Rolling Stock Market Size, Share & Industry Analysis, By Type (Locomotive, Passenger Carriages, and Wagons), By Application (Passenger and Freight), By Propulsion (ICE and Electric), and Regional Forecast, 2026-2034

Rolling Stock Market Size and Future Outlook

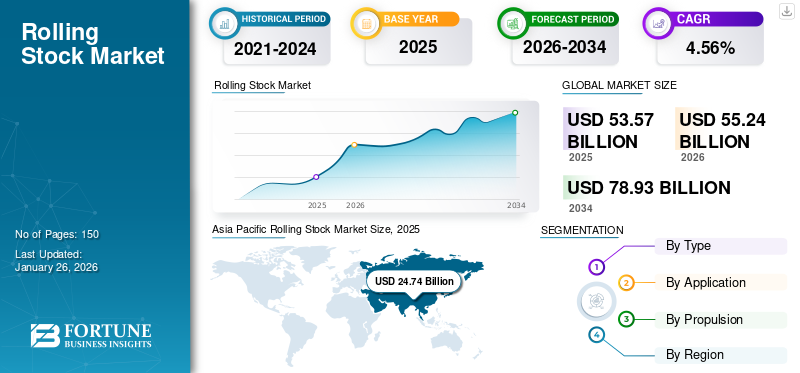

The global rolling stock market size was valued at USD 53.57 billion in 2025 and is projected to grow from USD 55.24 billion in 2026 to USD 78.93 billion by 2034, exhibiting a CAGR of 4.56% during the forecast period. Asia Pacific dominated the rolling stock market, accounting for 46.18% market share in 2025. The industry growth is driven by urbanization, rail electrification investments, freight corridor expansion, public transport modernization, and sustainability-driven infrastructure funding initiatives.

Rolling stock is a term used to denote all vehicles that move on rail wheels, encompassing both unpowered and powered vehicles. It includes locomotives, passenger carriages, and wagons. Key components of Rolling stock include car body, car body fittings, power system, guidance, auxiliary systems, propulsion, braking system, interiors, on-board vehicle control, Passenger Information System (PIS), communication system, cabling & cabinets, door system, Heating, Ventilation and Air-Conditioning (HVAC), lighting, tilt system, and coupler.

Favorable trends in passenger and freight transportation will drive market growth over the coming years. Increasing demand for transportation is expected to significantly boost passenger and freight activity by 2050. Asia Pacific and Latin America will exhibit the most significant growth opportunities during the forecast period, supported by the expansion of railway networks in emerging economies. Various urban rail projects are set to gain traction in Latin America. In December 2024, the World Bank Board approved USD 660 million in funding to support Türkiye's efforts to expand its electric rail transportation network. This initiative aims to enhance the efficient movement of goods nationwide, boost exports, create jobs, and reduce Greenhouse Gas (GHG) emissions.

The global rolling stock market is led by major players such as CRRC Corporation Limited, Siemens AG, Alstom SA, Kawasaki Heavy Industries Ltd., and Wabtec Corporation, among others. CRRC dominates with advanced manufacturing capabilities and diverse solutions, while Siemens focuses on technological innovation and smart systems. Alstom excels in sustainable transport solutions, which fuels the competitive edge in the market.

Rolling stock includes locomotives, passenger carriages, and freight wagons deployed across urban transit, intercity rail, and heavy-haul corridors. Institutional buyers evaluate procurement decisions based on lifecycle cost, energy efficiency, and long-term maintenance frameworks.

The current rolling stock market size is estimated in the high tens of billions of dollars annually, supported by multi-year rail modernization programs across Asia-Pacific and Europe. Electric rolling stock accounts for a growing share of total deliveries, reflecting policy emphasis on emission reduction and electrified rail networks. Freight-oriented rolling stock remains structurally significant in North America, where rail continues to serve as a primary bulk transportation mode. Rolling stock market growth through 2032 is projected to remain steady, supported by metro expansion, high-speed rail investments, and cross-border freight corridor upgrades. Replacement demand for aging fleets in mature economies contributes to consistent order pipelines. Meanwhile, emerging markets are investing in new passenger rail systems to manage urban congestion.

Rolling stock market trends indicate increasing integration of digital signaling compatibility, predictive maintenance systems, and lightweight materials. Operators prioritize reliability and operational uptime, leading to growing demand for long-term service agreements bundled with rolling stock contracts. Despite positive structural drivers, project delays, budget constraints, and geopolitical risk introduce uncertainty into procurement timelines. The rolling stock industry, therefore, reflects measured expansion rather than rapid acceleration. Sustained market share gains will depend on technological capability, financing flexibility, and alignment with national transportation strategies.

