Agriculture Equipment Market Size, Share & Industry Analysis, By Equipment Type (Agriculture Tractors, Harvesting Equipment, Irrigation & Crop Processing Equipment, Agriculture Spraying & Handling Equipment, Soil Preparation & Cultivation Equipment, and Others (Hay & Forage Equipment, Trailers)), By Application (Land Development, Threshing and Harvesting, Plant Protection, and After Agro Processing), and Regional Forecast, 2026-2034

Agriculture Equipment Market Size

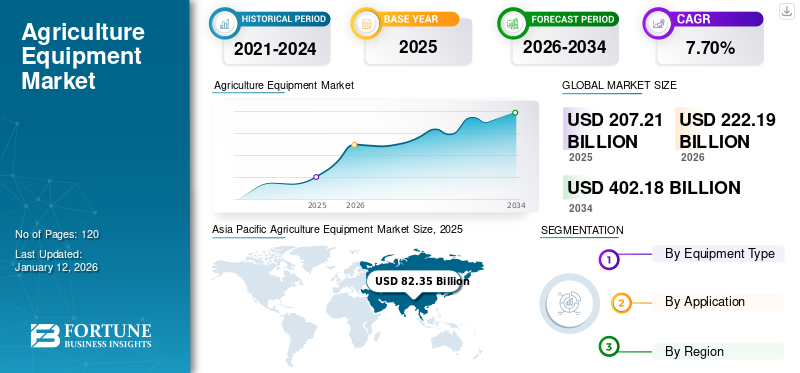

The global agriculture equipment market size was valued at USD 207.21 billion in 2025 and is projected to grow from USD 222.19 billion in 2026 to USD 402.18 billion by 2034, exhibiting a CAGR of 7.70% during the forecast period. Asia Pacific dominated the global market with a share of 39.80% in 2025.

Agriculture equipment constitutes machines or fabricated elements that enhance land yield across agro-based economies globally. The equipment helps directly promote the inclination of farmers or land operators toward the integration of automation technologies into their traditional farming. Additionally, the increasing scarcity of human workforce and heavy expenditure on the maintenance of cattle on the job site in numerous countries have encouraged customers to leverage the benefits of modernized equipment in farming applications.

GLOBAL AGRICULTURE EQUIPMENT MARKET OVERVIEW

How Big Is the Agriculture Equipment Market?

- 2025 Market Value: USD 207.21 billion

- 2026 Estimated Value: USD 222.19 billion

- 2034 Forecast Value: USD 402.18 billion

- CAGR (2026–2034): 7.70%

- Largest Region (2025): Asia Pacific – 39.80% market share

- Leading Equipment Type: Agriculture tractors

- Top Application Segment: Land development

- Fastest-Growing Country: India (driven by subsidy programs and mechanization initiatives)

Key Trends and Drivers:

Why Is Agriculture Equipment Demand Increasing?

- Smart Farming & IoT Adoption: Farmers are shifting to connected equipment for real-time crop monitoring and operational automation, improving efficiency and yield.

- Industry 4.0 Integration: AI-driven sensors, automation, and precision agriculture tools are driving the modernization of traditional farming methods.

- Population Growth: According to the UN, the global population will reach 9.7 billion by 2050, requiring a 69% increase in agricultural output, accelerating equipment adoption.

- Post-COVID Fuel Shift: Countries like India and Canada are encouraging agro-based fuels (ethanol, biodiesel), boosting demand for modern cultivation and processing equipment.

Market Opportunities:

What Opportunities Exist in the Agriculture Equipment Market?

- Electric & Compact Tractors: Rising fossil fuel prices and environmental concerns are fueling the adoption of electric and hybrid tractors with low operational costs.

- Government Subsidies: Programs offering up to 80% equipment subsidies in countries like India are rapidly improving affordability and adoption among small and mid-size farmers.

- Rural Mechanization: Increased penetration of equipment in developing regions is opening untapped markets and boosting productivity on smallholder farms.

- Forage Harvester Innovation: Launch of advanced, high-throughput forage harvesters by OEMs like John Deere and CLAAS are increasing profitability in livestock and silage operations.

Market Challenges:

What Is Holding the Market Back?

- High Initial Cost: Equipment like tractors, sprayers, and harvesters demand significant upfront investment, which can be difficult for small-scale farmers.

