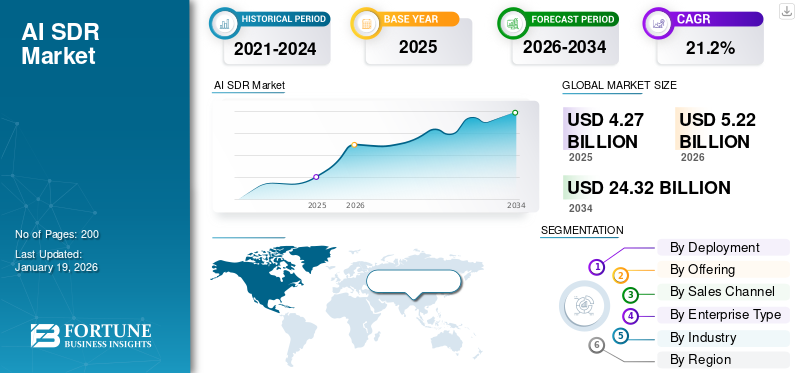

AI SDR Market Size, Share & Industry Analysis, By Deployment (Cloud, On-premise, and API/Add-ons Extensions), By Offering (Software and Services), By Sales Channel (Inbound, Outbound, and Hybrid), By Enterprise Type (Large Enterprises and SMEs), By Industry (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Education, and Others [Entertainment, Travel & Hospitality, etc.]), and Regional Forecast, 2026–2034

AI SDR Market Size

The global AI SDR market size was valued at USD 4.27 billion in 2025 and is projected to grow from USD 5.22 billion in 2026 to USD 24.32 billion by 2034, exhibiting a CAGR of 21.2% during the forecast period. North America dominated the AI SDR Market with a market share of 39.4% in 2025.

The AI SDR is a software tool that leverages the advantage of AI to automate and optimize the sales funnel, from lead prospecting to high-value customer conversions. It includes AI-operated tasks such as leading identification, qualification, personalized outreach via email or social media, and meeting booking, enabling to focus on valuable interactions by automating sales teams repeating tasks.

The market is experiencing rapid growth, inspired by increasing demand for scalable, efficient sales outreach, advanced data analytics, and integration with CRM systems. Major growth factors are growing adoption in areas such as SaaS, e-commerce, healthcare, and telecommunications, growth of 5G and IOT technologies, and push for AI-enabled personalized communication at scale, enabling faster pipeline generation and better conversion outcomes.

Some of the major players working in the market are HubSpot, Inc., Salesforce, Inc., 6Sense, AiSDR, Artisan AI, Luru, SuperAGI, and One Floworks Technologies, Inc.

Impact of Gen AI

Gen AI is Revolutionizing Sales by Driving Efficiency, Personalization, and Scalable Growth

Gen AI is transforming the global market by bringing unprecedented efficiency in lead generation and nurturing. Through advanced natural language models, AI SDRs can simulate human interaction and tailor outreach to individual prospects based on behavioral and contextual data. This level of hyper-personalization drives better engagement, higher reply rates, and improved conversion, while reducing human effort on repetitive tasks. It accelerates the entire sales cycle and also allows companies to scale operations without proportionally increasing headcount. As sales landscapes get more competitive, Gen AI is emerging as a key differentiator for revenue growth and efficiency.

MARKET DYNAMICS

Market Drivers

Rising Need for Sales Productivity & Efficiency Drives the Market Development

Organizations are under pressure to maximize sales productivity while keeping costs low. Manual lead qualification, prospecting, and follow-ups consume significant time, leaving SDRs with fewer opportunities to engage in strategic conversations. AI SDR solutions automate these processes with high accuracy, ensuring that no lead is lost in the funnel. By freeing up human representatives, companies achieve streamlined workflows, faster opportunity identification, and higher pipeline velocity. As remote selling accelerates globally, the demand for scalable and efficient AI SDR tools continues to rise, making efficiency a primary driver for the AI SDR market growth.

Market Restraints

Data Privacy & Compliance Concerns Hampers the Market Growth

While AI SDRs are highly effective, adoption faces hurdle around data governance. These systems process vast amounts of sensitive information such as email, phone number and behavior details, which increase the risks related to GDPR, CCPA and other privacy regulations. Mishandling personal data or poor compliance practices may lead to fines, brand damage, and loss of customer trust. Regulated industries such as healthcare and finance are particularly cautious, slowing large-scale AI SDR implementations. As a result, ethical AI deployment, robust encryption, and transparent data usage policies have become essential to drive trust and overcome resistance in highly regulated markets.

Market Opportunities

Voice & Conversational AI Expansion Offers Lucrative Growth Opportunities

The next frontier in AI SDRs lies in voice-based and real time conversational AI systems. Beyond email sequencing or chat interactions, AI-driven voice assistants are now capable of conducting natural sales conversations, handling objections, and scheduling demos. This opens significant growth opportunities as voice retains higher engagement rates compared to text-based communication. As speech recognition and smart conversational intelligence mature, AI SDR platforms can extend their capabilities into customer calls, multilingual markets, and industry-specific outreach. The shift from “assistants” to autonomous sales agents could redefine inside sales models, offering enterprises new avenues for customer acquisition at scale.