Download Free sample to learn more about this report.

Impact of COVID-19

Manufacturing delays and halted projects led to a slowdown in the production and delivery of new trains. Lockdowns and social distancing measures reduced passenger demand, particularly for commuter and long-distance rail services, leading to financial losses for operators. Several governments prioritized health and safety over infrastructure development, leading to delays or cancellations of planned rail projects. The freight sector experienced mixed impacts, with some regions experiencing increased demand due to a surge in online shopping, while others faced declines in goods movement. Overall, the pandemic caused uncertainty, resulting in the postponement of investments in fleet renewal and modernization.

Rolling Stock Market Trends

Rising Adoption of Electric Trains is Set to Gain Traction in the Future

The popularity of electric trains is rising rapidly owing to their numerous benefits. Unlike diesel locomotives, these trains do not require high-grade coal and are free from producing coal dust. Diesel locomotives often need time to start as their internal combustion engines require warming up, whereas electric trains, including electric locomotives and passenger cars, do not face such issues. Additionally, electric trains have lower repair & maintenance requirements compared to other locomotives. The running and maintenance costs of electric trains are comparatively lower than those of diesel locomotives.

Electric trains' large capacity and easy scheduling make them highly suitable for traffic congestion in urban and suburban regions. These trains are less complex, have greater reliability, and are environmentally friendly. Electric trains are not prone to sudden and temporary overloading, as they can draw additional energy from the supply network when needed. Moreover, regenerative braking systems can be employed in electric trains to promote energy savings. The center of gravity of electric trains is low due to lower heights compared to steam locomotive technology, enabling them to navigate curves at higher speeds safely.

In December 2024, Amtrak planned to debut its NextGen Acela fleet in spring 2025, featuring 28 high-speed electric trains for the Northeast Corridor. This USD 2.45 billion project aims to enhance the rider experience, reduce emissions, and create jobs. The new trains would replace the current Acela fleet, offering faster travel with speeds of up to 160 mph, more comfortable seating, personal outlets, USB ports, and free Wi-Fi. The fleet, which is 95% made in the U.S., will cut energy consumption by 20% and support over 1,300 new jobs. This investment aligns with Amtrak's efforts to improve infrastructure, boost the economy, and provide sustainable, reliable service to travelers.

Electrification is a defining rolling stock market trend. Governments are accelerating rail electrification to reduce carbon emissions and dependence on diesel propulsion. Electric multiple units and electric locomotives are capturing rising market share, particularly in passenger applications. Digitalization is reshaping fleet management practices. Rolling stock increasingly integrates condition-based monitoring systems, onboard diagnostics, and remote asset tracking. Predictive maintenance frameworks reduce downtime and optimize lifecycle cost, a key procurement criterion for institutional buyers.

High-speed rail expansion continues to influence market trends. Countries investing in intercity connectivity prioritize aerodynamic design, lightweight materials, and energy-efficient traction systems. These investments support sustained rolling stock market growth in advanced economies. Modular platform design is gaining prominence. Manufacturers are developing standardized rolling stock architectures adaptable across regional requirements. This approach improves production efficiency and supports scalable customization.

Freight wagon innovation also reflects structural demand. Higher axle load capacity, improved braking systems, and digital coupling technologies enhance operational efficiency in bulk transport corridors. Public-private partnership (PPP) models are increasingly common in rolling stock procurement. Operators bundle manufacturing contracts with long-term maintenance agreements, stabilizing revenue streams for suppliers.

Market Dynamics

Market Drivers

Rising Urbanization and Expanding Urban Rail Networks to Bolster Market Growth

One major driving factor for the global rolling stock market is the increasing demand for urban rail transit systems, particularly in emerging economies. Rapid urbanization, population growth, and the need for sustainable transportation solutions have fueled the expansion of urban rail networks worldwide. According to the International Association of Public Transport (UITP), urban rail systems are expected to grow from 182 in 2019 to over 250 by 2030.

In cities struggling with traffic congestion and air pollution, urban rail transit offers efficient, reliable, and environmentally friendly mobility options. Governments and city authorities are investing heavily in expanding and modernizing their urban rail networks to meet growing passenger demand and address urban mobility challenges.

China has emerged as a key driver, with ambitious plans to expand its urban rail transit systems. The country's Five-Year Plans prioritize the development of high-speed rail, metro, and light rail networks, with significant investments allocated to equipment procurement. China Railway Corporation (CRC) aims to extend the country's high-speed rail network to 38,000 kilometers by 2025, driving demand for rolling stock.