- Maintenance Burden: Heavier and complex machinery requires regular servicing and skilled labor, driving up costs and creating operational downtime.

- Soil Compaction & Overuse Risks: Improper or excessive use of mechanized tools can damage crops and soil, requiring better training and regulation.

Segment Insights:

Which Equipment Types Are Most Popular?

- Agriculture Tractors: Most dominant segment—shift toward electric, compact, and automated models is accelerating growth.

- Harvesting & Cultivation Equipment: Increasing use of advanced sprayers, irrigation systems, and mechanized tools for crop handling and protection.

- Forage Equipment: Significant rise in forage harvester sales due to improved throughput and precision in livestock feed production.

Where Equipment Is Used Most?

- Land Development: Fastest-growing application—mechanized plowing, grading, and soil preparation are enabling faster farm setup and improved yield.

- Post-Harvest Processing: Growing adoption of crop cleaning, sorting, and packaging equipment to meet commercial and export standards.

Regional Insights

Where Is the Agriculture Equipment Market Growing Fastest?

- Asia Pacific (2025 Value: USD 82.35 billion)

- Growth Rate: 8.7% CAGR (2025–2032)

- Leaders: China, India, ASEAN nations

- Key Drivers: Government subsidies, rising rural incomes, and tech integration in farming

- India Spotlight

- Why it Matters: High government subsidies (up to 80%) and strong policy support for mechanization

- Example: Mahindra & Mahindra’s Yuvo Tech+ tractors cater to fuel efficiency and torque improvements

- North America

- Key Players: John Deere, AGCO, Yanmar America

- Trends: Tech-driven diversification, labor shortages boosting automation

- Example: Yanmar partnered with Tarter Farm Equipment to expand tractor implement offerings

- Middle East & Africa

- Growth Factor: Government-backed interest-free loans and tax-free imports in GCC nations

- Example: Saudi Agricultural Bank supports farmers with direct financial aid

- Latin America

- Leaders: Brazil, Mexico

- Programs: Tax waivers, equipment leasing, and subsidies making mechanization more accessible

- Europe

- Strategic Shift: Farm-to-Fork policy, reduced land use, and increased mechanization to retain yields

- OEM Focus: John Deere’s new grappling system and compact utility tractors target labor substitution

The COVID-19 pandemic led to a disruptive impact on the global agricultural sector and broadened exponentially with volatile prices of essential agro commodities. This has given a downturn momentum across the agricultural economy due to a reduction in operations in labor-intensive agriculture countries such as India and China.

However, the economy’s downfall in the pandemic and expanded supply gap for fossil fuel across major developing and developed economies have shifted focus to alternative fuel sources such as ethanol and biodiesel. Thus, major agro-based economies, such as India, China, Canada, Mexico, South Africa, and others, have raised an initiative to replace fossil fuel needs with agro-based fuel. This subsequently boosted the demand for various equipment such as tractors, cultivation equipment, crop processing, and other equipment types across applications such as land development, threshing and harvesting, plant protection, and after agro-processing. Also, the latest IoT integration trend to traditional farming equipment is acting as a supplement, enhancing the tendency and valuation of the market size over the forecast period.

Agriculture Equipment Market Trends

Smart Farming Equipment and Industry 4.0 Integration to Create Lucrative Business Prospects

The agriculture industry is growing exponentially in the next few years with the rising population globally and the need for food to remain high. Therefore, to meet this requirement, agricultural manufacturers & farmers opt for the Internet of Things (IoT) for more yield from agriculture, boosting the economy globally.

According to the United Nations Organization, by 2050, the world's population will reach 9.7 billion, which will ultimately impact global agricultural production to grow about 69% in the span of 2010 to 2050.

The farmers have initiated the application of novel technologies and innovative products to increase operational efficiency and crop quality across their farmlands. The farmers prefer to use sensor integrated products in their lands which help them to better utilize the resources using land topography and help them to cut down the time required for operations owing to automated products. The use of Internet of Things (IoT) and automation is anticipated to increase over the forecast period.

Download Free sample to learn more about this report.

