and Public Transportation

In terms of application, the market is segmented into commercial vehicles, passenger cars, railway trains, and others.

The commercial vehicles segment is expected to dominate the market contributing 42.67% globally in 2026. This growth is attributed to their extensive logistics, freight, and public transportation use. Stringent emission regulations, such as Euro VI in Europe, BS-VI in India, and U.S. EPA standards, mandate using SCR systems to reduce nitrogen oxide (NOx) emissions from diesel engines.

The passenger cars segment is also experiencing favorable growth. Diesel-powered passenger vehicles equipped with SCR systems are gaining popularity due to fuel efficiency and compliance with NOx reduction mandates. Consumers are also becoming more environmentally conscious, leading to a preference for low-emission vehicles that are used to meet sustainability targets. Automakers are responding by integrating compact and efficient SCR systems in passenger vehicles without compromising the design or performance.

The railway trains segment is also registering positive growth in the market. The adoption of SCR technology in rail applications is driven by the need to reduce NOx emissions and meet government-imposed emission targets for the transportation sector. Rail operators are turning to AdBlue as a cost-effective solution to retrofit existing diesel locomotives without switching to full electrification, which can be capital-intensive and infrastructure-dependent.

AdBlue Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America AdBlue Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to account for a significant market position with a valuation of USD 13.1 billion in 2026. The market growth in the region is driven by strict environmental regulations from agencies, including the Environmental Protection Agency (EPA). Adopting SCR systems in heavy-duty trucks, off-road equipment, and diesel passenger vehicles has led to strong product demand. The U.S. focuses on reducing NOx emissions across transportation and industrial sectors, with regulatory frameworks mandating emissions-control technologies. A well-developed transportation infrastructure and widespread fuel station availability further support the market development. The U.S. market is projected to reach USD 10.42 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is witnessing growth driven by rapid urbanization, industrialization, and strict emissions regulations. Countries such as China, India, Japan, and South Korea are leading this growth, each implementing stricter policies such as China VI and Bharat Stage VI to combat rising air pollution levels. These regulations are accelerating the adoption of SCR systems in commercial and passenger diesel cars. The Japan market is projected to reach USD 0.63 billion by 2026, the China market is projected to reach USD 4.93 billion by 2026, and the India market is projected to reach USD 2.02 billion by 2026.

Europe

Europe is also a positive contributor to the market. The region has a deeply entrenched diesel vehicle culture, especially in countries including Germany, France, and the U.K., where diesel-powered transport remains prevalent despite a growing shift toward electrification. Public transportation, logistics fleets, and even agricultural machinery in Europe heavily rely on complying with environmental standards. The UK market is projected to reach USD 2.41 billion by 2026, while the Germany market is projected to reach USD 4.29 billion by 2026.

Latin America

The market growth in Latin America is attributed to the gradual adoption of emission control regulations and the modernization of the transportation sector. Brazil, Mexico, and Argentina are leading the shift toward cleaner diesel technologies, introducing policies aligned with Euro VI-equivalent standards. These regulations are prompting the use of SCR systems in heavy-duty vehicles, driving their consumption.

Middle East & Africa

The Middle East & Africa region is expected to see a positive market growth pace over the forecast period, driven by regulatory shifts and infrastructure development. While adoption has been relatively slow compared to other regions, countries such as South Africa, UAE, and Saudi Arabia are beginning to implement stricter emissions standards for commercial and industrial vehicles. With diesel engines heavily relied upon in construction, oil and gas, and mining sectors, SCR technology is gradually gaining traction.

Competitive Landscape

Key Market Players

Key Players Adopted Expansion Growth Strategy to Maintain Their Dominance in Market

In terms of the competitive landscape, the market represents the presence of emerging and established companies. Yara International ASA, Kingspan, Ford Motor Company Limited, TotalEnergies, and BASF are the major players in this market. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their global manufacturing capacity, sales, and distribution network.

List of Key AdBlue Companies Profiled

- Yara International ASA (Norway)

- Kingspan (Ireland)

- Ford Motor Company Limited (U.S.)

- TotalEnergies (France)

- OCI (Netherlands)

- Hitachi Construction Machinery (Europe) NV. (Netherlands)

- CF Industries (U.S.)

- Hindustan Petroleum Corporation Ltd (India)

- Shell plc (U.K.)

- Nissan Chemical Corporation (Japan)

- BASF SE (Germany)

- Guangzhou EverBlue Technology Co., Ltd. (China)

- Bharat Petroleum Corporation Limited (India)

- Cummins Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Fertiberia expanded its new AdBlue production and logistics center in France. The company opened a plant 50 kilometers from Paris with a manufacturing capacity of 50,000 tons per year.

- November 2024: New Era Energy announced the acquisition of Commercial Fuel Solutions (CFS) Limited, a U.K.-based provider of refueling infrastructure. Adding industry-leading hydrogen and low-carbon AdBlue expertise from CFS will enhance New Era Energy's broad fueling and lubricants product and service offering. The deal significantly boosts New Era Energy's offer, creating a U.K. powerhouse of fueling and lubricant solutions focused on delivering world-class customer service, sustainability, and growth.

- November 2023: ITOCHU ENEX announced the completion of new plant manufacturing of AdBlue, a high-grade aqueous urea solution, in Okayama, the group's second in-house manufacturing plant and first in West Japan.

- September 2023: GreenChem Holding B.V. acquired Promos d.o.o., a widely utilized provider of AdBlue solutions in Slovenia. This exciting new deal will expand GreenChem's reach to Central Europe and Western Balkan countries, enabling them to serve these regions better.

- October 2021: DGL Group, a specialist chemicals business that manufactures, transports, stores, and processes chemicals and hazardous waste, acquired the AUSblue Group ("AUSblue"). AUSblue is the manufacturer and distributor of AdBlue, a diesel exhaust fluid that removes harmful nitrous oxides and helps reduce emissions.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, usage methods, compositions used to produce these product types, and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors contributing to the market's growth.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.50% from 2026 to 2034 |

|

Segmentation |

By Usage Method

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 35.16 billion in 2025 and is projected to record a valuation of USD 55.18 billion by 2034.

Recording a CAGR of 5.50%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2026, the North America market value stood at USD 13.1 billion.

By application, the commercial vehicles segment is set to dominate the market over the forecast period.

Infrastructure expansion and OEM collaboration a key factor driving market growth.

North America dominated the adBlue market with a market share of 37% in 2025.

Yara International ASA, Kingspan, Ford Motor Company Limited, TotalEnergies, and BASF are major players in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us