Similarly, India is witnessing rapid growth in its urban rail transit sector, with metro rail projects underway in several major cities. The government's Smart Cities Mission and initiatives, such as the Atmanirbhar Bharat (Self-Reliant India) campaign, emphasize sustainable urban transportation. The Delhi Metro Rail Corporation (DMRC) added over 500 new metro cars to its fleet in 2022, stimulating demand for railway equipment manufacturers.

Urbanization remains a primary growth driver within the rolling stock industry. Expanding metropolitan populations require enhanced public transit capacity. Metro rail and commuter networks are expanding in Asia-Pacific, the Middle East, and select European markets. Freight corridor modernization also supports rolling stock market growth. Governments are upgrading rail infrastructure to facilitate bulk commodity transport and intermodal logistics efficiency. Rail’s lower carbon intensity compared to road transport strengthens policy support.

Decarbonization mandates further stimulate demand. National commitments to emission reduction are encouraging the replacement of diesel fleets with electric alternatives. Electrified rolling stock improves energy efficiency and reduces operational emissions. Aging fleet replacement in mature markets represents another structural driver. North America and Western Europe maintain extensive rail networks with rolling stock approaching end-of-life cycles. Replacement programs sustain baseline order volumes.

Export financing and multilateral funding mechanisms also facilitate procurement in developing economies. Infrastructure investment funds support rail modernization initiatives aligned with long-term economic development goals. Technological innovation strengthens competitiveness. Enhanced braking systems, regenerative energy recovery, and lightweight composite materials improve operational performance and lower maintenance requirements.

Market Restraints

Capital-intensive nature of the Rail Industry May Hamper Market Growth

High capital investments in rolling stock manufacturing and railway infrastructure development may hamper market growth in the future. Moreover, increased costs related to technology integration may negatively influence market growth. Intense competition in the industry will further pressure cost optimization. Rail customers’ buying behavior is influenced by various factors, including the mode of transport, choice of carrier, and most importantly, price. Such factors contribute to stringent cost control measures, thereby affecting manufacturing activities.

A stringent regulatory environment may affect industry growth within the forecast period. These regulations compel rail companies to compete fairly and effectively, posing challenges. Decarbonization trends fueled by rising awareness regarding lowering carbon emissions will drive the electrification of trains in the future. However, this will require additional capital, thereby affecting the market growth.

Project financing complexity represents a major restraint within the rolling stock market. Rail infrastructure and fleet procurement require substantial capital commitments. Budget constraints or shifting political priorities can delay contract awards. Procurement cycles are lengthy and highly regulated. Tender processes often extend over several years, limiting short-term revenue predictability for suppliers. Administrative hurdles add uncertainty to delivery timelines.

Supply chain volatility also affects manufacturing schedules. Components such as traction motors, braking systems, and electronic control units depend on global supplier networks. Disruptions can increase cost and extend lead times. Geopolitical tensions may restrict cross-border trade in rail technology. Export controls and localization requirements can limit market access for multinational manufacturers.

Standardization differences between regions present engineering challenges. Rolling stock must comply with varying gauge standards, safety certifications, and signaling systems. Customization increases design complexity and cost. Maintenance workforce shortages in certain markets affect service contract execution. Operators require skilled technicians to support advanced rolling stock technologies.

Freight demand fluctuations linked to commodity cycles introduce additional volatility. Bulk transport volumes influence wagon procurement rates. These restraining factors moderate rolling stock market growth. Industry participants must manage financial exposure, regulatory compliance, and supply chain resilience to maintain competitive positioning.

Market Opportunities

Fleets' Modernization Initiatives Present Growth Opportunity in the Market

Many countries, especially in Europe, North America, and Asia, operate outdated rail systems that require substantial upgrades. Replacing older trains with modern, energy-efficient trains improves reliability, safety, and performance. As governments and private companies invest in fleet modernization, demand is rising for advanced trains equipped with cutting-edge technology such as electric propulsion, automation, and improved fuel efficiency. Additionally, the need to reduce carbon emissions further drives the replacement of older, less environmentally friendly trains. This shift creates a substantial market for manufacturers and operators to supply new high-performance trains that meet the needs of modern transportation systems.

In January 2025, Northern Trains unveiled plans to modernize its fleet by introducing up to 450 sustainable trains, aiming to enhance travel across the Northern network. This initiative involves five manufacturers, including major companies such as Alstom, CAF, Hitachi, Siemens Mobility, and Stadler, competing to supply advanced electric-only and bi-mode trains that meet sustainability standards. The focus is on trains capable of transitioning to electric or battery operation over time, supporting the U.K.’s net-zero emissions goal. With 60% of Northern’s current fleet over 30 years old, the upgrade aims to reduce maintenance costs and improve passenger experience. Framework agreements are expected by 2026, with deliveries starting in 2030, marking a significant step in regional travel modernization.

