Air Quality Monitoring System Market Size, Share & Industry Analysis, By Type (Indoor Monitors and Outdoor Monitors), By Pollutant (Chemical, Physical, and Biological), By End-User (Commercial & Residential, Public Infrastructure, Power Generation Plants, Pharmaceutical Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

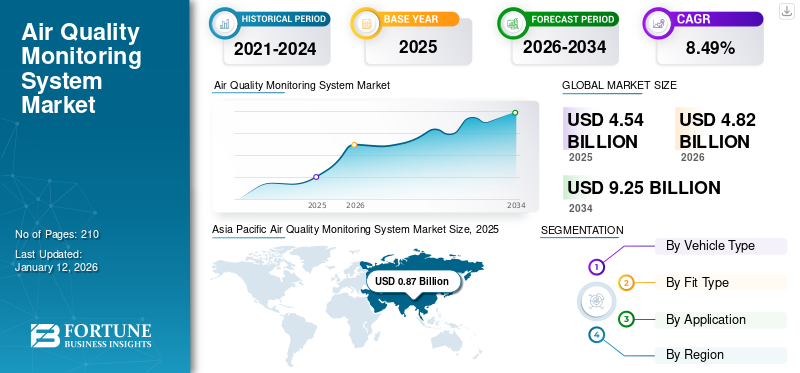

The global air quality monitoring system market size was valued at USD 4.54 billion in 2025. It is projected to be worth USD 4.82 billion in 2026 and reach USD 9.25 billion by 2034, exhibiting a CAGR of 8.49% during the forecast period. Asia Pacific dominated the global market with a share of 19.11% in 2025. Air Quality Monitoring System Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.10 billion by 2032.

Air Quality Monitoring systems are utilized for repeated measurement of ‘air pollutants’ or ‘criteria air pollutants,’ which identify different pollutants such as particulate matter, sulfur dioxide, Volatile Organic Compounds (VOC), carbon monoxide, and nitrous oxide. The contaminated air contains harmful contaminants that are responsible for various health issues. Air pollution monitoring and controlling data are crucial for assessing air pollution and environmental pollution policies by national and local authorities, public and private companies, and national organizations.

Global Air Quality Monitoring System Market Overview

Market Size:

- 2025 Value: USD 4.54 billion

- 2026 Value: USD 4.82 billion

- 2034 Forecast Value: USD 9.25 billion

- CAGR (2026–2034): 8.49%

Market Share:

- Regional Leader: North America leads the market, with the U.S. projected to reach USD 2.10 billion by 2032.

- Fastest‑Growing Region: Asia Pacific is expected to witness rapid growth, driven by regulatory actions and smart city initiatives.

- End‑User Leader: Government agencies and public infrastructure dominate as primary end-users due to strict air quality regulations and environmental monitoring requirements.

Industry Trends:

- Government-led air quality monitoring and regulatory enforcement is expanding globally.

- Integration of IoT-enabled sensors and real-time monitoring platforms is becoming a standard.

- Outdoor monitoring systems, particularly fixed stations, remain the dominant system type.

- Academic institutions and public organizations are increasingly adopting advanced monitoring systems for research and compliance.

Driving Factors:

- Rising global awareness of the health impacts of air pollution.

- Stricter government regulations and environmental policies.

- Rapid urbanization and smart city developments necessitating continuous air monitoring.

- Technological advancements in IoT-connected and real-time air quality monitoring systems.

- Increased institutional investments by government bodies and academic institutions for data-driven policy-making and research.

The market is expected to witness significant growth owing to factors such as increasing demand for improving air quality, which has led to growing demand for air quality monitor systems. Rising global pollution levels and government air quality mandates across the globe also propel the market.

HORIBA, Ltd. is one of the prominent players in the market. The company is a manufacturer and distributor of environmental measuring instruments, automotive emission measurement systems, and a wide range of scientific analyzers.

MARKET DYNAMICS

MARKET DRIVERS

Favorable Government Initiatives to Boost Air Quality Monitoring System Market Share

Governments across the globe are undertaking various regulatory initiatives to cut down and reduce air pollution from multiple sectors by utilizing awareness programs and campaigns. Rising awareness of the severe effects of contaminated air on health has propelled the growth of the global air quality monitoring market. For instance, in September 2024, the Climate & Clean Air Coalition (CCAC) launched the Air Quality Management Exchange Platform following the UNEA-6 resolution to boost regional cooperation among various governments and improve air quality globally. This platform has been developed to guide national air quality management in meeting World Health Organization (WHO) guidelines and air quality targets. Furthermore, the favorable government regulations related to the control and monitoring of air pollution and the rise in public-private partnerships for AQM solutions have boosted the demand for air quality monitors.