AI SDR MARKET TRENDS

Shift Toward Hybrid Sales Models Has Emerged as a Prominent Market Trend

A major trend in the market is to adopt hybrid sales teams where AI and human SDR basically collaborate. The AI handles high-volume functions such as lead priority, outreach personalization, and scheduling, ensuring that SDRs are well equipped with a qualified lead. Human representatives take over once prospects show deeper interest, allowing them to focus on complex negotiations and strategic relationship-building. This combination balances efficiency with empathy which are the two vital components of modern sales. Businesses adopting this hybrid model are reporting measurable gains in funnel conversion, increased sales rep productivity, and improved customer experience across engagement touchpoints.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Deployment

Cloud Segment Leads the Global Market Owing to Its Scalability and Reduced Upfront Investment

Based on the deployment, the market is segmented into cloud, on-premise, and API/add-ons extensions.

Cloud segment leads the global market recording a valuation of USD 2.41 billion in 2024. The Cloud segment is poised to account for 68.75% of the market share in 2026. The growth is owing to its scalability, reduced upfront investment, and easy integration with CRM and sales platforms. These benefits make cloud deployment the most preferred model for implementing AI SDR solutions across diverse business environments.

API/add-ons extensions represents the fastest-growing segment and is expected to record a CAGR of 24.98%. Enterprises increasingly prefer modular, plug-and-play AI SDR capabilities that can be embedded into existing sales and CRM workflows, thereby fueling the segment’s growth. By avoiding complete platform overhauls, businesses can improve efficiency and scalability with minimal disruption, thereby fueling the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Offering

Software Segment Leads the Market as Most AI SDR Solutions Are Delivered as SaaS Platforms

The market is divided into software and services, based on offering.

Software segment leads the global market generating a valuation of USD 2.42 billion in 2024 as most AI SDR solutions are delivered as SaaS platforms with built-in automation, personalization, and analytics, driving widespread adoption across diverse industries. The Software segment is forecast to represent 67.69% of total market share in 2026.

Services are projected to record the highest CAGR of 25.14%. The segment is expected to grow fastest, as organizations increasingly necessitate integration, customization, and managed support to effectively deploy and scale AI SDR solutions within existing sales processes.

By Sales Channel

Faster Conversions and Enhanced Sales Efficiency Augments the Inbound Segment Growth

The market is divided into inbound, outbound, and hybrid, based on sales channel.

Inbound segment holds the majority share of the global market with a valuation of USD 1.09 billion in 2024 as enterprises leverage AI-driven lead qualification and instant engagement for high-volume website and digital inquiries, ensuring faster conversions and enhanced sales efficiency. The Outbound segment is anticipated to hold a dominant market share of 43.3% in 2026.

Hybrid emerges as the fastest-growing segment and is projected to record a CAGR of 24.52%. Businesses increasingly rely on unified AI SDR solutions that integrate inbound lead management with outbound prospecting, improving efficiency and coverage across the entire sales funnel. This factor is driving the segment’s growth.

By Enterprise Type

Large Enterprises Dominated the Market Due to Higher Demand for Scalable AI SDR Solutions

Based on enterprise type, the market is divided into large enterprises and SMEs.

Large enterprises dominated the global market in 2024, accounting for a valuation of USD 2.13 billion. The segment’s growth is due to its capability to possess substantial budgets, expansive sales teams, and higher demand for scalable AI SDR solutions to efficiently manage complex, high-volume sales operations and extensive global customer bases.

SMEs is projected to record a CAGR of 25.11%. The increased adoption of cost-effective AI SDR solutions to automate outreach, streamline lead generation, and compete with larger enterprises without expanding operational headcount is fueling the segment’s market growth.

By Industry

BSFI Segment Dominates Due to Industry’s Reliance On High-Volume Prospecting and Cross-Selling Opportunities

The market is divided into BFSI, IT & telecom, retail & e-commerce, healthcare, education, and others {entertainment, travel & hospitality, etc.}, based on industry.

The BFSI sector holds the majority share with a market valuation of USD 1.00 billion. Its strong position is mainly to the industry’s reliance on high-volume prospecting, cross-selling opportunities, and compliance-driven client engagement, where AI SDR solutions are proven to be of significant value.

Healthcare is anticipated to be the fastest-growing segment, registering a CAGR of 25.45%. This acceleration is driven by the increasing adoption of AI SDR solutions by healthcare providers, pharmaceutical companies, and medtech firms to support compliant outreach, strengthen patient engagement, and foster strategic partnership development, all while operating within a highly regulated and complex environment.

AI SDR MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America holds the largest AI SDR market share during the forecast period. In 2025, the regional market was valued at USD 1.68 billion, reaching USD 2.02 billion in 2026, highlighting the strengthening speed of the region. The leadership of the region can be attributed to its mature sale automation ecosystem, early adoption of AI-driven tools, and the presence of major AI SDR companies.