Rail electrification in emerging markets presents a significant opportunity within the rolling stock market. Countries transitioning from diesel-based fleets to electric propulsion require new locomotives and multiple units. Hydrogen and battery-electric rolling stock technologies offer long-term growth potential. Non-electrified regional routes may adopt alternative propulsion systems to reduce emissions without extensive overhead infrastructure.

Urban transit expansion in secondary cities represents another opportunity. Growing populations are increasing demand for cost-effective commuter rail solutions. Manufacturers offering modular train sets can address diverse capacity requirements. Freight rail modernization in developing economies provides incremental market share potential. Upgraded wagon designs and digital tracking systems improve logistics transparency and efficiency.

Market Challenges

Competition from Alternative Transportation Models May Pose a Challenge to Market Demand

Competition from alternative transportation modes, such as road and air travel, poses a challenge to the growth of the global market by offering more flexible, cost-effective, and convenient options. Trucks and cars provide on-demand, door-to-door services, making them more attractive for short-distance and freight transport. Similarly, air travel is favored for long-distance journeys due to its speed and convenience. In many regions, these alternatives often outperform rail in terms of flexibility, accessibility, and pricing, reducing the demand for rail transport. This competition pressures rail operators to modernize and offer competitive services, which can be difficult without significant investments in infrastructure and new trains, ultimately slowing market growth during the forecast period.

Segmentation Analysis

By Type

Shift Toward Modern Passenger Carriages Drives Market Growth

Based on type, the market is categorized into locomotives, passenger carriages, and wagons.

Passenger Carriages

The passenger carriages segment held the majority share of 60.18% in 2026, and is predicted to maintain the fastest CAGR throughout the study period. The shift toward modern, visually appealing carriages creates a market opportunity for manufacturers to supply innovative and upgraded trains, spurring investment in advanced technologies and customization. This trend toward modernization encourages other operators worldwide to follow suit, further fueling demand in the passenger carriages market.

Passenger carriages encompass metro coaches, commuter rail units, intercity coaches, and high-speed trainsets. Urban transit authorities represent a primary customer base. Demand is closely linked to metropolitan population growth and infrastructure funding availability. High-speed trainsets command premium pricing due to advanced propulsion systems, aerodynamic design, and safety compliance requirements. Lightweight materials and modular interiors enhance efficiency and passenger comfort.

Passenger carriage procurement often follows phased network expansion strategies. Orders may span multiple years, stabilizing rolling stock market growth across extended planning cycles. Digital compatibility is increasingly essential. Modern passenger rolling stock integrates onboard information systems, predictive maintenance sensors, and compatibility with advanced signaling platforms.

In December 2024, Amtrak introduced its first passenger car featuring the new Phase VII livery, marking a step in fleet modernization and enhanced customer satisfaction. Initially exclusive to locomotives, the Phase VII design now appears on passenger cars, starting with the Iroquois River. The sleek design combines dark blue, red, and white arcs, with accent colors indicating different classes. Amtrak plans to roll out the new livery across its fleet, with 44 cars expected by year-end and additional rollouts continuing into 2025, reinforcing its brand identity and improving customer experience.

Wagons

The wagons segment holds the second-largest market share by rolling stock product type in 2024, driven by increased demand for efficient freight transportation, particularly due to rising global trade and e-commerce. Innovations in wagon design, such as eco-friendly materials and improved cargo capacity, are enhancing operational efficiency. Additionally, investments in rail infrastructure and the need to modernize aging fleets are boosting demand for advanced, durable wagons for both bulk and specialized cargo, sustaining growth in this segment over the forecasted period.

Freight wagons form the backbone of bulk transport corridors. They are segmented into tankers, flat wagons, hopper cars, and intermodal platforms. Commodity cycles heavily influence wagon demand. North America maintains a significant wagon base supporting agricultural and mineral transport. In Europe and the Asia-Pacific region, intermodal container wagons are expanding due to trade route optimization. Wagon innovation focuses on higher axle loads, braking efficiency, and digital coupling systems. Although unit pricing is lower than locomotives or passenger units, volume production contributes substantially to the overall rolling stock market size.

Locomotive

Locomotives represent a core revenue segment within the rolling stock market. They provide traction power for both passenger and freight operations and are available in diesel-electric and electric configurations. Electric locomotives account for a rising share in regions with established electrified rail infrastructure.