Agriculture Equipment Market Growth Factors

Increasing Equipment Technology Awareness and Favorable Government Policies to Propel the Market Growth

The growing adoption of semi-automatic and automatic machines for planting and fertilizers has raised the demand for advanced equipment globally. Additionally, self-propelled spreaders and sprayers are now delivering more efficiency resulting in faster operation covering huge span areas. These machines in the agricultural field ensure an even distribution of fertilizers and nutrients that help reduce overall operation cost and time and improve crop yields.

In addition, post-pandemic policies were introduced by government firms around the world to support the rapid adoption of agricultural mechanization. Also, to improve farmers’ potential income through sustainable alternatives such as ethanol procurement by the government for blending in several countries. This factor proactively pushes the demand for agriculture equipment such as tractors and combine harvesters during the study period. Moreover, agriculture equipment is increasingly used in the forestry industry for cutting and peeling, which will significantly gain sales prospects in the coming years.

- For instance, a global Ag-tech adoption survey of 5,500 farmers collated from secondary sources depicts that farmers across Europe and North America are the leaders in the adoption, with about 61% currently using or having plans to adopt at least one Ag-tech in preceding years.

RESTRAINING FACTORS

Heavy Initial Procurement Cost and High Expenditure on Maintenance to Restrain Market Growth

Expanding agriculture & technological evolution across the agriculture industry raises input prices for equipment commissioning across farms. Furthermore, utilizing such mechanized agricultural equipment incurs a high operational & maintenance cost, resulting in low profitability from agricultural operations. The intricate machine’s involvement in farming operations raised the complexity for farmers, causing worries for skilled labor to manage and supervise operations.

Additionally, the rising use of agriculture equipment, which is getting heavier over time, increases soil compaction and might sometimes damage the crops or food products. Thus, using modern farming equipment encourages the farm operator to use mechanized fertilizer spreaders excessively, causing equipment breakdown or frequent maintenance. Unavailability and delays in repairing and servicing the equipment increase the downtime. This incurs a hefty maintenance cost and repair work and also requires massive expenditure, disturbing the financial balance of the farmers in maintaining operation cost. These factors in the market are possible restraints hindering the market growth over the forecast period.

- For instance, according to the global Ag-tech adoption survey of 5,500 farmers collated by secondary sources, 67% of the respondents cited an increase in input prices as their top concern for reduced profitability.

Agriculture Equipment Market Segmentation Analysis

By Equipment Type Analysis

Development of Novel Products and Increasing Product Diversity to Propel the Demand for Agriculture Tractors

Based on equipment type, the market is classified into agriculture tractors, harvesting equipment, irrigation & crop processing equipment, agriculture spraying & handling equipment, soil preparation & cultivation equipment, and others (hay & forage equipment, trailers).

The agriculture tractors segment is set to register remarkable growth over the forecast period & it is expected to lead the market, contributing 36.35% globally in 2026. The introduction of modern solutions and products with exceptional operational efficiency is increasing the acceptance of the products in the market. Moreover, the proclivity of the farmers toward integrating mechanization and automation in the farming operations is boosting market prospects at a commendable pace. Rising price of the fossil fuels and increasing price volatility is a concern giving rise to the application of electric tractors in the farms. The replacement of conventional tractors with modern electric and compact products will also have an positive impact on the operations of the market.

The agriculture tractor segment is projected to grow exponentially across the equipment-type segment. The introduction of highly efficient and eco-friendly tractors enhances operational speed and reduced cost is considered a crucial factor driving the agriculture equipment market growth over the forecast period.

Additionally, the market is estimated to have a significant increase in the sales of forage harvesters due to their effective performance and reduction in the overhead operational cost. Manufacturers of agriculture equipment added novel products to their product portfolio to further strengthen their sales across the regional market. Also, prominent players in the market, such as John Deere, Kubota Corporation, and others, introduced more advanced forage harvesters that can deliver increased power and throughput. Moreover, adopting mechanized equipment for irrigation and crop processing, agricultural spraying, soil preparation, and other agriculture equipment across the industry provides uniform performance with low operation costs and increasing yield.

For instance, in August 2022, John Deere launched the new 9500 self-propelled forage harvester to deliver farmers more power, precision, and productivity.

Similarly, CLAAS JAGUAR 25, offered by Claas KGaA GmbH, helps to cut corn and break kernels while generating high-quality silage evenly.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Land Development Segment to Experience Profound Growth Owing to its Demand Across Industrial Sector

On the basis of application, the market is subdivided into land development, threshing and harvesting, plant protection, and after agro processing.