Development of Smart City Projects is Expected to Boost Market Growth

The air quality monitoring system is expected to witness significant growth fueled by the development of major smart city projects in many regions. For instance, in August 2024, the Cabinet Committee on Economic Affairs of India approved 12 major smart city projects across India under the National Industrial Corridor Development Programme (NICDP). The projects were approved with an investment of USD 3.41 billion, which is expected to attract USD 18.12 billion in investment from various industries and MSMEs. The aforementioned types of projects across the world are expected to propel demand for air quality monitoring systems over the forecast period.

MARKET RESTRAINTS

High Cost of Air Quality Monitoring Systems Restrain Market Growth

The high installation cost of this device is expected to restrain the market growth. The high maintenance cost of various pollution monitoring stations also hinders the market for AQM systems. For instance, Aeroqual provides an outdoor continuous air quality monitoring system at the price of approx. USD 230,000 to USD 250,000/unit, which makes it expensive for general buyers from end-use industries. High costs associated with the maintenance, establishment, and purchase of AQM sensors, as well as the establishment of air quality monitoring stations, coupled with stringent pollution control policies, further restrict the market growth.

MARKET OPPORTUNITIES

Growing Focus on Environmental and Climate Change Initiatives Offers Huge Growth Opportunities for Market Players

Rising environmental and climate change across the globe is expected to create lucrative opportunities for market players in the coming years, propelled by technological advancements and environmental regulations. Moreover, the introduction of carbon neutrality goals will also create opportunities for AQM systems manufacturers. For instance, in December 2024, the U.S. government announced a new carbon emissions target to achieve 61% to 66% below 2005 carbon levels by 2035, which is a part of the updated national contribution to the Paris Agreement. Such targets are announced by various governments across the world and are expected to foster the growth of the AQM systems market in the near future.

MARKET CHALLENGES

Lack of Technological Standardization in Product Development Challenge Market Growth

The air quality monitoring system industry faces challenges in developing standard products for each country due to variances in environmental policies, levels of pollution, and emission targets. Furthermore, the development of specialized products to cater to the regional markets poses technological and financial challenges to the manufacturers. Hence, different countries and regions vary in air quality monitoring processes and management, which poses a significant challenge for market players in developing a standardized product.

AIR QUALITY MONITORING SYSTEM MARKET TRENDS

Technological Advancements in Air Quality Monitoring Systems has Emerged as a Profitable Trend in the market

Key players in the AQM systems market are heavily investing in research and development to create systems that cater to various regions by integrating IoT into air quality management systems. For instance, in November 2024, Google launched a real-time air quality monitoring system named Air View + on Google Maps across India. The system provides region-wise real-time air quality data by utilizing a network of sensors and AI. This system provides data on pollutants such as ozone and PM2.5 through Google Maps. Such technological advancements play a major role in driving trends in the air quality monitoring systems market.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

During COVID-19, the growth of the air quality monitoring system sector experienced various challenges. This was due to a slowdown in industrial activity and lower orders. In addition, logistics & supply chain uncertainty caused various difficulties in obtaining raw materials and parts from suppliers, mainly those based in China and other Southeast Asian countries, creating several roadblocks for manufacturers.

Several market players, including 3M Company, Thermo Fisher, and Emerson, registered a decline in sales during 2020. However, according to the World Green Building Council, enhancement of Indoor Air Quality (IAQ) could play a vital role in reducing aerosol transmission of viruses by vaccinating 50-60% of the population. Post-COVID-19, demand for air quality monitoring systems has witnessed significant growth owing to the rising awareness about health issues caused by air pollution.

SEGMENTATION ANALYSIS

By Type

Indoor Air Quality Monitors is expected to Augment Segment Outlook Due to Increasing Health Implications of Indoor Air Pollution

Based on product type, the market is classified into indoor monitors and outdoor monitors.

Indoor monitors are holding 51.13% market share in 2026, owing to the increasing installation of AQM stations and several initiatives undertaken to enhance public awareness of the health implications of indoor air pollution. Furthermore, the growing adaptation of green-building and smart home technologies and increasing preference for pollution-free indoor environments is estimated to drive segmental growth.

Furthermore, outdoor monitors are estimated to grow at the highest CAGR during the projected period due to public-private investments in producing novel and affordable ambient monitoring products, growing industrial use of air pollution monitoring systems, and increasing end-user base.

By Pollutant

Increasing Carbon Emission Levels Drive Growth for Chemical Pollutant Segment

Based on pollutant, the market is classified into chemical, physical, and biological.