Freight-dedicated locomotives are typically designed for high tractive effort and long-haul durability. Passenger locomotives prioritize acceleration efficiency and energy management. Procurement cycles for locomotives are generally tied to corridor expansion or fleet modernization programs.

Lifecycle service agreements frequently accompany locomotive sales. Manufacturers bundle long-term maintenance contracts to secure recurring revenue streams. This structure influences rolling stock market share allocation among established global suppliers.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increased Urbanization, Government Investments, and Sustainable Transportation Practice Augment Passenger Segment Development

Based on the application, the market is divided into passenger and freight.

Passenger

The passenger segment dominated the market in 2026 with a share of 63.91%, and is expected to grow at the highest CAGR during the forecast period (2026-2034). Factors such as urbanization, increased demand for sustainable transportation, and government investments in rail infrastructure are driving segmental growth. Moreover, the rising need for efficient, reliable, and fast urban and intercity transportation, along with the shift toward greener options, propels the demand for modern passenger railcars worldwide.

Passenger rail applications account for a significant portion of the rolling stock market, particularly in densely populated regions. Urban metro systems, suburban commuter networks, and long-distance intercity routes require diverse rolling stock configurations. Electrified passenger fleets are expanding due to environmental mandates and operational efficiency benefits. Urban transit authorities prioritize high-capacity configurations and energy-efficient traction systems.

Passenger application growth aligns with public transport modernization programs. Infrastructure funding, often supported by government stimulus initiatives, sustains steady rolling stock market growth in this segment. Operational uptime and reliability are critical procurement criteria. Passenger service disruptions carry political and economic consequences, influencing buyer emphasis on proven technology platforms.

In February 2025, the Massachusetts Bay Transportation Authority (MBTA) announced the start date for South Coast Rail passenger service, set for March 24, 2025, pending Federal Railroad Administration (FRA) approval. For the first time in 65 years, communities such as Taunton, Freetown, New Bedford, Middleboro, and Fall River would regain access to passenger rail service. The service aims to reduce congestion, improve mobility, and support economic development. MBTA completed station construction and safety system testing, with operator training underway. The service will include 15 trips on the Fall River line, 17 on the New Bedford line, and late-night service.

Freight

The freight segment also held a sustainable share in the market in 2024 and is anticipated to grow with a significant CAGR of 4.00% during the forecast period (2025-2032). Increasing global trade, e-commerce, and demand for efficient, cost-effective cargo transportation fuel the demand for the segment. Innovations in rail logistics, such as improved cargo capacity and energy-efficient freight cars, enhance operational efficiency. Additionally, infrastructure investments and the growing need for sustainable transport solutions are supporting global supply chains, reducing environmental impact, and driving the growth of the segment.

Freight rail remains structurally important in global trade. Bulk commodities such as coal, grain, and metals rely on dedicated freight rolling stock. Intermodal container transport is gaining share in response to e-commerce and supply chain optimization. Freight rolling stock demand fluctuates with commodity price cycles and industrial production trends. North America and parts of the Asia-Pacific exhibit strong freight reliance.

Electrification in freight remains regionally concentrated. In electrified corridors, electric locomotives enhance energy efficiency. Diesel-electric locomotives continue to dominate non-electrified routes. Freight application procurement decisions emphasize durability, maintenance efficiency, and fuel consumption metrics. Long-term performance under heavy load conditions is a central evaluation factor.

By Propulsion

Electric Propulsion Leads with Amplified Demand for Energy-Efficient Propulsion Systems

Based on propulsion, the market is divided into ICE and electric.

Electric

The electric segment dominated the market in 2026 by holding a substantial share of 69.69%, and is expected to grow at the highest CAGR during the forecast period (2026-2034). The segment is driven by the growing demand for energy-efficient, eco-friendly transport, urbanization, and supportive government policies. Electric propulsion types such as overhead electric lines and battery-electric systems are favored due to lower emissions, reduced operating costs, and advancements in electrification infrastructure. Additionally, increasing investments in rail networks and a push for sustainable mobility further boost the adoption of electric-powered rolling stock worldwide.

- In April 2025, Stadler expanded its Salt Lake City manufacturing facility to include North America's first electric train battery charging station. This addition supports the development of battery-powered trains for U.S. transit systems, including Metra in Chicago and a demonstration project with Utah State University.

Electric propulsion is gaining momentum across both passenger and freight applications. Electric multiple units (EMUs) and electric locomotives offer lower operational emissions and improved energy efficiency. Electrified networks support higher acceleration rates and reduced maintenance requirements. Urban metro systems are almost exclusively electric.