By 2026, U.S. is expected to contribute to USD 1.43 billion, strengthening its position as a major driver of global market expansion. U.S. market development drivers include the region's advanced technological infrastructure and early adoption of AI-powered sales automation tools, especially within areas such as SaaS, technology and e-commerce.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe market is estimated to record a valuation USD 1.14 billion in 2026, with U.K. (USD 0.22 billion), Germany (USD 0.21 billion). France (USD 0.15 billion) contributing in 2025. The region’s growth is fueled by factors such as increasing defense modernization programs, strong R&D ecosystems, and enhancing AI-operated SDR for safe communication in military and commercial applications. In addition, the focus of the region on 5G and spectrum efficiency further enhances the growth of the market.

Asia Pacific

Asia Pacific is estimated to record a market valuation of USD 1.09 billion by 2025. It is marked as the fastest growing area with a notable CAGR of 27.42%. The Japan market is projected to reach USD 0.27 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.20 billion by 2026. The region’s growth is driven by factors such as rapid digital transformation, widespread SaaS adoption, and increasing investment in AI-centered sales solutions. The high demand of the region for adopting advanced technology and scalable cloud-based platforms in developing economies also promotes this development.

South America and Middle East & Africa

South America is estimated to record a valuation of USD 0.24 billion in 2025 mainly due to increasing digital transformation, increasing adoption of AI- powered solutions in industries, and expanding investments in smart infrastructure. The growth of the region is also owing to the acceleration of cloud-based technologies and government initiatives encouraging innovation. In the Middle East and Africa, the market is expected to record USD 0.32 billion in 2025, with GCC contributing USD 0.10 billion, fueled by rapid economic diversification, strong investment in AI, and smart city development projects.

COMPETITIVE LANDSCAPE

Key Industry Players

Companiesto Expand Their Portfolios Through Product Launches, Mergers, and Acquisitions

Companies working in the market are focusing on innovation and strategic initiatives to strengthen their position. Top players in the market include Klenty Soft Inc., Common Room, Qualified, 11x AI, Alta, Cognism, and Gong. They are intensifying efforts to expand the portfolio by adopting strategies such as product launch, merger and acquisition. Companies are also making significant investments in innovative AI technologies and data-operated solutions to meet customer needs.

LIST OF KEY AI SDR COMPANIES PROFILED:

- HubSpot, Inc. (U.S.)

- Salesforce, Inc. (U.S.)

- 6Sense (U.S.)

- AiSDR (U.S.)

- Artisan AI (U.S.)

- Luru (U.S.)

- SuperAGI (U.S.)

- One Floworks Technologies, Inc. (U.S.)

- Klenty Soft Inc. (U.S.)

- Common Room (U.S.)

- Qualified (U.S.)

- 11x AI (U.S.)

- Alta (Israel)

- Cognism (U.K.)

- Gong (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2025- Qualified announced the launch of new capabilities that evolve their AI sales development representative (SDR) agent, Piper, into the first full‑funnel AI SDR superagent that can autonomously engage, nurture, and convert buyers through multi‑modal, face‑to‑face experiences. Designed for the agentic marketing era, Piper goes far beyond conventional AI sales assistants, delivering human-like interactions at scale for more than 500 leading brands.

- March 2025- Alta AI, the pioneer in AI SDR agent technology, has announced a USD 7 million seed financing round and its launch from stealth mode. The company has developed a specialized large language model for sales and trained AI agents to perform marketing, sales development, and revenue operations tasks. The funding round was led by Entrée Capital and Target Global.

- January 2025- HubSpot, the leading customer platform for scaling businesses, announced today that it has successfully finalized its acquisition of Frame AI, an AI-powered conversation intelligence platform. Frame AI is now a wholly owned subsidiary of HubSpot and will be integrated into Breeze, HubSpot’s AI that powers the customer platform, over time.

- November 2024- Lyzr, a leading company, which is known for its pioneering AI-driven solutions, is set to launch Jazon 2.0, a better version of its AI-powered Sales Development Representative (SDR). Jazon 2.0 aims to transform outbound sales through advanced automation paired with human-like personalization, designed to meet the evolving needs of enterprise sales teams.

- August 2024- Salesforce, the American company that provides CRM software and applications for sales, service, and marketing, has unveiled two new fully autonomous AI sales agents: Einstein Sales Development Rep (SDR) Agent and Einstein Sales Coach Agent. According to the company, they will be available in October and are built on Salesforce’s Einstein 1 Agentforce Platform, enabling sales teams to accelerate growth.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ARRTIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 21.2% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

| By Deployment |

|

| By Offering |

|

| By Sales Channel |

|

| By Enterprise Type |

|

| By Industry |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 5.22 billion in 2026 and is projected to reach USD 24.32 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 21.2% during the forecast period.

Rising need for sales productivity & efficiency drives the market growth.

HubSpot, Inc., Salesforce, Inc., 6Sense, AiSDR, Artisan AI, Luru, SuperAGI, and One Floworks Technologies, Inc. are some of the top players in the market.

The North America region held the largest market share.

North America was valued at USD 1.68 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us