The chemicals segment dominated the market with a size of USD 2.66 billion in 2026, accounting for 55.11% market share. Due to growth in industrialization and car registration, there has been a significant spike in carbon emissions, which fueled the demand for air quality monitoring systems across the globe. Carbon emissions fall under the chemical pollutant category. Hence, the large volume of industrial activities and cars fosters the growth of the chemical segment and is expected to influence the market growth over the forecast period.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Commercial & Residential End-User Segment Dominated Owing to Growing Awareness for Improving Air Quality

By end-user, the global market is segmented into commercial & residential, public infrastructure, power generation plants, pharmaceutical industry, and others.

The commercial & residential end-users accounted for the largest share of the market owing to high spending capacity, growing demand for a high-quality life, and rising awareness for protection from severe pollutants that cause health problems.

Public Infrastructure represented the largest segment with a market value of USD 1.65 billion in 2026, capturing 34.26% of the total market share. Public infrastructure is expected to grow due to various government agencies using AQM solutions and establishing national AQM networks. Also, air quality monitors play an important role in academic institutes to avoid the health impact and monitor air pollution.

AIR QUALITY MONITORING SYSTEM MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Air Quality Monitoring System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Consumer & Government Preference for Clean Air drives Market Growth

North America holds the largest share of the market owing to the presence of key manufacturers in the region. Manufacturers such as Thermo Fisher Scientific, 3M Company, Emerson Electric, Teledyne Technologies, Honeywell, and others have dominated the regional market for AQM systems. Moreover, favorable government initiatives have also contributed to the air quality monitoring system demand in the region. For instance, in February 2024, the U.S. Environmental Protection Agency announced funding worth USD 83 million to expand air monitoring across the U.S. Hence, more such government initiative is expected to boost the market growth in the region over the forecast period.

U.S.

Stringent Environmental Regulations Drive Market Growth in the Country

The U.S. market is projected to reach USD 1.21 billion by 2026. The U.S. has been receiving significant support from the government for improving the air quality index through federal programs and initiatives, which, in turn, contribute to the growing demand for air quality monitoring systems across the country. For instance, in March 2024, the U.S. Department of Transportation announced funding worth USD 1.2 million to decrease air pollution from the transportation sector. Such government initiatives are expected to propel the demand for air quality monitoring systems in the country in the near future.

Europe

Favorable Government Initiatives to Tackle Air Pollution Drives Market Growth in Europe

Europe is expected to grow due to the favorable initiatives carried out by the countries in the region to improve air quality. Furthermore, the UN’s framework to lower greenhouse gas emissions, combined with air filtration technologies, is set to enhance the market growth. Germany is one of the leading manufacturers of air quality monitoring solutions and sensors. Manufacturers such as Renesas Electronics, Testo, and others have industrial facilities in the country which augment the market outlook. In April 2022, the European Environment Agency (EEA) has stated that in European cities, pollution levels remain above recommended safety levels. Furthermore, 96% of Europeans are exposed to concentrations of fine particulate matter of PM 2.2, which are above the WHO guidelines level. The aforementioned factor indicates the requirement for air quality monitoring systems across Europe, which is expected to boost market growth in the coming years. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

Asia Pacific

Rapid Modernization of Public and Industrial Infrastructures to boost AQM systems

Countries in this region observe significant rise and growth in their GDPs by the regional government on air quality monitoring solutions, modernization of public and industrial infrastructures, and increasing cutting-edge environmental monitoring technologies, primarily in rural areas. For instance, in January 2025, Brihanmumbai Municipal Corporation (BMC) in India announced plans to issue tenders for the installation of 5 new Continuous Ambient Air Quality Monitoring Stations (CAAQMS), which floated by February 2025 at strategic location in Mumbai. Such initiatives by the countries are expected to propel the growth of the Asia Pacific air quality monitoring systems market over the forecast period. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.41 billion by 2026, and the India market is projected to reach USD 0.20 billion by 2026.

China

China’s Air Quality Monitoring Systems Market is Growing Due to Presence of Favorable Government Initiatives

China poses a lucrative market for air quality monitoring systems owing to the favorable government initiatives to tackle air pollution. For instance, in May 2024, the Government of China launched a dedicated Air pollution data center supported by the Major Research Plan of the National Natural Science Foundation of China (NSFC) to tackle the increasing complexity of air quality challenges. Such initiative and development of air quality management infrastructure indicates the government's inclination towards improvement of air quality in the country. Hence, the aforementioned factor is expected to have a positive impact on the air quality monitoring system market over the forecast period.