Capital-intensive electrification infrastructure is a prerequisite. Regions investing in overhead line equipment and grid upgrades are driving the electric rolling stock market growth. Battery-electric and hydrogen-powered trainsets represent emerging alternatives for non-electrified routes. Although still limited in deployment scale, pilot projects signal long-term innovation pathways. Electric propulsion’s expanding share reflects structural decarbonization priorities and public investment commitments.

Internal Combustion Engine (ICE)

The ICE segment held a supportable market share of 99% in 2025. The Internal Combustion Engine (ICE) segment is sustained by factors such as the high cost and infrastructure requirements of electrification, especially in regions with limited rail networks. ICE locomotives offer operational flexibility and are essential for freight services in areas lacking electrified tracks. Additionally, advancements in hybrid propulsion systems and fuel-efficient technologies are enhancing the appeal of ICE-powered rolling stock, ensuring their continued relevance in the evolving rail industry.

Internal combustion engine rolling stock, primarily diesel-electric locomotives, remains relevant in regions without comprehensive electrification infrastructure. These systems provide operational flexibility and lower upfront infrastructure costs. However, emission regulations are tightening globally. Operators must balance capital expenditure for electrification against incremental upgrades to cleaner diesel technologies.

Diesel locomotives continue to represent a significant rolling stock market share in North America and select emerging economies. Yet, long-term market growth for ICE platforms may moderate as decarbonization strategies advance. Manufacturers are improving engine efficiency and emission control systems to remain compliant with evolving standards.

Regional Market Insights

North America Rolling Stock Market Analysis:

Asia Pacific Rolling Stock Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds a significant share of the global market with a valuation of USD 25.48 billion in 2026, attributed to increasing investments in rail infrastructure, fleet modernization, and a focus on sustainable transportation solutions. Demand for high-speed trains, efficient freight systems, and eco-friendly options, such as electric and hybrid trains, fuels market growth. Additionally, government initiatives and private-sector partnerships aimed at enhancing connectivity, reducing congestion, and supporting economic development further drive the expansion of the region.

In November 2024, Amtrak received funding for 13 projects aimed at modernizing the Northeast Corridor (NEC) to alleviate bottlenecks and enhance passenger rail service in the North America region. These initiatives are aimed at improving infrastructure, reducing travel times, and supporting economic growth. Key projects include expanding New York Penn Station, modernizing Washington Union Station, and replacing aging bridges such as the Sawtooth Bridges in Kearny, NJ. The funding from the Federal-State Partnership for Intercity Passenger Rail Program will also support signal upgrades and catenary system improvements, ensuring more efficient rail operations.

North America rolling stock market is characterized by strong freight dominance and steady passenger modernization. Freight wagons and diesel-electric locomotives represent significant market share, particularly in the United States and Canada. Passenger investment focuses on commuter rail upgrades and intercity improvements. Market growth remains stable, supported by federal infrastructure programs and private freight operator capital expenditure.

United States Rolling Stock Market:

The United States rolling stock market is freight-centric, driven by bulk commodity and intermodal transport demand. Diesel-electric locomotives continue to dominate due to limited nationwide electrification. Passenger rail modernization programs, including corridor upgrades, support incremental market size expansion. Federal funding mechanisms influence procurement timing and supplier competition.

The U.S. market holds a significant share of the North American market, valued at USD 6.3 billion in 2026. The U.S. rolling stock market is driven by strong economic growth, robust industrial output, and increased consumer demand for railway transportation solutions. Advancements in technology, such as automation and smart systems, and government investments in infrastructure development, also drive the market growth in the country. Moreover, rising urbanization and the need for efficient freight and passenger transport further fuel demand. Additionally, sustainability initiatives promote the adoption of energy-efficient rail systems, boosting market growth in the country.

Europe Rolling Stock Market Analysis:

Europe is the second largest market, anticipated to capture the valuation of USD 16.43 billion in 2026 and to grow at the significant CAGR of 3.70% during the forecast period (2026-2034). In Europe, the market is driven by investments in high-speed rail networks, fleet modernization, and a strong focus on sustainability. The U.K. market is growing significantly and is expected to reach a value of USD 1.17 billion in 2026. European governments are prioritizing green transportation solutions to reduce emissions, leading to increased demand for electric and hydrogen-powered trains. Additionally, the growing emphasis on intercity connectivity, urbanization, and cross-border rail services, along with EU funding for infrastructure projects, contributes to the growth of the market in the region. Germany is estimated to be worth USD 3.91 billion in 2026, while France is projected to be valued at USD 2.09 billion in the same year.