The constant increment of agricultural land to fulfill the food consumable need of the growing population is expanding the application of land development significantly. The land development segment dominated the market accounting for 42.14% market share in 2026. The development and launch of products equipped with advanced technologies are transforming land utilization. Also, the need for better distribution of fertilizers and the potential need for field contours are also stimulating the sales of land development equipment in the global market. Considering industry growth, the land development segment is expected to contribute heavily across the application segment, which will expand the agriculture equipment market share notably. A substantial focus on increasing land fertility and farm yield is a decisive factor supporting plant protection, harvesting plant, and after-agro-processing equipment sales over the forecast period.

REGIONAL INSIGHTS

Asia Pacific Agriculture Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The Asia Pacific market was valued at USD 82.35 billion in 2025 and is projected to witness an impressive CAGR of 8.7% over the forecast period. Development across the market is owing to the economic stability and growth of China, India, and other agro-based countries within the ASEAN region, which collectively contributes to the development of the Asia Pacific market.

The market Asia Pacific is projected to expand exponentially, owing to the heavy integration of electrical drives, computer sensing, digitalization, agro-tech, and easy attachment capabilities of equipment and machinery to primary machinery such as tractors. China is assessed to hold the highest market share as a result of tremendous opportunities for agriculture equipment manufacturers. Many established and well-known market players are executing diverse product offerings that are highly efficient and powerful equipment models for the market of India, South Korea, Taiwan, and ASEAN countries. The companies are further trying to introduce innovative features and technologies to their product portfolio that will attract numerous consumers. The Japan market is projected to reach USD 21.23 billion by 2026, the China market is projected to reach USD 30.96 billion by 2026

- For instance, in June 2022, Mahindra & Mahindra, a farm equipment giant, launched six new tractors under their Mahindra Yuvo Tech+ series equipped with an m-Zip ELS-4 engine that can deliver more torque with more mileage.

India to Develop with a Promising Pace Due to Increasing Equipment Subsidiaries by Government Authorities

The government of India is providing cost-effective subsidies and additional benefits to farmers that will instigate the procurement and application of modern agricultural equipment. Also, government commitment to propel agriculture mechanization across the agriculture sector is anticipated to encourage regional growth prospects. The growth-driving contribution of the agriculture sector in the country’s GDP development accentuates the importance of modernization in farming across the country. India market is projected to reach USD 27.27 billion by 2026.

- For instance, in 2022, the central government of India decided to aid farmers and provide a 50% to 80% subsidy for the procurement of agricultural equipment. The government has further quoted that integrating novel machines and equipment is vital for incrementing crop yield and doubling farmer income.

To know how our report can help streamline your business, Speak to Analyst

North America

The presence of prominent companies, such as AGCO Corporation, Alamo Group Inc., Deere & Company, and Valmont Industries, across the U.S. is aiding the North America market growth. Additionally, an explicit downfall of the labor force in agricultural fields and implicit efforts of these companies to acquire a prominent market share are leveraging the market. Players through technological development, strong investments across research and development operations, acquisitions, strategic partnerships, and joint ventures are pivotal factors boosting the development potential of North America. The U.S. market is projected to reach USD 30.32 billion by 2026.

- For instance, in April 2023, Yanmar America, a compact and subcompact tractor manufacturing leader, partnered with Tarter Farm and Ranch Equipment to diversify their product offerings by pairing it with a broad range of high-quality tractor implements.

Middle East & Africa

The GCC accounts for a major share in the Middle East & Africa market, owing to the support by government agencies to elevate farming operations and incorporate modern farming techniques. Additionally, the government focuses on growing the agricultural sector to minimize the dependency on other nations for agricultural produce is a thriving demand for agricultural equipment. Financial aid by the Saudi Arabia Kingdom to farmers through funding and subsidies provides better sales of imported agriculture machinery across the Middle East & Africa region.

- For instance, the Saudi Arabian Agricultural Bank (SAAB) and the Ministry of Agriculture, which are authorized to disburse farming loans and subsidies across the country, initiated providing interest-free loans and technical services to facilitate the duty-free import of advanced agriculture equipment and machinery.