Latin America

Increased Public Awareness regarding Pollution, along with Favorable Government Initiatives, is driving Market Growth

In Latin America the air quality systems are expected to witness significant growth owing to the continuous government efforts to improve air quality in the country. For instance, in October 2024, the Mexican government announced that Mexico City had joined the Breathe Cities initiative with the motive to improve air quality data, technical capacity building, and community engagements. The aforementioned social awareness initiatives will drive the demand for air quality monitoring systems over the forecast period.

Middle East & Africa

Increasing Pollution in the Region is Expected to offer Considerable Opportunities over Forecast period

The Middle East & Africa are expected to observe substantial growth as they witness rising air pollution levels. According to the World Heart Foundation (WHF), Egypt, UAE, and Kuwait have severe concentrations of particles less than 2.5 micrometers in diameter emitted from power plant combustion, vehicle exhaust fumes, and burning wood. High air pollution levels in the major countries of the region pose a significant opportunity for the Air Quality Monitoring System market player to increase their reach over the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

The competitive landscape of the global market is dominated by Thermo Fisher Scientific and 3M Company. These companies are some of the major market players in the market. The presence of other major players such as Horiba, PerkinElmer, Testo, Merck, and others makes the market highly competitive. Extensive customer reach and higher brand value, as opposed to other companies, has allowed companies such as Thermo Fisher Scientific and 3M to gain a solid foothold in the global market.

List of Key Air Quality Monitoring System Companies Profiled:

- Thermo Fisher Scientific (U.S.)

- Emerson Electric (U.S.)

- 3M Company (U.S.)

- Horiba, Ltd. (Japan)

- Siemens AG (Germany)

- RXI Instruments (U.S.)

- Testo (Germany)

- Innovaer Technologies (U.S.)

- Chemtrols (India)

- Honeywell (U.S.)

- Aeroqual (New Zealand)

- TSI Incorporated (U.S.)

- Tisch Environmental (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In April 2025, Sarajevo Canton launched a new register for emissions and pollutant data, utilizing GIS technology to improve air quality monitoring and assist in achieving climate neutrality objectives. This digital tool offers a geographical perspective of emission sources within the region, implementing a completely digitized method for monitoring yearly air emissions. Authorities state that this system brings Sarajevo in line with the standards of more advanced European cities.

- In April 2025, the Ministry of Ecology and Environment in China unveiled the “National Digital and Intelligent Transformation Plan for the Eco-Environmental Monitoring Network.” This plan requires the digital and intelligent enhancement of automatic monitoring stations and equipment for air and surface water, with the goal of establishing a smart central hub—referred to as “the brain”—for ecological and environmental monitoring.

- In November 2024, Oizom launched ‘Pollusense’ which provides portable air quality monitoring. It is designed to meet the urgent requirement for accurate real-time data for cities, industries, and communities to help Environmental Health and Safety (EHS) managers ensure adherence to regulatory compliances and air-quality standards.

- In June 2024, the Ministry of Electronics & IT of India launched an Indigenous Air-Pravah App supported on Android devices and an air quality monitoring system that offers real-time air quality data with unit conversions, multi-device support, remote monitoring, and AQI comparisons.

- In March 2023, Attune introduced a new sensor-based platform, ‘Attune's UL-2905,’ Certified indoor air quality monitoring sensors for outdoor air quality monitoring devices and providing data around any given site.

Investment Analysis and Opportunities

The growing emphasis on environmental sustainability & public health has led to an increase in demand for air quality monitoring systems globally.

- In August 2024, the Government of India announced plans to install 1,000 more air quality monitoring stations under revised National Ambient Air Quality Standards. Moreover, the government also announced achieving a reduction in PM10 level by up to 40% or achievement of national standards (60 µg/m3) by 2025-26. This initiative presents significant growth opportunities for the companies operating in the air quality monitoring systems.

- In June 2024, The Ministry of Cohesion and Regional Development, Slovenia, approved the European Union funding of USD 2.72 million for the project Lastovka, equipped with an outdoor air quality information monitoring system providing air quality data and raising air quality alerts.

REPORT COVERAGE

The global air quality monitoring system market research report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers insights into the global market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.49% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Pollutant

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.82 billion in 2026.

The market is likely to grow at a CAGR of 8.49% over the forecast period (2026-2034).

The public infrastructure end-user segment is expected to lead the market in the forecast period.

The market size of North America stood at USD 0.87 billion in 2025.

Increased awareness regarding the harmful effects of pollution is the key factor driving market growth.

Some of the top players in the market are Aeroqual, Honeywell, Emerson Electric, Thermo Fisher Scientific, and others.

The global market size is expected to reach USD 9.25 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us