In October 2024, the European Commission granted CPK PLN 162 million (USD 41.3 million) in financial support through the "Connecting Europe Facility" (CEF). This funding is designated for designing a 155-kilometer railway section connecting Sieradz, Kalisz, Pleszew, and Poznań. The section is a crucial part of Poland's future "Y" route, which will serve as the backbone of the country's High-Speed Rail network, enhancing connectivity and modernizing rail infrastructure.

Europe's rolling stock market is heavily passenger-oriented, supported by electrified networks and high-speed rail investment. Electric multiple units and regional trainsets account for a growing market share. Freight modernization remains active along trans-European corridors. Regulatory emphasis on emission reduction and interoperability standards shapes procurement strategies and steady rolling stock market growth.

Germany Rolling Stock Market:

Germany's rolling stock market reflects strong passenger rail demand and export-oriented manufacturing strength. Fleet replacement programs and regional rail upgrades sustain market size stability. Electrification remains central to procurement decisions. Domestic manufacturers maintain competitive positioning through advanced engineering and integrated maintenance offerings.

United Kingdom Rolling Stock Market:

The United Kingdom rolling stock market is driven by commuter rail capacity expansion and fleet renewal programs. Public-private partnership structures influence procurement cycles. Electrification progress supports electric train adoption, although regional infrastructure constraints remain. Market growth remains measured and policy-dependent.

Asia-Pacific Rolling Stock Market Analysis:

The rolling stock market in the Asia Pacific dominated the market and was valued at USD 24.74 billion in 2025 and USD 25.48 billion in 2026. This region is projected to grow at a CAGR of 4.0% during the forecast period. The growth in the regional market is driven by rapid urbanization, increasing public transportation demand, and government investments in rail infrastructure. Technological advancements such as IoT and 5G integration enhance operational efficiency, while high-speed trains and metro systems address traffic congestion and environmental concerns, further fueling market growth in the region. Moreover, governments across the region are pushing train electrification owing to its environmental and economic benefits. For instance, in February 2023, the Ministry of Railways reported that 3,375 Route kilometers (RKM) were electrified in 2022 – 2023, displaying 38% growth from 2021 – 2022. In April 2023, Haryana became India's first state to have a 100% electrified network. The market value of India is estimated to be worth USD 4.05 billion in 2026.

In June 2021, China launched a fully electrified bullet train in the Himalayan region of Tibet. This train connects the provincial capital, Lhasa, and Nyingchi, reducing travel time by 1.5 hours. This train is capable of around 10 million tons of freight transport capacity per year. In 2019, the Chinese government invested USD 120 billion into the rail construction project as a decarbonization program. China’s five-year plan (2016 – 2020) set a target of building 30,000 km of high-speed rail to connect 80% of major cities. China's market value is expected to be USD 17 billion in 2026.

Asia-Pacific represents the fastest-expanding rolling stock market, driven by urban metro expansion and high-speed rail development. China, Japan, and India lead passenger investment. Freight corridor upgrades also contribute. Government-backed infrastructure funding sustains strong rolling stock market growth.

Japan Rolling Stock Market:

Japan's rolling stock market is technologically advanced, emphasizing high-speed and urban rail innovation. Electric trainsets dominate market share due to widespread electrification. Fleet modernization and export activities support sustained market size expansion.

China Rolling Stock Market:

China's rolling stock market is the largest globally by production volume. High-speed rail expansion and urban metro systems drive substantial demand. Domestic manufacturers maintain a strong market share supported by state investment programs.

Rest of the World

The rest of the world comprises Latin America, the Middle East & and Africa. The market within the region is driven by infrastructure development, urbanization, and the need for more efficient transportation systems. Governments are investing in rail networks to improve connectivity and reduce traffic congestion. Additionally, there is a growing demand for sustainable and energy-efficient solutions, such as electric and hybrid trains, to address environmental concerns. Public-private partnerships and international funding also play a key role in advancing rail projects across these regions. The ROW is poised to be valued at USD 4.25 billion in 2025.

In January 2025, Brazil unveiled a USD 17 billion freight rail plan, aiming to place 40% of the country’s cargo on rail by 2035, reducing highway traffic and improving safety. After years of stagnation, rail freight volumes have steadily increased, with last year marking a historic transport record. The plan involves 5,000km of rail lines, with a mix of public and private investments. Private companies will bid based on the least public funding required. Key projects include expanding the Transnordestina line and connecting major freight corridors.