Moreover, Brazil is projected to have the highest market share across Latin America. In accordance with market developments, Brazil is foreseen to portray stable growth with financial aid and healthy agro-food demands across neighboring regions. The key growth factor of Mexico’s market is the flagship programs instituted by the government to provide easy leases and financing to small farmers.

- For instance, in January 2023, a delegate of the Tennessee Department of Agriculture, has recently launched a tax waiver program for farm machinery to make them more affordable and mechanization more accessible for farmers in the country.

Europe

After the outbreak of COVID-19 and the potential breakdown of the food ecosystem in Europe, the European Commission has proposed Farm to Bifurcate and adopt biodiversity strategies to streamline the food system in the region, making it more resilient and disruption-proof.

Furthermore, the aforementioned strategy provides directives for the removal of farmlands available for agricultural use by about 10% by the end of 2030. Therefore, operators may suppress the beef-up labor costs with farm equipment to retain the production pace of farmlands. The UK market is projected to reach USD 7.02 billion by 2026, while the Germany market is projected to reach USD 19.17 billion by 2026.

- For instance, in November 2021, John Deere launched a new mechanized grapple & material collection system for compact utility tractors. Its new frontier mechanical grapple, MG20F, delivers a rapid attack solution for quick installation & features a 544 kg lift capacity.

KEY INDUSTRY PLAYERS

Leading Players to Focus on Enhancing R&D Capacities to Expand their Horizon

The promising share of the established market leaders can be attributed to these players' diverse product portfolio offerings. The robust R&D infrastructure of these companies empowers them to develop and unveil modern products with the highest world standards in terms of operational efficiency and embedded technology. These companies are also working to identify on-demand machinery and manufacturing based on the current demand landscape of the market.

- For instance, in May 2023, AGCO Corporation and Bosch BASF started integrating and commercializing smart spraying technology on the Fendt Rogator sprayers that will deliver targeted spraying with minimal operational cost.

LIST OF TOP AGRICULTURE EQUIPMENT COMPANIES:

- AGCO Corporation (U.S.)

- Alamo Group Inc. (U.S.)

- China National Machinery Industry Corporation (China)

- CNH Industrial N.V. (U.K.)

- CLAAS KGaA GmbH (Japan)

- Deere & Company (U.S.)

- Kubota Corporation (Japan)

- Mahindra & Mahindra (India)

- SDF S.p.A. (Italy)

- Valmont Industries Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Linamar Corp. has recently finalised acquisition of Bourgault Industries Ltd. the decision will help Linamar to increase product diversity and addition of seeding equipment line in its existing product portflio.

- October 2023: Mahindra Ltd. which is one of the prominent manufacturer of agriculture products has launched a compact tractor 6075 E Cab. The product will help the company to increase its prominence amongst medium and small scale farmers in the market.

- January 2023: John Deere has unveiled its newly developed battery powered farming equipment in the market. The new product will help to increase electrification and acceptance of modern products in the agriculture sector.

- November 2022: John Deere widened its tractor lineup with the newly added 5EN and 5ML Series. Tractors are highly efficient in operating narrow orchards and vineyards and would enable monitoring, managing, and maximizing performance with higher profitability from businesses.

- May 2022: AGCO Corporation, a leading global distributor and manufacturer of agriculture equipment, machinery, and precision agriculture technology, acquired JCA Industries, Inc., which is a leading provider of autonomous software for farm equipment and electronic systems. The acquisition would allow AGCO Corporation to utilize JCA technologies precision agriculture software in its agriculture machinery, which will improve the experience of customers of AGCO Corporation.

REPORT COVERAGE

The research report provides a detailed analysis of the global market and focuses on key aspects such as leading companies, equipment types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights the key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 222.19 billion in 2026 to USD 402.18 billion by 2034

In 2025, the Asia Pacific market value stood at USD 82.35 billion.

The market is expected to grow at a CAGR of 7.70% during the forecast period (2026-2034).

The agricultural tractors segment is expected to be the leading segment in the market during the forecast period.

Increasing equipment technology awareness and favorable government policies are the key factors driving the market.

AGCO Corporation, Alamo Group Inc., China National Machinery Industry Corporation, CNH Industrial N.V., and CLAAS KGaA GmbH are the major players in the global market.

Heavy initial procurement costs and high expenditure on maintenance are expected to restrain the market growth.

The land development application is expected to drive the adoption of these machine tools.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us