Competitive Landscape

Key Industry Players

Major Players Focus on Partnerships to Bolster Their Market Position

CRRC Corporation Limited, Alstom, Hyundai Rotem Company, Siemens Mobility, GE Transportation, Wabtec Corporation, Hitachi Railway Systems, CISC Transmashholding, Stadler Rail, and Kawasaki Railcar Manufacturing Co., Ltd. are major players in the rolling stock industry. These key players adopt strategies such as product differentiation & development, strategic partnerships, and expansion of distribution networks to strengthen their market position. In July 2022, CRRC tied with Titagarh Wagons to supply 216 coaches for Bangalore’s Metro Phase 2.

- In January 2023, Siemens Mobility was awarded a USD 3.31 billion contract from Indian Railways to deliver 1,200 locomotives with 9,000 horsepower (HP). The deliveries will be provided over eleven years, and the company will offer 35 years of full-service maintenance.

In January 2021, Alstom completed the acquisition of Bombardier Transportation for USD 6.06 billion. This acquisition solidifies Alstom’s leadership in the sustainable mobility industry. The newly formed entity has a combined pro forma revenue of around USD 17.29 billion and a backlog of USD 78.32 billion. In March 2023, the Ministry of Transportation of Egypt was awarded a contract worth USD 474 million to CJSC Transmashholding for providing maintenance services for 12 years. Such initiatives will help the company to gain a competitive advantage and increase profitability.

The rolling stock industry is concentrated among a limited group of multinational manufacturers with strong engineering capabilities and global delivery footprints. Market share distribution reflects technological depth, financial strength, and long-term service integration capacity.

Leading suppliers compete across locomotives, passenger carriages, and freight wagons, often bundling procurement contracts with multi-decade maintenance agreements. This lifecycle-based approach stabilizes revenue and strengthens institutional relationships. Competitive positioning increasingly depends on electrification expertise. Firms investing in electric traction systems, energy recovery technology, and digital monitoring platforms are securing larger shares of new passenger and metro contracts.

Regional manufacturers maintain relevance through localization strategies. Joint ventures and domestic assembly operations help meet regulatory content requirements. Export financing arrangements also influence contract awards.

Freight-focused suppliers emphasize durability and efficiency enhancements. Improved braking systems, digital coupling, and predictive maintenance capabilities differentiate offerings in competitive tenders.

Barriers to entry remain high due to certification requirements, capital intensity, and the complexity of cross-border compliance standards. Project execution capability and financing flexibility often determine supplier selection. Innovation remains incremental rather than disruptive. Buyers prioritize proven platforms with reliable performance records. Cost control and schedule adherence are decisive evaluation criteria.

Key Companies Analyzed:

- CRRC Corporation Limited (China)

- Alstom SA (France)

- Siemens Mobility (Germany)

- Hyundai Rotem Company (South Korea)

- GE Transportation (U.S.)

- Wabtec Corporation (U.S.)

- Hitachi Rail Limited (U.K.)

- CJSC Transmashholding (Russia)

- Stadler Rail AG (Switzerland)

- Kawasaki Railcar Manufacturing Co., Ltd. (Japan)

- Skoda Transportation (Czech Republic)

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain)

Recent Industry Developments

- January 2024: Alstom secured a contract to supply electric multiple units for a European regional rail upgrade program, enhancing energy efficiency through advanced traction systems and integrated digital maintenance platforms.

- May 2024: Siemens Mobility expanded its high-speed train portfolio by introducing upgraded aerodynamic trainsets designed to improve energy recovery performance and interoperability across European signaling systems.

- September 2024: CRRC Corporation delivered new metro rolling stock units equipped with predictive maintenance sensors and real-time monitoring capabilities to support urban transit expansion in the Asia-Pacific.

- February 2025: Hitachi Rail launched a battery-electric regional train prototype aimed at reducing emissions on non-electrified routes, incorporating modular battery packs and regenerative braking systems.

- June 2025: Stadler Rail signed a long-term service agreement alongside locomotive deliveries in North America, integrating remote diagnostics and lifecycle asset management software to optimize fleet reliability.

REPORT COVERAGE

The global rolling stock market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies and segmentation by type, application, and propulsion. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors contributing to the industry's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.56% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Propulsion

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 55.24 billion in 2026 and is projected to register USD 78.93 billion by 2034.

The market is expected to register a CAGR of 4.56% during the forecast period 2026-2034.

Rising urbanization and expanding urban rail networks to bolster market growth

The market is led by major players such as CRRC Corporation Limited, Siemens AG, Alstom SA, Kawasaki Heavy Industries Ltd., and Wabtec Corporation, among others.

Passenger segment is attributed to hold the largest share of the market in 2025.

Asia Pacific led the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us